Key Insights

The European membrane water treatment chemicals market is poised for significant expansion, driven by escalating demand for purified water, stringent environmental mandates, and the widespread adoption of advanced membrane filtration technologies across diverse industrial sectors. The market's robust Compound Annual Growth Rate (CAGR) of 6.1% from 2019 to 2024 signifies a substantial growth trajectory. This expansion is underpinned by increasing water scarcity across the continent, a heightened emphasis on water reuse and recycling, and the growing implementation of sophisticated membrane systems, such as reverse osmosis and ultrafiltration, in both industrial and municipal water treatment facilities. Furthermore, the rising need for high-purity water in sectors like pharmaceuticals, food and beverages, and power generation is a key driver of market growth. Leading companies are actively innovating, fostering competition and the development of specialized, high-performance chemicals for membrane filtration applications, further propelled by governmental initiatives promoting sustainable water management.

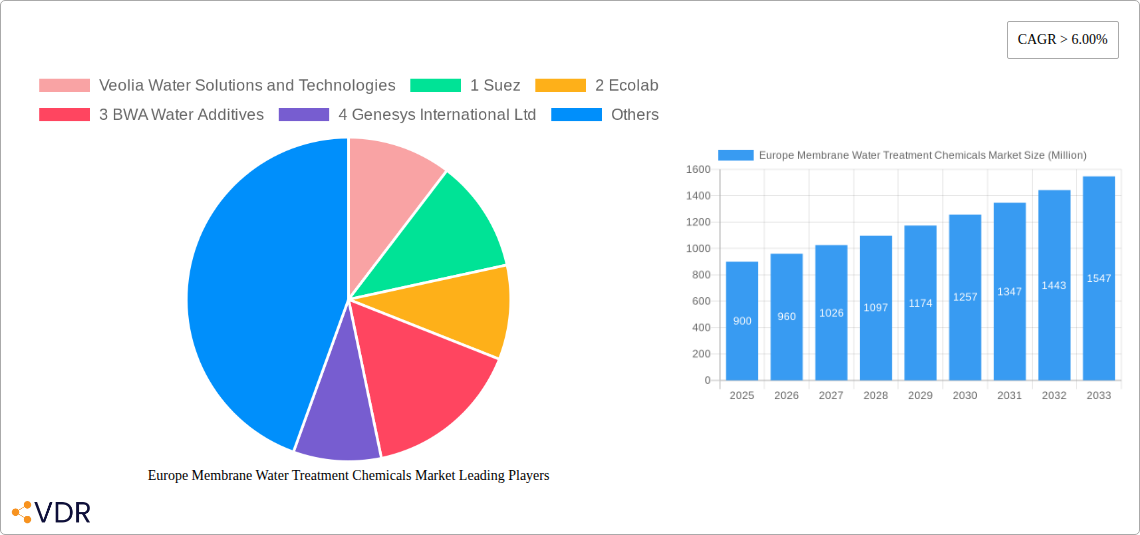

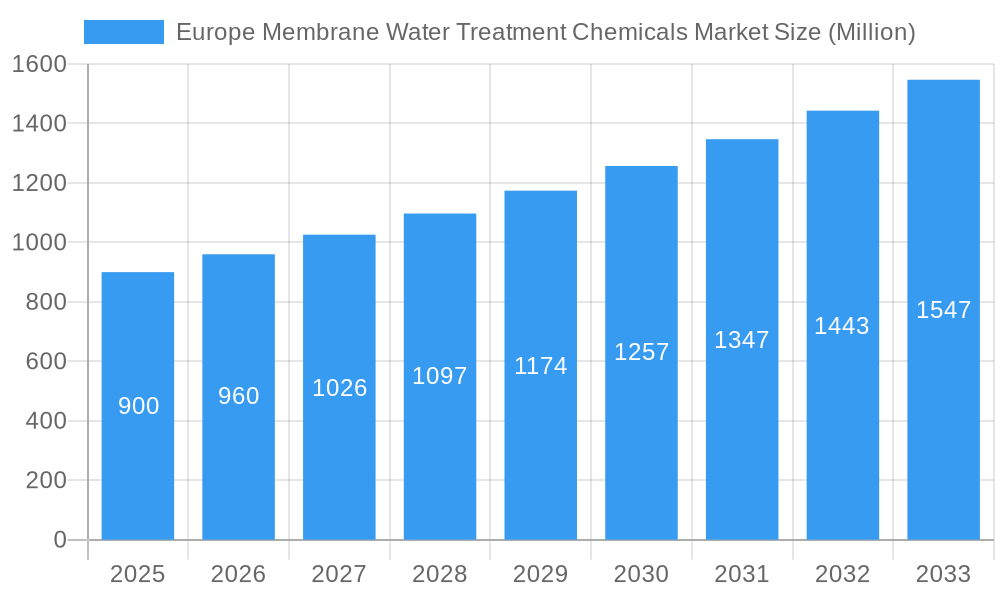

Europe Membrane Water Treatment Chemicals Market Market Size (In Billion)

While the growth outlook is positive, several factors may temper market expansion, including volatility in raw material costs, rigorous regulations on chemical usage, and concerns regarding the ecological impact of specific chemicals. Nevertheless, the development of sustainable, eco-friendly chemical alternatives and continuous improvements in membrane technology are actively addressing these challenges. Market segmentation by chemical type (e.g., anti-scalants, biocides, cleaning agents), application (industrial, municipal), and region will offer a clearer view of specific market opportunities. Projections for the forecast period (2025-2033) indicate sustained market growth, with precise rates influenced by technological innovation, regulatory shifts, and prevailing economic conditions. Based on current trends, the market size is estimated at €2.4 billion in the base year of 2025, with an anticipated CAGR of 6.1% extending through 2033. This forecast considers both the driving forces and potential impediments to market development.

Europe Membrane Water Treatment Chemicals Market Company Market Share

Europe Membrane Water Treatment Chemicals Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Membrane Water Treatment Chemicals Market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive data analysis to provide actionable insights for industry professionals, investors, and stakeholders. The parent market is the broader European water treatment chemicals market, while the child market focuses specifically on membrane-based water treatment applications. The market size is projected in Million units.

Note: Values presented as "xx" represent data unavailable at the time of report creation but included for contextual completeness. Predictive models were utilized where data gaps existed.

Europe Membrane Water Treatment Chemicals Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the European membrane water treatment chemicals market. The market is moderately concentrated, with a handful of major players holding significant market share. Technological innovation, particularly in reverse osmosis (RO) and nanofiltration (NF) membrane technologies, is a key driver. Stringent environmental regulations across Europe are further boosting market growth, while cost-effective substitutes and evolving end-user demographics present challenges.

- Market Concentration: xx% market share held by top 5 players in 2025.

- Technological Innovation: Significant investment in advanced membrane materials (e.g., graphene-based membranes) and improved chemical formulations.

- Regulatory Framework: EU directives on water quality and wastewater treatment are key drivers.

- Competitive Substitutes: Alternative water treatment technologies, such as ion exchange, pose some competitive pressure.

- End-User Demographics: The municipal sector accounts for xx% of the market, followed by industrial applications (xx%) and commercial segments (xx%).

- M&A Trends: xx M&A deals were recorded between 2019 and 2024, reflecting consolidation in the market. Factors include economies of scale and access to new technologies. Innovation barriers include high R&D costs and regulatory approval processes.

Europe Membrane Water Treatment Chemicals Market Growth Trends & Insights

The Europe Membrane Water Treatment Chemicals Market is undergoing significant expansion, propelled by escalating demand for high-quality water resources, increasingly stringent environmental mandates, and continuous advancements in membrane technology. This dynamic market was valued at approximately [Insert Specific Value] million units in 2019 and is forecasted to surge to an estimated [Insert Specific Value] million units by 2033, demonstrating a compound annual growth rate (CAGR) of around [Insert Specific Percentage]% throughout the 2025-2033 projection period. Adoption rates are particularly pronounced in regions grappling with water scarcity and those boasting highly developed industrial sectors. Technological innovations, such as the development of more energy-efficient and fouling-resistant membranes, are acting as powerful accelerators for market growth. Furthermore, a palpable shift in consumer and industrial preferences towards sustainable and environmentally responsible solutions is positively influencing market demand for specialized membrane treatment chemicals.

Dominant Regions, Countries, or Segments in Europe Membrane Water Treatment Chemicals Market

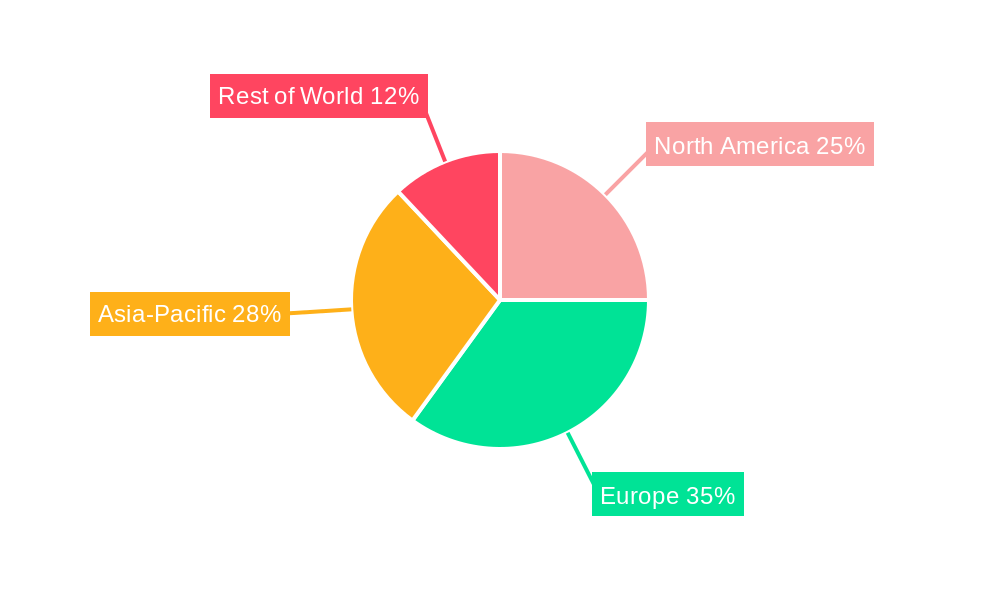

Western Europe currently holds a dominant position in the market, with countries like Germany, France, and the United Kingdom leading the charge. This leadership is attributed to the region's highly developed water infrastructure, a robust framework of stringent environmental regulations, and a consistently high level of industrial activity. The escalating emphasis on water reuse initiatives and the expansion of desalination projects across Southern Europe are also significant contributors to market growth in these areas.

-

Key Market Drivers:

- Strict and evolving environmental regulations and water quality standards.

- The presence of a large and diverse industrial base, especially in chemical processing, manufacturing, and pharmaceuticals.

- Growing urban populations leading to increased demand for potable water and advanced wastewater treatment.

- Substantial government investments in modernizing and expanding water infrastructure.

- The need to address emerging contaminants and ensure water safety.

-

Factors Contributing to Market Dominance:

- Significant market share driven by advanced industrialization and adherence to rigorous regulatory frameworks.

- The strategic presence of major global players in the membrane chemicals sector.

- High and widespread adoption rates of advanced membrane water treatment technologies across various applications.

- Well-established distribution networks and a strong focus on research and development.

The municipal sector commands the largest market share, underscoring the critical and widespread need for effective potable water purification and sophisticated wastewater management. The continued growth within this segment is being propelled by rapid urbanization, increasing population density, and a growing awareness of public health concerns related to water quality.

Europe Membrane Water Treatment Chemicals Market Product Landscape

The market encompasses a wide range of chemicals tailored to different membrane types and applications, including antiscalants, biocides, cleaning agents, and dispersants. Product innovation focuses on developing more environmentally friendly, energy-efficient, and high-performance formulations. Unique selling propositions often revolve around enhanced efficiency, reduced environmental impact, and improved membrane lifespan. Technological advancements include the development of intelligent chemicals that adapt to changing water conditions.

Key Drivers, Barriers & Challenges in Europe Membrane Water Treatment Chemicals Market

Key Drivers: The sustained demand for high-purity water, coupled with increasingly stringent environmental regulations across the EU and individual member states, alongside continuous technological advancements in membrane science, are the primary catalysts for market expansion. These robust regulatory frameworks mandate the implementation of effective and safe water treatment chemicals, thereby fostering innovation and driving the adoption of advanced solutions.

Key Barriers & Challenges: Significant hurdles include potential supply chain disruptions stemming from geopolitical instability, volatility in the prices of essential raw materials, and the lengthy and complex processes involved in obtaining stringent regulatory approvals for new chemical formulations. Furthermore, intense competition from alternative water treatment technologies and the imperative for ongoing research and development to enhance product efficacy and sustainability present ongoing challenges for market participants.

Emerging Opportunities in Europe Membrane Water Treatment Chemicals Market

The European market presents a wealth of opportunities, particularly in the development of more sustainable, cost-effective, and environmentally benign water treatment solutions. The burgeoning interest in water reuse applications and the expansion of desalination capacities are opening up new and significant avenues for chemical suppliers. Emerging markets in Eastern Europe, characterized by increasing industrialization and urbanization, also offer substantial untapped growth potential. Crucially, innovation in chemical formulations specifically designed to address emerging contaminants, such as microplastics and pharmaceutical residues, represents a vital and growing trend.

Growth Accelerators in the Europe Membrane Water Treatment Chemicals Market Industry

Technological breakthroughs, particularly in membrane technology and chemical formulations, are accelerating market growth. Strategic partnerships between chemical manufacturers and membrane technology providers are enhancing product development and market penetration. Market expansion strategies targeting emerging regions and new applications, such as industrial wastewater treatment and desalination, are fueling market expansion.

Key Players Shaping the Europe Membrane Water Treatment Chemicals Market Market

- Veolia Water Solutions and Technologies

- Suez

- Ecolab

- BWA Water Additives

- Genesys International Ltd

- Kemira

- Kurita Water Industries Ltd

- AWC

- King Lee Technologies

- H2O Innovation Inc

- Dow

- Solenis

- Italmatch Chemicals S p A

- Reverse Osmosis Chemicals International

- Danaher (ChemTreat Inc)

- Hydrite Chemical Co

- AES Arabia ltd

- Toray

- Muromachi Chemicals Inc

- List Not Exhaustive

Notable Milestones in Europe Membrane Water Treatment Chemicals Market Sector

- 2020: Introduction of a new, environmentally friendly antiscalant by Ecolab.

- 2021: Merger between two leading chemical manufacturers in the UK, creating a larger market player.

- 2022: Launch of a novel membrane cleaning technology by Veolia.

- 2023: New EU regulations on the use of biocides in water treatment.

- 2024: Significant investment in R&D by Kurita to develop advanced membrane cleaning chemicals.

In-Depth Europe Membrane Water Treatment Chemicals Market Market Outlook

The Europe Membrane Water Treatment Chemicals Market is firmly positioned for sustained and robust growth. This trajectory is underpinned by enduring global trends including escalating water scarcity, the progressive tightening of environmental regulations, and the relentless pace of technological innovation. Strategic partnerships, targeted expansion into nascent markets, and significant investment in research and development are anticipated to further accelerate market expansion. Promising opportunities lie in the creation of sustainable and economically viable treatment solutions, the development of specialized chemicals for emerging contaminants, and the servicing of the rapidly expanding desalination sector. The market demonstrates considerable potential for continued expansion and groundbreaking innovation throughout the next decade and beyond.

Europe Membrane Water Treatment Chemicals Market Segmentation

-

1. Chemical Type

- 1.1. Pre-treatment

- 1.2. Biological Controllers

- 1.3. Other Chemical Type

-

2. End-user Industry

- 2.1. Food & Beverage Processing

- 2.2. Healthcare

- 2.3. Municipal

- 2.4. Chemicals

- 2.5. Power

- 2.6. Other End-user Industries

Europe Membrane Water Treatment Chemicals Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Rest of Europe

Europe Membrane Water Treatment Chemicals Market Regional Market Share

Geographic Coverage of Europe Membrane Water Treatment Chemicals Market

Europe Membrane Water Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Freshwater; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Growing Demand for Freshwater; Other Drivers

- 3.4. Market Trends

- 3.4.1. Pre-treatment chemicals to dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Pre-treatment

- 5.1.2. Biological Controllers

- 5.1.3. Other Chemical Type

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food & Beverage Processing

- 5.2.2. Healthcare

- 5.2.3. Municipal

- 5.2.4. Chemicals

- 5.2.5. Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. Germany Europe Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Pre-treatment

- 6.1.2. Biological Controllers

- 6.1.3. Other Chemical Type

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food & Beverage Processing

- 6.2.2. Healthcare

- 6.2.3. Municipal

- 6.2.4. Chemicals

- 6.2.5. Power

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. United Kingdom Europe Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Pre-treatment

- 7.1.2. Biological Controllers

- 7.1.3. Other Chemical Type

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food & Beverage Processing

- 7.2.2. Healthcare

- 7.2.3. Municipal

- 7.2.4. Chemicals

- 7.2.5. Power

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. France Europe Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Pre-treatment

- 8.1.2. Biological Controllers

- 8.1.3. Other Chemical Type

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food & Beverage Processing

- 8.2.2. Healthcare

- 8.2.3. Municipal

- 8.2.4. Chemicals

- 8.2.5. Power

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. Italy Europe Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Pre-treatment

- 9.1.2. Biological Controllers

- 9.1.3. Other Chemical Type

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food & Beverage Processing

- 9.2.2. Healthcare

- 9.2.3. Municipal

- 9.2.4. Chemicals

- 9.2.5. Power

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. Rest of Europe Europe Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Pre-treatment

- 10.1.2. Biological Controllers

- 10.1.3. Other Chemical Type

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food & Beverage Processing

- 10.2.2. Healthcare

- 10.2.3. Municipal

- 10.2.4. Chemicals

- 10.2.5. Power

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Veolia Water Solutions and Technologies

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 1 Suez

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 2 Ecolab

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 3 BWA Water Additives

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 4 Genesys International Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 5 Kemira

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 6 Kurita Water Industries Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 7 AWC

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 8 King Lee Technologies

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 9 H2O Innovation Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 10 Dow

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 11 Solenis

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 12 Italmatch Chemicals S p A

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 13 Reverse Osmosis Chemicals International

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 14 Danaher (ChemTreat Inc )

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 15 Hydrite Chemical Co

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 16 AES Arabia ltd

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 17 Toray

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 18 Muromachi Chemicals Inc *List Not Exhaustive

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.1 Veolia Water Solutions and Technologies

List of Figures

- Figure 1: Global Europe Membrane Water Treatment Chemicals Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Germany Europe Membrane Water Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 3: Germany Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 4: Germany Europe Membrane Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 5: Germany Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: Germany Europe Membrane Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 7: Germany Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: United Kingdom Europe Membrane Water Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 9: United Kingdom Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 10: United Kingdom Europe Membrane Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 11: United Kingdom Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: United Kingdom Europe Membrane Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 13: United Kingdom Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: France Europe Membrane Water Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 15: France Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 16: France Europe Membrane Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 17: France Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: France Europe Membrane Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 19: France Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Italy Europe Membrane Water Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 21: Italy Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 22: Italy Europe Membrane Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Italy Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Italy Europe Membrane Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Italy Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Europe Europe Membrane Water Treatment Chemicals Market Revenue (billion), by Chemical Type 2025 & 2033

- Figure 27: Rest of Europe Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 28: Rest of Europe Europe Membrane Water Treatment Chemicals Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 29: Rest of Europe Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Rest of Europe Europe Membrane Water Treatment Chemicals Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Rest of Europe Europe Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 2: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 5: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 6: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 8: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 11: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 14: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Chemical Type 2020 & 2033

- Table 17: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 18: Global Europe Membrane Water Treatment Chemicals Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Membrane Water Treatment Chemicals Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Europe Membrane Water Treatment Chemicals Market?

Key companies in the market include Veolia Water Solutions and Technologies, 1 Suez, 2 Ecolab, 3 BWA Water Additives, 4 Genesys International Ltd, 5 Kemira, 6 Kurita Water Industries Ltd, 7 AWC, 8 King Lee Technologies, 9 H2O Innovation Inc, 10 Dow, 11 Solenis, 12 Italmatch Chemicals S p A, 13 Reverse Osmosis Chemicals International, 14 Danaher (ChemTreat Inc ), 15 Hydrite Chemical Co, 16 AES Arabia ltd, 17 Toray, 18 Muromachi Chemicals Inc *List Not Exhaustive.

3. What are the main segments of the Europe Membrane Water Treatment Chemicals Market?

The market segments include Chemical Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.4 billion as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Freshwater; Other Drivers.

6. What are the notable trends driving market growth?

Pre-treatment chemicals to dominate the Market.

7. Are there any restraints impacting market growth?

; Growing Demand for Freshwater; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Membrane Water Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Membrane Water Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Membrane Water Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Europe Membrane Water Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence