Key Insights

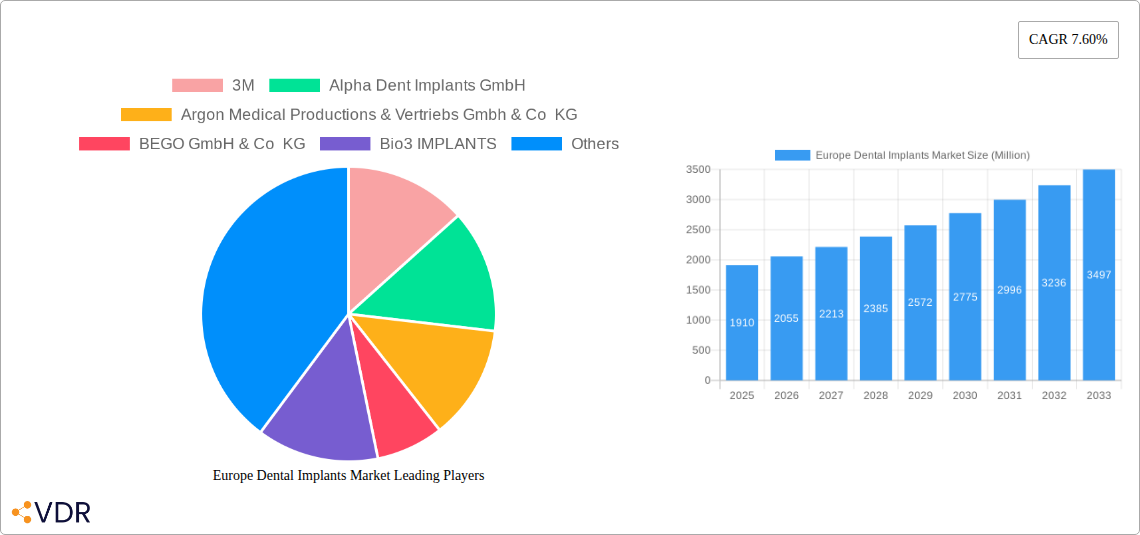

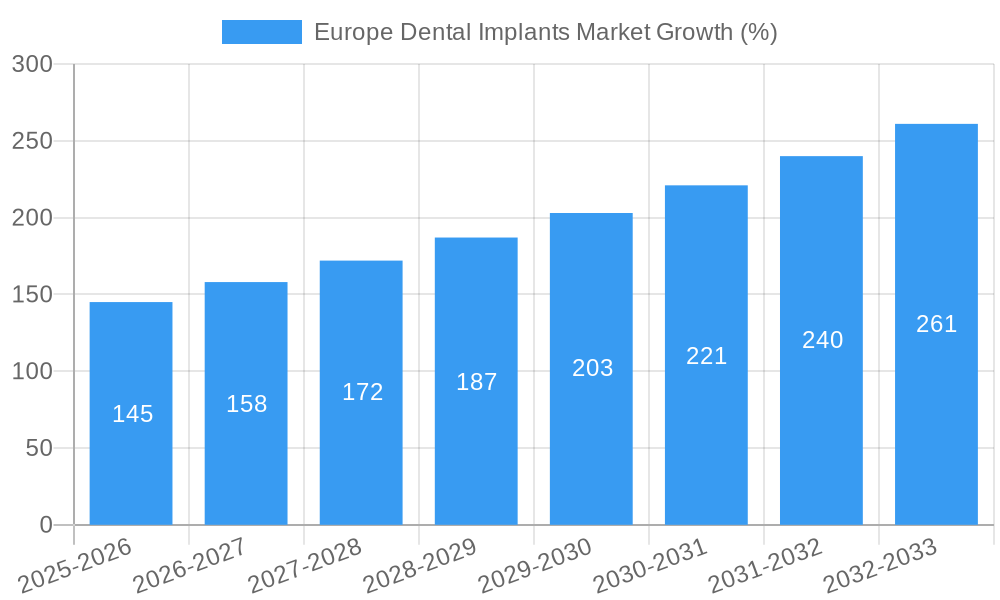

The European dental implants market, valued at €1.91 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 7.60% from 2025 to 2033. This expansion is fueled by several key drivers. An aging population across Europe is leading to increased prevalence of tooth loss and subsequent demand for dental implant solutions. Furthermore, rising disposable incomes and improved access to healthcare are empowering more individuals to seek advanced dental care, including implant procedures. Technological advancements, such as the development of minimally invasive techniques and improved implant materials, are also contributing to market growth by enhancing procedure efficacy and patient comfort. The increasing preference for aesthetically pleasing and functional dental solutions further fuels this demand. While challenges such as high procedure costs and potential complications can act as restraints, the overall market outlook remains positive due to the strong underlying growth drivers.

Competition within the European dental implants market is intense, with key players including 3M, Alpha Dent Implants GmbH, Argon Medical, BEGO, Bio3 IMPLANTS, Straumann, Dentsply Sirona, Nobel Biocare, CAMLOG, and Champions-Implants, amongst others. These companies are actively engaged in research and development, strategic partnerships, and mergers and acquisitions to maintain a competitive edge. Market segmentation is likely driven by implant type (e.g., titanium, zirconia), procedure type (e.g., single-tooth, multiple-tooth), and end-user (e.g., dental clinics, hospitals). Regional variations in market growth are anticipated, with potentially higher growth in countries with strong healthcare infrastructure and rising dental awareness. Future market trends will likely center on digital dentistry technologies, personalized treatment plans, and the integration of artificial intelligence in implant planning and placement.

Europe Dental Implants Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe Dental Implants Market, covering market dynamics, growth trends, regional performance, product landscape, key players, and future outlook. The report utilizes data from the historical period (2019-2024), base year (2025), and estimated year (2025) to project the market's trajectory through the forecast period (2025-2033). The total market size is projected to reach xx Million units by 2033. This report is an essential resource for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic sector.

Europe Dental Implants Market Market Dynamics & Structure

The European dental implants market is characterized by a moderately concentrated landscape, with several major players holding significant market share. While the exact market share percentages for individual companies vary, key players like Straumann, Dentsply Sirona, and Nobel Biocare collectively command a substantial portion. Technological innovation, particularly in digital dentistry and implant materials, is a key driver. Stringent regulatory frameworks, varying across European nations, influence market access and product approvals. The market also faces competition from alternative treatments like dentures and bridges. The aging population across Europe, coupled with rising disposable incomes and increased awareness of dental health, fuels market demand. M&A activity, as exemplified by Straumann's acquisition of GalvoSurge in May 2023, is reshaping the competitive landscape. This deal, valued at xx Million units, highlights the strategic focus on expanding treatment options, especially in peri-implantitis management.

- Market Concentration: Moderately concentrated, with key players holding significant market share.

- Technological Innovation: Digital dentistry, advanced materials (e.g., zirconia), and minimally invasive techniques are driving growth.

- Regulatory Framework: Stringent regulations vary across European countries, impacting market access.

- Competitive Substitutes: Dentures, bridges, and other restorative treatments.

- End-User Demographics: Aging population and rising disposable incomes contribute to market growth.

- M&A Trends: Strategic acquisitions, like Straumann's acquisition of GalvoSurge, are reshaping the market landscape. Approximate M&A deal volume in the past 5 years: xx Million units.

Europe Dental Implants Market Growth Trends & Insights

The European dental implants market is experiencing robust growth, driven by a confluence of factors. The market size is projected to register a CAGR of xx% during the forecast period (2025-2033). This growth is fuelled by increasing awareness of dental health, rising geriatric population requiring dental implants, technological advancements in digital dentistry, and improved implant success rates. Consumer preferences are shifting towards minimally invasive procedures and aesthetically pleasing solutions. The adoption rate of dental implants is steadily increasing, particularly in countries with well-developed healthcare infrastructure. Technological disruptions, such as the introduction of guided surgery and CAD/CAM technologies, are significantly impacting procedural efficiency and patient outcomes. The market penetration is expected to reach xx% by 2033.

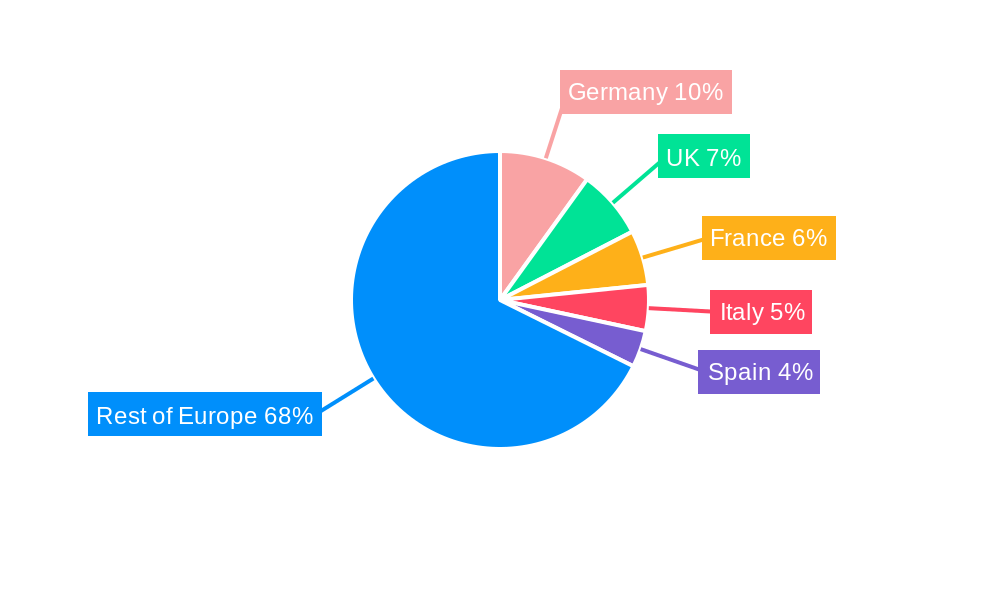

Dominant Regions, Countries, or Segments in Europe Dental Implants Market

Germany, France, and the UK currently dominate the European dental implants market, representing a significant proportion of the overall market size (xx Million units). This dominance can be attributed to several factors:

- Germany: Strong healthcare infrastructure, high disposable incomes, and a large geriatric population.

- France: Well-established dental healthcare system and high consumer spending on dental care.

- UK: Growing demand for aesthetic dental solutions and increasing awareness of dental health.

Other key drivers include favorable economic policies supporting healthcare investment and a well-developed network of dental professionals. These regions display high market penetration rates and have witnessed consistent growth over the past five years. However, the Eastern European market also presents significant growth potential owing to improving healthcare access and rising disposable incomes.

Europe Dental Implants Market Product Landscape

The market offers a diverse range of dental implant products, including different implant materials (titanium, zirconia), surface treatments (SLA, TiUnite), and implant designs (straight, tapered, etc.). These advancements improve osseointegration, longevity, and aesthetic outcomes. Products are differentiated by their biocompatibility, strength, and ease of placement. Digital solutions, such as guided surgery and CAD/CAM systems, enhance precision and efficiency. Companies are increasingly focusing on providing comprehensive treatment solutions, including implants, abutments, and restorative components.

Key Drivers, Barriers & Challenges in Europe Dental Implants Market

Key Drivers:

- Aging Population: The increasing elderly population is a significant driver of demand.

- Technological Advancements: Innovations in implant materials and digital dentistry enhance efficacy.

- Rising Disposable Incomes: Increased spending capacity fuels demand for aesthetic dental solutions.

Key Barriers and Challenges:

- High Treatment Costs: The high cost of dental implants limits access for some segments of the population.

- Regulatory Hurdles: Varying regulatory requirements across Europe can hinder market penetration.

- Competition from Substitutes: Alternative treatments like dentures pose competitive pressure. The market share lost to substitutes is estimated at xx% annually.

Emerging Opportunities in Europe Dental Implants Market

- Untapped Markets in Eastern Europe: Expansion into less saturated markets presents significant growth opportunities.

- Miniaturization and Innovation in Implant Design: Smaller and more biocompatible implants are driving market innovation.

- Growth in Digital Dentistry: Integration of digital technologies, such as 3D printing and guided surgery, will enhance efficiency and patient experience.

Growth Accelerators in the Europe Dental Implants Market Industry

Long-term growth will be accelerated by continued technological advancements, strategic partnerships between implant manufacturers and dental clinics, and expansion into emerging markets. Increased investment in research and development of new implant materials and surgical techniques will further enhance market growth and product innovation. The focus on digital dentistry solutions and personalized treatments will play a pivotal role in market evolution.

Key Players Shaping the Europe Dental Implants Market Market

- 3M

- Alpha Dent Implants GmbH

- Argon Medical Productions & Vertriebs Gmbh & Co KG

- BEGO GmbH & Co KG

- Bio3 IMPLANTS

- Institut Straumann AG

- Dentsply Sirona

- Nobel Biocare Services AG

- CAMLOG Biotechnologies GmbH

- Champions-Implants GmbH

- List Not Exhaustive

Notable Milestones in Europe Dental Implants Market Sector

- May 2023: Straumann acquired GalvoSurge, expanding its peri-implantitis treatment portfolio.

- March 2023: Straumann launched new digital solutions for implantology at IDS Cologne.

In-Depth Europe Dental Implants Market Market Outlook

The future of the European dental implants market is promising. Continued technological innovation, coupled with the aging population and rising disposable incomes, will drive robust growth throughout the forecast period. Strategic partnerships, market expansion into emerging economies, and a focus on patient-centric care will create significant opportunities for market players. The increasing adoption of digital solutions and minimally invasive techniques promises to further enhance treatment efficacy and patient satisfaction, resulting in substantial market expansion.

Europe Dental Implants Market Segmentation

-

1. Part

-

1.1. Fixture

- 1.1.1. Endosteal Implants

- 1.1.2. Subperiosteal Implants

- 1.1.3. Transosteal Implants

- 1.2. Abutment

-

1.1. Fixture

-

2. Material

- 2.1. Titanium Implants

- 2.2. Zirconium Implants

Europe Dental Implants Market Segmentation By Geography

- 1. Germany

- 2. United Kingdom

- 3. France

- 4. Italy

- 5. Spain

- 6. Rest of Europe

Europe Dental Implants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Geriatric Population and Burden of Dental Diseases; Increasing Demand for Cosmetic Dentistry; Increasing Application of CAD/CAM Technologies

- 3.3. Market Restrains

- 3.3.1. Rising Geriatric Population and Burden of Dental Diseases; Increasing Demand for Cosmetic Dentistry; Increasing Application of CAD/CAM Technologies

- 3.4. Market Trends

- 3.4.1. The Zirconium Implants Segment is Expected to Witness a Positive Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Part

- 5.1.1. Fixture

- 5.1.1.1. Endosteal Implants

- 5.1.1.2. Subperiosteal Implants

- 5.1.1.3. Transosteal Implants

- 5.1.2. Abutment

- 5.1.1. Fixture

- 5.2. Market Analysis, Insights and Forecast - by Material

- 5.2.1. Titanium Implants

- 5.2.2. Zirconium Implants

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Germany

- 5.3.2. United Kingdom

- 5.3.3. France

- 5.3.4. Italy

- 5.3.5. Spain

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Part

- 6. Germany Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Part

- 6.1.1. Fixture

- 6.1.1.1. Endosteal Implants

- 6.1.1.2. Subperiosteal Implants

- 6.1.1.3. Transosteal Implants

- 6.1.2. Abutment

- 6.1.1. Fixture

- 6.2. Market Analysis, Insights and Forecast - by Material

- 6.2.1. Titanium Implants

- 6.2.2. Zirconium Implants

- 6.1. Market Analysis, Insights and Forecast - by Part

- 7. United Kingdom Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Part

- 7.1.1. Fixture

- 7.1.1.1. Endosteal Implants

- 7.1.1.2. Subperiosteal Implants

- 7.1.1.3. Transosteal Implants

- 7.1.2. Abutment

- 7.1.1. Fixture

- 7.2. Market Analysis, Insights and Forecast - by Material

- 7.2.1. Titanium Implants

- 7.2.2. Zirconium Implants

- 7.1. Market Analysis, Insights and Forecast - by Part

- 8. France Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Part

- 8.1.1. Fixture

- 8.1.1.1. Endosteal Implants

- 8.1.1.2. Subperiosteal Implants

- 8.1.1.3. Transosteal Implants

- 8.1.2. Abutment

- 8.1.1. Fixture

- 8.2. Market Analysis, Insights and Forecast - by Material

- 8.2.1. Titanium Implants

- 8.2.2. Zirconium Implants

- 8.1. Market Analysis, Insights and Forecast - by Part

- 9. Italy Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Part

- 9.1.1. Fixture

- 9.1.1.1. Endosteal Implants

- 9.1.1.2. Subperiosteal Implants

- 9.1.1.3. Transosteal Implants

- 9.1.2. Abutment

- 9.1.1. Fixture

- 9.2. Market Analysis, Insights and Forecast - by Material

- 9.2.1. Titanium Implants

- 9.2.2. Zirconium Implants

- 9.1. Market Analysis, Insights and Forecast - by Part

- 10. Spain Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Part

- 10.1.1. Fixture

- 10.1.1.1. Endosteal Implants

- 10.1.1.2. Subperiosteal Implants

- 10.1.1.3. Transosteal Implants

- 10.1.2. Abutment

- 10.1.1. Fixture

- 10.2. Market Analysis, Insights and Forecast - by Material

- 10.2.1. Titanium Implants

- 10.2.2. Zirconium Implants

- 10.1. Market Analysis, Insights and Forecast - by Part

- 11. Rest of Europe Europe Dental Implants Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Part

- 11.1.1. Fixture

- 11.1.1.1. Endosteal Implants

- 11.1.1.2. Subperiosteal Implants

- 11.1.1.3. Transosteal Implants

- 11.1.2. Abutment

- 11.1.1. Fixture

- 11.2. Market Analysis, Insights and Forecast - by Material

- 11.2.1. Titanium Implants

- 11.2.2. Zirconium Implants

- 11.1. Market Analysis, Insights and Forecast - by Part

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 3M

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Alpha Dent Implants GmbH

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Argon Medical Productions & Vertriebs Gmbh & Co KG

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 BEGO GmbH & Co KG

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Bio3 IMPLANTS

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Institut Straumann AG

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Dentsply Sirona

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Nobel Biocare Services AG

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 CAMLOG Biotechnologies GmbH

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Champions-Implants GmbH*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 3M

List of Figures

- Figure 1: Global Europe Dental Implants Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Europe Dental Implants Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: Germany Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 4: Germany Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 5: Germany Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 6: Germany Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 7: Germany Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 8: Germany Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 9: Germany Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 10: Germany Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 11: Germany Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Germany Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 13: Germany Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Germany Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

- Figure 15: United Kingdom Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 16: United Kingdom Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 17: United Kingdom Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 18: United Kingdom Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 19: United Kingdom Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 20: United Kingdom Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 21: United Kingdom Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 22: United Kingdom Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 23: United Kingdom Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 24: United Kingdom Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 25: United Kingdom Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: United Kingdom Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

- Figure 27: France Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 28: France Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 29: France Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 30: France Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 31: France Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 32: France Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 33: France Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 34: France Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 35: France Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 36: France Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 37: France Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: France Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Italy Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 40: Italy Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 41: Italy Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 42: Italy Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 43: Italy Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 44: Italy Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 45: Italy Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 46: Italy Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 47: Italy Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Italy Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Italy Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Italy Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Spain Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 52: Spain Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 53: Spain Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 54: Spain Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 55: Spain Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 56: Spain Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 57: Spain Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 58: Spain Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 59: Spain Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 60: Spain Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 61: Spain Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 62: Spain Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

- Figure 63: Rest of Europe Europe Dental Implants Market Revenue (Million), by Part 2024 & 2032

- Figure 64: Rest of Europe Europe Dental Implants Market Volume (Billion), by Part 2024 & 2032

- Figure 65: Rest of Europe Europe Dental Implants Market Revenue Share (%), by Part 2024 & 2032

- Figure 66: Rest of Europe Europe Dental Implants Market Volume Share (%), by Part 2024 & 2032

- Figure 67: Rest of Europe Europe Dental Implants Market Revenue (Million), by Material 2024 & 2032

- Figure 68: Rest of Europe Europe Dental Implants Market Volume (Billion), by Material 2024 & 2032

- Figure 69: Rest of Europe Europe Dental Implants Market Revenue Share (%), by Material 2024 & 2032

- Figure 70: Rest of Europe Europe Dental Implants Market Volume Share (%), by Material 2024 & 2032

- Figure 71: Rest of Europe Europe Dental Implants Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Rest of Europe Europe Dental Implants Market Volume (Billion), by Country 2024 & 2032

- Figure 73: Rest of Europe Europe Dental Implants Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Rest of Europe Europe Dental Implants Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Europe Dental Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Europe Dental Implants Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 4: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 5: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 6: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 7: Global Europe Dental Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Europe Dental Implants Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 10: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 11: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 12: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 13: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 15: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 16: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 17: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 18: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 19: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 21: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 22: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 23: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 24: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 25: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 28: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 29: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 30: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 31: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 33: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 34: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 35: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 36: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 37: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

- Table 39: Global Europe Dental Implants Market Revenue Million Forecast, by Part 2019 & 2032

- Table 40: Global Europe Dental Implants Market Volume Billion Forecast, by Part 2019 & 2032

- Table 41: Global Europe Dental Implants Market Revenue Million Forecast, by Material 2019 & 2032

- Table 42: Global Europe Dental Implants Market Volume Billion Forecast, by Material 2019 & 2032

- Table 43: Global Europe Dental Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Europe Dental Implants Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Dental Implants Market?

The projected CAGR is approximately 7.60%.

2. Which companies are prominent players in the Europe Dental Implants Market?

Key companies in the market include 3M, Alpha Dent Implants GmbH, Argon Medical Productions & Vertriebs Gmbh & Co KG, BEGO GmbH & Co KG, Bio3 IMPLANTS, Institut Straumann AG, Dentsply Sirona, Nobel Biocare Services AG, CAMLOG Biotechnologies GmbH, Champions-Implants GmbH*List Not Exhaustive.

3. What are the main segments of the Europe Dental Implants Market?

The market segments include Part, Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.91 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Geriatric Population and Burden of Dental Diseases; Increasing Demand for Cosmetic Dentistry; Increasing Application of CAD/CAM Technologies.

6. What are the notable trends driving market growth?

The Zirconium Implants Segment is Expected to Witness a Positive Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Rising Geriatric Population and Burden of Dental Diseases; Increasing Demand for Cosmetic Dentistry; Increasing Application of CAD/CAM Technologies.

8. Can you provide examples of recent developments in the market?

May 2023: Straumann acquired GalvoSurge, a Swiss medical device manufacturer in the dental field. GalvoSurge specializes in implant care and maintenance solutions, and with the acquisition, Straumann is expected to meet the increasing demand for peri-implantitis treatments and protect patients from implant loss.March 2023: Straumann launched digital solutions for implantology and new features from the group’s orthodontic brand, ClearCorrect, during the International Dental Show (IDS) in Cologne, Germany.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Dental Implants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Dental Implants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Dental Implants Market?

To stay informed about further developments, trends, and reports in the Europe Dental Implants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence