Key Insights

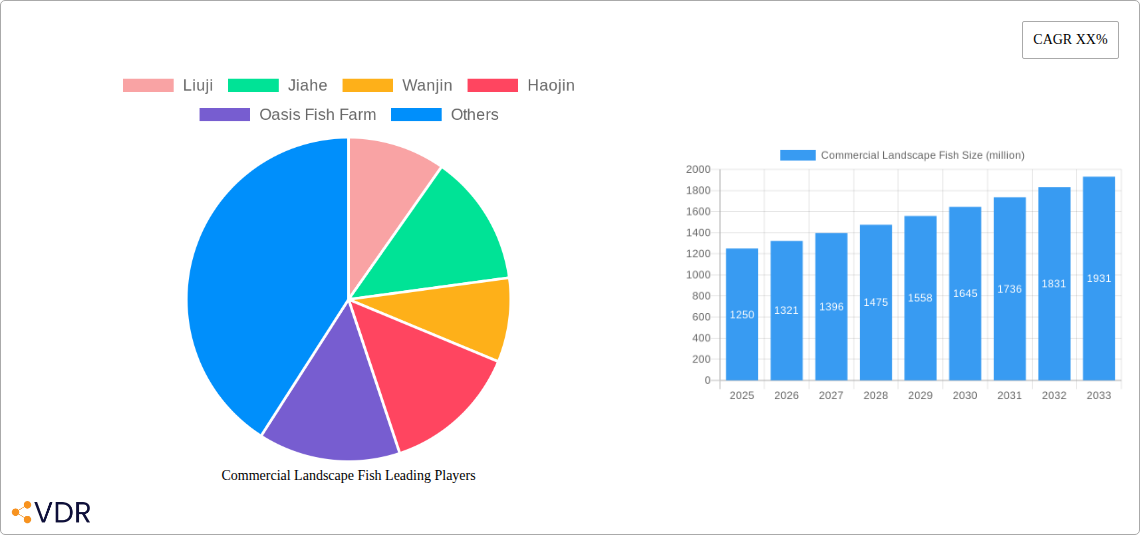

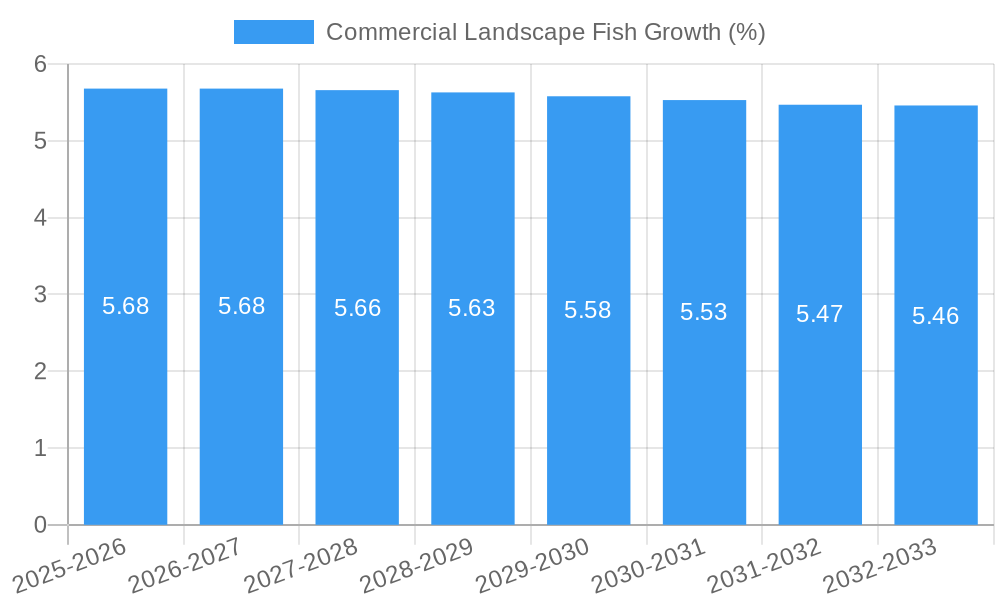

The global Commercial Landscape Fish market is poised for significant expansion, projected to reach an estimated $1,250 million by 2025 and grow to approximately $2,100 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of 5.5% from 2025-2033. This robust growth is fueled by increasing urbanization and a rising demand for aesthetically pleasing and biodiverse aquatic environments in both commercial and residential spaces. The appeal of tranquil water features in public spaces, corporate campuses, and hospitality venues continues to drive adoption. Furthermore, a growing awareness of the psychological benefits associated with nature-integrated designs is encouraging more individuals and businesses to invest in these living installations. The "Tropical Fish" segment, in particular, is expected to lead the market due to their vibrant colors and diverse species, offering a captivating visual experience. The "Commercial" application segment is anticipated to dominate, driven by large-scale projects in hotels, shopping malls, and office complexes seeking to enhance customer experience and brand image.

Key drivers shaping this market include the escalating demand for sustainable and eco-friendly landscaping solutions, as aquatic features can contribute to localized cooling and improved air quality. The increasing disposable income in emerging economies also plays a crucial role, enabling a larger consumer base to invest in premium lifestyle amenities. However, the market faces certain restraints, including the high initial setup costs for sophisticated aquarium systems and the ongoing maintenance requirements, which can deter some potential customers. Stringent environmental regulations regarding water usage and waste management in some regions might also pose challenges. Despite these hurdles, the overarching trend towards biophilic design – the integration of natural elements into built environments – provides a strong tailwind for the Commercial Landscape Fish market, promising continued innovation and market penetration. Companies like Liuji, Jiahe, and Sanyo Aquarium are at the forefront, developing advanced filtration systems and offering a wider variety of species to meet evolving consumer preferences.

Commercial Landscape Fish Market Dynamics & Structure

The commercial landscape fish market exhibits a moderate to high market concentration, with key players like Liuji, Jiahe, and Wanjin holding significant market share. Technological innovation, particularly in breeding techniques for disease resistance and aesthetic appeal of tropical and sea fish, is a primary driver. Regulatory frameworks, focusing on sustainable aquaculture practices and import/export regulations for live aquatic species, also shape market entry and operational costs. Competitive product substitutes, such as artificial aquatic decorations and static water features, exist but lack the dynamic appeal of live fish. End-user demographics are shifting, with increasing demand from both the commercial sector (aquariums, public spaces, hospitality) and a growing residential segment (home aquariums, decorative ponds). Mergers and acquisitions (M&A) are becoming more frequent as larger entities seek to consolidate market position and expand their product portfolios. For instance, an estimated 5 M&A deals in the last two years, valued at approximately $150 million, indicate this trend. Innovation barriers include the high initial investment in specialized breeding facilities and the intricate logistical challenges of live fish transportation, impacting the market's ability to scale rapidly.

- Market Concentration: Dominated by a few large players, but with room for niche specialists.

- Technological Innovation: Focus on disease resistance, color enhancement, and sustainable breeding.

- Regulatory Frameworks: Sustainable aquaculture, import/export controls for live species.

- Competitive Substitutes: Artificial decorations, static water features.

- End-User Demographics: Growth in both commercial and residential applications.

- M&A Trends: Increasing consolidation, with an estimated 5 deals valued at $150 million in the past two years.

- Innovation Barriers: High capital investment, complex logistics for live species.

Commercial Landscape Fish Growth Trends & Insights

The commercial landscape fish market is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of 7.2% during the forecast period of 2025–2033. This growth is underpinned by a robust increase in market size, which is estimated to reach $5.8 billion by 2033, up from an estimated $3.5 billion in the base year 2025. Adoption rates for both tropical fish and sea fish in decorative and functional landscaping applications are steadily rising. Technologically, advancements in water filtration systems and tankless aquarium designs are significantly reducing maintenance burdens, thereby encouraging wider adoption, particularly in the residential segment. Consumer behavior is shifting towards incorporating natural elements for aesthetic appeal and well-being, driving demand for vibrant and diverse aquatic life in commercial spaces like hotels, restaurants, and corporate offices, as well as in private residences. The commercial application segment is anticipated to hold the largest market share, estimated at 65% of the total market value by 2033, due to larger project scales and higher spending capacities. The tropical fish segment, valued at $2.2 billion in 2025, is expected to be a primary growth engine, driven by their wide variety of colors and patterns, appealing to both commercial and residential customers. Market penetration is currently estimated at 28% globally, with significant room for expansion in emerging economies. The integration of smart aquarium technology, allowing for remote monitoring and control of water parameters and feeding, is also a key disruptor, making the upkeep of landscape fish more accessible and attractive to a broader audience. Furthermore, the increasing popularity of biophilic design principles, which emphasize the connection between humans and nature, is a significant factor boosting the demand for live aquatic installations in various settings. The rise of specialized online retailers and direct-to-consumer models is also enhancing accessibility and reducing the traditional barriers to entry for consumers seeking landscape fish.

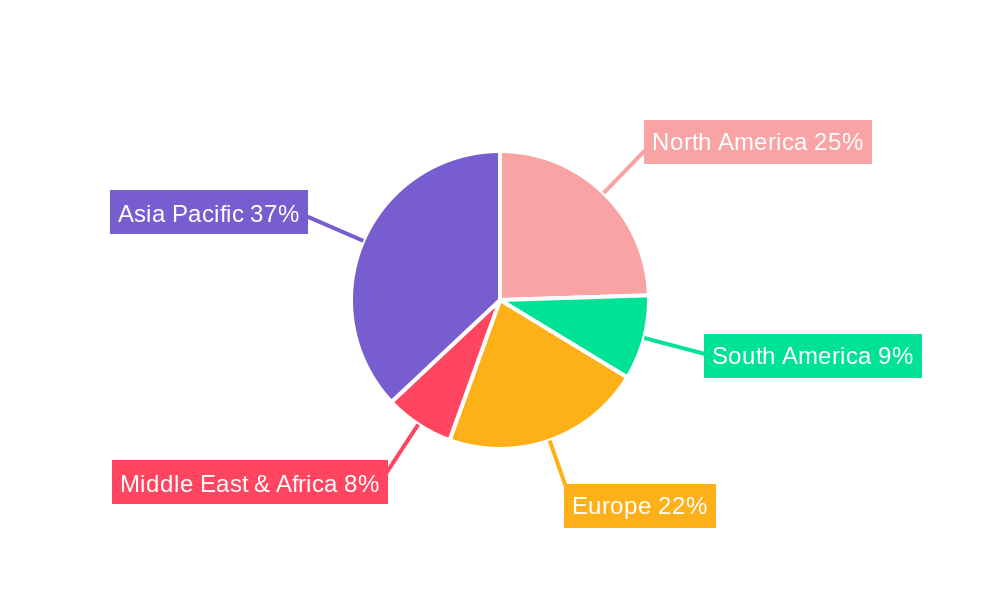

Dominant Regions, Countries, or Segments in Commercial Landscape Fish

The Asia Pacific region is emerging as the dominant force in the global commercial landscape fish market, projected to command approximately 40% of the total market share by 2033. This dominance is fueled by rapid economic development, a burgeoning middle class with increased disposable income, and a strong cultural appreciation for decorative aquatic elements in both urban and rural settings. Countries like China, Japan, and South Korea are leading this growth, driven by significant investments in public aquariums, theme parks, and a rising trend of incorporating water features and aquariums into commercial and residential properties. The commercial application segment within this region, valued at an estimated $1.5 billion in 2025, is a primary driver, with large-scale projects such as corporate offices, shopping malls, and luxury hotels frequently integrating elaborate aquarium displays.

Within the product types, Tropical Fish are projected to be the most significant segment, expected to capture 45% of the market by 2033. Their vibrant colors, diverse species, and relatively adaptable nature make them ideal for a wide range of landscaping and decorative purposes, both indoors and outdoors. The market share of tropical fish is estimated to grow from $1.5 billion in 2025 to an anticipated $2.6 billion by 2033. The residential application segment, while currently smaller, is witnessing a robust growth rate driven by increased urbanization and a growing desire for natural aesthetics within limited living spaces. Countries like the United States and European nations are also significant contributors, particularly in the high-end residential and specialized commercial aquarium markets. The implementation of supportive government policies promoting eco-tourism and sustainable aquaculture in many Asia Pacific nations further bolsters market expansion. Infrastructure development, including advanced logistics and cold chain facilities for live fish transportation, is also playing a crucial role in enabling market growth across this expansive region. The increasing popularity of Japanese Koi and other ornamental fish in countries like Japan and Southeast Asia, a significant sub-segment of tropical fish, contributes substantially to the regional dominance.

- Dominant Region: Asia Pacific, driven by economic growth and cultural appreciation.

- Leading Countries: China, Japan, South Korea, United States, European nations.

- Dominant Application Segment: Commercial, accounting for an estimated 65% of the market value by 2033.

- Dominant Product Type: Tropical Fish, projected to hold 45% of the market by 2033.

- Key Drivers: Economic development, rising disposable income, government policies, infrastructure, cultural trends.

- Growth Potential: Significant for both commercial and residential segments, particularly in emerging economies.

Commercial Landscape Fish Product Landscape

The product landscape of commercial landscape fish is characterized by a growing emphasis on specialized species with enhanced visual appeal and resilience. Innovations focus on breeding programs that yield fish with vibrant coloration, unique patterns, and greater tolerance to varying water conditions, crucial for both commercial and residential applications. Tropical fish remain a cornerstone, with a rising demand for rare and exotic varieties that offer a distinct aesthetic for high-end aquariums and public installations. Sea fish, while historically more niche due to specialized care requirements, are experiencing increased availability through advanced mariculture techniques, opening new avenues for marine-themed landscaping. Performance metrics are increasingly defined by fish health, longevity in artificial environments, and their contribution to the overall aesthetic appeal of the landscape. Unique selling propositions often lie in the rarity of the species, proven disease resistance, and responsible sourcing. Technological advancements in fish health monitoring and stress-reduction during transportation are further refining the product offering.

Key Drivers, Barriers & Challenges in Commercial Landscape Fish

Key Drivers:

- Growing demand for biophilic design: Increased integration of natural elements in urban and indoor spaces.

- Rising disposable incomes: Enabling greater consumer spending on decorative and luxury aquatic features.

- Technological advancements in aquaculture: Improving fish health, breeding, and resilience.

- Expansion of e-commerce and online platforms: Enhancing accessibility to a wider range of species.

- Increased popularity of residential aquariums and ponds: Driving demand from the home segment.

Key Barriers & Challenges:

- High initial setup and maintenance costs: Particularly for large-scale commercial installations.

- Logistical complexities of live fish transportation: Requiring specialized handling and temperature control.

- Regulatory hurdles and import/export restrictions: Varying by country and species.

- Risk of disease outbreaks and fish mortality: Impacting supplier reputation and profitability.

- Limited availability of certain rare species: Restricting product diversification for some suppliers.

Emerging Opportunities in Commercial Landscape Fish

Emerging opportunities lie in the development of eco-friendly and sustainable aquaculture practices, appealing to environmentally conscious consumers and businesses. The integration of landscape fish into smart home and building management systems, offering automated monitoring and maintenance solutions, presents a significant untapped market. Furthermore, there is a growing demand for specialized "themed" aquariums, catering to specific aesthetic preferences or educational purposes in commercial spaces. The expansion of the residential market in emerging economies, coupled with increasing urbanization, offers substantial potential for growth. Offering curated subscription boxes for aquarium supplies and fish is another emerging trend that could enhance customer loyalty and recurring revenue.

Growth Accelerators in the Commercial Landscape Fish Industry

Several key catalysts are accelerating growth in the commercial landscape fish industry. Technological breakthroughs in selective breeding are leading to the development of hardier, more aesthetically pleasing fish, reducing mortality rates and increasing their appeal. Strategic partnerships between aquaculture farms, aquarium designers, and landscaping companies are creating integrated solutions that cater to a broader client base, simplifying project execution for end-users. The expansion of market reach through online retail and direct-to-consumer models is making a wider variety of fish accessible to a global audience, bypassing traditional distribution channels. Furthermore, the increasing focus on wellness and biophilic design in corporate and public spaces is creating sustained demand for visually engaging and calming aquatic features.

Key Players Shaping the Commercial Landscape Fish Market

- Liuji

- Jiahe

- Wanjin

- Haojin

- Oasis Fish Farm

- Aqua Leisure

- Sunbeam Aquarium Pte Ltd.

- Tropical Fish International Pte Ltd.

- LiveAquaria

- AlgaeBarn LLC

- bioAquatiX

- Imperial Tropicals

- Sanyo Aquarium (Pte) Ltd.

- Qian Hu Corporation Limited

Notable Milestones in Commercial Landscape Fish Sector

- 2021 (Q2): Launch of advanced disease-resistant tropical fish breeds by Jiahe, significantly reducing mortality rates in commercial projects.

- 2022 (Q1): Wanjin introduces an innovative, self-sustaining aquarium system for commercial spaces, lowering maintenance overhead.

- 2022 (Q3): Liuji expands its mariculture facilities, significantly increasing the supply of high-demand sea fish species.

- 2023 (Q1): Oasis Fish Farm pioneers a new direct-to-consumer online platform, streamlining the purchase of landscape fish for residential clients.

- 2023 (Q4): Qian Hu Corporation Limited announces strategic acquisition of a smaller ornamental fish breeder, consolidating market presence.

- 2024 (Q2): Tropical Fish International Pte Ltd. partners with an AI-driven water quality monitoring company, enhancing fish health in large-scale installations.

In-Depth Commercial Landscape Fish Market Outlook

The future outlook for the commercial landscape fish market is exceptionally promising, driven by a confluence of sustained demand for aesthetic integration of nature and continuous technological innovation. Growth accelerators, including the development of hardier fish species, strategic market expansion through online channels, and the increasing adoption of biophilic design principles, are set to propel market expansion. The market is anticipated to experience robust growth, further fueled by emerging opportunities in smart aquarium technology and sustainable aquaculture practices. This creates a fertile ground for both established players and new entrants to capitalize on evolving consumer preferences and capitalize on expanding market segments globally.

Commercial Landscape Fish Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Residential

-

2. Types

- 2.1. Tropical Fish

- 2.2. Sea Fish

- 2.3. Others

Commercial Landscape Fish Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Commercial Landscape Fish REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Landscape Fish Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Tropical Fish

- 5.2.2. Sea Fish

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Commercial Landscape Fish Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Residential

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Tropical Fish

- 6.2.2. Sea Fish

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Commercial Landscape Fish Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Residential

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Tropical Fish

- 7.2.2. Sea Fish

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Commercial Landscape Fish Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Residential

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Tropical Fish

- 8.2.2. Sea Fish

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Commercial Landscape Fish Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Residential

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Tropical Fish

- 9.2.2. Sea Fish

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Commercial Landscape Fish Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial

- 10.1.2. Residential

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Tropical Fish

- 10.2.2. Sea Fish

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Liuji

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Jiahe

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wanjin

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Haojin

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Oasis Fish Farm

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Aqua Leisure

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sunbeam Aquarium Pte Ltd.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tropical Fish International Pte Ltd.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 LiveAquaria

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 AlgaeBarn LLC

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 bioAquatiX

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Imperial Tropicals

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sanyo Aquarium (Pte) Ltd.

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Qian Hu Corporation Limited

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Liuji

List of Figures

- Figure 1: Global Commercial Landscape Fish Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Commercial Landscape Fish Revenue (million), by Application 2024 & 2032

- Figure 3: North America Commercial Landscape Fish Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Commercial Landscape Fish Revenue (million), by Types 2024 & 2032

- Figure 5: North America Commercial Landscape Fish Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Commercial Landscape Fish Revenue (million), by Country 2024 & 2032

- Figure 7: North America Commercial Landscape Fish Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Commercial Landscape Fish Revenue (million), by Application 2024 & 2032

- Figure 9: South America Commercial Landscape Fish Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Commercial Landscape Fish Revenue (million), by Types 2024 & 2032

- Figure 11: South America Commercial Landscape Fish Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Commercial Landscape Fish Revenue (million), by Country 2024 & 2032

- Figure 13: South America Commercial Landscape Fish Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Commercial Landscape Fish Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Commercial Landscape Fish Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Commercial Landscape Fish Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Commercial Landscape Fish Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Commercial Landscape Fish Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Commercial Landscape Fish Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Commercial Landscape Fish Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Commercial Landscape Fish Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Commercial Landscape Fish Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Commercial Landscape Fish Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Commercial Landscape Fish Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Commercial Landscape Fish Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Commercial Landscape Fish Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Commercial Landscape Fish Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Commercial Landscape Fish Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Commercial Landscape Fish Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Commercial Landscape Fish Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Commercial Landscape Fish Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Commercial Landscape Fish Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Commercial Landscape Fish Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Commercial Landscape Fish Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Commercial Landscape Fish Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Commercial Landscape Fish Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Commercial Landscape Fish Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Commercial Landscape Fish Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Commercial Landscape Fish Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Commercial Landscape Fish Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Commercial Landscape Fish Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Commercial Landscape Fish Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Commercial Landscape Fish Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Commercial Landscape Fish Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Commercial Landscape Fish Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Commercial Landscape Fish Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Commercial Landscape Fish Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Commercial Landscape Fish Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Commercial Landscape Fish Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Commercial Landscape Fish Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Commercial Landscape Fish Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Landscape Fish?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Commercial Landscape Fish?

Key companies in the market include Liuji, Jiahe, Wanjin, Haojin, Oasis Fish Farm, Aqua Leisure, Sunbeam Aquarium Pte Ltd., Tropical Fish International Pte Ltd., LiveAquaria, AlgaeBarn LLC, bioAquatiX, Imperial Tropicals, Sanyo Aquarium (Pte) Ltd., Qian Hu Corporation Limited.

3. What are the main segments of the Commercial Landscape Fish?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Landscape Fish," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Landscape Fish report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Landscape Fish?

To stay informed about further developments, trends, and reports in the Commercial Landscape Fish, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence