Key Insights

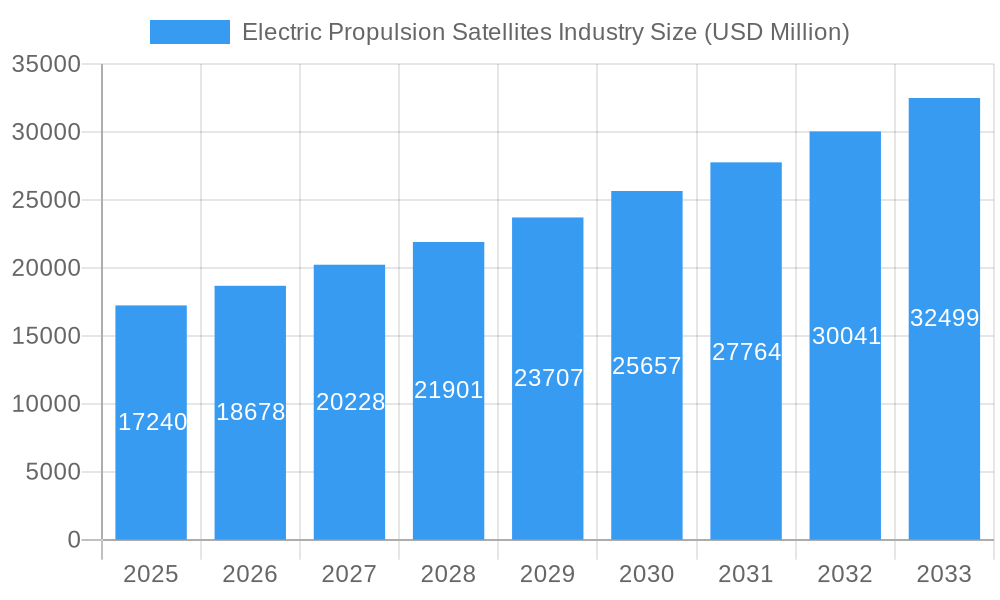

The global Electric Propulsion Satellites Industry is poised for robust expansion, projected to reach an estimated market size of $17.24 billion in 2025. This growth is fueled by the escalating demand for more efficient, cost-effective, and versatile satellite operations across both commercial and military sectors. Key drivers include the increasing number of satellite launches for telecommunications, Earth observation, and national security applications, coupled with advancements in electric propulsion technology that offer higher specific impulse and longer operational lifetimes compared to traditional chemical propulsion systems. The industry is experiencing a significant CAGR of 8.4%, indicating sustained and substantial market momentum throughout the forecast period of 2025-2033. This upward trajectory is further supported by governmental investments in space exploration and defense, as well as the burgeoning private space sector, all of which are actively seeking and adopting electric propulsion solutions for their satellite constellations.

Electric Propulsion Satellites Industry Market Size (In Billion)

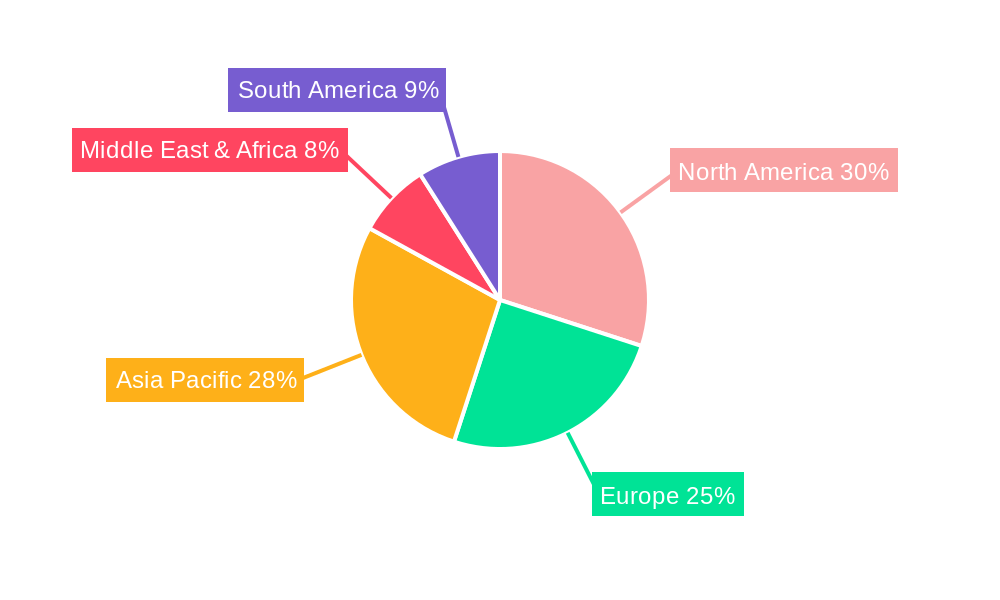

The market segmentation reveals a dynamic landscape. Within propulsion types, Full Electric propulsion is likely to dominate due to its inherent efficiency and suitability for long-duration missions, though Hybrid systems will also maintain a strong presence, offering a balance of power and maneuverability. On the end-user front, both Commercial and Military segments are significant growth engines. The commercial sector benefits from reduced launch costs and enhanced payload capacity enabled by electric propulsion, driving demand for satellite constellations in areas like broadband internet, IoT, and advanced remote sensing. Simultaneously, the military's need for sophisticated satellite capabilities in surveillance, communication, and reconnaissance ensures continued robust demand from this segment. Geographically, North America and Asia Pacific are expected to be key growth regions, driven by strong government support, technological innovation, and a thriving commercial space ecosystem.

Electric Propulsion Satellites Industry Company Market Share

This report provides a comprehensive analysis of the Electric Propulsion Satellites Industry, a critical and rapidly evolving sector of the space economy. With advancements in satellite technology and increasing demand for efficient and cost-effective propulsion systems, electric propulsion is poised for significant expansion. This report leverages high-traffic keywords such as "satellite propulsion systems," "electric thrusters," "space launch," "new space," and "satellite constellations" to maximize search engine visibility. We explore both parent market opportunities and child market growth, offering in-depth insights for industry professionals, investors, and policymakers.

Electric Propulsion Satellites Industry Market Dynamics & Structure

The Electric Propulsion Satellites Industry is characterized by dynamic growth driven by technological innovation and increasing demand for cost-efficient space missions. Market concentration is moderate, with a mix of established aerospace giants and agile new space companies vying for market share. Key innovation drivers include the quest for higher specific impulse, reduced propellant mass, and enhanced mission longevity. Regulatory frameworks, primarily managed by international bodies and national space agencies, are evolving to accommodate the proliferation of small satellites and sophisticated propulsion technologies. Competitive product substitutes, such as advanced chemical propulsion, are being challenged by the superior performance and fuel efficiency of electric propulsion systems, especially for in-orbit maneuvers and station-keeping. End-user demographics are diversifying, with a significant surge in demand from commercial entities for broadband internet, Earth observation, and satellite servicing, alongside continued robust demand from military applications for enhanced surveillance and communication capabilities. Mergers and acquisitions (M&A) trends are notable, as larger companies seek to integrate advanced electric propulsion capabilities into their satellite offerings and new players consolidate their market positions.

- Market Concentration: Moderate, with a growing number of specialized electric propulsion providers.

- Technological Innovation Drivers: Increased specific impulse, reduced propellant consumption, extended satellite lifespan, miniaturization of thrusters.

- Regulatory Frameworks: Evolving to support small satellite deployment and advanced propulsion technologies.

- Competitive Product Substitutes: Advanced chemical propulsion, albeit with increasing disadvantages for certain mission profiles.

- End-User Demographics: Expanding commercial applications (telecom, EO, LEO constellations) and sustained military requirements.

- M&A Trends: Strategic acquisitions to enhance technological portfolios and market reach.

Electric Propulsion Satellites Industry Growth Trends & Insights

The global Electric Propulsion Satellites Industry is experiencing an unprecedented growth trajectory, projected to reach a market size of $XX billion by 2033. This expansion is fueled by an escalating adoption rate of electric propulsion across various satellite applications, driven by its inherent advantages in fuel efficiency and mission flexibility. Technological disruptions, particularly in the development of highly efficient and compact electric thrusters, are continuously redefining the industry's capabilities. These advancements enable smaller, more agile satellites to perform complex maneuvers, leading to a paradigm shift in how space missions are conceived and executed. Consumer behavior shifts, primarily from the commercial sector, are prioritizing cost-effectiveness and longer operational lifetimes for satellite constellations. This trend directly benefits electric propulsion, which significantly reduces launch mass and fuel requirements, thereby lowering overall mission costs. The compound annual growth rate (CAGR) for the forecast period is estimated at an impressive XX%, indicating sustained and robust expansion. Market penetration of electric propulsion systems is rapidly increasing, especially within the small satellite segment, where its benefits are most pronounced. The proliferation of Low Earth Orbit (LEO) constellations for broadband internet services and Earth observation is a major catalyst, demanding thousands of satellites, each requiring reliable and efficient propulsion for deployment, station-keeping, and de-orbiting. Furthermore, the growing interest in in-orbit servicing, assembly, and manufacturing (OSAM) applications also relies heavily on the precise control and sustained thrust capabilities offered by electric propulsion. The development of new propellant types and advanced power processing units (PPUs) are further contributing to enhanced performance and reliability, making electric propulsion an indispensable technology for the future of space exploration and utilization. The industry is moving towards more integrated propulsion solutions, where electric propulsion systems are designed in conjunction with satellite platforms from the outset, optimizing overall performance and reducing development timelines. This synergistic approach is a key indicator of the industry's maturity and its growing importance in the broader space ecosystem.

Dominant Regions, Countries, or Segments in Electric Propulsion Satellites Industry

The Electric Propulsion Satellites Industry is witnessing significant growth across various segments, with Full Electric propulsion systems currently dominating the market, driven by their unparalleled efficiency for long-duration missions and station-keeping. This dominance is particularly evident in the Commercial end-user segment, which accounts for the largest market share, estimated at $XX billion in 2025. The proliferation of satellite constellations for broadband internet and Earth observation, largely driven by commercial entities, necessitates robust and cost-effective propulsion solutions, where full electric systems excel. Key drivers for this segment's dominance include strong economic policies supporting private space ventures, substantial investment in new space technologies, and the development of advanced manufacturing capabilities.

The United States emerges as the leading country in the Electric Propulsion Satellites Industry, contributing an estimated market share of XX% in 2025, valued at $XX billion. This leadership is attributed to a strong ecosystem of established aerospace companies and innovative startups, coupled with significant government investment in space research and development. The presence of key players like Accion Systems Inc., Aerojet Rocketdyne Holdings Inc., and Northrop Grumman Corporation, alongside pioneering research institutions, fosters a highly competitive and technologically advanced landscape. The US also benefits from robust regulatory support for commercial space activities and a well-developed infrastructure for satellite manufacturing and launch.

The Hybrid propulsion segment, while smaller, is experiencing rapid growth, particularly within the Military end-user segment, valued at $XX billion in 2025. Military applications demand versatile propulsion systems capable of rapid maneuvers, high thrust for orbital changes, and stealth capabilities, which hybrid systems can offer. Economic policies favoring defense spending and the increasing strategic importance of space-based assets for national security are key drivers. Countries with strong defense sectors and a focus on maintaining space superiority are investing heavily in these technologies.

- Dominant Propulsion Type: Full Electric (estimated market share of XX% in 2025).

- Dominant End User: Commercial (estimated market share of XX% in 2025).

- Leading Country: United States (estimated market share of XX% in 2025).

- Key Drivers for Commercial Dominance: Proliferation of LEO constellations, demand for broadband internet and Earth observation services, cost-effectiveness of electric propulsion for station-keeping.

- Key Drivers for US Leadership: Strong R&D ecosystem, government investment, favorable regulatory environment, presence of key industry players.

- Growing Segment: Hybrid propulsion for military applications.

- Growth Potential: Hybrid systems for niche military applications and emerging hybrid thruster designs.

Electric Propulsion Satellites Industry Product Landscape

The Electric Propulsion Satellites Industry is characterized by a rapidly evolving product landscape focused on enhancing efficiency, miniaturization, and performance. Innovations in Hall effect thrusters, ion propulsion, and gridded ion engines are leading to higher specific impulse and thrust levels, enabling more ambitious satellite missions. Product applications span a wide range, from the precise station-keeping of large telecommunications satellites to the complex orbital maneuvers of constellations and the deep-space exploration probes. Unique selling propositions include significantly reduced propellant mass compared to chemical propulsion, leading to lighter and more cost-effective launch payloads. Technological advancements are also focusing on the development of compact and modular propulsion systems suitable for CubeSats and small satellites, democratizing access to space. The performance metrics, such as thrust-to-power ratio and operational lifespan, are continuously improving, making electric propulsion the preferred choice for an increasing number of satellite applications.

Key Drivers, Barriers & Challenges in Electric Propulsion Satellites Industry

The Electric Propulsion Satellites Industry is propelled by several key drivers, including the relentless pursuit of reduced launch costs through mass reduction, the growing demand for extended satellite operational lifetimes, and the increasing complexity and number of satellite constellations. Technological advancements in thruster efficiency and power processing units (PPUs) are also significant catalysts. Furthermore, favorable government policies and increasing private investment in the New Space sector are accelerating adoption.

Conversely, the industry faces several barriers and challenges. High initial development costs for advanced electric propulsion systems can be a significant hurdle. The need for substantial electrical power for operation limits their application on very small satellites with limited power budgets. Supply chain issues, particularly for specialized components and rare earth materials, can impact production timelines and costs. Stringent regulatory approvals for new propulsion technologies can also slow down market entry. Competitive pressures from increasingly efficient chemical propulsion systems and the inherent technical risks associated with novel propulsion technologies present further challenges.

Emerging Opportunities in Electric Propulsion Satellites Industry

Emerging opportunities within the Electric Propulsion Satellites Industry are abundant and multifaceted. The growing demand for in-orbit servicing, assembly, and manufacturing (OSAM) presents a significant avenue for growth, as precise and sustained thrust is critical for these operations. The miniaturization of electric propulsion systems is unlocking new applications for CubeSats and small satellites, enabling more sophisticated missions at lower costs. Furthermore, the development of novel propulsion concepts, such as electrodeless thrusters and advanced plasma propulsion, promises even greater efficiency and performance, potentially opening up entirely new mission paradigms. The increasing focus on sustainable space operations, including debris removal and de-orbiting capabilities, also relies heavily on efficient electric propulsion. Untapped markets in scientific research and deep-space exploration missions, where long transit times and high delta-v requirements are common, represent further growth potential.

Growth Accelerators in the Electric Propulsion Satellites Industry Industry

Several key catalysts are accelerating the long-term growth of the Electric Propulsion Satellites Industry. Technological breakthroughs in areas such as advanced materials for thruster components and more efficient power conversion are continuously improving performance and reducing costs. Strategic partnerships between satellite manufacturers, propulsion system developers, and launch providers are streamlining the integration of electric propulsion into complete satellite solutions. Market expansion strategies, including the development of standardized propulsion modules and the establishment of robust supply chains, are further facilitating wider adoption. The increasing number of small satellite constellations being deployed for global connectivity and Earth observation is a major growth accelerator, as these missions inherently benefit from the fuel efficiency and extended operational capabilities offered by electric propulsion.

Key Players Shaping the Electric Propulsion Satellites Industry Market

- Accion Systems Inc.

- Airbus SE

- The Boeing Company

- Ad Astra Rocket Company

- Safran SA

- Thales

- Aerojet Rocketdyne Holdings Inc.

- Sitael S p A

- Busek Co Inc.

- Northrop Grumman Corporation

Notable Milestones in Electric Propulsion Satellites Industry Sector

- 2021: First successful demonstration of a next-generation Hall effect thruster with enhanced thrust-to-power ratio.

- 2022: Significant advancements in miniaturized ion thrusters enabling their integration into CubeSat platforms.

- 2023: Major satellite constellation operator announces exclusive adoption of electric propulsion for all future deployments.

- 2024: Introduction of highly efficient propellantless electric propulsion concepts entering advanced testing phases.

- 2025: Expected launch of new satellite servicing missions heavily relying on advanced electric propulsion for orbital maneuvers.

In-Depth Electric Propulsion Satellites Industry Market Outlook

The future outlook for the Electric Propulsion Satellites Industry is exceptionally bright, driven by its intrinsic advantages in efficiency and mission flexibility. Growth accelerators like continuous technological innovation, strategic collaborations, and the exponential rise of satellite constellations will continue to propel the market forward. The industry is expected to witness increasing specialization, with companies focusing on niche propulsion solutions for specific mission requirements. The growing emphasis on space sustainability will further boost demand for electric propulsion systems capable of controlled de-orbiting. Overall, the market is poised for sustained and robust expansion, becoming an indispensable component of the global space economy.

Electric Propulsion Satellites Industry Segmentation

-

1. Propulsion Type

- 1.1. Full Electric

- 1.2. Hybrid

-

2. End User

- 2.1. Commercial

- 2.2. Military

Electric Propulsion Satellites Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Electric Propulsion Satellites Industry Regional Market Share

Geographic Coverage of Electric Propulsion Satellites Industry

Electric Propulsion Satellites Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The growing interest of governments and private players in space exploration have fueled the expansion of this market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Electric Propulsion Satellites Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 5.1.1. Full Electric

- 5.1.2. Hybrid

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Commercial

- 5.2.2. Military

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6. North America Electric Propulsion Satellites Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 6.1.1. Full Electric

- 6.1.2. Hybrid

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Commercial

- 6.2.2. Military

- 6.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7. South America Electric Propulsion Satellites Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 7.1.1. Full Electric

- 7.1.2. Hybrid

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Commercial

- 7.2.2. Military

- 7.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8. Europe Electric Propulsion Satellites Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 8.1.1. Full Electric

- 8.1.2. Hybrid

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Commercial

- 8.2.2. Military

- 8.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9. Middle East & Africa Electric Propulsion Satellites Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 9.1.1. Full Electric

- 9.1.2. Hybrid

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Commercial

- 9.2.2. Military

- 9.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10. Asia Pacific Electric Propulsion Satellites Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 10.1.1. Full Electric

- 10.1.2. Hybrid

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Commercial

- 10.2.2. Military

- 10.1. Market Analysis, Insights and Forecast - by Propulsion Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accion Systems Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Airbus SE

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The Boeing Compan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ad Astra Rocket Company

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Safran SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thales

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aerojet Rocketdyne Holdings Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sitael S p A

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Busek Co Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Northrop Grumman Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Accion Systems Inc

List of Figures

- Figure 1: Global Electric Propulsion Satellites Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Electric Propulsion Satellites Industry Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 3: North America Electric Propulsion Satellites Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 4: North America Electric Propulsion Satellites Industry Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Electric Propulsion Satellites Industry Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Electric Propulsion Satellites Industry Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Electric Propulsion Satellites Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Electric Propulsion Satellites Industry Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 9: South America Electric Propulsion Satellites Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 10: South America Electric Propulsion Satellites Industry Revenue (undefined), by End User 2025 & 2033

- Figure 11: South America Electric Propulsion Satellites Industry Revenue Share (%), by End User 2025 & 2033

- Figure 12: South America Electric Propulsion Satellites Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Electric Propulsion Satellites Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Electric Propulsion Satellites Industry Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 15: Europe Electric Propulsion Satellites Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 16: Europe Electric Propulsion Satellites Industry Revenue (undefined), by End User 2025 & 2033

- Figure 17: Europe Electric Propulsion Satellites Industry Revenue Share (%), by End User 2025 & 2033

- Figure 18: Europe Electric Propulsion Satellites Industry Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Electric Propulsion Satellites Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Electric Propulsion Satellites Industry Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 21: Middle East & Africa Electric Propulsion Satellites Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 22: Middle East & Africa Electric Propulsion Satellites Industry Revenue (undefined), by End User 2025 & 2033

- Figure 23: Middle East & Africa Electric Propulsion Satellites Industry Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East & Africa Electric Propulsion Satellites Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Electric Propulsion Satellites Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Electric Propulsion Satellites Industry Revenue (undefined), by Propulsion Type 2025 & 2033

- Figure 27: Asia Pacific Electric Propulsion Satellites Industry Revenue Share (%), by Propulsion Type 2025 & 2033

- Figure 28: Asia Pacific Electric Propulsion Satellites Industry Revenue (undefined), by End User 2025 & 2033

- Figure 29: Asia Pacific Electric Propulsion Satellites Industry Revenue Share (%), by End User 2025 & 2033

- Figure 30: Asia Pacific Electric Propulsion Satellites Industry Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Electric Propulsion Satellites Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 2: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 5: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 11: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 17: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 29: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 30: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Propulsion Type 2020 & 2033

- Table 38: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by End User 2020 & 2033

- Table 39: Global Electric Propulsion Satellites Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Electric Propulsion Satellites Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Electric Propulsion Satellites Industry?

The projected CAGR is approximately 8.4%.

2. Which companies are prominent players in the Electric Propulsion Satellites Industry?

Key companies in the market include Accion Systems Inc, Airbus SE, The Boeing Compan, Ad Astra Rocket Company, Safran SA, Thales, Aerojet Rocketdyne Holdings Inc, Sitael S p A, Busek Co Inc, Northrop Grumman Corporation.

3. What are the main segments of the Electric Propulsion Satellites Industry?

The market segments include Propulsion Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The growing interest of governments and private players in space exploration have fueled the expansion of this market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Electric Propulsion Satellites Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Electric Propulsion Satellites Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Electric Propulsion Satellites Industry?

To stay informed about further developments, trends, and reports in the Electric Propulsion Satellites Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence