Key Insights

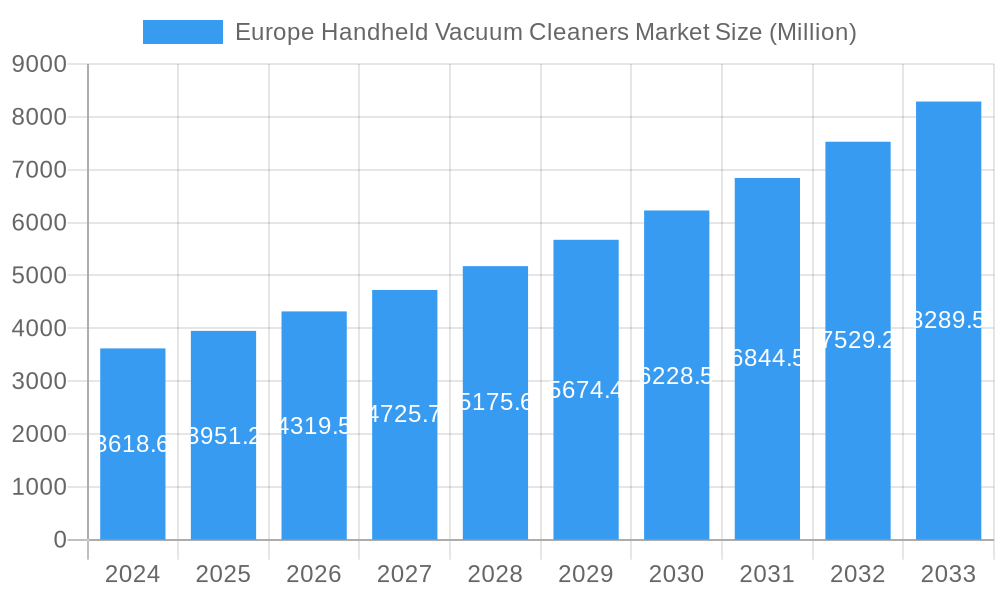

The European handheld vacuum cleaner market is poised for significant growth, projected to reach $3,618.6 million in 2024 and expand at a robust Compound Annual Growth Rate (CAGR) of 9.3% through 2033. This dynamic expansion is fueled by escalating consumer demand for convenient and efficient cleaning solutions. The increasing adoption of cordless models, offering unparalleled maneuverability and ease of use, is a primary driver. Furthermore, rising disposable incomes across European nations translate to a greater willingness among consumers to invest in advanced home appliances that simplify household chores. The growing prevalence of smaller living spaces, particularly in urban centers, also propels the demand for compact and portable vacuum cleaners. Beyond residential use, the commercial sector, including hospitality and small businesses, is increasingly recognizing the value of handheld vacuums for quick clean-ups and specialized tasks, further bolstering market penetration.

Europe Handheld Vacuum Cleaners Market Market Size (In Billion)

The market's trajectory is further shaped by evolving consumer preferences towards smart technology and eco-friendly products. Manufacturers are responding by integrating innovative features such as advanced filtration systems, long-lasting battery life, and lightweight designs. The online retail channel continues to play a pivotal role in market accessibility, offering consumers a wide selection and competitive pricing. However, the offline segment, encompassing brick-and-mortar stores, remains relevant, particularly for product demonstrations and immediate purchase needs. While the market presents substantial opportunities, potential restraints such as the high initial cost of premium cordless models and intense competition among established brands like Dyson, Hoover, and iRobot require strategic consideration by market participants. Nevertheless, the overarching trend of convenience-driven purchasing and technological advancements suggests a bright future for the European handheld vacuum cleaner market.

Europe Handheld Vacuum Cleaners Market Company Market Share

Unlock critical insights into the dynamic Europe handheld vacuum cleaners market. This comprehensive report, spanning 2019 to 2033 with a base year of 2025 and a forecast period of 2025-2033, offers an in-depth analysis of market size evolution, key growth drivers, emerging opportunities, and competitive landscapes. Explore the increasing demand for cordless vacuum cleaners in home applications and the impact of online distribution channels on market penetration. With a focus on technological innovation and consumer behavior shifts, this report is essential for stakeholders seeking to capitalize on the expanding Europe handheld vacuum cleaner industry.

Europe Handheld Vacuum Cleaners Market Market Dynamics & Structure

The Europe handheld vacuum cleaners market exhibits a moderately concentrated structure, driven by intense competition and continuous product innovation. Leading companies like Dyson, Hoover, and Xiaomi are at the forefront, investing heavily in research and development to enhance features such as suction power, battery life, and portability. Technological innovation is a primary driver, with advancements in battery technology and motor efficiency leading to the development of more powerful and user-friendly cordless models. Regulatory frameworks, particularly concerning energy efficiency and safety standards, also shape product development and market entry. Competitive product substitutes, including robotic vacuums and larger upright vacuums, offer alternative cleaning solutions, necessitating continuous differentiation for handheld devices. End-user demographics are shifting towards tech-savvy consumers, prioritizing convenience and performance. Mergers and acquisitions (M&A) activity, while not pervasive, can significantly alter market dynamics by consolidating market share and expanding product portfolios. For instance, the acquisition of smaller innovative brands by larger players can accelerate the integration of new technologies. The market is characterized by a high volume of unit sales driven by increasing disposable incomes and a growing awareness of hygiene. Barriers to innovation include high R&D costs and the need for extensive consumer testing to ensure product reliability and user satisfaction. The market size for handheld vacuum cleaners in Europe is projected to reach approximately 55 million units by 2025, with a significant portion attributed to the cordless segment.

- Market Concentration: Moderately concentrated with key players holding substantial market share.

- Technological Innovation: Driven by advancements in battery technology, motor efficiency, and smart features.

- Regulatory Frameworks: Focus on energy efficiency, safety, and environmental compliance.

- Competitive Substitutes: Robotic vacuums, upright vacuums, and specialized cleaning tools.

- End-User Demographics: Growing demand from urban households, pet owners, and car owners.

- M&A Trends: Potential for strategic acquisitions to gain market access or technological edge.

- Market Size (Estimated 2025): Approximately 55 million units.

Europe Handheld Vacuum Cleaners Market Growth Trends & Insights

The Europe handheld vacuum cleaners market is poised for significant growth, projected to expand from approximately 48 million units in 2023 to a remarkable 62 million units by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 5.8% during the forecast period. This upward trajectory is fueled by a confluence of evolving consumer preferences, technological advancements, and increasing disposable incomes across the continent. The shift towards convenience and agility in domestic chores has cemented the cordless vacuum cleaner as the dominant product type, capturing an estimated 75% of the market share in 2025. Consumers are increasingly valuing the freedom of movement and the ease of use offered by battery-powered devices, making them ideal for quick clean-ups and smaller living spaces prevalent in European urban centers.

Technological disruptions are continually redefining the performance benchmarks for handheld vacuums. Innovations in lithium-ion battery technology have led to longer runtimes and faster charging capabilities, addressing a key historical concern for cordless models. Furthermore, the integration of smart features, such as advanced filtration systems capturing microscopic allergens and dust particles, and intuitive user interfaces, is enhancing their appeal. The market penetration of high-performance handheld vacuums is expected to rise as consumers become more discerning about indoor air quality and hygiene.

Consumer behavior is a pivotal driver of this market expansion. A growing emphasis on cleanliness and a proactive approach to maintaining healthy living environments, amplified by global health awareness, is spurring demand. The "smart home" ecosystem is also playing an increasingly important role, with consumers seeking connected devices that can be integrated into their existing smart home setups. This trend is particularly evident in the home application segment, which is expected to account for over 80% of the total market by 2033. The convenience of online distribution channels, offering wider product selection, competitive pricing, and doorstep delivery, is also accelerating adoption rates, contributing to an estimated 60% of sales originating from e-commerce platforms in 2025.

The automotive sector, though smaller, presents a growing niche, driven by the demand for specialized compact cleaning solutions to maintain vehicle interiors. As car ownership remains high in Europe, the need for effective and portable car cleaning tools is on the rise. This segment is expected to grow at a CAGR of 4.5% during the forecast period. The overall market size evolution reflects a strong and sustained demand for efficient, portable, and technologically advanced cleaning solutions.

Dominant Regions, Countries, or Segments in Europe Handheld Vacuum Cleaners Market

The Europe handheld vacuum cleaners market is predominantly driven by the cordless vacuum cleaner segment, which is projected to hold an impressive 75% market share by 2025, contributing significantly to the overall market volume, estimated at over 55 million units for the year. This dominance stems from evolving consumer lifestyles that prioritize convenience, agility, and freedom from restrictive cords. The home application segment is another colossal driver, expected to account for a substantial 80% of the market share by 2033. This is underpinned by increasing urbanization, smaller living spaces where maneuverability is key, and a growing awareness of domestic hygiene and air quality among European households.

Geographically, Germany stands out as the leading country, driven by its strong economy, high disposable incomes, and a mature consumer electronics market. German consumers are early adopters of new technologies and place a premium on product quality and performance, making them highly receptive to advanced cordless vacuum cleaner models. The country’s robust retail infrastructure, encompassing both sophisticated online platforms and a widespread network of brick-and-mortar stores, ensures broad accessibility of these devices. The market size in Germany alone is anticipated to represent approximately 20% of the total European market in 2025.

The United Kingdom follows closely, with similar trends in consumer preference for cordless convenience and home applications. The increasing prevalence of pet ownership in the UK further boosts demand for effective handheld vacuums capable of tackling pet hair. France and Italy also represent significant markets, with growing demand for energy-efficient and compact cleaning solutions, reflecting a continental shift towards sustainable and space-saving appliances.

The online distribution channel is emerging as a critical growth engine, projected to capture 60% of the market share by 2025. The ease of comparison, competitive pricing, and convenient delivery offered by e-commerce platforms like Amazon, and brand-specific websites, are transforming purchasing habits. This channel is particularly effective in reaching a wider demographic and catering to the needs of consumers in remote areas or those with busy schedules. Offline channels, including hypermarkets and specialized electronics retailers, still hold a significant share, particularly for consumers who prefer hands-on product evaluation before purchase.

- Dominant Segment (Type): Cordless Vacuum Cleaner (Estimated 75% market share in 2025).

- Dominant Segment (Application): Home (Estimated 80% market share by 2033).

- Leading Country: Germany (Estimated 20% of European market share in 2025).

- Key Growth Drivers in Leading Countries: High disposable income, early technology adoption, robust retail infrastructure.

- Dominant Distribution Channel: Online (Estimated 60% market share in 2025).

- Emerging Application Segment: Automotive (growing demand for compact cleaning).

Europe Handheld Vacuum Cleaners Market Product Landscape

The Europe handheld vacuum cleaners market is characterized by a vibrant product landscape focused on enhancing user convenience and cleaning efficacy. Manufacturers are continuously introducing models with improved suction power, extended battery life, and advanced filtration systems, such as HEPA filters, to capture allergens and fine dust particles. Innovations include lightweight designs for effortless portability, ergonomic grips for comfortable handling, and versatile attachments for various cleaning tasks, from upholstery to car interiors. Smart features are also gaining traction, with some models offering app connectivity for battery status monitoring and filter replacement reminders. The distinction between cordless vacuum cleaner and corded vacuum cleaner types is stark, with cordless options dominating due to their unparalleled portability. Product performance metrics are increasingly scrutinized, with consumers looking for powerful yet energy-efficient solutions. Unique selling propositions often revolve around extended runtime, rapid charging capabilities, and specialized cleaning modes for different surfaces.

Key Drivers, Barriers & Challenges in Europe Handheld Vacuum Cleaners Market

Key Drivers:

- Increasing Demand for Convenience: The shift towards compact and portable cleaning solutions for quick clean-ups and smaller living spaces.

- Technological Advancements: Innovations in battery technology leading to longer runtimes and faster charging, coupled with enhanced suction power and filtration systems.

- Growing Hygiene Awareness: Heightened consumer concern for indoor air quality and cleanliness, particularly in households with children and pets.

- Rise of the Smart Home Ecosystem: Integration of smart features and connectivity in appliances, appealing to tech-savvy consumers.

- Urbanization: A larger urban population in Europe means smaller living spaces where maneuverability and compact storage are prioritized.

Key Barriers & Challenges:

- Battery Life Limitations: While improving, battery life remains a concern for some consumers, especially for larger cleaning tasks.

- Price Sensitivity: Premium models with advanced features can be expensive, limiting adoption among budget-conscious consumers.

- Competition from Other Vacuum Types: Upright vacuums and robotic vacuums offer alternative solutions that may be preferred for different cleaning needs.

- Supply Chain Disruptions: Potential for global supply chain issues impacting component availability and manufacturing costs.

- Environmental Regulations: Evolving regulations on battery disposal and product recyclability can add complexity and cost to product development.

Emerging Opportunities in Europe Handheld Vacuum Cleaners Market

Emerging opportunities in the Europe handheld vacuum cleaners market lie in the continued innovation of smart functionalities and specialized applications. The integration of AI for intelligent surface detection and optimized cleaning modes presents a significant avenue for differentiation. Untapped markets include more focused solutions for specific user groups, such as the elderly or individuals with mobility issues, requiring ultra-lightweight and ergonomically designed models. The growing trend of sustainable living also opens doors for eco-friendly product lines, utilizing recycled materials and offering extended product lifecycles. Furthermore, the expansion of the automotive segment, with a focus on bespoke car cleaning kits, offers niche growth potential. Evolving consumer preferences for multi-functional devices also present opportunities for handheld vacuums that can seamlessly transition between different cleaning tasks, perhaps incorporating features like UV sanitization or upholstery steaming.

Growth Accelerators in the Europe Handheld Vacuum Cleaners Market Industry

Growth accelerators for the Europe handheld vacuum cleaners market are primarily driven by sustained technological breakthroughs and strategic market expansion initiatives. The ongoing miniaturization and efficiency improvements in battery technology will continue to reduce the reliance on corded alternatives and enhance the appeal of cordless models. Strategic partnerships between manufacturers and retailers, particularly those focused on expanding online presence and enhancing the e-commerce customer experience, will further fuel adoption. The increasing consumer focus on health and wellness, amplified by awareness campaigns around air quality and allergen reduction, acts as a potent market stimulant. Furthermore, brands that effectively leverage digital marketing to educate consumers about the benefits of advanced handheld vacuums and their applications in modern living will witness accelerated market penetration.

Key Players Shaping the Europe Handheld Vacuum Cleaners Market Market

- Dyson

- Hoover

- Xiaomi

- Roborock

- Dreame

- Bissell

- Karcher

- Bosch

- Shark

- Irobot

Notable Milestones in Europe Handheld Vacuum Cleaners Market Sector

- September 2023: ISS Partners With ToolSense to Digitise Asset Operations. ISS has established a new global strategic partnership with tech startup company ToolSense to help their employees manage moveable assets such as vacuum cleaners and healthcare equipment.

- May 2023: Eros Group, a leading distributor and retailer in the UAE, announced its partnership with Dreame, a smart consumer technology company that specializes in innovative vacuum cleaners that promises to revolutionize the way people clean their homes.

In-Depth Europe Handheld Vacuum Cleaners Market Market Outlook

The future outlook for the Europe handheld vacuum cleaners market is exceptionally positive, driven by a confluence of sustained innovation, evolving consumer demands, and expanding market accessibility. Growth accelerators such as advancements in battery efficiency and smart home integration will continue to push the boundaries of performance and convenience. The increasing emphasis on hygiene and air quality will maintain strong demand, particularly within the home application segment. Strategic partnerships and the continued dominance of online distribution channels will further broaden market reach and accelerate sales. Opportunities for niche product development, catering to specific consumer needs like automotive cleaning or eco-conscious solutions, present avenues for further expansion. The market is projected to witness consistent volume growth, with an estimated 62 million units by 2033, solidifying its position as a vital segment within the European home appliance industry.

Europe Handheld Vacuum Cleaners Market Segmentation

-

1. Type

- 1.1. Cordless Vacuum Cleaner

- 1.2. Corded Vacuum Cleaner

-

2. Application

- 2.1. Home

- 2.2. Commercial

- 2.3. Automotive

- 2.4. Other Applications

-

3. Distribution Channel

- 3.1. Online

- 3.2. Offline

Europe Handheld Vacuum Cleaners Market Segmentation By Geography

- 1. Germany

- 2. Italy

- 3. Spain

- 4. United Kingdom

- 5. Rest of the Europe

Europe Handheld Vacuum Cleaners Market Regional Market Share

Geographic Coverage of Europe Handheld Vacuum Cleaners Market

Europe Handheld Vacuum Cleaners Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.3% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Changing Lifestyles and Housing Conditions is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Price Sensitivity of Consumers

- 3.4. Market Trends

- 3.4.1. Cordless Technology is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cordless Vacuum Cleaner

- 5.1.2. Corded Vacuum Cleaner

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Home

- 5.2.2. Commercial

- 5.2.3. Automotive

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Online

- 5.3.2. Offline

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Germany

- 5.4.2. Italy

- 5.4.3. Spain

- 5.4.4. United Kingdom

- 5.4.5. Rest of the Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Cordless Vacuum Cleaner

- 6.1.2. Corded Vacuum Cleaner

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Home

- 6.2.2. Commercial

- 6.2.3. Automotive

- 6.2.4. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Online

- 6.3.2. Offline

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Italy Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Cordless Vacuum Cleaner

- 7.1.2. Corded Vacuum Cleaner

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Home

- 7.2.2. Commercial

- 7.2.3. Automotive

- 7.2.4. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Online

- 7.3.2. Offline

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Spain Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Cordless Vacuum Cleaner

- 8.1.2. Corded Vacuum Cleaner

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Home

- 8.2.2. Commercial

- 8.2.3. Automotive

- 8.2.4. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Online

- 8.3.2. Offline

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. United Kingdom Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Cordless Vacuum Cleaner

- 9.1.2. Corded Vacuum Cleaner

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Home

- 9.2.2. Commercial

- 9.2.3. Automotive

- 9.2.4. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Online

- 9.3.2. Offline

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Rest of the Europe Europe Handheld Vacuum Cleaners Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Cordless Vacuum Cleaner

- 10.1.2. Corded Vacuum Cleaner

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Home

- 10.2.2. Commercial

- 10.2.3. Automotive

- 10.2.4. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Online

- 10.3.2. Offline

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Hoover

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dyson

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Irobot

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Xiaomi

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Roborock

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dreame

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bissell

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Karcher

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bosch

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shark

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Hoover

List of Figures

- Figure 1: Europe Handheld Vacuum Cleaners Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Europe Handheld Vacuum Cleaners Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 3: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 6: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 11: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 14: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 19: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 20: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 21: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 22: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 23: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 27: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 29: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 30: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 31: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 32: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 33: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 34: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 35: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 36: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 37: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 38: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 39: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 42: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Type 2020 & 2033

- Table 43: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 44: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 45: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Distribution Channel 2020 & 2033

- Table 46: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 47: Europe Handheld Vacuum Cleaners Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 48: Europe Handheld Vacuum Cleaners Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Handheld Vacuum Cleaners Market?

The projected CAGR is approximately 9.3%.

2. Which companies are prominent players in the Europe Handheld Vacuum Cleaners Market?

Key companies in the market include Hoover, Dyson, Irobot, Xiaomi, Roborock, Dreame, Bissell, Karcher, Bosch, Shark.

3. What are the main segments of the Europe Handheld Vacuum Cleaners Market?

The market segments include Type, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Changing Lifestyles and Housing Conditions is Driving the Market.

6. What are the notable trends driving market growth?

Cordless Technology is Driving the Market.

7. Are there any restraints impacting market growth?

Price Sensitivity of Consumers.

8. Can you provide examples of recent developments in the market?

September 2023: ISS Partners With ToolSense to Digitise Asset Operations. ISS has established a new global strategic partnership with tech startup company ToolSense to help their employees manage moveable assets such as vacuum cleaners and healthcare equipment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Handheld Vacuum Cleaners Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Handheld Vacuum Cleaners Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Handheld Vacuum Cleaners Market?

To stay informed about further developments, trends, and reports in the Europe Handheld Vacuum Cleaners Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence