Key Insights

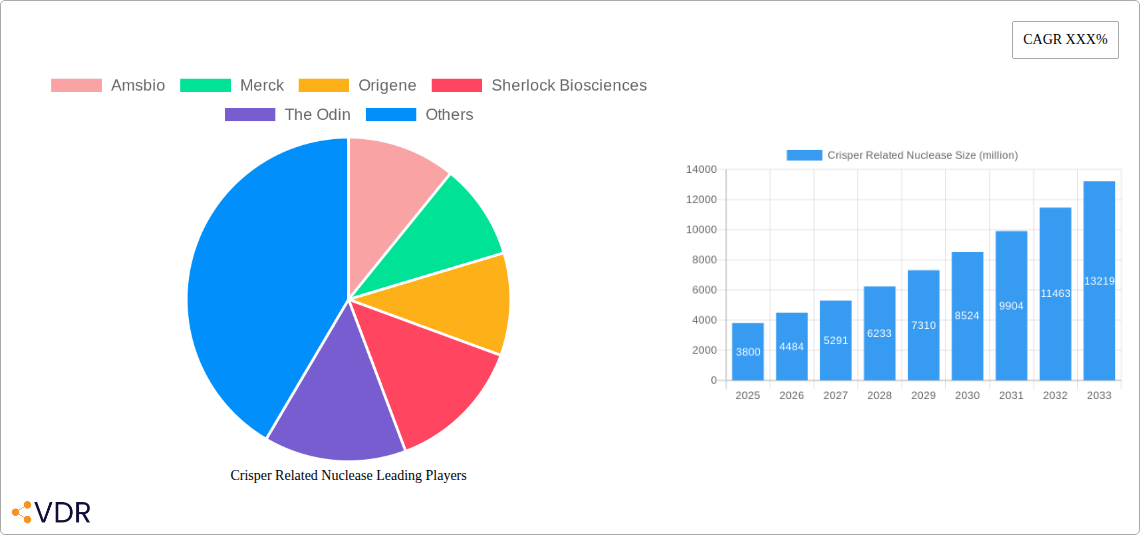

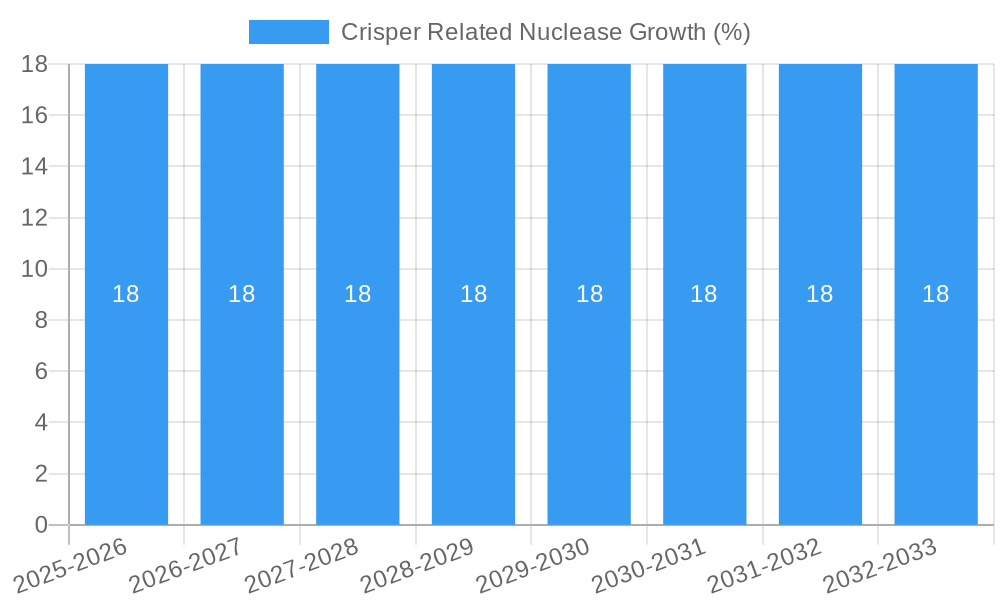

The global CRISPR-related nuclease market is experiencing robust growth, projected to reach an estimated market size of approximately USD 3,800 million in 2025. This expansion is fueled by the groundbreaking potential of CRISPR technology across various life science applications, including advanced DNA and RNA editing. The compound annual growth rate (CAGR) is anticipated to be around 18% between 2025 and 2033, indicating a sustained and significant upward trajectory. Key drivers include the escalating demand for novel therapeutics for genetic diseases, the increasing adoption of CRISPR in drug discovery and development, and its growing utilization in agricultural biotechnology for crop improvement and disease resistance. Furthermore, advancements in precision and efficiency of CRISPR-associated proteins, particularly Cas9 and Cas13, are expanding the scope of their applications, from basic research to clinical trials.

The market is segmented into DNA Editing and RNA Editing applications, with both areas witnessing substantial investment and research activity. The increasing sophistication and accessibility of CRISPR-associated protein 9 (Cas9) and CRISPR-associated protein 13 (Cas13) are central to this growth. These nucleases are becoming indispensable tools for researchers and pharmaceutical companies alike, enabling targeted gene modifications and transcriptional regulation. Despite the promising outlook, certain restraints, such as the ethical considerations surrounding germline editing and the ongoing refinement of delivery mechanisms for in vivo applications, need to be addressed. However, the overarching trend points towards a dynamic and innovation-driven market, with key players like Thermo Fisher Scientific, Merck, and Editas Medicine leading the charge in product development and commercialization. North America, particularly the United States, is expected to maintain a dominant market share due to its strong research infrastructure and significant investments in biotechnology.

Crisper Related Nuclease Market Report: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Crisper Related Nuclease market, examining its dynamic evolution, key growth drivers, and future trajectory. Leveraging extensive data from the historical period (2019-2024) through the forecast period (2025-2033), with a base year of 2025, this report offers actionable insights for stakeholders across the biotechnology and pharmaceutical industries. We meticulously analyze market concentration, technological advancements, regulatory landscapes, and competitive dynamics, segmented by critical applications like DNA Editing and RNA Editing, and driven by essential nuclease types such as CRISPER-associated Protein 9 (Cas9) and CRISPER-associated Protein 13 (Cas13).

Crisper Related Nuclease Market Dynamics & Structure

The Crisper Related Nuclease market is characterized by a dynamic yet moderately concentrated structure, driven by significant technological innovation and a rapidly evolving regulatory framework. Major players are investing heavily in research and development, pushing the boundaries of gene editing capabilities and expanding therapeutic applications. Competitive product substitutes are emerging, particularly from alternative gene editing technologies, but CRISPR's precision and versatility continue to maintain its dominance. End-user demographics are diverse, spanning academic research institutions, pharmaceutical companies, and an increasing number of emerging biotech startups. Merger and acquisition (M&A) trends are significant, reflecting a consolidation of expertise and market share as companies seek to expand their portfolios and secure intellectual property.

- Market Concentration: Moderate, with a few dominant players and a growing number of specialized startups.

- Technological Innovation Drivers: Advancements in Cas variants, delivery systems, and multiplex editing capabilities.

- Regulatory Frameworks: Evolving landscape, with increasing scrutiny and guidelines for therapeutic applications.

- Competitive Product Substitutes: TALENs, Zinc-finger nucleases, and base editing technologies.

- End-User Demographics: Academic researchers (40%), pharmaceutical/biotech companies (55%), contract research organizations (5%).

- M&A Trends: Several high-value acquisitions in recent years, indicating industry consolidation. Deal volumes are projected to increase by approximately 15% annually over the forecast period.

Crisper Related Nuclease Growth Trends & Insights

The Crisper Related Nuclease market is poised for substantial expansion, driven by its transformative potential in both research and therapeutic settings. The market size is projected to grow from an estimated $1,500 million in the base year 2025 to over $5,000 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 17%. Adoption rates are accelerating across diverse applications, particularly in oncology, infectious diseases, and rare genetic disorders. Technological disruptions, such as the development of more precise and efficient Cas variants and novel delivery mechanisms, are continuously reshaping the competitive landscape. Consumer behavior shifts are also evident, with researchers and clinicians increasingly favoring CRISPR-based solutions for their reliability and adaptability.

The increasing prevalence of genetic diseases, coupled with a growing demand for personalized medicine, acts as a significant catalyst for market growth. The inherent versatility of CRISPR-Cas systems allows for applications ranging from basic scientific research, such as gene function studies, to advanced therapeutic interventions, including the development of novel gene therapies. For instance, the application of CRISPR for DNA editing in treating sickle cell anemia and beta-thalassemia has seen remarkable clinical progress, driving significant investment and adoption. Similarly, the application of CRISPR for RNA editing is gaining traction for its transient nature, offering a safer alternative for certain therapeutic interventions.

The market penetration of CRISPR-based technologies in therapeutic development is still in its nascent stages but is rapidly expanding. As regulatory pathways become more defined and clinical trial data accumulates, the translation of CRISPR-based therapies from bench to bedside will accelerate. This will, in turn, drive demand for high-quality CRISPR reagents, kits, and associated services. The development of advanced delivery systems, such as lipid nanoparticles (LNPs) and adeno-associated viruses (AAVs), is crucial for overcoming in vivo delivery challenges and further boosting market adoption. Furthermore, the integration of AI and machine learning in CRISPR target design and off-target prediction is enhancing the efficiency and safety of gene editing experiments, contributing to broader acceptance and application.

Dominant Regions, Countries, or Segments in Crisper Related Nuclease

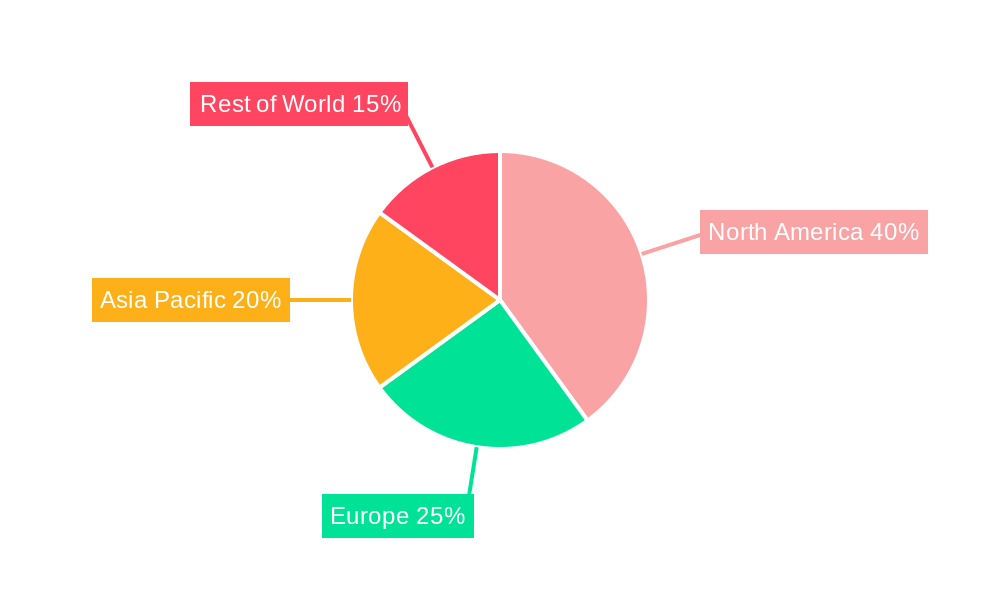

North America currently dominates the Crisper Related Nuclease market, driven by a robust research infrastructure, significant government funding for biomedical research, and the presence of leading biotechnology and pharmaceutical companies. The United States, in particular, plays a pivotal role, boasting a high concentration of academic institutions and a well-established venture capital ecosystem that fuels innovation in gene editing technologies. This dominance is further underscored by the substantial investment in clinical trials for CRISPR-based therapeutics, with a strong focus on applications in DNA editing.

- Dominant Region: North America (55% market share in 2025, projected to reach 60% by 2033).

- Dominant Country: United States.

- Leading Application Segment: DNA Editing (estimated $1,200 million market size in 2025, projected to grow to $3,800 million by 2033, with a CAGR of 19%).

- Key Drivers in North America:

- High R&D expenditure by government and private sectors.

- Presence of key industry players and research centers.

- Favorable regulatory environment for gene editing research.

- Strong emphasis on developing therapies for genetic disorders.

- Significant investment in clinical trials.

- Market Share Analysis (2025): North America (55%), Europe (25%), Asia Pacific (15%), Rest of the World (5%).

- Growth Potential in Asia Pacific: The Asia Pacific region is expected to witness the fastest growth, driven by increasing investments in R&D, growing healthcare expenditure, and a rising prevalence of chronic diseases. Countries like China and Japan are emerging as key markets.

The dominance of DNA Editing within the application segment is attributed to its foundational role in gene therapy development and its broader applicability in disease research. CRISPER-associated Protein 9 (Cas9) is the most widely utilized nuclease type, owing to its well-established protocols and extensive research support, contributing an estimated $1,000 million to the total market value in 2025. While RNA Editing and CRISPER-associated Protein 13 (Cas13) are nascent segments, their unique advantages in transient gene modulation are paving the way for rapid growth, projected to achieve a CAGR of 15% and 12% respectively over the forecast period.

Crisper Related Nuclease Product Landscape

The Crisper Related Nuclease product landscape is characterized by continuous innovation in nuclease engineering and delivery systems. Companies are offering a range of pre-designed gRNAs, optimized Cas variants with enhanced specificity and reduced off-target effects, and complete gene editing kits for diverse research needs. Key product advancements include the development of smaller Cas proteins for easier viral delivery, base editors for precise single-nucleotide changes without double-strand breaks, and prime editors for greater editing flexibility. These innovations aim to improve editing efficiency, minimize unintended genomic modifications, and broaden the therapeutic applicability of CRISPR technology.

Key Drivers, Barriers & Challenges in Crisper Related Nuclease

Key Drivers:

- Technological Advancements: Continuous improvements in nuclease efficiency, specificity, and delivery methods.

- Growing Demand for Gene Therapies: Increasing research and development in treating genetic disorders, cancer, and infectious diseases.

- Government Funding and Initiatives: Significant public and private investment in life sciences and gene editing research.

- Expanding Research Applications: Broad adoption in functional genomics, drug discovery, and agricultural biotechnology.

Key Barriers & Challenges:

- Off-Target Effects and Delivery Efficiency: Ensuring precise editing and effective delivery to target cells remains a challenge, impacting safety and efficacy.

- Regulatory Hurdles: Stringent regulatory pathways for gene therapy approval can lead to prolonged development timelines and high costs.

- High Development and Manufacturing Costs: The complexity of CRISPR-based therapies translates to substantial financial investment.

- Ethical Considerations: Public perception and ethical debates surrounding germline editing can influence research and adoption.

- Supply Chain Vulnerabilities: Dependence on specialized reagents and manufacturing capabilities can pose supply chain risks.

Emerging Opportunities in Crisper Related Nuclease

Emerging opportunities lie in the development of highly multiplexed CRISPR systems for complex genetic interventions, the application of CRISPR in diagnostics for rapid disease detection, and its use in developing novel antiviral strategies. The untapped potential in agriculture for crop improvement and disease resistance also presents a significant growth avenue. Furthermore, the increasing interest in ex vivo gene editing for various hematological disorders and the exploration of CRISPR for neurological conditions are creating new frontiers for market expansion. The development of cell-free CRISPR systems for rapid prototyping and screening also represents a promising area.

Growth Accelerators in the Crisper Related Nuclease Industry

Long-term growth in the Crisper Related Nuclease industry is being significantly accelerated by breakthroughs in in vivo delivery systems, such as improved viral vectors and non-viral methods like LNPs, enabling targeted editing of cells within the body. Strategic partnerships between academic institutions, large pharmaceutical companies, and specialized CRISPR startups are fostering collaboration and accelerating the translation of research into clinical applications. Market expansion strategies, including geographical diversification into emerging economies and the development of platform technologies that can be applied across multiple disease areas, are also critical growth accelerators.

Key Players Shaping the Crisper Related Nuclease Market

- Amsbio

- Merck

- Origene

- Sherlock Biosciences

- The Odin

- Thermo Fisher Scientific

- BioLabs

- Boai Nky Medical Holdings Ltd

- Inscripta

- Editas

- Biocompare

Notable Milestones in Crisper Related Nuclease Sector

- 2019: FDA approval of first CRISPR-based therapy (Casgevy) for sickle cell disease and beta-thalassemia.

- 2020: Development of advanced CRISPR-based diagnostic tools for rapid pathogen detection.

- 2021: Significant progress in developing CRISPR-based therapies for various cancers.

- 2022: Advancements in multiplex gene editing enabling simultaneous modification of multiple genes.

- 2023: Increased investment in developing CRISPR for rare disease treatments and agricultural applications.

- 2024: Emergence of refined base and prime editing technologies for higher precision.

In-Depth Crisper Related Nuclease Market Outlook

The Crisper Related Nuclease market outlook is exceptionally promising, fueled by ongoing innovation and expanding clinical applications. The convergence of advanced nuclease technology, sophisticated delivery mechanisms, and a deepening understanding of disease biology will continue to drive market growth. Strategic collaborations, coupled with increasing regulatory clarity for gene therapies, will further solidify the market's trajectory. The potential to address unmet medical needs across a broad spectrum of diseases, from rare genetic disorders to prevalent chronic conditions, positions Crisper Related Nuclease as a cornerstone of future biotechnology and healthcare. The market is expected to witness continued robust growth, exceeding $5,000 million by 2033.

Crisper Related Nuclease Segmentation

-

1. Application

- 1.1. DNA Editing

- 1.2. RNA Editing

-

2. Type

- 2.1. CRISPER-associated Protein 9

- 2.2. CRISPER-associated Protein 13

Crisper Related Nuclease Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Crisper Related Nuclease REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Crisper Related Nuclease Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. DNA Editing

- 5.1.2. RNA Editing

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. CRISPER-associated Protein 9

- 5.2.2. CRISPER-associated Protein 13

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Crisper Related Nuclease Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. DNA Editing

- 6.1.2. RNA Editing

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. CRISPER-associated Protein 9

- 6.2.2. CRISPER-associated Protein 13

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Crisper Related Nuclease Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. DNA Editing

- 7.1.2. RNA Editing

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. CRISPER-associated Protein 9

- 7.2.2. CRISPER-associated Protein 13

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Crisper Related Nuclease Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. DNA Editing

- 8.1.2. RNA Editing

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. CRISPER-associated Protein 9

- 8.2.2. CRISPER-associated Protein 13

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Crisper Related Nuclease Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. DNA Editing

- 9.1.2. RNA Editing

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. CRISPER-associated Protein 9

- 9.2.2. CRISPER-associated Protein 13

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Crisper Related Nuclease Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. DNA Editing

- 10.1.2. RNA Editing

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. CRISPER-associated Protein 9

- 10.2.2. CRISPER-associated Protein 13

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Amsbio

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Merck

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Origene

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Sherlock Biosciences

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Odin

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Thermo Fisher Scientific

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BioLabs

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Boai Nky Medical Holdings Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Inscripta

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Editas

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Biocompare

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Amsbio

List of Figures

- Figure 1: Global Crisper Related Nuclease Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Crisper Related Nuclease Revenue (million), by Application 2024 & 2032

- Figure 3: North America Crisper Related Nuclease Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Crisper Related Nuclease Revenue (million), by Type 2024 & 2032

- Figure 5: North America Crisper Related Nuclease Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Crisper Related Nuclease Revenue (million), by Country 2024 & 2032

- Figure 7: North America Crisper Related Nuclease Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Crisper Related Nuclease Revenue (million), by Application 2024 & 2032

- Figure 9: South America Crisper Related Nuclease Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Crisper Related Nuclease Revenue (million), by Type 2024 & 2032

- Figure 11: South America Crisper Related Nuclease Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Crisper Related Nuclease Revenue (million), by Country 2024 & 2032

- Figure 13: South America Crisper Related Nuclease Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Crisper Related Nuclease Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Crisper Related Nuclease Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Crisper Related Nuclease Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Crisper Related Nuclease Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Crisper Related Nuclease Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Crisper Related Nuclease Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Crisper Related Nuclease Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Crisper Related Nuclease Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Crisper Related Nuclease Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Crisper Related Nuclease Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Crisper Related Nuclease Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Crisper Related Nuclease Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Crisper Related Nuclease Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Crisper Related Nuclease Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Crisper Related Nuclease Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Crisper Related Nuclease Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Crisper Related Nuclease Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Crisper Related Nuclease Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Crisper Related Nuclease Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Crisper Related Nuclease Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Crisper Related Nuclease Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Crisper Related Nuclease Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Crisper Related Nuclease Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Crisper Related Nuclease Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Crisper Related Nuclease Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Crisper Related Nuclease Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Crisper Related Nuclease Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Crisper Related Nuclease Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Crisper Related Nuclease Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Crisper Related Nuclease Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Crisper Related Nuclease Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Crisper Related Nuclease Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Crisper Related Nuclease Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Crisper Related Nuclease Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Crisper Related Nuclease Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Crisper Related Nuclease Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Crisper Related Nuclease Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Crisper Related Nuclease Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Crisper Related Nuclease?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Crisper Related Nuclease?

Key companies in the market include Amsbio, Merck, Origene, Sherlock Biosciences, The Odin, Thermo Fisher Scientific, BioLabs, Boai Nky Medical Holdings Ltd, Inscripta, Editas, Biocompare.

3. What are the main segments of the Crisper Related Nuclease?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Crisper Related Nuclease," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Crisper Related Nuclease report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Crisper Related Nuclease?

To stay informed about further developments, trends, and reports in the Crisper Related Nuclease, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence