Key Insights

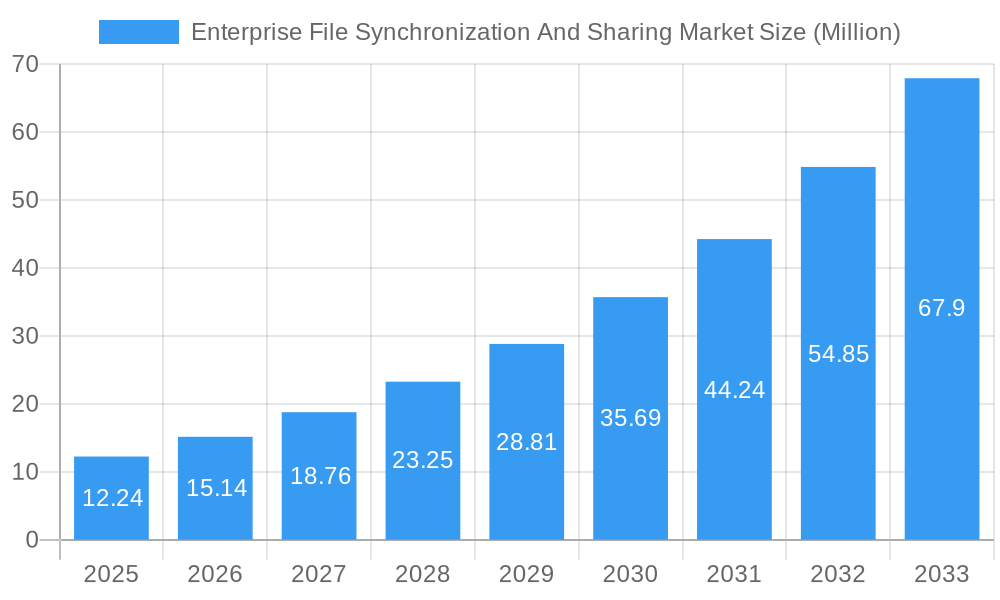

The Enterprise File Synchronization and Sharing (EFSS) market is experiencing explosive growth, projected to reach $12.24 million by 2025, driven by an impressive 24.38% CAGR over the forecast period. This surge is primarily fueled by the escalating need for secure and efficient data collaboration and access across distributed workforces. Organizations are increasingly adopting cloud-based EFSS solutions to enhance productivity, streamline workflows, and ensure data integrity. The shift towards remote and hybrid work models has further accelerated this trend, making seamless file sharing and synchronization a critical component of modern business operations. Small and medium-sized enterprises (SMEs) are actively embracing EFSS to compete with larger organizations by leveraging scalable and cost-effective solutions. Professional services and managed services are emerging as dominant segments within the EFSS market, reflecting the growing demand for expert implementation and ongoing support to maximize the benefits of these platforms.

Enterprise File Synchronization And Sharing Market Market Size (In Million)

The EFSS market's robust expansion is also attributed to the increasing regulatory compliance requirements that necessitate stringent data security and access controls. This has propelled the adoption of advanced features such as granular permissions, data loss prevention (DLP), and audit trails. While the market demonstrates immense potential, certain restraints such as concerns over data privacy and security breaches in cloud environments and the complexity of integrating EFSS solutions with existing IT infrastructures need to be addressed. However, the widespread adoption of cloud infrastructure and the continuous innovation in security protocols are mitigating these challenges. The IT & Telecom and BFSI sectors are leading the adoption of EFSS solutions, followed by Retail, Manufacturing, and Education, all seeking to improve operational efficiency and data management in a dynamic business landscape. Geographical analysis indicates strong market penetration in North America and Europe, with significant growth anticipated in the Asia Pacific region due to rapid digital transformation initiatives.

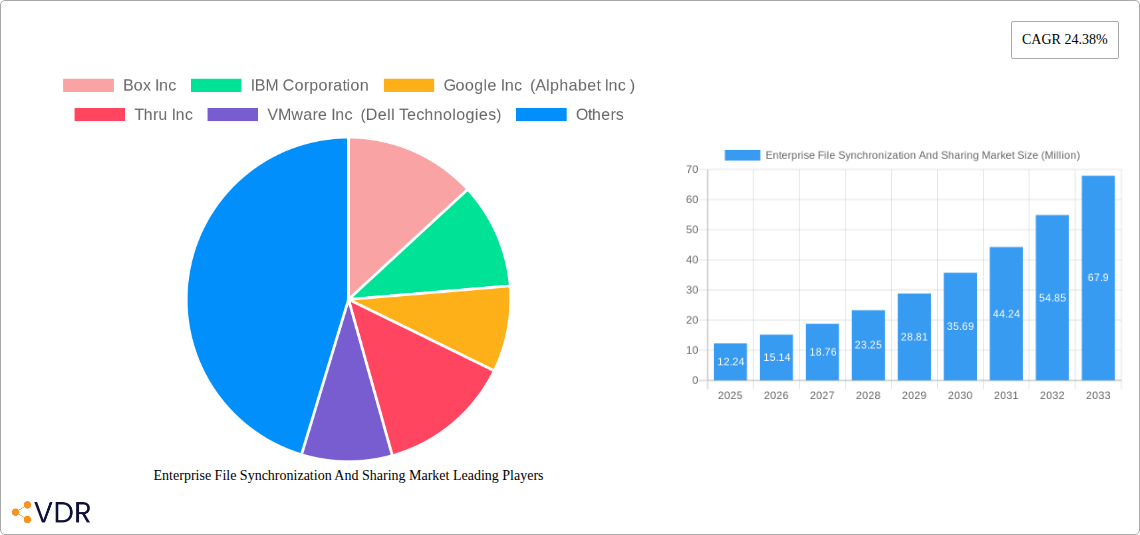

Enterprise File Synchronization And Sharing Market Company Market Share

Enterprise File Synchronization and Sharing Market: Strategic Insights and Future Projections (2019-2033)

Gain a comprehensive understanding of the global Enterprise File Synchronization and Sharing (EFSS) market with our in-depth report. This critical analysis covers market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities, providing actionable intelligence for stakeholders. The report leverages extensive historical data from 2019-2024 and detailed forecasts from 2025-2033, with a base year of 2025, offering a clear vision of market evolution.

The EFSS market is characterized by a blend of established players and emerging innovators, with a dynamic competitive landscape driven by technological advancements and evolving enterprise needs for secure and efficient data collaboration. Market concentration is moderate, with key companies investing heavily in cloud-native solutions and advanced security features. Regulatory frameworks, particularly those concerning data privacy and compliance (e.g., GDPR, CCPA), significantly influence product development and market entry strategies. The prevalence of cloud adoption is a major driver, shifting demand towards SaaS-based EFSS solutions.

Key Market Dynamics & Structure Insights:

- Market Concentration: Moderate, with key players like Microsoft, Google, and IBM holding significant market share, but with increasing innovation from specialized EFSS providers.

- Technological Innovation Drivers: Enhanced security protocols (encryption, access controls), AI-powered data management, seamless cross-platform integration, and user experience improvements are key innovation areas.

- Regulatory Frameworks: Data privacy laws (GDPR, CCPA) and industry-specific regulations (e.g., HIPAA for healthcare, SOX for finance) are critical considerations, driving demand for compliant EFSS solutions.

- Competitive Product Substitutes: While direct EFSS solutions are dominant, adjacent technologies like cloud storage, project management tools with file-sharing capabilities, and secure email gateways can act as partial substitutes.

- End-User Demographics: Increasing remote workforces and a growing reliance on digital collaboration tools across all enterprise sizes fuel market expansion.

- Mergers & Acquisitions (M&A) Trends: Strategic acquisitions are common as larger players aim to integrate advanced EFSS capabilities into their broader cloud and security portfolios, or niche players are acquired for their specialized technologies.

Enterprise File Synchronization And Sharing Market Growth Trends & Insights

The Enterprise File Synchronization and Sharing (EFSS) market is poised for robust growth, driven by the escalating need for secure, collaborative, and accessible data management solutions across all enterprise verticals. The shift towards hybrid and remote work models has significantly accelerated the adoption of EFSS platforms, as organizations prioritize seamless file sharing, version control, and secure access from any location. The market size is projected to expand from approximately $15,000 million in 2019 to an estimated $45,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 10.5% during the forecast period of 2025-2033. This growth is underpinned by increasing investments in cloud infrastructure and a growing awareness of the security risks associated with unmanaged file sharing.

Technological advancements, including the integration of artificial intelligence (AI) for intelligent data categorization, automated workflows, and enhanced security threat detection, are further propelling market adoption. AI-powered features not only improve user productivity but also bolster data governance and compliance efforts. The increasing adoption of mobile devices in enterprise settings necessitates robust mobile EFSS solutions, enabling employees to access and share files securely on the go. Consumerization of IT also plays a role, as employees expect the ease of use and functionality they experience with personal cloud storage solutions, pushing EFSS providers to enhance user interfaces and integrate with popular collaboration tools.

The evolving consumer behavior, characterized by a preference for collaborative work environments and a reduced tolerance for inefficient data workflows, is a significant market influencer. Businesses are actively seeking solutions that can streamline project management, facilitate real-time collaboration, and ensure data integrity. This trend is particularly evident in industries like IT & Telecom, BFSI, and Retail, where rapid innovation and dynamic market conditions demand agile data handling capabilities. The market penetration of EFSS solutions is expected to deepen as more Small and Medium Enterprises (SMEs) recognize the security and productivity benefits, moving beyond basic file sharing to comprehensive content management. The growing emphasis on data security and regulatory compliance, especially in sectors like Banking, Financial Services and Insurance (BFSI) and Government, further solidifies the demand for advanced EFSS solutions that offer robust encryption, audit trails, and access control mechanisms. The market's trajectory is also influenced by the increasing demand for hybrid cloud solutions, allowing organizations to leverage the scalability of cloud while maintaining control over sensitive data on-premise. The integration of EFSS with other enterprise applications, such as CRM and ERP systems, is also creating new avenues for growth by enabling a more unified and efficient business process.

Dominant Regions, Countries, or Segments in Enterprise File Synchronization And Sharing Market

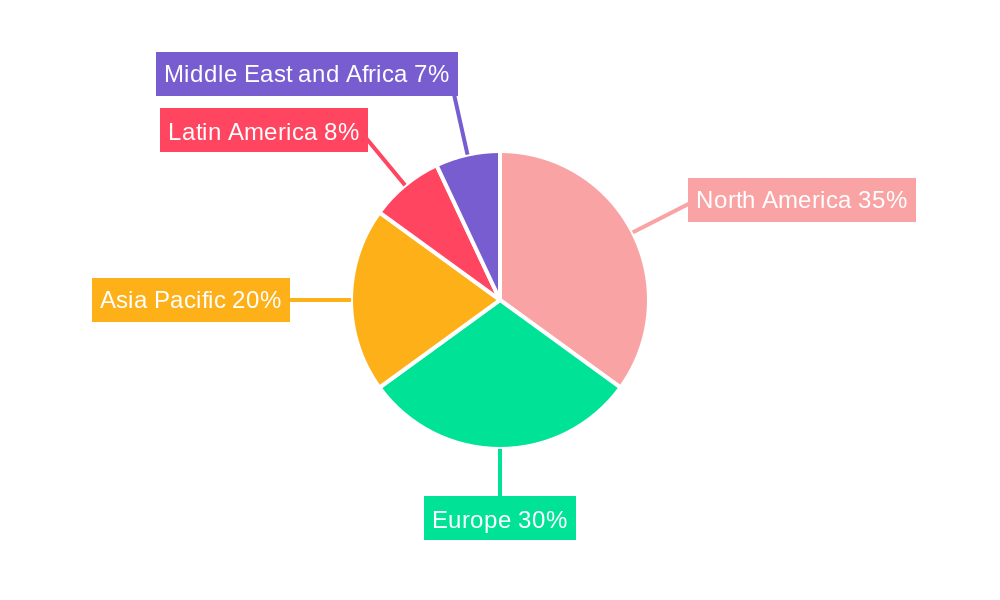

The global Enterprise File Synchronization and Sharing (EFSS) market exhibits significant regional variations, with North America and Europe currently leading in terms of market share and adoption rates. This dominance is primarily attributed to the presence of a well-established IT infrastructure, high digital transformation rates, and strong regulatory frameworks that mandate robust data security and privacy measures. Large enterprises in these regions have been early adopters of cloud technologies, driving the demand for advanced EFSS solutions that integrate seamlessly with existing IT ecosystems.

Within North America, the United States stands out as a key market due to the concentration of leading technology companies, financial institutions, and a substantial proportion of large enterprises across various sectors like IT & Telecom, BFSI, and Healthcare. The country's proactive stance on cybersecurity and data protection further fuels the demand for sophisticated EFSS solutions. Europe, particularly countries like Germany, the UK, and France, also represents a significant market, driven by stringent data privacy regulations like GDPR, which compel organizations to implement compliant and secure file-sharing mechanisms. The increasing adoption of hybrid cloud strategies across European enterprises further bolsters the demand for flexible EFSS solutions.

When analyzing market segments, the Cloud deployment type emerges as the dominant force, eclipsing on-premise solutions. This trend is a direct consequence of the scalability, cost-effectiveness, and accessibility offered by cloud-based EFSS platforms. The ability to access and share files from anywhere, coupled with reduced IT overhead, makes cloud deployment highly attractive to businesses of all sizes. The Service segment is increasingly leaning towards Managed Services. While Professional Services remain crucial for implementation and customization, the growing complexity of cybersecurity threats and the need for continuous monitoring and support are driving the demand for managed EFSS solutions, where providers take on the responsibility for maintenance, security, and updates.

In terms of End-user Verticals, the IT & Telecom sector leads the pack due to its inherently data-intensive nature, rapid innovation cycles, and the widespread adoption of remote work. The need for seamless collaboration, rapid software deployment, and secure sharing of sensitive intellectual property makes EFSS indispensable for this industry. The Banking, Financial Services and Insurance (BFSI) sector also holds a significant market share, driven by stringent regulatory compliance requirements and the critical need for secure handling of sensitive financial data. Retail is another burgeoning vertical, propelled by the increasing adoption of e-commerce, supply chain management optimization, and the need for collaborative tools among geographically dispersed teams.

The Size of Enterprise segment shows a strong inclination towards Large Enterprises, owing to their complex IT infrastructures, larger datasets, and higher stakes in terms of data security and regulatory compliance. However, Small and Medium Enterprises (SMEs) represent a rapidly growing segment, as awareness of EFSS benefits increases and more affordable, scalable cloud-based solutions become available. The market's future growth will also be significantly shaped by the expansion into emerging economies and the increasing adoption of EFSS by government agencies and educational institutions seeking to enhance collaboration and data security.

Enterprise File Synchronization And Sharing Market Product Landscape

The EFSS product landscape is characterized by continuous innovation focused on enhancing security, usability, and integration capabilities. Key product developments include advanced encryption methods (end-to-end encryption), granular access controls, sophisticated audit trails for compliance, and AI-powered features for content analysis and automated data lifecycle management. Companies are increasingly offering hybrid solutions that allow for both cloud and on-premise deployment, catering to diverse enterprise needs. Unique selling propositions often revolve around seamless integration with existing enterprise applications like Microsoft 365, Google Workspace, and various CRM/ERP systems, as well as robust mobile accessibility and offline synchronization capabilities. Performance metrics often highlight speed of synchronization, storage capacity, and the efficiency of collaboration features.

Key Drivers, Barriers & Challenges in Enterprise File Synchronization And Sharing Market

Key Drivers:

- Escalating Data Volumes: The exponential growth of data necessitates efficient and secure storage, sharing, and collaboration solutions.

- Remote and Hybrid Work Models: The widespread adoption of flexible work arrangements has made EFSS indispensable for maintaining productivity and collaboration.

- Enhanced Security and Compliance Needs: Stringent data privacy regulations (e.g., GDPR, CCPA) and the increasing threat of cyberattacks drive demand for secure EFSS platforms with robust security features.

- Digital Transformation Initiatives: Organizations undergoing digital transformation are actively seeking modern tools to streamline workflows and improve collaboration.

- Improved User Experience and Collaboration Features: Demand for intuitive interfaces and seamless integration with other productivity tools drives innovation.

Barriers & Challenges:

- Integration Complexity: Integrating EFSS solutions with legacy IT systems can be complex and time-consuming for some organizations.

- Cost Concerns for SMEs: While cloud solutions are becoming more affordable, initial setup costs and ongoing subscription fees can still be a barrier for smaller businesses.

- User Adoption and Training: Ensuring widespread user adoption and proper training on security best practices can be a challenge.

- Competition from Adjacent Technologies: File sharing features within project management tools or collaboration suites can act as indirect competition.

- Data Governance and Control: Maintaining comprehensive data governance and control across dispersed workforces can be challenging for some organizations.

Emerging Opportunities in Enterprise File Synchronization And Sharing Market

Emerging opportunities lie in the deeper integration of AI and machine learning for intelligent document management, automated data classification, and predictive security analytics. The expansion of EFSS solutions into specialized verticals like healthcare (secure patient record sharing) and manufacturing (supply chain collaboration) presents significant growth potential. Furthermore, the development of more granular and user-friendly collaboration tools, alongside enhanced integration with emerging technologies like augmented reality (AR) for remote assistance and collaborative design, offers new avenues for market expansion. The growing demand for sovereign cloud solutions in specific regions also presents a niche opportunity for localized EFSS offerings.

Growth Accelerators in the Enterprise File Synchronization And Sharing Market Industry

Long-term growth in the EFSS market will be accelerated by ongoing technological breakthroughs in data security, such as advanced AI-driven threat detection and zero-trust architectures. Strategic partnerships between EFSS providers and major cloud infrastructure providers, as well as enterprise software vendors, will expand market reach and integration capabilities. Furthermore, aggressive market expansion strategies targeting underserved regions and industries, coupled with the development of specialized EFSS solutions tailored to the unique needs of sectors like IoT device management and scientific research, will act as significant growth catalysts. The increasing focus on data analytics and the ability of EFSS platforms to provide insights into data usage and collaboration patterns will also drive adoption.

Key Players Shaping the Enterprise File Synchronization And Sharing Market Market

- Box Inc

- IBM Corporation

- Google Inc (Alphabet Inc )

- Thru Inc

- VMware Inc (Dell Technologies)

- Acronis Inc

- Qnext Corp

- CTERA Networks Inc

- SugarSync Inc

- BlackBerry Limited

- Dropbox Inc

- Microsoft Corporation (Microsoft OneDrive)

- Citrix Systems Inc

Notable Milestones in Enterprise File Synchronization And Sharing Market Sector

- July 2023: Google officially released its Nearby Share app for Windows PCs, enhancing file-sharing accessibility across devices, including estimated transfer times and image previews.

- August 2023: IBM launched an open-source detection and response framework for Managed File Transfer (MFT) attacks, aiming to expedite the detection of vulnerabilities and provide incident response playbooks.

In-Depth Enterprise File Synchronization And Sharing Market Market Outlook

The future outlook for the Enterprise File Synchronization and Sharing market is exceptionally bright, driven by the persistent global trends of digitalization, remote work, and the ever-increasing importance of data security and collaboration. Growth accelerators such as advanced AI integrations for smarter data management and predictive threat intelligence, coupled with strategic partnerships that deepen ecosystem integration, will continue to propel the market forward. The increasing adoption of EFSS by a wider array of end-user verticals, including healthcare and education, and the sustained demand for hybrid cloud deployments underscore the market's resilience and adaptability. Continued innovation in user experience, mobile accessibility, and specialized industry solutions will ensure that EFSS platforms remain integral to modern enterprise operations, unlocking significant future market potential.

Enterprise File Synchronization And Sharing Market Segmentation

-

1. Service

- 1.1. Managed Service

- 1.2. Professional Service

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Deployment Type

- 3.1. On-premise

- 3.2. Cloud

-

4. End-user Vertical

- 4.1. IT & Telecom

- 4.2. Banking, Financial Services and Insurance

- 4.3. Retail

- 4.4. Manufacturing

- 4.5. Education

- 4.6. Government

- 4.7. Other End-user Verticals

Enterprise File Synchronization And Sharing Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Enterprise File Synchronization And Sharing Market Regional Market Share

Geographic Coverage of Enterprise File Synchronization And Sharing Market

Enterprise File Synchronization And Sharing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 24.38% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of BYOD across Various Industries

- 3.3. Market Restrains

- 3.3.1. Growing Penetration of Smartphones and Laptops; Data Privacy Challenges

- 3.4. Market Trends

- 3.4.1. BFSI Segment Is Expected To Account For Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Enterprise File Synchronization And Sharing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Managed Service

- 5.1.2. Professional Service

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Deployment Type

- 5.3.1. On-premise

- 5.3.2. Cloud

- 5.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.4.1. IT & Telecom

- 5.4.2. Banking, Financial Services and Insurance

- 5.4.3. Retail

- 5.4.4. Manufacturing

- 5.4.5. Education

- 5.4.6. Government

- 5.4.7. Other End-user Verticals

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.5.2. Europe

- 5.5.3. Asia Pacific

- 5.5.4. Latin America

- 5.5.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. North America Enterprise File Synchronization And Sharing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service

- 6.1.1. Managed Service

- 6.1.2. Professional Service

- 6.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 6.2.1. Small and Medium Enterprises

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Deployment Type

- 6.3.1. On-premise

- 6.3.2. Cloud

- 6.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.4.1. IT & Telecom

- 6.4.2. Banking, Financial Services and Insurance

- 6.4.3. Retail

- 6.4.4. Manufacturing

- 6.4.5. Education

- 6.4.6. Government

- 6.4.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Service

- 7. Europe Enterprise File Synchronization And Sharing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service

- 7.1.1. Managed Service

- 7.1.2. Professional Service

- 7.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 7.2.1. Small and Medium Enterprises

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Deployment Type

- 7.3.1. On-premise

- 7.3.2. Cloud

- 7.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.4.1. IT & Telecom

- 7.4.2. Banking, Financial Services and Insurance

- 7.4.3. Retail

- 7.4.4. Manufacturing

- 7.4.5. Education

- 7.4.6. Government

- 7.4.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Service

- 8. Asia Pacific Enterprise File Synchronization And Sharing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service

- 8.1.1. Managed Service

- 8.1.2. Professional Service

- 8.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 8.2.1. Small and Medium Enterprises

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Deployment Type

- 8.3.1. On-premise

- 8.3.2. Cloud

- 8.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.4.1. IT & Telecom

- 8.4.2. Banking, Financial Services and Insurance

- 8.4.3. Retail

- 8.4.4. Manufacturing

- 8.4.5. Education

- 8.4.6. Government

- 8.4.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Service

- 9. Latin America Enterprise File Synchronization And Sharing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service

- 9.1.1. Managed Service

- 9.1.2. Professional Service

- 9.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 9.2.1. Small and Medium Enterprises

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Deployment Type

- 9.3.1. On-premise

- 9.3.2. Cloud

- 9.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.4.1. IT & Telecom

- 9.4.2. Banking, Financial Services and Insurance

- 9.4.3. Retail

- 9.4.4. Manufacturing

- 9.4.5. Education

- 9.4.6. Government

- 9.4.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Service

- 10. Middle East and Africa Enterprise File Synchronization And Sharing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service

- 10.1.1. Managed Service

- 10.1.2. Professional Service

- 10.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 10.2.1. Small and Medium Enterprises

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Deployment Type

- 10.3.1. On-premise

- 10.3.2. Cloud

- 10.4. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.4.1. IT & Telecom

- 10.4.2. Banking, Financial Services and Insurance

- 10.4.3. Retail

- 10.4.4. Manufacturing

- 10.4.5. Education

- 10.4.6. Government

- 10.4.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Service

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Box Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Google Inc (Alphabet Inc )

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Thru Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 VMware Inc (Dell Technologies)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Acronis Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Qnext Corp

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 CTERA Networks Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SugarSync Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BlackBerry Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Dropbox Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Microsoft Corporation (Microsoft OneDrive)

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Citrix Systems Inc

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Box Inc

List of Figures

- Figure 1: Global Enterprise File Synchronization And Sharing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Enterprise File Synchronization And Sharing Market Revenue (Million), by Service 2025 & 2033

- Figure 3: North America Enterprise File Synchronization And Sharing Market Revenue Share (%), by Service 2025 & 2033

- Figure 4: North America Enterprise File Synchronization And Sharing Market Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 5: North America Enterprise File Synchronization And Sharing Market Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 6: North America Enterprise File Synchronization And Sharing Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 7: North America Enterprise File Synchronization And Sharing Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 8: North America Enterprise File Synchronization And Sharing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 9: North America Enterprise File Synchronization And Sharing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 10: North America Enterprise File Synchronization And Sharing Market Revenue (Million), by Country 2025 & 2033

- Figure 11: North America Enterprise File Synchronization And Sharing Market Revenue Share (%), by Country 2025 & 2033

- Figure 12: Europe Enterprise File Synchronization And Sharing Market Revenue (Million), by Service 2025 & 2033

- Figure 13: Europe Enterprise File Synchronization And Sharing Market Revenue Share (%), by Service 2025 & 2033

- Figure 14: Europe Enterprise File Synchronization And Sharing Market Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 15: Europe Enterprise File Synchronization And Sharing Market Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 16: Europe Enterprise File Synchronization And Sharing Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 17: Europe Enterprise File Synchronization And Sharing Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 18: Europe Enterprise File Synchronization And Sharing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 19: Europe Enterprise File Synchronization And Sharing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 20: Europe Enterprise File Synchronization And Sharing Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Europe Enterprise File Synchronization And Sharing Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Asia Pacific Enterprise File Synchronization And Sharing Market Revenue (Million), by Service 2025 & 2033

- Figure 23: Asia Pacific Enterprise File Synchronization And Sharing Market Revenue Share (%), by Service 2025 & 2033

- Figure 24: Asia Pacific Enterprise File Synchronization And Sharing Market Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 25: Asia Pacific Enterprise File Synchronization And Sharing Market Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 26: Asia Pacific Enterprise File Synchronization And Sharing Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 27: Asia Pacific Enterprise File Synchronization And Sharing Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 28: Asia Pacific Enterprise File Synchronization And Sharing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 29: Asia Pacific Enterprise File Synchronization And Sharing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 30: Asia Pacific Enterprise File Synchronization And Sharing Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Enterprise File Synchronization And Sharing Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America Enterprise File Synchronization And Sharing Market Revenue (Million), by Service 2025 & 2033

- Figure 33: Latin America Enterprise File Synchronization And Sharing Market Revenue Share (%), by Service 2025 & 2033

- Figure 34: Latin America Enterprise File Synchronization And Sharing Market Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 35: Latin America Enterprise File Synchronization And Sharing Market Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 36: Latin America Enterprise File Synchronization And Sharing Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 37: Latin America Enterprise File Synchronization And Sharing Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 38: Latin America Enterprise File Synchronization And Sharing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 39: Latin America Enterprise File Synchronization And Sharing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 40: Latin America Enterprise File Synchronization And Sharing Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Latin America Enterprise File Synchronization And Sharing Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa Enterprise File Synchronization And Sharing Market Revenue (Million), by Service 2025 & 2033

- Figure 43: Middle East and Africa Enterprise File Synchronization And Sharing Market Revenue Share (%), by Service 2025 & 2033

- Figure 44: Middle East and Africa Enterprise File Synchronization And Sharing Market Revenue (Million), by Size of Enterprise 2025 & 2033

- Figure 45: Middle East and Africa Enterprise File Synchronization And Sharing Market Revenue Share (%), by Size of Enterprise 2025 & 2033

- Figure 46: Middle East and Africa Enterprise File Synchronization And Sharing Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 47: Middle East and Africa Enterprise File Synchronization And Sharing Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 48: Middle East and Africa Enterprise File Synchronization And Sharing Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 49: Middle East and Africa Enterprise File Synchronization And Sharing Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 50: Middle East and Africa Enterprise File Synchronization And Sharing Market Revenue (Million), by Country 2025 & 2033

- Figure 51: Middle East and Africa Enterprise File Synchronization And Sharing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 3: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 4: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 5: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 8: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 9: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 10: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 11: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Service 2020 & 2033

- Table 12: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 13: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 14: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Service 2020 & 2033

- Table 17: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 18: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 19: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 20: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Service 2020 & 2033

- Table 22: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 23: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 24: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 25: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Service 2020 & 2033

- Table 27: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Size of Enterprise 2020 & 2033

- Table 28: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 29: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 30: Global Enterprise File Synchronization And Sharing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Enterprise File Synchronization And Sharing Market?

The projected CAGR is approximately 24.38%.

2. Which companies are prominent players in the Enterprise File Synchronization And Sharing Market?

Key companies in the market include Box Inc, IBM Corporation, Google Inc (Alphabet Inc ), Thru Inc, VMware Inc (Dell Technologies), Acronis Inc, Qnext Corp, CTERA Networks Inc , SugarSync Inc, BlackBerry Limited, Dropbox Inc, Microsoft Corporation (Microsoft OneDrive), Citrix Systems Inc.

3. What are the main segments of the Enterprise File Synchronization And Sharing Market?

The market segments include Service, Size of Enterprise, Deployment Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.24 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of BYOD across Various Industries.

6. What are the notable trends driving market growth?

BFSI Segment Is Expected To Account For Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Penetration of Smartphones and Laptops; Data Privacy Challenges.

8. Can you provide examples of recent developments in the market?

July 2023 - Google has officially released its Nearby Share app for Windows PCs, which makes file-sharing between various devices, including phones, tablets, and Chromebooks, more accessible. The app's official launch included several new improvements, such as the estimated time for file transfers to be completed and image previews within device notifications showing the correct file being shared.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Enterprise File Synchronization And Sharing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Enterprise File Synchronization And Sharing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Enterprise File Synchronization And Sharing Market?

To stay informed about further developments, trends, and reports in the Enterprise File Synchronization And Sharing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence