Key Insights

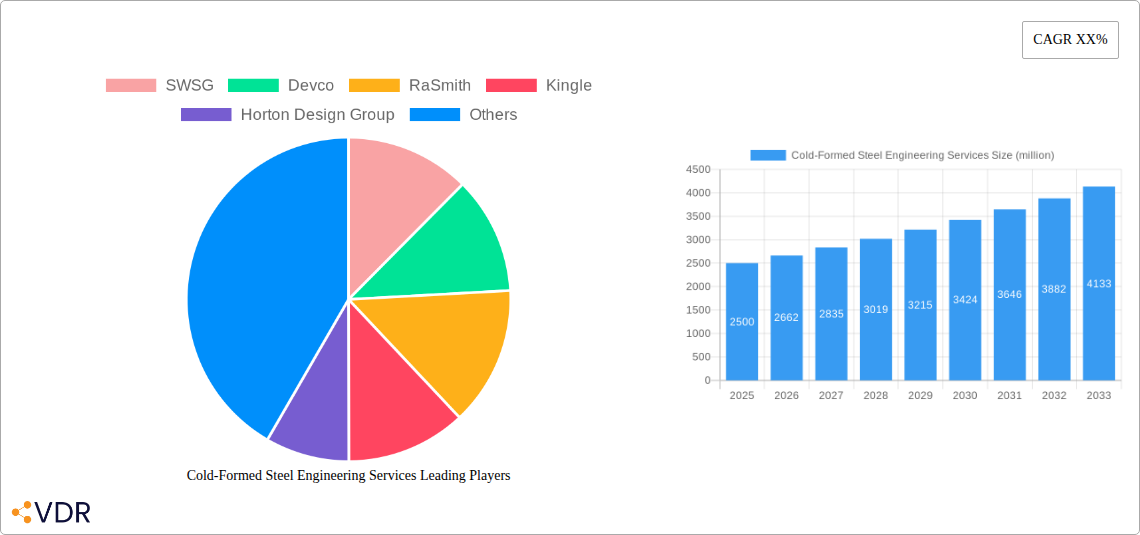

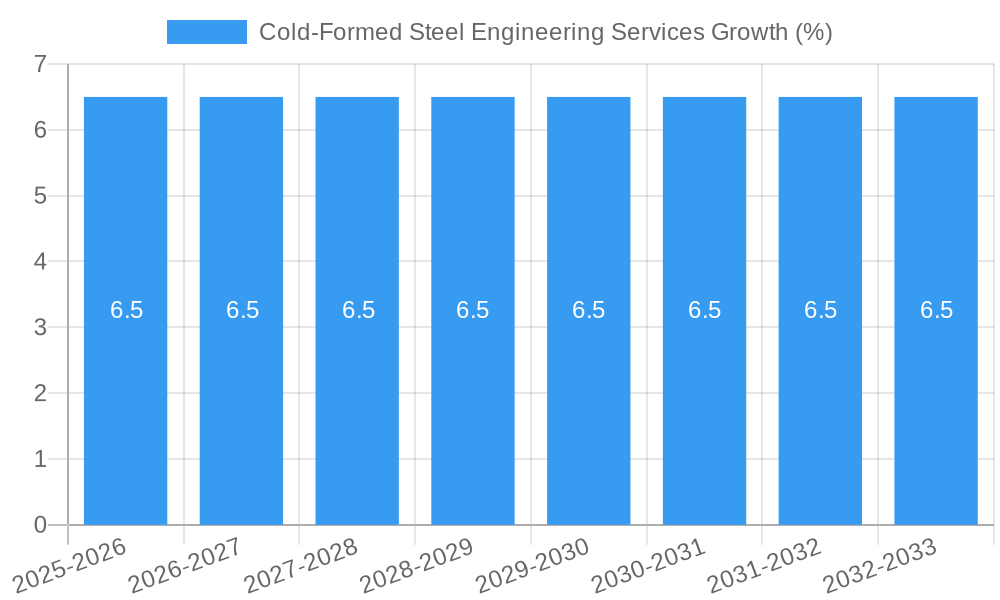

The global Cold-Formed Steel Engineering Services market is projected to reach an estimated USD 2,500 million by 2025, demonstrating robust growth with a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. This expansion is primarily fueled by the increasing demand for lightweight, durable, and sustainable construction materials, particularly in residential and commercial building applications. Cold-formed steel offers significant advantages over traditional materials like timber and hot-rolled steel, including faster construction times, reduced labor costs, enhanced structural integrity, and superior resistance to fire and pests. The growing emphasis on green building practices and energy efficiency further propels the adoption of cold-formed steel solutions, making engineering services essential for their optimal design and implementation.

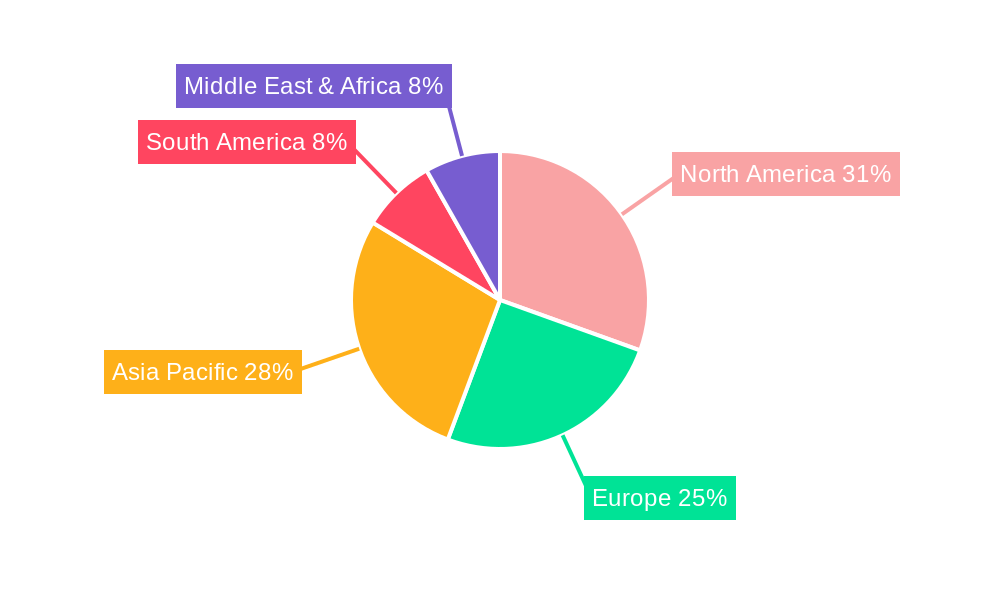

Key drivers of this market include advancements in steel manufacturing technologies, leading to more versatile and cost-effective cold-formed steel products, and a rising awareness of its long-term economic and environmental benefits. The market is segmented into applications such as Residential Buildings, Commercial Buildings, and Others, with Residential Buildings likely holding a substantial share due to ongoing urbanization and housing demand. Types of services span Structural Design, Material Selection, Construction Oversight, and Others, with structural design and material selection being pivotal at the early stages of any construction project. Despite its strong growth trajectory, the market may face restraints such as the initial capital investment for specialized manufacturing equipment and the need for skilled labor to handle cold-formed steel construction. However, the innovative spirit of companies like SWSG, Devco, and RaSmith, alongside a concentrated effort on technological advancements and market penetration across regions like North America, Europe, and Asia Pacific, is expected to overcome these challenges and sustain the market's upward momentum.

Here is a compelling, SEO-optimized report description for Cold-Formed Steel Engineering Services:

Cold-Formed Steel Engineering Services Market Dynamics & Structure

The global Cold-Formed Steel Engineering Services market is characterized by a moderately concentrated structure, driven by a blend of established engineering firms and specialized cold-formed steel consultants. Technological innovation is a primary market driver, with advancements in structural analysis software, BIM integration, and sustainable design practices continually enhancing the efficiency and applicability of cold-formed steel solutions. Regulatory frameworks, particularly those promoting sustainability and fire safety standards, are increasingly influencing service demand. Competitive product substitutes, such as traditional hot-rolled steel and timber, present ongoing challenges, but the superior strength-to-weight ratio, corrosion resistance, and speed of construction offered by cold-formed steel continue to expand its niche. End-user demographics are shifting towards clients prioritizing speed, cost-effectiveness, and eco-friendly construction. Mergers and Acquisitions (M&A) are playing a role in market consolidation, allowing larger entities to expand their service offerings and geographic reach.

- Market Concentration: Dominated by a mix of large, diversified engineering firms and specialized cold-formed steel experts.

- Technological Innovation Drivers: Advanced structural analysis software, BIM integration, prefabrication techniques.

- Regulatory Frameworks: Growing emphasis on building codes promoting lightweight construction and sustainability.

- Competitive Product Substitutes: Hot-rolled steel, timber, precast concrete.

- End-User Demographics: Increased demand from developers and contractors seeking faster, cost-efficient construction methods.

- M&A Trends: Strategic acquisitions to enhance service portfolios and market penetration.

Cold-Formed Steel Engineering Services Growth Trends & Insights

The Cold-Formed Steel Engineering Services market is projected for substantial growth over the forecast period. Driven by increasing adoption in both residential and commercial construction, the market size is expected to evolve significantly. The CAGR for this sector is estimated at xx% from 2025 to 2033, reflecting a robust expansion trajectory. Adoption rates are climbing as the benefits of cold-formed steel, such as its light weight, design flexibility, and rapid installation, become more widely recognized by architects, engineers, and construction professionals. Technological disruptions, including the integration of AI in structural design and the development of advanced material technologies, are poised to further accelerate adoption. Consumer behavior is shifting towards sustainable and resilient building solutions, areas where cold-formed steel excels. The market penetration is expanding into new applications and regions, fueled by favorable economic conditions and government initiatives promoting construction.

Dominant Regions, Countries, or Segments in Cold-Formed Steel Engineering Services

Commercial Buildings represent the dominant segment within the Cold-Formed Steel Engineering Services market. This dominance is fueled by several key drivers, including the growing demand for flexible and adaptable interior spaces, rapid construction timelines for retail and office spaces, and the inherent fire resistance of steel.

- Key Drivers for Commercial Buildings Dominance:

- Economic Policies: Government incentives for business expansion and development.

- Infrastructure Development: Investment in new commercial hubs and mixed-use developments.

- Sustainability Initiatives: Cold-formed steel's recyclability and energy-efficient designs appeal to corporate social responsibility goals.

- Speed of Construction: Crucial for meeting market demands and reducing project financing costs.

In terms of Application, Commercial Buildings are leading the charge. The unique properties of cold-formed steel, such as its high strength-to-weight ratio, allow for larger clear spans, which are highly desirable in retail environments, exhibition halls, and office complexes. The Type of service driving this dominance is Structural Design. Sophisticated software and advanced engineering expertise are crucial for optimizing the use of cold-formed steel in complex commercial structures, ensuring safety, code compliance, and cost-effectiveness. Market share within this segment is substantial, with growth potential remaining high due to ongoing urbanization and the need for modern, efficient commercial spaces.

Cold-Formed Steel Engineering Services Product Landscape

The product landscape of Cold-Formed Steel Engineering Services is defined by innovative design solutions and performance optimization. Services encompass advanced structural analysis for complex geometries, precise material selection to meet specific load and environmental requirements, and detailed construction oversight to ensure accurate fabrication and erection. Unique selling propositions include the ability to design lightweight yet robust structures, facilitate rapid on-site assembly, and incorporate sustainable material choices. Technological advancements focus on integrating AI-powered design optimization, virtual prototyping, and advanced manufacturing techniques for bespoke cold-formed steel components, enhancing both design efficiency and the structural integrity of the final product.

Key Drivers, Barriers & Challenges in Cold-Formed Steel Engineering Services

Key Drivers: The primary forces propelling the Cold-Formed Steel Engineering Services market include the global push for sustainable construction practices, the inherent advantages of cold-formed steel in terms of speed and cost-effectiveness, and ongoing technological advancements in design software and fabrication processes. Government incentives promoting green building and the need for rapid infrastructure development also act as significant catalysts.

Key Barriers & Challenges: Significant challenges include the perception of cold-formed steel as less robust than traditional materials, a shortage of skilled labor in specialized cold-formed steel fabrication and erection, and fluctuations in raw material prices. Supply chain disruptions can impact project timelines and costs. Furthermore, navigating varying international building codes and standards presents a regulatory hurdle for widespread adoption. Competitive pressures from established building materials and engineering methods also pose a restraint. Quantifiable impacts include potential project delays of up to xx% and cost escalations of xx% due to supply chain issues.

Emerging Opportunities in Cold-Formed Steel Engineering Services

Emerging opportunities lie in the growing demand for prefabricated and modular construction solutions, where cold-formed steel excels due to its precision and lightweight nature. The increasing focus on retrofitting and upgrading existing structures with lightweight, sustainable materials presents a significant untapped market. Innovative applications in the renewable energy sector, such as solar panel mounting structures and wind turbine components, are also on the rise. Furthermore, evolving consumer preferences for resilient and earthquake-resistant buildings are creating demand for specialized cold-formed steel engineering services in seismically active regions.

Growth Accelerators in the Cold-Formed Steel Engineering Services Industry

Growth accelerators for the Cold-Formed Steel Engineering Services industry are multi-faceted, including pioneering technological breakthroughs in generative design and AI-assisted structural optimization. Strategic partnerships between engineering firms, material suppliers, and software developers are fostering innovation and expanding service reach. Market expansion strategies focusing on emerging economies and developing regions with significant infrastructure needs will further drive growth. The increasing adoption of Building Information Modeling (BIM) across the construction lifecycle is also a key accelerator, enabling more efficient collaboration and design coordination for cold-formed steel projects.

Key Players Shaping the Cold-Formed Steel Engineering Services Market

- SWSG

- Devco

- RaSmith

- Kingle

- Horton Design Group

- Tower Engineering Professionals

- Northeastern Engineering Corp.

- Heyer Engineering

- Applied Science International

- ISAT Cold Form Steel

- Excel Engineering

- ATLANTIC ENGINEERING SERVICE

- FDR Engineers

- Iron Engineering

Notable Milestones in Cold-Formed Steel Engineering Services Sector

- 2019: Widespread adoption of advanced Finite Element Analysis (FEA) software for complex cold-formed steel structural simulations.

- 2020: Increased integration of Building Information Modeling (BIM) into cold-formed steel design workflows, improving collaboration and reducing errors.

- 2021: Emergence of AI-powered design optimization tools for cold-formed steel structures, enhancing efficiency and material utilization.

- 2022: Growing emphasis on sustainability standards and certifications, driving demand for eco-friendly cold-formed steel engineering solutions.

- 2023: Significant advancements in cold-formed steel connection design, enabling greater structural integrity and load-bearing capacity.

- 2024: Expansion of cold-formed steel applications in prefabricated and modular construction projects.

- 2025: Predicted increase in demand for cold-formed steel engineering services in renewable energy infrastructure projects.

- 2026: Anticipated further development of advanced material coatings for enhanced corrosion resistance in cold-formed steel.

- 2027: Expected rise in the use of cold-formed steel for resilient building designs in areas prone to natural disasters.

- 2028: Predicted greater adoption of virtual and augmented reality for construction oversight in cold-formed steel projects.

- 2029: Forecasted advancements in the standardization of cold-formed steel design codes globally.

- 2030: Expected further integration of smart technologies within cold-formed steel structures for building performance monitoring.

- 2031: Projected increase in cold-formed steel utilization for mixed-use development projects.

- 2032: Anticipated development of novel cold-formed steel alloys for specialized high-performance applications.

- 2033: Predicted continued growth in the adoption of cold-formed steel for affordable housing solutions.

In-Depth Cold-Formed Steel Engineering Services Market Outlook

The future outlook for the Cold-Formed Steel Engineering Services market is exceptionally promising, driven by a confluence of sustainable construction imperatives, technological innovation, and evolving market demands. Growth accelerators such as the widespread integration of AI in design, strategic partnerships fostering synergistic development, and proactive market expansion into burgeoning economies will continue to fuel this trajectory. The increasing demand for prefabricated solutions and resilient infrastructure further solidifies the long-term potential. Strategic opportunities lie in leveraging advanced analytical tools to optimize material usage, expanding service offerings to encompass the entire project lifecycle, and actively engaging with regulatory bodies to promote favorable codes for cold-formed steel construction, ensuring sustained market leadership.

Cold-Formed Steel Engineering Services Segmentation

-

1. Application

- 1.1. Residential Buildings

- 1.2. Commercial Buildings

- 1.3. Others

-

2. Types

- 2.1. Structural Design

- 2.2. Material Selection

- 2.3. Construction Oversight

- 2.4. Others

Cold-Formed Steel Engineering Services Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cold-Formed Steel Engineering Services REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cold-Formed Steel Engineering Services Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Residential Buildings

- 5.1.2. Commercial Buildings

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Structural Design

- 5.2.2. Material Selection

- 5.2.3. Construction Oversight

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cold-Formed Steel Engineering Services Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Residential Buildings

- 6.1.2. Commercial Buildings

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Structural Design

- 6.2.2. Material Selection

- 6.2.3. Construction Oversight

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cold-Formed Steel Engineering Services Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Residential Buildings

- 7.1.2. Commercial Buildings

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Structural Design

- 7.2.2. Material Selection

- 7.2.3. Construction Oversight

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cold-Formed Steel Engineering Services Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Residential Buildings

- 8.1.2. Commercial Buildings

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Structural Design

- 8.2.2. Material Selection

- 8.2.3. Construction Oversight

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cold-Formed Steel Engineering Services Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Residential Buildings

- 9.1.2. Commercial Buildings

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Structural Design

- 9.2.2. Material Selection

- 9.2.3. Construction Oversight

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cold-Formed Steel Engineering Services Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Residential Buildings

- 10.1.2. Commercial Buildings

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Structural Design

- 10.2.2. Material Selection

- 10.2.3. Construction Oversight

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 SWSG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Devco

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 RaSmith

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Kingle

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Horton Design Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Tower Engineering Professionals

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Northeastern Engineering Corp.

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Heyer Engineering

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Applied Science International

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ISAT Cold Form Steel

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Excel Engineering

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 ATLANTIC ENGINEERING SERVICE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 FDR Engineers

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Iron Engineering

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 SWSG

List of Figures

- Figure 1: Global Cold-Formed Steel Engineering Services Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cold-Formed Steel Engineering Services Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cold-Formed Steel Engineering Services Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cold-Formed Steel Engineering Services Revenue (million), by Types 2024 & 2032

- Figure 5: North America Cold-Formed Steel Engineering Services Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Cold-Formed Steel Engineering Services Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cold-Formed Steel Engineering Services Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cold-Formed Steel Engineering Services Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cold-Formed Steel Engineering Services Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cold-Formed Steel Engineering Services Revenue (million), by Types 2024 & 2032

- Figure 11: South America Cold-Formed Steel Engineering Services Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Cold-Formed Steel Engineering Services Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cold-Formed Steel Engineering Services Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cold-Formed Steel Engineering Services Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cold-Formed Steel Engineering Services Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cold-Formed Steel Engineering Services Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Cold-Formed Steel Engineering Services Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Cold-Formed Steel Engineering Services Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cold-Formed Steel Engineering Services Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cold-Formed Steel Engineering Services Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cold-Formed Steel Engineering Services Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cold-Formed Steel Engineering Services Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Cold-Formed Steel Engineering Services Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Cold-Formed Steel Engineering Services Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cold-Formed Steel Engineering Services Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cold-Formed Steel Engineering Services Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cold-Formed Steel Engineering Services Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cold-Formed Steel Engineering Services Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Cold-Formed Steel Engineering Services Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Cold-Formed Steel Engineering Services Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cold-Formed Steel Engineering Services Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Cold-Formed Steel Engineering Services Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cold-Formed Steel Engineering Services Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cold-Formed Steel Engineering Services?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Cold-Formed Steel Engineering Services?

Key companies in the market include SWSG, Devco, RaSmith, Kingle, Horton Design Group, Tower Engineering Professionals, Northeastern Engineering Corp., Heyer Engineering, Applied Science International, ISAT Cold Form Steel, Excel Engineering, ATLANTIC ENGINEERING SERVICE, FDR Engineers, Iron Engineering.

3. What are the main segments of the Cold-Formed Steel Engineering Services?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cold-Formed Steel Engineering Services," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cold-Formed Steel Engineering Services report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cold-Formed Steel Engineering Services?

To stay informed about further developments, trends, and reports in the Cold-Formed Steel Engineering Services, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence