Key Insights

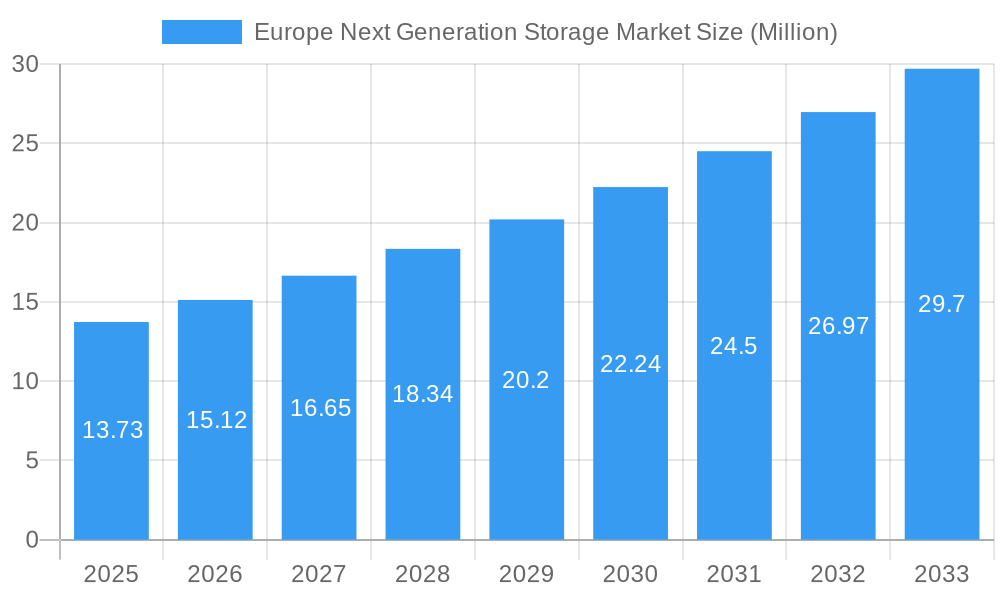

The European Next Generation Storage Market is poised for significant expansion, projected to reach $13.73 million by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 10.30% from 2019 to 2033. This upward trajectory is primarily fueled by the insatiable demand for efficient data management solutions across various industries. Key drivers include the escalating volumes of data generated by the digital transformation initiatives, the increasing adoption of cloud computing services, and the burgeoning need for advanced analytics and AI applications. Businesses are actively investing in next-generation storage systems like Network Attached Storage (NAS) and Storage Area Networks (SAN) to enhance data accessibility, improve performance, and ensure data security. Furthermore, the rise of File and Object-based Storage (FOBS) and Block Storage solutions caters to the diverse data storage requirements of modern enterprises, from unstructured media files to critical transactional data.

Europe Next Generation Storage Market Market Size (In Million)

The European market is experiencing a substantial shift towards agile and scalable storage architectures. The IT and Telecom sector, along with BFSI and Healthcare, are leading this adoption, driven by regulatory compliance, the need for rapid data retrieval, and the integration of sophisticated technologies. While the market benefits from these strong drivers, it also faces certain restraints. The high initial investment costs associated with advanced storage solutions and concerns regarding data privacy and security can pose challenges. However, ongoing innovation in storage technologies, including advancements in flash storage, software-defined storage (SDS), and hybrid cloud solutions, are expected to mitigate these concerns. The competitive landscape features major players like IBM Corporation, Dell Inc., NetApp Inc., and Hewlett Packard Enterprise Company, all vying to capture market share through product innovation and strategic partnerships. Europe's diverse economic landscape, with strong technological adoption in countries like the United Kingdom, Germany, and France, presents a fertile ground for the continued growth of the next-generation storage market.

Europe Next Generation Storage Market Company Market Share

This comprehensive report offers an in-depth analysis of the Europe Next Generation Storage Market, a critical sector experiencing rapid evolution due to escalating data generation and the imperative for efficient, secure, and scalable storage solutions. Covering the Study Period 2019–2033, with Base Year 2025 and Forecast Period 2025–2033, this report provides a definitive roadmap for understanding market dynamics, growth trajectories, and competitive landscapes. We delve into key market segments, including Direct Attached Storage (DAS), Network Attached Storage (NAS), and Storage Area Network (SAN), alongside File and Object-based Storage (FOBS) and Block Storage architectures. Furthermore, we examine the influence of end-user industries such as BFSI, Retail, IT and Telecom, Healthcare, and Media and Entertainment. Expect a detailed breakdown of market trends, technological innovations, regulatory impacts, and the strategic moves of leading players like Netgear Inc, IBM Corporation, Fujitsu Ltd, Toshiba Corp, Hewlett Packard Enterprise Company, Scality Inc, Hitachi Ltd, Dell Inc, DataDirect Networks, NetApp Inc, and Pure Storage Inc.

Europe Next Generation Storage Market Market Dynamics & Structure

The Europe Next Generation Storage Market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and shifting end-user demographics, driving intense market concentration. Leading entities like Dell Inc., Hewlett Packard Enterprise Company, and NetApp Inc. hold significant market share, fueled by continuous advancements in performance, scalability, and data security. Technological innovation is primarily driven by the relentless demand for higher storage densities, faster data access, and intelligent data management capabilities, essential for sectors like IT and Telecom and BFSI. Regulatory frameworks, particularly concerning data privacy (e.g., GDPR) and cross-border data transfer, significantly influence market strategies, pushing for localized storage solutions and robust security protocols. Competitive product substitutes, including cloud storage solutions and emerging technologies like computational storage, present both challenges and opportunities, forcing traditional storage providers to innovate or risk obsolescence. End-user demographics are increasingly skewed towards enterprises demanding sophisticated, integrated storage solutions that can handle massive datasets generated by AI, IoT, and big data analytics. Mergers and acquisitions (M&A) are a prevalent trend, with companies consolidating to expand their product portfolios, acquire specialized technologies, and gain market access. For instance, the market has witnessed several strategic acquisitions aimed at bolstering offerings in hyperconverged infrastructure and software-defined storage. Barriers to innovation include the substantial capital investment required for R&D, the long product development cycles in enterprise hardware, and the need for interoperability across diverse IT environments. Approximately 20% of market players are actively involved in M&A activities annually, seeking to enhance their competitive edge.

Europe Next Generation Storage Market Growth Trends & Insights

The Europe Next Generation Storage Market is poised for substantial expansion, projected to witness a Compound Annual Growth Rate (CAGR) of approximately xx% between 2025 and 2033. This robust growth is intrinsically linked to the exponential surge in data creation across all sectors, driven by digital transformation initiatives, the proliferation of IoT devices, and the increasing adoption of data-intensive applications such as artificial intelligence and machine learning. The market size evolution is marked by a consistent upward trend, with the estimated market value expected to reach hundreds of billions of Euros by the end of the forecast period. Adoption rates for advanced storage technologies are accelerating, particularly for software-defined storage (SDS) and hyperconverged infrastructure (HCI), which offer greater flexibility, scalability, and cost-efficiency compared to traditional storage systems. Technological disruptions, including the advent of NVMe-oF (Non-Volatile Memory Express over Fabrics) and computational storage, are redefining performance benchmarks and enabling real-time data processing at the edge. Consumer behavior shifts are evident in the growing preference for integrated, cloud-enabled storage solutions that facilitate seamless data access and collaboration across distributed environments. Enterprises are no longer viewing storage as a mere repository but as a strategic asset that underpins business operations, innovation, and competitive advantage. The increasing demand for real-time analytics and data-driven decision-making further amplifies the need for high-performance, low-latency storage solutions. The market penetration of object-based storage, in particular, is anticipated to climb as organizations grapple with unstructured data growth from sources like video surveillance, social media, and scientific research. This evolution necessitates advanced storage architectures capable of handling massive, diverse datasets with unparalleled efficiency and agility.

Dominant Regions, Countries, or Segments in Europe Next Generation Storage Market

The Europe Next Generation Storage Market is significantly influenced by dominant segments and the strategic importance of specific regions and countries. Within the Storage System segment, Network Attached Storage (NAS) and Storage Area Network (SAN) are demonstrating particularly strong growth, driven by the increasing need for centralized data access and management in enterprise environments. File and Object-based Storage (FOBS), a key Storage Architecture, is rapidly gaining traction, accounting for an estimated xx% of the market share in 2025. This is primarily due to its scalability and cost-effectiveness in handling vast amounts of unstructured data prevalent in industries like Media and Entertainment and IT and Telecom. The IT and Telecom sector stands out as the leading End-User Industry, contributing approximately xx% to the overall market revenue in 2025. This dominance is propelled by the continuous infrastructure upgrades, the burgeoning demand for cloud services, and the deployment of 5G networks, all of which necessitate massive, high-performance storage capabilities.

- Key Drivers for Dominance:

- Economic Policies: Government initiatives promoting digital transformation and data-driven economies within countries like Germany, the UK, and France are fostering significant investment in advanced storage infrastructure.

- Infrastructure Development: Extensive investments in data centers and cloud computing facilities across major European hubs are directly fueling the demand for next-generation storage solutions.

- Technological Adoption Rates: Higher adoption rates of AI, big data analytics, and IoT across industries like BFSI and Healthcare in technologically advanced nations are creating a substantial need for sophisticated storage.

- Regulatory Compliance: Stringent data protection regulations, such as GDPR, are driving demand for secure, localized, and resilient storage solutions, particularly benefiting providers offering on-premises and hybrid storage options.

The United Kingdom and Germany are identified as the dominant countries, collectively accounting for an estimated xx% of the European market share in 2025. Their strong economic foundations, mature IT sectors, and proactive stance on digital innovation position them as key growth engines. The rapid expansion of the IT and Telecom sector in these countries, coupled with significant investments in research and development, further solidifies their leadership. The market share for File and Object-based Storage (FOBS) is projected to grow at a CAGR of xx% through 2033, outpacing other architectures due to its suitability for managing diverse and ever-increasing data volumes.

Europe Next Generation Storage Market Product Landscape

The Europe Next Generation Storage Market product landscape is characterized by innovation focused on enhanced performance, data intelligence, and seamless integration. Leading companies are introducing solutions that leverage advanced flash technologies, NVMe, and software-defined architectures to deliver unprecedented speed and efficiency. Key product advancements include intelligent data tiering, automated data lifecycle management, and robust data protection features, catering to the complex needs of modern enterprises. Applications span across high-performance computing, big data analytics, AI/ML workloads, and hyper-scale cloud environments. Performance metrics are continually being redefined, with lower latency, higher IOPS (Input/Output Operations Per Second), and increased throughput becoming standard expectations. Unique selling propositions often revolve around scalability, cost optimization through intelligent resource utilization, and enhanced data security and compliance features, making them indispensable for sensitive industries like BFSI and Healthcare.

Key Drivers, Barriers & Challenges in Europe Next Generation Storage Market

Key Drivers:

- Exponential Data Growth: The relentless increase in data volume from IoT, AI, and digital transformation initiatives is the primary catalyst.

- Demand for High-Performance Computing: Industries require faster data access and processing for analytics, simulations, and real-time operations.

- Cloud Adoption and Hybrid Environments: The shift towards cloud and hybrid infrastructure necessitates scalable, flexible, and interoperable storage solutions.

- Advancements in Flash and SSD Technology: Continuous improvements in speed, density, and cost-effectiveness of flash storage are driving adoption.

- Regulatory Compliance & Data Security: Stricter data privacy laws and the need for robust security measures are pushing demand for advanced storage.

Barriers & Challenges:

- High Initial Investment Costs: Implementing next-generation storage solutions can involve significant upfront capital expenditure.

- Interoperability and Integration Complexity: Ensuring seamless integration with existing IT infrastructure remains a challenge for many organizations.

- Skills Gap: A shortage of skilled professionals capable of managing and optimizing advanced storage systems can hinder adoption.

- Supply Chain Disruptions: Geopolitical factors and component shortages can impact the availability and pricing of storage hardware, with an estimated impact of xx% on project timelines.

- Legacy System Modernization: The inertia associated with upgrading or replacing established legacy storage systems can slow down market penetration.

Emerging Opportunities in Europe Next Generation Storage Market

Emerging opportunities in the Europe Next Generation Storage Market are abundant, driven by evolving technological paradigms and unmet market needs. The burgeoning field of edge computing presents a significant opportunity for distributed and intelligent storage solutions that can process data closer to its source, reducing latency and bandwidth requirements. Furthermore, the increasing adoption of AI and machine learning across various industries is creating demand for specialized storage architectures optimized for high-throughput, parallel data access, and rapid data ingestion. The growth of the Internet of Things (IoT) ecosystem is generating massive amounts of sensor data, requiring scalable and cost-effective object storage solutions. Additionally, the continued focus on data sovereignty and localized data storage within Europe creates opportunities for providers offering robust, compliant on-premises and hybrid solutions, especially within the BFSI and Public Sector domains.

Growth Accelerators in the Europe Next Generation Storage Market Industry

Several catalysts are accelerating the growth of the Europe Next Generation Storage Market. Technological breakthroughs, particularly in areas like DNA data storage and advanced solid-state technologies, promise to revolutionize storage density and longevity, paving the way for future market expansion. Strategic partnerships between storage vendors, cloud providers, and software developers are crucial for creating integrated solutions that address complex enterprise needs, fostering broader market adoption. Market expansion strategies, including the development of specialized solutions for emerging industries like genomics and quantum computing, are opening up new revenue streams. The increasing emphasis on sustainability and energy efficiency in data centers is also driving innovation in storage hardware and software, creating opportunities for greener and more cost-effective solutions that resonate with environmentally conscious businesses.

Key Players Shaping the Europe Next Generation Storage Market Market

- Netgear Inc

- IBM Corporation

- Fujitsu Ltd

- Toshiba Corp

- Hewlett Packard Enterprise Company

- Scality Inc

- Hitachi Ltd

- Dell Inc

- DataDirect Networks

- NetApp Inc

- Pure Storage Inc

Notable Milestones in Europe Next Generation Storage Market Sector

- January 2023: Google and Telefonica signed a deal for digital transformation and an advance 5G mobile edge computing system in Spain. Google cloud region will integrate the Highest worldwide security and data protection standards for Telefonica's Madrid region infrastructure. This collaboration signifies a major step towards secure, high-performance edge data processing and storage, impacting the demand for localized and robust storage solutions.

- September 2022: Seagate Technology Holdings launched its next-generation Exos X systems, an advanced storage array powered by Seagate's sixth-generation controller architecture. The enhanced version of the store offers improved enterprise-class durability and performance up to twice as fast as the previous generation. This launch represents a significant advancement in traditional disk-based storage, pushing performance boundaries and offering enhanced value for enterprises.

- February 2022: Hard disk drives (HDDs) are an essential data storage medium, and companies are regularly working and developing devices with enhanced features. Toshiba Corporation plans to introduce a 30TB HDD in the market by 2023. This initiative was taken after the company realized the need to increase demand for high-storage devices from cloud companies to store the burgeoning data. This development highlights the continued importance of high-capacity HDDs in meeting the ever-growing data storage needs of cloud providers.

In-Depth Europe Next Generation Storage Market Market Outlook

The Europe Next Generation Storage Market is set for sustained and dynamic growth, propelled by the fundamental shift towards data-centric operations across all industries. Future market potential is significant, driven by the ongoing digital transformation, the widespread adoption of AI and IoT, and the increasing demand for advanced analytics. Strategic opportunities lie in developing highly scalable, intelligent, and secure storage solutions that can cater to the unique requirements of emerging technologies like edge computing and the metaverse. The market will likely witness further consolidation as companies seek to gain competitive advantages through technological integration and expanded service offerings. The increasing focus on data sovereignty and compliance will also continue to shape market strategies, favoring providers with robust localized solutions and strong security postures.

Europe Next Generation Storage Market Segmentation

-

1. Storage System

- 1.1. Direct Attached Storage (DAS)

- 1.2. Network Attached Storage (NAS)

- 1.3. Storage Area Network (SAN)

-

2. Storage Architecture

- 2.1. File and Object-based Storage (FOBS)

- 2.2. Block Storage

-

3. End-User Industry

- 3.1. BFSI

- 3.2. Retail

- 3.3. IT and Telecom

- 3.4. Healthcare

- 3.5. Media and Entertainment

Europe Next Generation Storage Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Next Generation Storage Market Regional Market Share

Geographic Coverage of Europe Next Generation Storage Market

Europe Next Generation Storage Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.30% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Volume of Digital Data; Rising Adoption of Solid-state Devices; Increasing Proliferation of Smartphones

- 3.2.2 Laptops

- 3.2.3 and Tablets

- 3.3. Market Restrains

- 3.3.1. Lack of Data Security in Cloud- and Server-based Services

- 3.4. Market Trends

- 3.4.1. IT and telecom segment is expected to grow at a higher pace.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Next Generation Storage Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 5.1.1. Direct Attached Storage (DAS)

- 5.1.2. Network Attached Storage (NAS)

- 5.1.3. Storage Area Network (SAN)

- 5.2. Market Analysis, Insights and Forecast - by Storage Architecture

- 5.2.1. File and Object-based Storage (FOBS)

- 5.2.2. Block Storage

- 5.3. Market Analysis, Insights and Forecast - by End-User Industry

- 5.3.1. BFSI

- 5.3.2. Retail

- 5.3.3. IT and Telecom

- 5.3.4. Healthcare

- 5.3.5. Media and Entertainment

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Storage System

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Netgear Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fujitsu Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Corp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hewlett Packard Enterprise Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Scality Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Hitachi Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Dell Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 DataDirect Networks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 NetApp Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Pure Storage Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Netgear Inc

List of Figures

- Figure 1: Europe Next Generation Storage Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Next Generation Storage Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Next Generation Storage Market Revenue Million Forecast, by Storage System 2020 & 2033

- Table 2: Europe Next Generation Storage Market Revenue Million Forecast, by Storage Architecture 2020 & 2033

- Table 3: Europe Next Generation Storage Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 4: Europe Next Generation Storage Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Next Generation Storage Market Revenue Million Forecast, by Storage System 2020 & 2033

- Table 6: Europe Next Generation Storage Market Revenue Million Forecast, by Storage Architecture 2020 & 2033

- Table 7: Europe Next Generation Storage Market Revenue Million Forecast, by End-User Industry 2020 & 2033

- Table 8: Europe Next Generation Storage Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Next Generation Storage Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Next Generation Storage Market?

The projected CAGR is approximately 10.30%.

2. Which companies are prominent players in the Europe Next Generation Storage Market?

Key companies in the market include Netgear Inc, IBM Corporation, Fujitsu Ltd, Toshiba Corp, Hewlett Packard Enterprise Company, Scality Inc, Hitachi Ltd, Dell Inc, DataDirect Networks, NetApp Inc, Pure Storage Inc.

3. What are the main segments of the Europe Next Generation Storage Market?

The market segments include Storage System, Storage Architecture, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Volume of Digital Data; Rising Adoption of Solid-state Devices; Increasing Proliferation of Smartphones. Laptops. and Tablets.

6. What are the notable trends driving market growth?

IT and telecom segment is expected to grow at a higher pace..

7. Are there any restraints impacting market growth?

Lack of Data Security in Cloud- and Server-based Services.

8. Can you provide examples of recent developments in the market?

January 2023 - Google and Telefonica signed a deal for digital transformation and an advance 5G mobile edge computing system in Spain. Google cloud region will integrate the Highest worldwide security and data protection standards for Telefonica's Madrid region infrastructure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Next Generation Storage Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Next Generation Storage Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Next Generation Storage Market?

To stay informed about further developments, trends, and reports in the Europe Next Generation Storage Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence