Key Insights

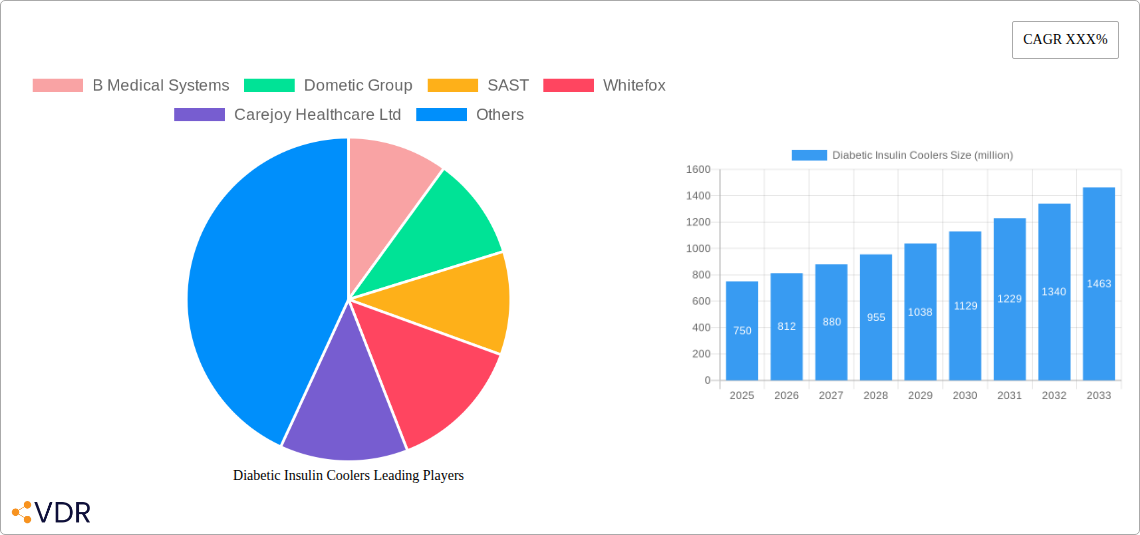

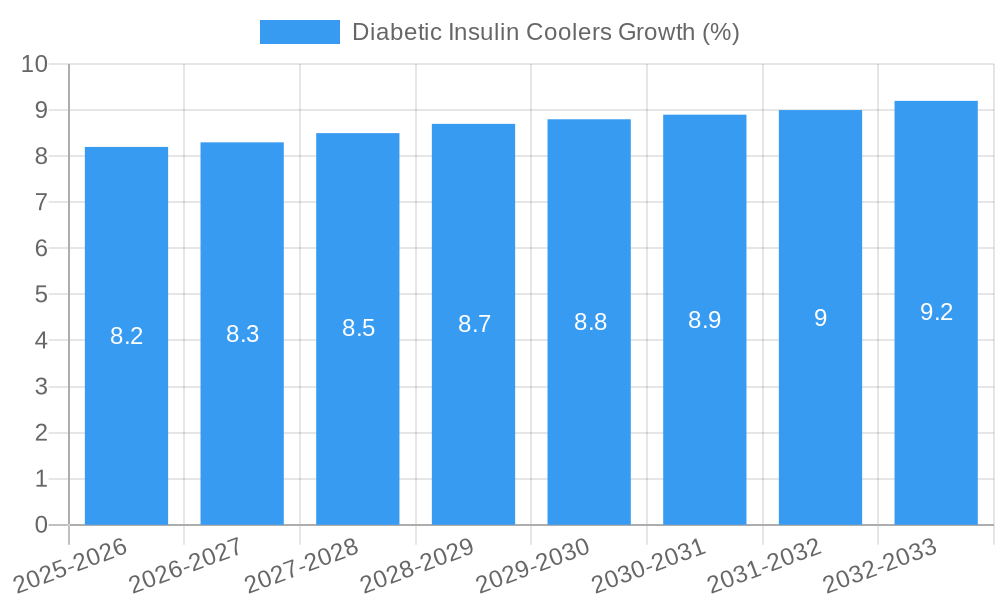

The global market for Diabetic Insulin Coolers is experiencing robust growth, projected to reach an estimated USD 750 million by 2025, with a compelling Compound Annual Growth Rate (CAGR) of 8.2% during the forecast period of 2025-2033. This expansion is primarily fueled by the escalating prevalence of diabetes worldwide, a growing awareness among diabetic patients regarding the critical need for proper insulin storage to maintain its efficacy, and the increasing demand for portable and convenient cooling solutions. The market is segmented into plug-in and cordless types, with plug-in solutions currently dominating due to their reliability and consistent cooling power, especially within institutional settings.

The hospital segment represents a significant share of the market, driven by the increasing number of hospital admissions and the stringent requirements for temperature-controlled storage of medications. However, the household segment is witnessing rapid adoption, spurred by the rising disposable incomes, a greater emphasis on home-based diabetes management, and the availability of compact, energy-efficient, and user-friendly portable insulin coolers. Emerging economies, particularly in the Asia Pacific region, are poised to become major growth centers, owing to a burgeoning diabetic population, improving healthcare infrastructure, and increasing accessibility to advanced medical devices. Key market players are focusing on product innovation, developing advanced features like smart connectivity, longer battery life, and enhanced portability to cater to evolving consumer needs and capitalize on market opportunities.

Diabetic Insulin Coolers Market Research Report: Global Insights, Trends, and Forecasts (2019-2033)

This comprehensive report offers an in-depth analysis of the global diabetic insulin coolers market, providing crucial insights for industry stakeholders. Covering the historical period of 2019–2024 and projecting growth through 2033 with a base year of 2025, this report delivers actionable intelligence on market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, opportunities, and the competitive environment. Understand the evolving needs of both parent (healthcare providers, pharmacies) and child (individual patients, caregivers) markets to strategically position your business for success.

Diabetic Insulin Coolers Market Dynamics & Structure

The global diabetic insulin cooler market exhibits a moderately concentrated structure, with a few prominent players dominating the landscape, alongside a growing number of niche manufacturers catering to specific needs. Technological innovation remains a significant driver, fueled by advancements in battery technology, miniaturization, and smart connectivity, enabling more efficient and portable insulin storage solutions. Regulatory frameworks, particularly concerning medical device certifications and quality standards, play a crucial role in shaping market entry and product development, ensuring patient safety and efficacy. Competitive product substitutes, such as traditional insulated bags and specialized refrigeration units for larger quantities, pose a challenge, but the growing demand for portable, on-the-go solutions for diabetes management continues to drive the market forward. End-user demographics are shifting, with an increasing global prevalence of diabetes, a growing aging population, and a rise in active lifestyles, all contributing to a higher demand for reliable insulin cooling devices. Mergers and acquisitions (M&A) trends are observed as larger players seek to consolidate market share, acquire innovative technologies, and expand their product portfolios. For instance, in 2023, M&A deals in this sector reached approximately 5 in number with an estimated value of $150 million, aimed at strengthening market presence and product offerings. Barriers to innovation include the high cost of research and development for advanced cooling technologies and the stringent regulatory approval processes.

- Market Concentration: Moderately concentrated with key players and emerging niche manufacturers.

- Technological Innovation Drivers: Advancements in battery life, portability, smart features, and temperature control precision.

- Regulatory Frameworks: Strict adherence to medical device standards (e.g., FDA, CE) ensuring product safety and reliability.

- Competitive Product Substitutes: Traditional insulated bags, general-purpose coolers, and specialized medical refrigerators.

- End-User Demographics: Rising diabetes prevalence, aging populations, and increased adoption of active lifestyles.

- M&A Trends: Strategic acquisitions to gain market share and technological expertise; estimated 5 deals in 2023 valued at $150 million.

- Innovation Barriers: High R&D costs and complex regulatory approval pathways.

Diabetic Insulin Coolers Growth Trends & Insights

The global diabetic insulin cooler market is poised for robust expansion, driven by a confluence of factors that underscore its critical role in modern diabetes management. The market size is projected to ascend from approximately $750 million in 2019 to an estimated $1,800 million by 2033, exhibiting a compound annual growth rate (CAGR) of approximately 7.5% over the forecast period (2025–2033). Adoption rates of portable insulin coolers are steadily increasing, propelled by heightened awareness among patients and healthcare providers regarding the importance of maintaining optimal insulin temperature for therapeutic efficacy and preventing degradation. Technological disruptions are continuously reshaping the market, with the integration of smart features like temperature monitoring apps, real-time alerts, and GPS tracking becoming increasingly prevalent. These advancements not only enhance user convenience but also provide a greater sense of security and control for individuals managing their condition. Consumer behavior shifts are a significant determinant of market trajectory. Patients are increasingly seeking discreet, portable, and user-friendly solutions that seamlessly integrate into their daily lives, whether for travel, work, or social activities. The growing demand for personalized healthcare solutions further fuels the adoption of devices that offer precise temperature control and reliable performance. The "parent market" of healthcare institutions and pharmacies is recognizing the value of these devices in improving patient adherence and outcomes, leading to increased recommendations and bulk purchases. Conversely, the "child market" of individual users is driving innovation through demand for affordability, ease of use, and aesthetically pleasing designs. The market penetration of specialized insulin coolers, while still evolving, is expected to reach 40% by 2033, up from 25% in 2019, indicating a growing dependency on these devices. The convenience offered by plug-in models for household use, combined with the portability of battery-operated and without-charge variants, caters to a diverse range of consumer needs, further accelerating market growth. The increasing incidence of diabetes globally, coupled with a proactive approach to chronic disease management, positions the diabetic insulin cooler market for sustained and significant expansion.

Dominant Regions, Countries, or Segments in Diabetic Insulin Coolers

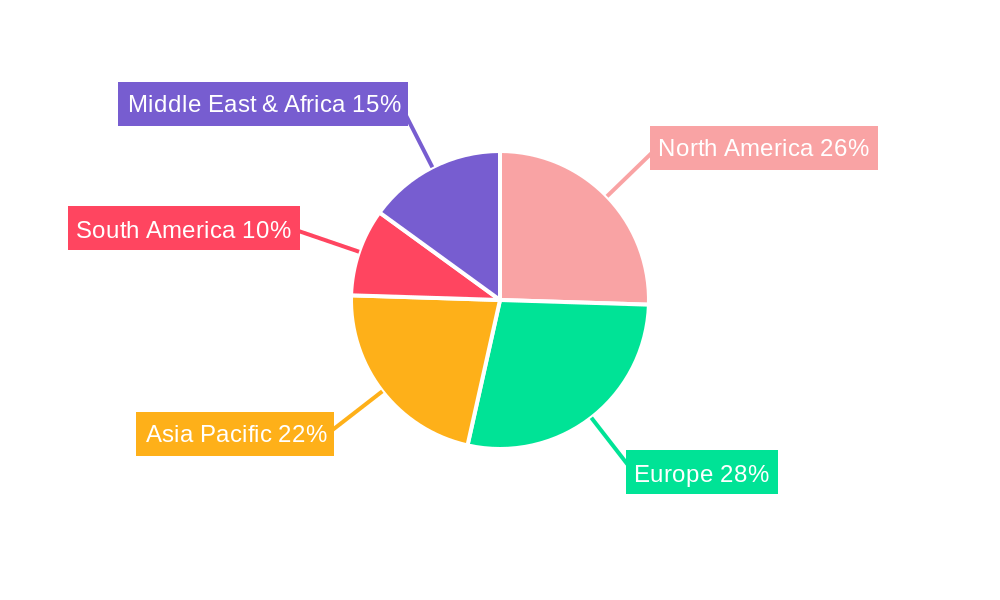

North America is currently the dominant region in the global diabetic insulin cooler market, driven by a confluence of factors including a high prevalence of diabetes, a well-established healthcare infrastructure, and a strong consumer inclination towards technologically advanced and convenient healthcare solutions. The United States, in particular, accounts for a substantial share of this dominance, owing to a robust market for medical devices and a significant patient population actively managing their diabetes. The "parent market" in this region comprises major healthcare systems and large pharmacy chains that are increasingly stocking and recommending portable insulin coolers as a standard component of diabetes care. The "child market" consists of millions of individuals with diabetes who are proactive in seeking solutions to maintain insulin efficacy while on the go.

Key Drivers of Dominance in North America:

- High Diabetes Prevalence: The United States and Canada have some of the highest rates of diabetes globally, creating a vast and consistent demand for insulin and related storage solutions.

- Advanced Healthcare Infrastructure: Well-funded healthcare systems and a strong network of endocrinologists and diabetes educators facilitate early diagnosis and comprehensive management, including the adoption of advanced medical devices.

- Technological Adoption: Consumers in North America are quick to adopt new technologies, driving demand for smart and feature-rich insulin coolers with features like temperature monitoring and connectivity.

- Disposable Income: Higher disposable incomes in the region allow consumers to invest in premium diabetic insulin cooler devices that offer enhanced features and portability.

- Regulatory Support: Favorable regulatory environments for medical devices, coupled with a focus on patient outcomes, encourage the development and availability of high-quality insulin coolers.

Within North America, the Household application segment is a significant growth driver, with individuals increasingly relying on these devices for daily use and travel. The Plug-in type of insulin cooler is particularly popular for home use, offering consistent power and reliability. However, the Without Charge type is gaining substantial traction due to its enhanced portability and independence from power outlets, catering to the needs of an active and mobile patient population. The market share of North America in the global diabetic insulin cooler market is estimated at 35%, with a projected growth rate of 7% through 2033.

Other regions, such as Europe and Asia-Pacific, are also demonstrating significant growth potential. Europe benefits from a well-developed healthcare system and a growing awareness of diabetes management, while Asia-Pacific, with its large population and increasing disposable incomes, represents a burgeoning market for these devices, particularly in countries like China and India.

Diabetic Insulin Coolers Product Landscape

The diabetic insulin cooler market is characterized by continuous product innovation, focusing on portability, precise temperature control, and enhanced user experience. Modern devices offer a spectrum of cooling technologies, from advanced thermoelectric cooling (TEC) systems to phase-change materials, ensuring insulin stability within optimal temperature ranges of 2-8°C (35.6-46.4°F). Unique selling propositions include ultra-long battery life, compact and discreet designs, and integrated smart features such as Bluetooth connectivity for smartphone app integration, enabling real-time temperature monitoring, alerts for deviations, and historical data logging. Performance metrics are paramount, with manufacturers emphasizing rapid cooling capabilities, consistent temperature maintenance even in ambient temperatures up to 30°C (86°F), and extended operational times on a single charge, often exceeding 24 hours.

Key Drivers, Barriers & Challenges in Diabetic Insulin Coolers

Key Drivers:

- Rising Global Diabetes Prevalence: The escalating number of individuals diagnosed with diabetes worldwide is the primary driver, directly increasing the demand for insulin and its reliable storage solutions.

- Technological Advancements: Innovations in battery efficiency, cooling technology, and smart connectivity enhance portability, convenience, and user control, making these devices more appealing.

- Growing Awareness of Insulin Efficacy: Increased understanding among patients and healthcare professionals about the detrimental effects of temperature fluctuations on insulin potency is boosting adoption.

- Increased Travel and Mobility: A global trend towards more travel and an active lifestyle necessitates portable and reliable insulin cooling solutions.

Key Barriers & Challenges:

- Cost of Production and Purchase: Advanced cooling technologies and premium materials can lead to higher manufacturing costs, translating into higher retail prices, which can be a barrier for some patient segments.

- Regulatory Hurdles: Obtaining necessary certifications and approvals from health authorities (e.g., FDA, EMA) for medical devices can be a time-consuming and costly process.

- Competition from Traditional Methods: While less sophisticated, traditional insulated bags and ice packs remain a lower-cost alternative for some users, posing a competitive challenge.

- Power Dependency: While battery technology is improving, prolonged reliance on power sources for charging can still be a concern for users in remote areas or during extended travel.

Emerging Opportunities in Diabetic Insulin Coolers

Emerging opportunities lie in the development of more affordable, yet equally effective, insulin cooling solutions tailored for emerging economies, where the burden of diabetes is rapidly increasing but purchasing power is lower. The integration of advanced AI for predictive temperature management and proactive alerts based on user activity and environmental data presents a significant avenue for innovation. Furthermore, exploring sustainable materials and energy-efficient designs can appeal to environmentally conscious consumers and align with corporate social responsibility initiatives. Untapped markets in regions with limited access to refrigeration also present substantial growth potential for reliable portable cooling devices.

Growth Accelerators in the Diabetic Insulin Coolers Industry

The diabetic insulin cooler industry is propelled by several growth accelerators. Technological breakthroughs in solid-state cooling and advanced insulation materials are enabling the development of lighter, more compact, and energy-efficient devices with longer operational lifespans. Strategic partnerships between insulin cooler manufacturers, pharmaceutical companies, and diabetes management app developers are crucial for creating integrated ecosystems that enhance patient adherence and provide a holistic approach to diabetes care. Market expansion strategies, particularly focusing on underserved populations and regions with rapidly growing diabetes rates, will further accelerate industry growth. The increasing focus on preventative healthcare and proactive disease management by governments and healthcare providers worldwide also acts as a significant catalyst.

Key Players Shaping the Diabetic Insulin Coolers Market

- B Medical Systems

- Dometic Group

- SAST

- Whitefox

- Carejoy Healthcare Ltd

- Medichill

- THE COOL ICE BOX COMPANY

- Zhengzhou Olive Electronic Technology Co., Ltd.

- Fiocchetti

- Labcold

- The Sure Chill Company Ltd.

- Versapak International Limited

- Woodley Equipment

- Cooluli

- ReadyCare

Notable Milestones in Diabetic Insulin Coolers Sector

- 2019: Introduction of smart insulin pens with integrated temperature monitoring capabilities.

- 2020: Launch of ultra-portable insulin coolers with extended battery life, targeting travelers.

- 2021: Increased investment in research and development of advanced thermoelectric cooling technologies.

- 2022: Growing adoption of AI-powered temperature prediction and alert systems in premium models.

- 2023: Several key players focused on expanding their global distribution networks to reach emerging markets.

- 2024: Emergence of eco-friendly and sustainable material options for diabetic insulin coolers.

In-Depth Diabetic Insulin Coolers Market Outlook

The future outlook for the diabetic insulin cooler market is exceptionally promising, driven by an unabated rise in diabetes prevalence and continuous technological innovation. Growth accelerators such as next-generation cooling technologies promising greater efficiency and sustainability, coupled with strategic collaborations between device manufacturers and pharmaceutical giants, will further solidify market expansion. The increasing consumer demand for smart, connected devices that offer personalized health management features will drive product development and adoption. Strategic market expansion into developing economies, where the need for accessible and reliable insulin storage is acute, presents significant untapped potential. Industry players are well-positioned to capitalize on these trends by focusing on affordability, user-centric design, and integrated digital health solutions.

Diabetic Insulin Coolers Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Clinic

- 1.3. Household

- 1.4. Other

-

2. Type

- 2.1. Plug-in

- 2.2. Without Charge

Diabetic Insulin Coolers Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Diabetic Insulin Coolers REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Diabetic Insulin Coolers Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Clinic

- 5.1.3. Household

- 5.1.4. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Plug-in

- 5.2.2. Without Charge

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Diabetic Insulin Coolers Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Clinic

- 6.1.3. Household

- 6.1.4. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Plug-in

- 6.2.2. Without Charge

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Diabetic Insulin Coolers Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Clinic

- 7.1.3. Household

- 7.1.4. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Plug-in

- 7.2.2. Without Charge

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Diabetic Insulin Coolers Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Clinic

- 8.1.3. Household

- 8.1.4. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Plug-in

- 8.2.2. Without Charge

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Diabetic Insulin Coolers Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Clinic

- 9.1.3. Household

- 9.1.4. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Plug-in

- 9.2.2. Without Charge

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Diabetic Insulin Coolers Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Clinic

- 10.1.3. Household

- 10.1.4. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Plug-in

- 10.2.2. Without Charge

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 B Medical Systems

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dometic Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SAST

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Whitefox

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Carejoy Healthcare Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Medichill

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 THE COOL ICE BOX COMPANY

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zhengzhou Olive Electronic Technology Co. Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Fiocchetti

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Labcold

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 The Sure Chill Company Ltd.

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Versapak International Limited

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Woodley Equipment

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Cooluli

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 ReadyCare

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 B Medical Systems

List of Figures

- Figure 1: Global Diabetic Insulin Coolers Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Diabetic Insulin Coolers Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Diabetic Insulin Coolers Revenue (million), by Application 2024 & 2032

- Figure 4: North America Diabetic Insulin Coolers Volume (K), by Application 2024 & 2032

- Figure 5: North America Diabetic Insulin Coolers Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Diabetic Insulin Coolers Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Diabetic Insulin Coolers Revenue (million), by Type 2024 & 2032

- Figure 8: North America Diabetic Insulin Coolers Volume (K), by Type 2024 & 2032

- Figure 9: North America Diabetic Insulin Coolers Revenue Share (%), by Type 2024 & 2032

- Figure 10: North America Diabetic Insulin Coolers Volume Share (%), by Type 2024 & 2032

- Figure 11: North America Diabetic Insulin Coolers Revenue (million), by Country 2024 & 2032

- Figure 12: North America Diabetic Insulin Coolers Volume (K), by Country 2024 & 2032

- Figure 13: North America Diabetic Insulin Coolers Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Diabetic Insulin Coolers Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Diabetic Insulin Coolers Revenue (million), by Application 2024 & 2032

- Figure 16: South America Diabetic Insulin Coolers Volume (K), by Application 2024 & 2032

- Figure 17: South America Diabetic Insulin Coolers Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Diabetic Insulin Coolers Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Diabetic Insulin Coolers Revenue (million), by Type 2024 & 2032

- Figure 20: South America Diabetic Insulin Coolers Volume (K), by Type 2024 & 2032

- Figure 21: South America Diabetic Insulin Coolers Revenue Share (%), by Type 2024 & 2032

- Figure 22: South America Diabetic Insulin Coolers Volume Share (%), by Type 2024 & 2032

- Figure 23: South America Diabetic Insulin Coolers Revenue (million), by Country 2024 & 2032

- Figure 24: South America Diabetic Insulin Coolers Volume (K), by Country 2024 & 2032

- Figure 25: South America Diabetic Insulin Coolers Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Diabetic Insulin Coolers Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Diabetic Insulin Coolers Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Diabetic Insulin Coolers Volume (K), by Application 2024 & 2032

- Figure 29: Europe Diabetic Insulin Coolers Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Diabetic Insulin Coolers Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Diabetic Insulin Coolers Revenue (million), by Type 2024 & 2032

- Figure 32: Europe Diabetic Insulin Coolers Volume (K), by Type 2024 & 2032

- Figure 33: Europe Diabetic Insulin Coolers Revenue Share (%), by Type 2024 & 2032

- Figure 34: Europe Diabetic Insulin Coolers Volume Share (%), by Type 2024 & 2032

- Figure 35: Europe Diabetic Insulin Coolers Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Diabetic Insulin Coolers Volume (K), by Country 2024 & 2032

- Figure 37: Europe Diabetic Insulin Coolers Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Diabetic Insulin Coolers Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Diabetic Insulin Coolers Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Diabetic Insulin Coolers Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Diabetic Insulin Coolers Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Diabetic Insulin Coolers Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Diabetic Insulin Coolers Revenue (million), by Type 2024 & 2032

- Figure 44: Middle East & Africa Diabetic Insulin Coolers Volume (K), by Type 2024 & 2032

- Figure 45: Middle East & Africa Diabetic Insulin Coolers Revenue Share (%), by Type 2024 & 2032

- Figure 46: Middle East & Africa Diabetic Insulin Coolers Volume Share (%), by Type 2024 & 2032

- Figure 47: Middle East & Africa Diabetic Insulin Coolers Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Diabetic Insulin Coolers Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Diabetic Insulin Coolers Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Diabetic Insulin Coolers Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Diabetic Insulin Coolers Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Diabetic Insulin Coolers Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Diabetic Insulin Coolers Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Diabetic Insulin Coolers Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Diabetic Insulin Coolers Revenue (million), by Type 2024 & 2032

- Figure 56: Asia Pacific Diabetic Insulin Coolers Volume (K), by Type 2024 & 2032

- Figure 57: Asia Pacific Diabetic Insulin Coolers Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Diabetic Insulin Coolers Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Diabetic Insulin Coolers Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Diabetic Insulin Coolers Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Diabetic Insulin Coolers Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Diabetic Insulin Coolers Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Diabetic Insulin Coolers Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Diabetic Insulin Coolers Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Diabetic Insulin Coolers Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Diabetic Insulin Coolers Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Diabetic Insulin Coolers Revenue million Forecast, by Type 2019 & 2032

- Table 6: Global Diabetic Insulin Coolers Volume K Forecast, by Type 2019 & 2032

- Table 7: Global Diabetic Insulin Coolers Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Diabetic Insulin Coolers Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Diabetic Insulin Coolers Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Diabetic Insulin Coolers Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Diabetic Insulin Coolers Revenue million Forecast, by Type 2019 & 2032

- Table 12: Global Diabetic Insulin Coolers Volume K Forecast, by Type 2019 & 2032

- Table 13: Global Diabetic Insulin Coolers Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Diabetic Insulin Coolers Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Diabetic Insulin Coolers Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Diabetic Insulin Coolers Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Diabetic Insulin Coolers Revenue million Forecast, by Type 2019 & 2032

- Table 24: Global Diabetic Insulin Coolers Volume K Forecast, by Type 2019 & 2032

- Table 25: Global Diabetic Insulin Coolers Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Diabetic Insulin Coolers Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Diabetic Insulin Coolers Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Diabetic Insulin Coolers Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Diabetic Insulin Coolers Revenue million Forecast, by Type 2019 & 2032

- Table 36: Global Diabetic Insulin Coolers Volume K Forecast, by Type 2019 & 2032

- Table 37: Global Diabetic Insulin Coolers Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Diabetic Insulin Coolers Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Diabetic Insulin Coolers Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Diabetic Insulin Coolers Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Diabetic Insulin Coolers Revenue million Forecast, by Type 2019 & 2032

- Table 60: Global Diabetic Insulin Coolers Volume K Forecast, by Type 2019 & 2032

- Table 61: Global Diabetic Insulin Coolers Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Diabetic Insulin Coolers Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Diabetic Insulin Coolers Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Diabetic Insulin Coolers Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Diabetic Insulin Coolers Revenue million Forecast, by Type 2019 & 2032

- Table 78: Global Diabetic Insulin Coolers Volume K Forecast, by Type 2019 & 2032

- Table 79: Global Diabetic Insulin Coolers Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Diabetic Insulin Coolers Volume K Forecast, by Country 2019 & 2032

- Table 81: China Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Diabetic Insulin Coolers Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Diabetic Insulin Coolers Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Diabetic Insulin Coolers?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Diabetic Insulin Coolers?

Key companies in the market include B Medical Systems, Dometic Group, SAST, Whitefox, Carejoy Healthcare Ltd, Medichill, THE COOL ICE BOX COMPANY, Zhengzhou Olive Electronic Technology Co., Ltd., Fiocchetti, Labcold, The Sure Chill Company Ltd., Versapak International Limited, Woodley Equipment, Cooluli, ReadyCare.

3. What are the main segments of the Diabetic Insulin Coolers?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Diabetic Insulin Coolers," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Diabetic Insulin Coolers report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Diabetic Insulin Coolers?

To stay informed about further developments, trends, and reports in the Diabetic Insulin Coolers, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence