Key Insights

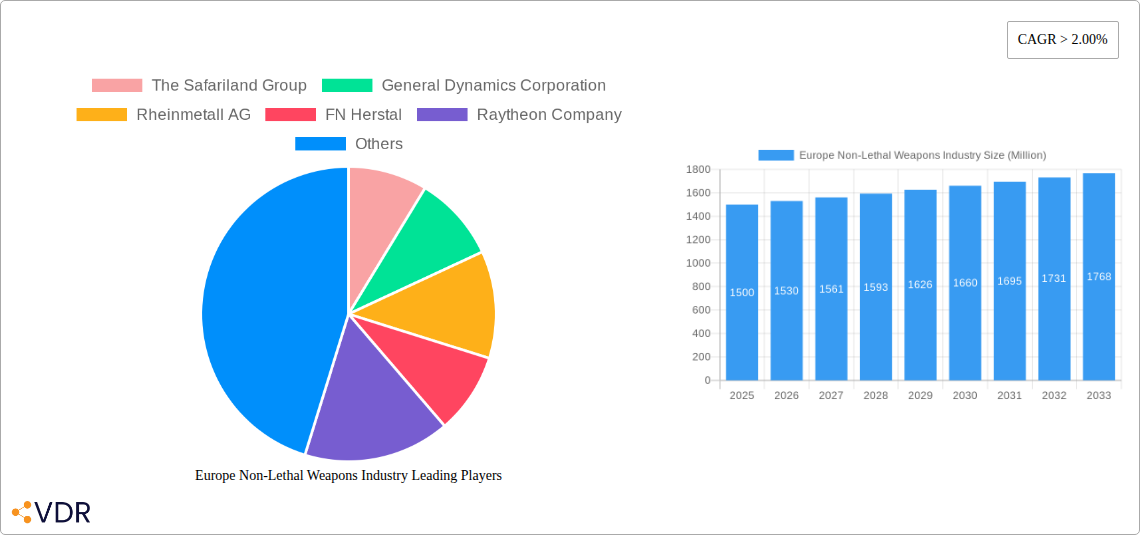

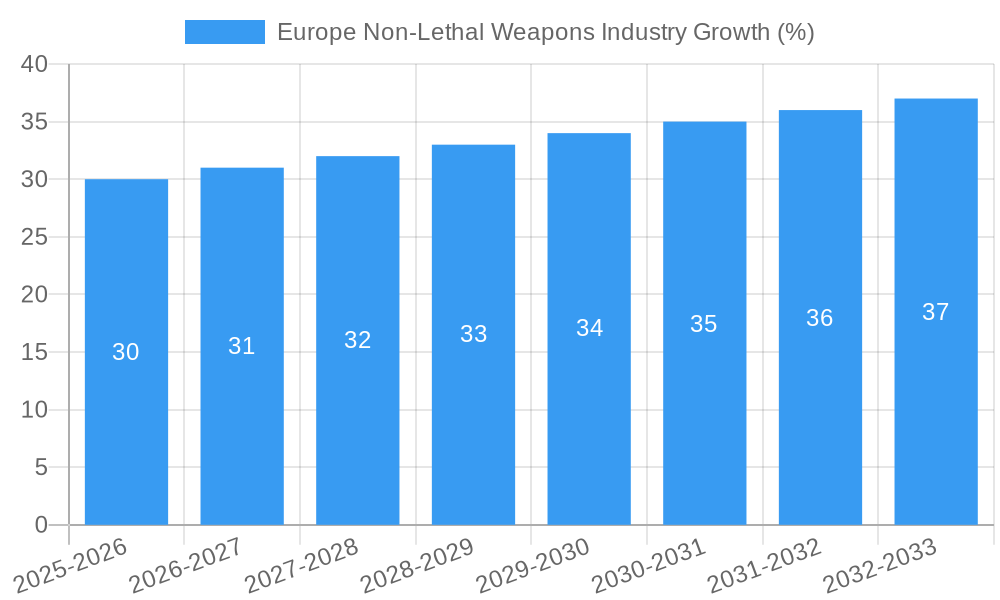

The European non-lethal weapons market, valued at approximately €1.5 billion in 2025, is projected to experience robust growth, driven by increasing demand from law enforcement agencies and military forces across the region. This growth is fueled by a rising need for crowd control solutions, a greater emphasis on minimizing collateral damage during operations, and the adoption of advanced technologies within non-lethal weaponry. The market is segmented into various weapon types, including area denial systems, ammunition (less-lethal rounds), explosives (e.g., flashbang grenades), gases and sprays (pepper spray, tear gas), directed energy weapons (lasers, acoustic devices), and electroshock weapons (TASERs). Law enforcement agencies constitute a significant portion of the market, prioritizing non-lethal options to subdue suspects while minimizing injuries. Military applications, focusing on crowd control and riot suppression, are another significant driver, with ongoing conflicts and potential threats shaping procurement strategies. While regulatory hurdles and ethical concerns related to the use of some non-lethal weapons pose a challenge, the overall market is expected to maintain a Compound Annual Growth Rate (CAGR) exceeding 2% through 2033. Germany, France, the United Kingdom, and Italy represent the largest national markets within Europe, reflecting their substantial law enforcement and defense budgets.

The continued development and adoption of advanced non-lethal technologies, such as improved accuracy in directed energy weapons and more effective incapacitating agents, will further stimulate market expansion. Furthermore, increasing cross-border cooperation among European nations in security and defense initiatives could lead to joint procurement programs, benefiting leading manufacturers like The Safariland Group, General Dynamics, Rheinmetall, FN Herstal, and Raytheon. However, potential constraints include budgetary limitations within some European countries, evolving ethical debates regarding the use of certain non-lethal weapons, and the potential for the development of countermeasures against existing technologies. The market’s evolution will be shaped by technological advancements, regulatory frameworks, and evolving security priorities across Europe.

This comprehensive report provides an in-depth analysis of the Europe Non-Lethal Weapons market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033, this report meticulously examines market dynamics, growth trends, key players, and future opportunities within this crucial sector. The report segments the market by Type (Area Denial, Ammunition, Explosives, Gases and Sprays, Directed Energy Weapons, Electroshock Weapons) and Application (Law Enforcement, Military), providing granular analysis of each segment's performance and growth potential.

Europe Non-Lethal Weapons Industry Market Dynamics & Structure

The European non-lethal weapons market is characterized by moderate concentration, with a few major players holding significant market share. Technological innovation, particularly in directed energy weapons and less-lethal ammunition, is a key driver. Stringent regulatory frameworks governing the production, sale, and use of these weapons influence market dynamics significantly. The market also witnesses competitive pressure from substitutes like traditional firearms in certain applications. End-user demographics, primarily law enforcement and military agencies, influence demand patterns. M&A activity remains moderate, with strategic acquisitions aimed at enhancing technological capabilities and expanding market reach.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2024.

- Technological Innovation: Focus on improved accuracy, reduced collateral damage, and enhanced effectiveness of non-lethal technologies.

- Regulatory Framework: Strict regulations on the use and export of non-lethal weapons vary across European nations, impacting market growth.

- Competitive Substitutes: Traditional firearms remain a competitive substitute in some applications.

- M&A Activity: An average of xx M&A deals annually in the historical period (2019-2024).

- Innovation Barriers: High R&D costs, stringent regulatory approvals, and ethical concerns.

Europe Non-Lethal Weapons Industry Growth Trends & Insights

The European non-lethal weapons market experienced steady growth between 2019 and 2024, driven by increasing demand from law enforcement agencies and militaries seeking less-lethal options for crowd control and riot management. The market size reached xx Million units in 2024, exhibiting a CAGR of xx% during the historical period. Technological advancements, such as the development of more precise and effective directed energy weapons, are fueling market expansion. Changing consumer preferences towards less-lethal alternatives and growing awareness of the need for minimizing civilian casualties are also positively impacting the market. The forecast period (2025-2033) projects continued growth, with a projected market size of xx Million units by 2033 and a CAGR of xx%. Market penetration in law enforcement is expected to reach xx% by 2033. However, budget constraints and concerns about the long-term effectiveness of some non-lethal technologies may present challenges.

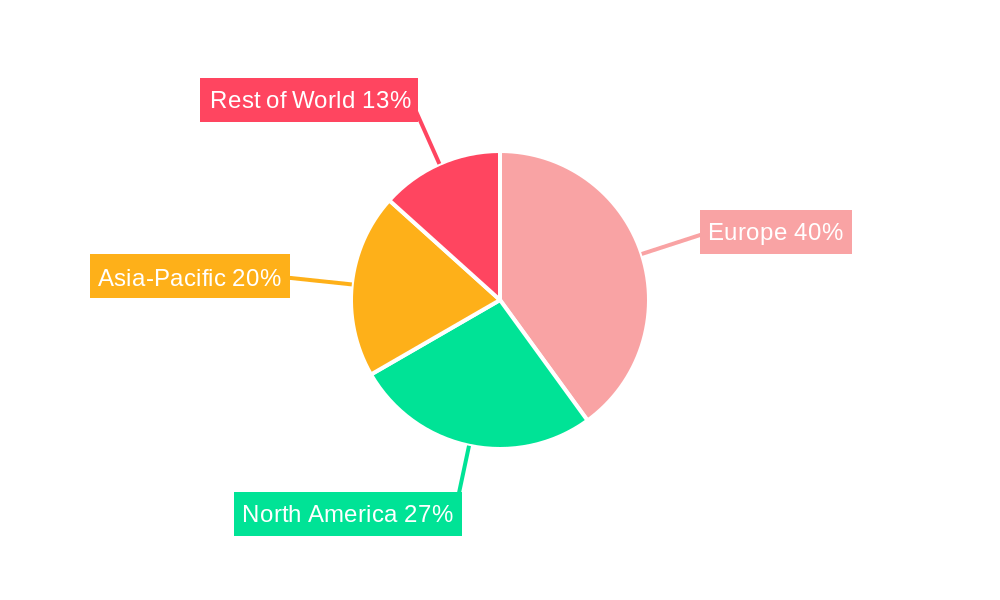

Dominant Regions, Countries, or Segments in Europe Non-Lethal Weapons Industry

Western European countries, particularly Germany, France, and the UK, are the dominant regions driving market growth, due to robust defense budgets, higher technological advancement, and strong law enforcement agencies. The area denial segment holds the largest market share within the Type category due to its broad applications in crowd control and security. The law enforcement application segment accounts for the majority of the market share, driven by escalating demands for effective yet non-lethal crowd control measures.

- Key Drivers (Western Europe): High defense spending, advanced technological capabilities, strong law enforcement presence.

- Germany: Significant contributions from domestic manufacturers and substantial government procurement.

- France: Strong internal security needs and export-oriented manufacturing.

- UK: Focus on technological advancements and investment in specialized non-lethal technologies.

- Area Denial Segment Dominance: High demand for crowd control and perimeter security solutions.

- Law Enforcement Application Dominance: Prioritization of less-lethal methods for managing civil unrest and crime control.

Europe Non-Lethal Weapons Industry Product Landscape

The non-lethal weapons market showcases a diverse range of products, encompassing advanced less-lethal ammunition, sophisticated area denial systems, and evolving directed energy weapons. These products are characterized by improved accuracy, reduced risk of serious injury, and enhanced effectiveness. Significant advancements include improved projectile designs in less-lethal ammunition, enhanced targeting systems in area-denial weapons, and the exploration of more precise directed energy technologies. Manufacturers emphasize unique selling propositions like enhanced precision, reduced collateral damage, and ease of use.

Key Drivers, Barriers & Challenges in Europe Non-Lethal Weapons Industry

Key Drivers: Growing concerns over civilian casualties in conflict situations and civil unrest are driving the demand for non-lethal options. Technological advancements, such as improved accuracy and effectiveness, are also pushing the market forward. Government regulations regarding the use and deployment of less lethal weapons are shaping market trends.

Key Challenges & Restraints: High initial investment costs associated with technological development and deployment limit adoption in some sectors. Concerns about potential misuse and long-term health effects of some non-lethal weapons may curb market growth. Supply chain disruptions and material shortages can hinder production. Stringent export regulations and international agreements can limit market access.

Emerging Opportunities in Europe Non-Lethal Weapons Industry

Untapped markets exist within specialized law enforcement units, private security firms, and emerging nations. The increasing demand for advanced non-lethal crowd control solutions presents significant opportunities. Innovative applications of directed energy weapons for non-lethal purposes are also emerging. The evolution of consumer preferences towards more ethical and humane technologies is opening doors for innovative products.

Growth Accelerators in the Europe Non-Lethal Weapons Industry Industry

Technological breakthroughs in directed energy weapons and less-lethal ammunition are key growth accelerators. Strategic partnerships between technology developers and manufacturers are driving innovation and market penetration. Expansion strategies focusing on emerging markets and untapped sectors like private security are poised to accelerate growth.

Key Players Shaping the Europe Non-Lethal Weapons Industry Market

- The Safariland Group

- General Dynamics Corporation

- Rheinmetall AG

- FN Herstal

- Raytheon Company

- RUAG Group

- Fiocchi Munizioni SpA

- BAE Systems PLC

- AARDVAR

Notable Milestones in Europe Non-Lethal Weapons Industry Sector

- 2021-Q3: Launch of a new less-lethal ammunition type with improved accuracy by Rheinmetall.

- 2022-Q1: Acquisition of a small technology company specializing in directed energy weapons by General Dynamics.

- 2023-Q2: Successful field testing of a new area denial system by RUAG. (Further milestones to be added based on data)

In-Depth Europe Non-Lethal Weapons Industry Market Outlook

The European non-lethal weapons market is projected to witness substantial growth in the coming years, driven by technological advancements, increasing demand, and ongoing modernization efforts within law enforcement and military sectors. Significant opportunities lie in strategic partnerships, technological innovation, and expansion into niche markets. The market's future is bright, offering considerable potential for innovation and growth.

Europe Non-Lethal Weapons Industry Segmentation

-

1. Type

- 1.1. Area Denial

- 1.2. Ammunition

- 1.3. Explosives

- 1.4. Gases and Sprays

- 1.5. Directed Energy Weapons

- 1.6. Electroshock Weapons

-

2. Application

- 2.1. Law Enforcement

- 2.2. Military

Europe Non-Lethal Weapons Industry Segmentation By Geography

-

1. By Country

- 1.1. United Kingdom

- 1.2. France

- 1.3. Germany

- 1.4. Italy

- 1.5. Spain

- 1.6. Rest of Europe

Europe Non-Lethal Weapons Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 2.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Law Enforcement Segment is Expected to Experience the Highest Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Area Denial

- 5.1.2. Ammunition

- 5.1.3. Explosives

- 5.1.4. Gases and Sprays

- 5.1.5. Directed Energy Weapons

- 5.1.6. Electroshock Weapons

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Law Enforcement

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. By Country

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Non-Lethal Weapons Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 The Safariland Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 General Dynamics Corporation

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Rheinmetall AG

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 FN Herstal

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Raytheon Company

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 RUAG Group

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Fiocchi Munizioni SpA

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 BAE Systems PLC

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 AARDVAR

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 The Safariland Group

List of Figures

- Figure 1: Europe Non-Lethal Weapons Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Non-Lethal Weapons Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 4: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 15: Europe Non-Lethal Weapons Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: France Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Germany Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Europe Europe Non-Lethal Weapons Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Non-Lethal Weapons Industry?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the Europe Non-Lethal Weapons Industry?

Key companies in the market include The Safariland Group, General Dynamics Corporation, Rheinmetall AG, FN Herstal, Raytheon Company, RUAG Group, Fiocchi Munizioni SpA, BAE Systems PLC, AARDVAR.

3. What are the main segments of the Europe Non-Lethal Weapons Industry?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Law Enforcement Segment is Expected to Experience the Highest Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Non-Lethal Weapons Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Non-Lethal Weapons Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Non-Lethal Weapons Industry?

To stay informed about further developments, trends, and reports in the Europe Non-Lethal Weapons Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence