Key Insights

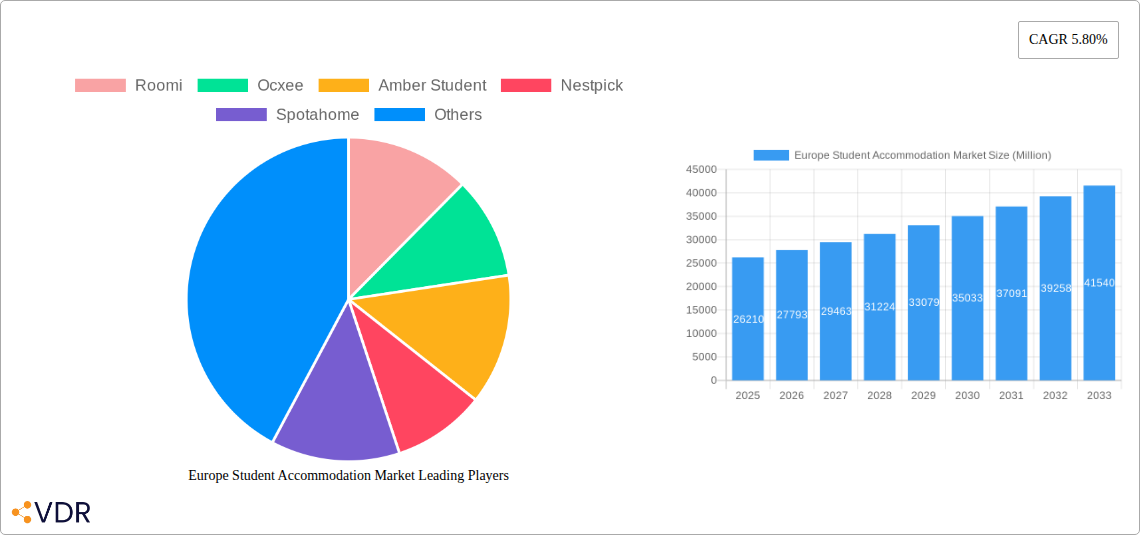

The European student accommodation market, valued at €26.21 billion in 2025, is projected to experience robust growth, driven by increasing student enrollment across major European nations and a persistent shortage of affordable on-campus housing. A compound annual growth rate (CAGR) of 5.80% from 2025 to 2033 indicates a significant expansion of this market. Key drivers include rising urbanization, increasing international student mobility, and the growing preference for convenient, professionally managed accommodation options, especially in city centers. Trends such as the rise of online booking platforms and the increasing demand for flexible rental agreements are shaping the market landscape. While rising rental costs in prime locations pose a restraint, the market's overall trajectory remains positive due to the continuous influx of students seeking quality accommodation. The market is segmented by accommodation type (Halls of Residence, Rented Houses/Rooms, Private Student Accommodation), location (City Centre, Periphery), rent type (Basic Rent, Total Rent), booking mode (Online, Offline), and country (Germany, Iceland, Ireland, Italy, France, Belgium, Norway, and Rest of Europe). The competitive landscape features established players like Roomi, Spotahome, and Nestpick, alongside newer entrants vying for market share, indicating an ongoing dynamic evolution of this crucial sector.

Europe Student Accommodation Market Market Size (In Billion)

The substantial growth potential of this market segment necessitates a comprehensive understanding of consumer preferences. Factors such as proximity to educational institutions, amenities, safety, and the overall student experience significantly influence accommodation choices. Therefore, companies are increasingly focusing on providing value-added services, enhanced security features, and flexible lease terms to attract students. Furthermore, the integration of technology into the booking and management processes, through dedicated online platforms and streamlined communication channels, plays a significant role in improving customer experience and market efficiency. The continued expansion of the higher education sector in Europe, combined with the persistent demand for student accommodation will likely fuel further market growth throughout the forecast period.

Europe Student Accommodation Market Company Market Share

Europe Student Accommodation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the European student accommodation market, covering the period from 2019 to 2033. It segments the market by accommodation type (Halls of Residence, Rented Houses or Rooms, Private Student Accommodation), location (City Centre, Periphery), rent type (Basic Rent, Total Rent), mode (Online, Offline), and country (Germany, Iceland, Ireland, Italy, France, Belgium, Norway, Rest of Europe). The report features detailed market sizing, growth projections, competitive landscape analysis, and key industry developments, making it an essential resource for investors, developers, operators, and other stakeholders in the student housing sector. The base year for this report is 2025, with a forecast period extending to 2033.

Europe Student Accommodation Market Dynamics & Structure

The European student accommodation market is characterized by a moderately concentrated landscape, with several large players competing alongside numerous smaller operators. Technological innovation, particularly in online booking platforms and property management systems, is a significant driver of market growth. Regulatory frameworks, varying across different European countries, influence development and investment decisions. Competitive substitutes include traditional rental markets and shared housing arrangements. The end-user demographic is predominantly young adults aged 18-25, with growing demand driven by increasing student enrollment numbers and urbanization trends. Mergers and acquisitions (M&A) activity is significant, reflecting consolidation and expansion strategies within the sector.

- Market Concentration: xx% controlled by top 5 players (2024).

- Technological Innovation: Focus on online booking, smart home technologies, and data-driven management solutions.

- Regulatory Framework: Differing regulations across countries impacting development costs and timelines.

- Competitive Substitutes: Traditional rental market, shared housing platforms.

- M&A Activity: xx deals in 2024, indicating consolidation and expansion.

- End-User Demographics: Primarily 18-25-year-old students, with a growing segment of young professionals.

- Innovation Barriers: High initial investment costs, regulatory complexities, and competition for suitable properties.

Europe Student Accommodation Market Growth Trends & Insights

The European student accommodation market experienced significant growth during the historical period (2019-2024), driven by factors such as rising student enrollment, increasing urbanization, and growing demand for purpose-built student accommodation (PBSA). This trend is projected to continue throughout the forecast period (2025-2033), with a Compound Annual Growth Rate (CAGR) of xx% expected. Technological advancements, such as online booking platforms and smart home technology, are further enhancing the market's appeal. Consumer behavior is evolving towards a preference for modern, amenity-rich student housing options. Market penetration of online booking platforms is expected to reach xx% by 2033, significantly impacting traditional offline channels. Factors like increasing tuition fees and rising living costs are also bolstering the demand for purpose-built student housing.

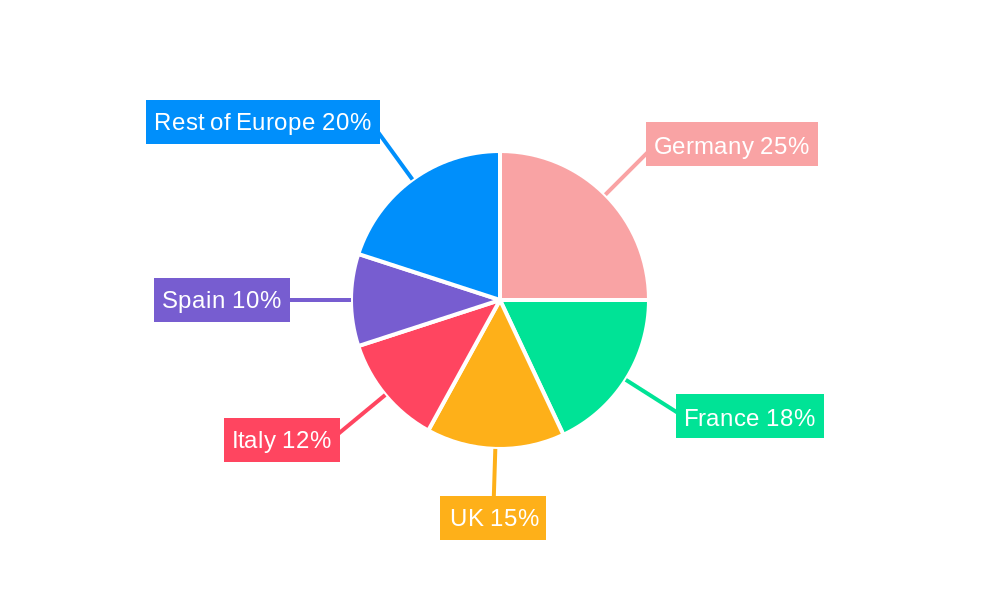

Dominant Regions, Countries, or Segments in Europe Student Accommodation Market

The UK and Germany are currently the leading markets, driving a significant portion of market growth. By accommodation type, Private Student Accommodation is experiencing the fastest growth due to its flexibility and diverse offerings. Within location, City Centre properties command higher rents and remain in high demand. Online booking is the dominant mode, gaining popularity over offline methods.

- Key Drivers:

- Rising Student Enrollment: Consistent increase in university enrollment across major European countries.

- Urbanization: Migration of students to urban centers for educational opportunities.

- Government Policies: Supportive policies promoting PBSA development.

- Technological Advancements: Online booking platforms and smart home integration.

- Dominant Segments:

- Country: UK, Germany (market share xx% and xx% respectively in 2024).

- Accommodation Type: Private Student Accommodation (market share xx% in 2024)

- Location: City Centre (market share xx% in 2024)

- Mode: Online (market share xx% in 2024)

Europe Student Accommodation Market Product Landscape

The student accommodation product landscape is evolving with a focus on providing modern, amenity-rich living spaces. Developments include enhanced security features, flexible lease terms, communal areas tailored to student needs, and integrated technology solutions improving efficiency and convenience. Unique selling propositions emphasize location, amenities, and the overall student experience. Technological advancements are focused on building management systems, online booking platforms, and smart home technologies for increased convenience and better resource management.

Key Drivers, Barriers & Challenges in Europe Student Accommodation Market

Key Drivers: Increasing student population, urbanization, demand for quality accommodation, technological advancements, and supportive government policies in some regions are key growth drivers.

Key Challenges: High development costs, competition for suitable properties, regulatory hurdles, and supply chain disruptions impacting construction timelines. Competition from traditional rental markets and other housing options also poses a challenge. The impact of these challenges is estimated to reduce market growth by xx% annually.

Emerging Opportunities in Europe Student Accommodation Market

Emerging opportunities lie in targeting niche markets, such as postgraduate students or international students with specific needs. Innovative applications of technology, including sustainable building practices and smart home integration, represent significant growth avenues. Evolving consumer preferences towards co-living spaces and flexible lease agreements create new market segments to cater to.

Growth Accelerators in the Europe Student Accommodation Market Industry

Long-term growth will be driven by technological advancements, strategic partnerships between developers and educational institutions, and expansion into underserved markets. Sustainable development practices and integration with campus infrastructure will also play a significant role.

Key Players Shaping the Europe Student Accommodation Market Market

- Roomi

- Ocxee

- Amber Student

- Nestpick

- Spotahome

- Casita

- Housing Anywhere

- Homelike

- UniAcco

- UniPlaces

- Yugo

Notable Milestones in Europe Student Accommodation Market Sector

- October 2022: Unite Group acquired 180 Stratford, a 178-unit property, for GBP 71 million, expanding its reach into the young professional market. The company operated 1,700 student beds at the time with two further developments in the pipeline.

- January 2022: Patrizia SE invested EUR 314 million in a Danish student accommodation portfolio, highlighting strong investor interest in the sector.

In-Depth Europe Student Accommodation Market Market Outlook

The European student accommodation market holds significant future potential, driven by sustained growth in student enrollment, urbanization, and the increasing demand for high-quality, purpose-built student housing. Strategic partnerships and technological innovation will play a key role in shaping the market's future. The focus will remain on providing amenity-rich, sustainable, and technologically advanced accommodation solutions that cater to the evolving needs and preferences of the student demographic. The market is expected to reach a value of xx Million units by 2033.

Europe Student Accommodation Market Segmentation

-

1. Accomodation Type

- 1.1. Halls of Residence

- 1.2. Rented Houses or Rooms

- 1.3. Private Student Accomodation

-

2. location

- 2.1. City Centre

- 2.2. Periphery

-

3. Rent Type

- 3.1. Basic Rent

- 3.2. Total Rent

-

4. Mode

- 4.1. Online

- 4.2. Offline

Europe Student Accommodation Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Student Accommodation Market Regional Market Share

Geographic Coverage of Europe Student Accommodation Market

Europe Student Accommodation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.80% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in the Number of Restaurants and Bars in the Industry; Increase in the Number of Tourist Attractions and Activities

- 3.3. Market Restrains

- 3.3.1 Inadequate Research and Development

- 3.3.2 Unpredictability of the Market

- 3.4. Market Trends

- 3.4.1. Percentage of Young Adults in Education Affecting Europe Student Accommodation Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Student Accommodation Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Accomodation Type

- 5.1.1. Halls of Residence

- 5.1.2. Rented Houses or Rooms

- 5.1.3. Private Student Accomodation

- 5.2. Market Analysis, Insights and Forecast - by location

- 5.2.1. City Centre

- 5.2.2. Periphery

- 5.3. Market Analysis, Insights and Forecast - by Rent Type

- 5.3.1. Basic Rent

- 5.3.2. Total Rent

- 5.4. Market Analysis, Insights and Forecast - by Mode

- 5.4.1. Online

- 5.4.2. Offline

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Accomodation Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Roomi

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ocxee

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Amber Student

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nestpick

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Spotahome

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Casita

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Housing Anywhere

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Homelike*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 UniAcco

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 UniPlaces

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Yugo

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Roomi

List of Figures

- Figure 1: Europe Student Accommodation Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Student Accommodation Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Student Accommodation Market Revenue Million Forecast, by Accomodation Type 2020 & 2033

- Table 2: Europe Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 3: Europe Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 4: Europe Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 5: Europe Student Accommodation Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Europe Student Accommodation Market Revenue Million Forecast, by Accomodation Type 2020 & 2033

- Table 7: Europe Student Accommodation Market Revenue Million Forecast, by location 2020 & 2033

- Table 8: Europe Student Accommodation Market Revenue Million Forecast, by Rent Type 2020 & 2033

- Table 9: Europe Student Accommodation Market Revenue Million Forecast, by Mode 2020 & 2033

- Table 10: Europe Student Accommodation Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: United Kingdom Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Germany Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Spain Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Netherlands Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Belgium Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Sweden Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Norway Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Poland Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Denmark Europe Student Accommodation Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Student Accommodation Market?

The projected CAGR is approximately 5.80%.

2. Which companies are prominent players in the Europe Student Accommodation Market?

Key companies in the market include Roomi, Ocxee, Amber Student, Nestpick, Spotahome, Casita, Housing Anywhere, Homelike*List Not Exhaustive, UniAcco, UniPlaces, Yugo.

3. What are the main segments of the Europe Student Accommodation Market?

The market segments include Accomodation Type, location, Rent Type, Mode.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.21 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in the Number of Restaurants and Bars in the Industry; Increase in the Number of Tourist Attractions and Activities.

6. What are the notable trends driving market growth?

Percentage of Young Adults in Education Affecting Europe Student Accommodation Market.

7. Are there any restraints impacting market growth?

Inadequate Research and Development. Unpredictability of the Market.

8. Can you provide examples of recent developments in the market?

October 2022: Unite Group leading developer of student accommodation, acquired 180 Stratford, a 178-unit purpose-to-build-to-rent property in Stratford, East London for GBP 71 Mn. This acquisition will enable the group to test its operational capability to extend its accommodation offer to young professionals In the Stratford market united group during October 2022 was operating 1,700 student beds with two student development in its pipeline.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Student Accommodation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Student Accommodation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Student Accommodation Market?

To stay informed about further developments, trends, and reports in the Europe Student Accommodation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence