Key Insights

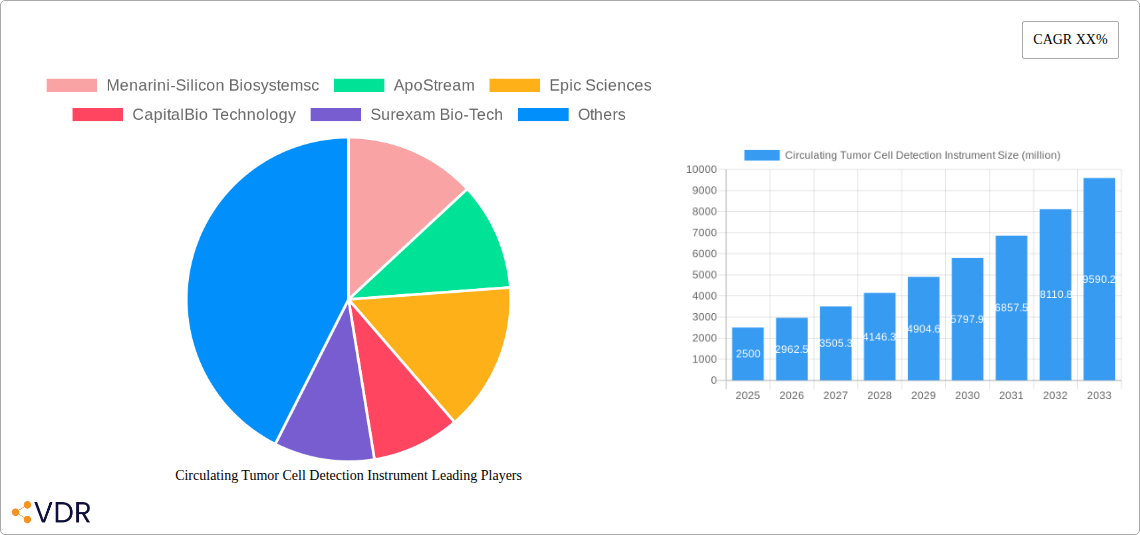

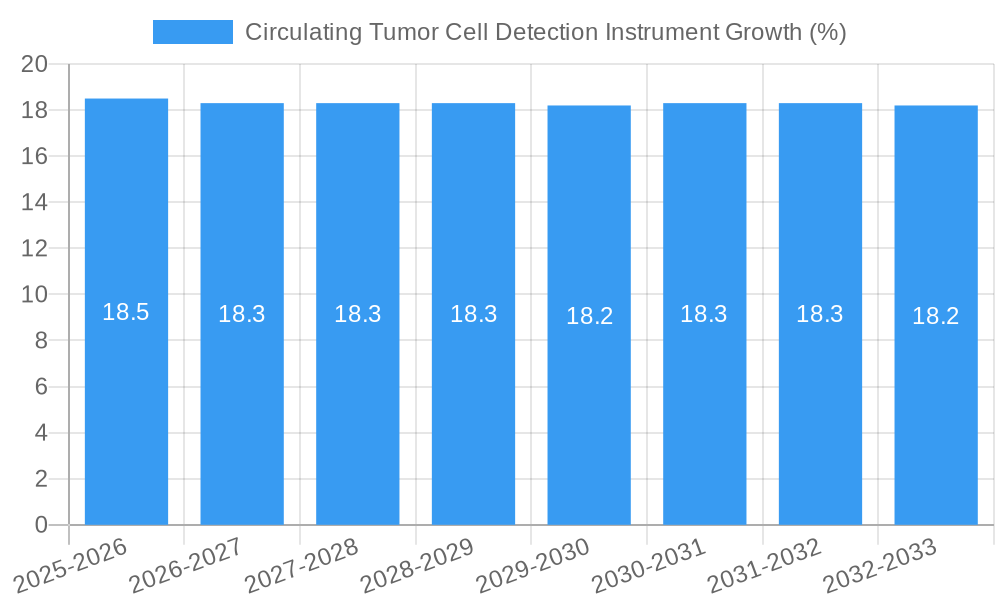

The Circulating Tumor Cell (CTC) Detection Instrument market is poised for significant expansion, driven by advancements in cancer diagnostics and treatment monitoring. With a projected market size of approximately USD 2.5 billion in 2025, the industry is expected to witness a robust Compound Annual Growth Rate (CAGR) of 18.5% during the forecast period of 2025-2033. This substantial growth is fueled by the increasing prevalence of cancer globally, coupled with a growing emphasis on personalized medicine and early disease detection. The ability of CTC detection instruments to provide non-invasive insights into tumor progression, treatment efficacy, and potential metastasis makes them invaluable tools for oncologists and researchers. Key market drivers include the rising demand for liquid biopsy solutions, technological innovations leading to higher sensitivity and specificity in CTC isolation and analysis, and expanding applications beyond cancer diagnosis, such as therapeutic drug development and monitoring. The demand for these advanced instruments is particularly strong in drug R&D institutions and laboratories, as well as in hospitals, where they are integral to patient care pathways.

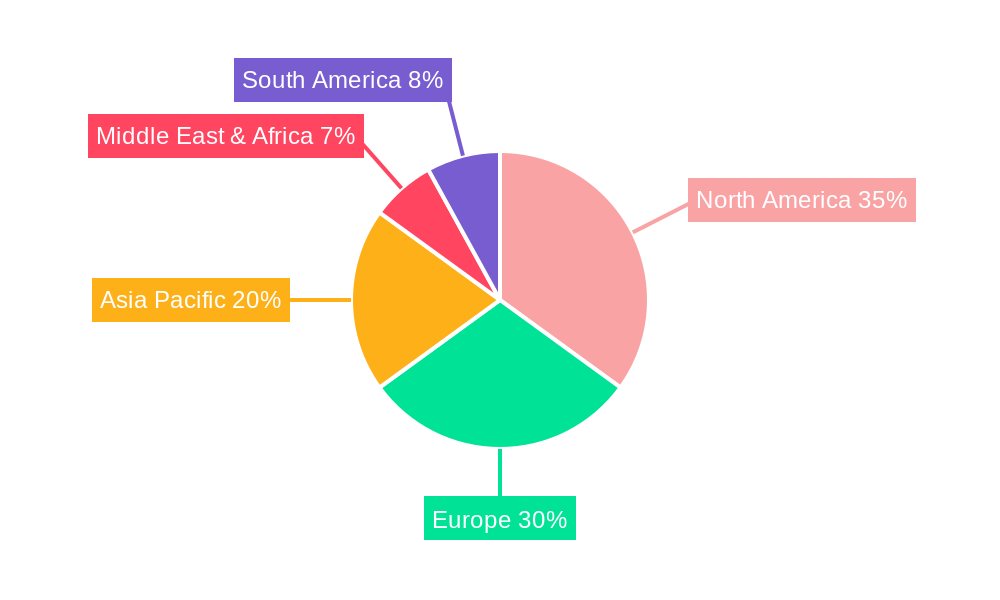

The market segmentation by technology highlights the dominance and innovation within RNA-based techniques, microfluidic chips-based techniques, and immunostaining/immunofluorescence labeling-based techniques. These methods offer increasingly sophisticated ways to isolate, identify, and characterize CTCs with unparalleled precision. However, the market also faces certain restraints, including the high cost of sophisticated instruments and the need for specialized expertise for their operation and data interpretation. Despite these challenges, the market's trajectory remains exceptionally positive, with North America and Europe leading in adoption due to advanced healthcare infrastructure and significant R&D investments. The Asia Pacific region is expected to emerge as a high-growth market, driven by increasing healthcare expenditure, rising cancer incidence, and government initiatives promoting advanced diagnostics. Prominent companies like Menarini-Silicon Biosystems, ApoStream, and Epic Sciences are at the forefront, continuously innovating to enhance CTC detection capabilities and address unmet clinical needs, further propelling market growth and solidifying the importance of CTC detection instruments in modern oncology.

Circulating Tumor Cell Detection Instrument Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a thorough analysis of the global Circulating Tumor Cell (CTC) Detection Instrument market, offering critical insights into market dynamics, growth trends, regional dominance, product innovations, key drivers, challenges, and future opportunities. Spanning the historical period of 2019-2024, with a base year of 2025 and a forecast period extending to 2033, this report is an indispensable resource for industry professionals, researchers, and investors seeking to understand the evolving landscape of CTC detection technologies.

Circulating Tumor Cell Detection Instrument Market Dynamics & Structure

The Circulating Tumor Cell (CTC) Detection Instrument market is characterized by moderate concentration, with a few key players holding significant market share. Technological innovation is the primary driver, fueled by the increasing demand for personalized medicine and early cancer detection. Regulatory frameworks, particularly those governing in-vitro diagnostics (IVDs), play a crucial role in market access and product development. Competitive product substitutes, such as liquid biopsy assays and advanced imaging techniques, are emerging, necessitating continuous innovation in CTC detection. End-user demographics are shifting towards academic research institutions and hospitals actively involved in oncology research and clinical trials, alongside a growing segment of diagnostic laboratories. Merger and acquisition (M&A) activities are moderately present as companies seek to consolidate technologies and expand their market reach.

- Market Concentration: Moderate, with top players focusing on R&D and strategic collaborations.

- Technological Innovation Drivers: Advancements in microfluidics, single-cell analysis, and molecular biology are key.

- Regulatory Frameworks: FDA, CE marking, and other regional IVD regulations influence market entry and compliance.

- Competitive Product Substitutes: Advanced PCR, next-generation sequencing, and novel imaging modalities.

- End-User Demographics: Academic research labs (estimated 40% of market), hospitals (estimated 35% of market), and commercial diagnostic labs (estimated 25% of market).

- M&A Trends: Strategic acquisitions of smaller tech companies and collaborations for technology integration are observed.

Circulating Tumor Cell Detection Instrument Growth Trends & Insights

The Circulating Tumor Cell Detection Instrument market has witnessed significant evolution, driven by advancements in cancer diagnostics and the growing emphasis on non-invasive liquid biopsy approaches. The market size for CTC detection instruments is projected to expand from approximately \$550 million in the historical period to an estimated \$1.8 billion by 2033, exhibiting a compound annual growth rate (CAGR) of around 11.5%. Adoption rates are accelerating as oncologists and researchers recognize the potential of CTCs for early diagnosis, treatment monitoring, and prognosis prediction. Technological disruptions, including the development of more sensitive and specific detection methods and automation, are reshaping the competitive landscape. Consumer behavior shifts are evident, with an increasing preference for less invasive diagnostic tools that offer real-time therapeutic response monitoring. The ability of CTC detection instruments to provide actionable insights into tumor heterogeneity and drug resistance is fostering their integration into routine clinical practice and drug development pipelines.

The market penetration of CTC detection instruments is still in its growth phase, with significant untapped potential in emerging economies. The increasing incidence of cancer globally, coupled with substantial investments in cancer research and development, further bolsters the market's upward trajectory. The base year of 2025 sees the market valued at approximately \$800 million, with a robust growth forecast driven by unmet clinical needs and ongoing technological refinements. The base year's estimated value of \$800 million is derived from an aggregation of historical sales data and projected market expansion based on current adoption rates and technological readiness. The forecast period of 2025–2033 anticipates a sustained high growth rate as more clinical applications are validated and reimbursement policies evolve to support CTC-based diagnostics. The historical period of 2019–2024 has laid the groundwork for this expansion, marked by crucial technological breakthroughs and increased research interest.

Dominant Regions, Countries, or Segments in Circulating Tumor Cell Detection Instrument

North America, particularly the United States, currently dominates the Circulating Tumor Cell Detection Instrument market. This regional supremacy is attributed to robust healthcare infrastructure, significant investments in cancer research, a high prevalence of cancer, and a favorable regulatory environment for novel diagnostic technologies. The United States accounts for an estimated 45% of the global market share in 2025. The Application segment of Drug R&D Institutions and Laboratories is the most significant driver, contributing approximately 50% to the market revenue in 2025, owing to extensive use in preclinical and clinical trials for drug efficacy and resistance studies. Hospitals, representing about 30% of the market share, are increasingly adopting these instruments for patient stratification and treatment monitoring.

Within the Types segment, Microfluidic Chips-based Techniques are leading the market, capturing an estimated 40% share in 2025. These techniques offer advantages in precision, automation, and the ability to handle low cell numbers, making them ideal for sensitive CTC isolation. Immunostaining and Immunofluorescence Labeling-based Techniques follow closely, with an estimated 35% market share, crucial for identifying and characterizing CTCs based on specific protein expression. RNA-based Techniques, though a smaller segment currently with around 20% market share, are gaining traction due to their potential for deeper molecular profiling of CTCs.

Key drivers for this dominance include proactive government funding for biomedical research, the presence of leading pharmaceutical and biotechnology companies, and a well-established ecosystem of academic research centers. Economic policies that encourage innovation and early adoption of advanced medical technologies further propel market growth. The increasing incidence of cancer in the region, coupled with a growing awareness and demand for personalized cancer care, solidifies North America's leading position. Europe, with countries like Germany and the UK, is the second-largest market, driven by similar factors and a strong focus on early cancer detection initiatives. Asia-Pacific, particularly China and Japan, is the fastest-growing region, propelled by increasing healthcare expenditure, a rising cancer burden, and a burgeoning diagnostics industry.

Circulating Tumor Cell Detection Instrument Product Landscape

The product landscape of Circulating Tumor Cell Detection Instruments is characterized by continuous innovation focused on enhancing sensitivity, specificity, and throughput. Leading instruments utilize advanced microfluidic designs for efficient cell capture, coupled with sophisticated imaging and staining techniques for accurate identification and enumeration of CTCs. Unique selling propositions include the ability to detect rare cell populations with high precision, perform downstream molecular analysis of captured CTCs, and offer automated workflows for clinical laboratories. Technological advancements are also enabling multiplexed detection of CTCs and their associated biomarkers, providing a more comprehensive picture of tumor biology and patient prognosis.

Key Drivers, Barriers & Challenges in Circulating Tumor Cell Detection Instrument

Key Drivers:

- Advancements in Personalized Medicine: The increasing demand for tailored cancer treatments drives the need for CTC analysis for patient stratification and monitoring treatment response.

- Rising Cancer Incidence and Mortality: The growing global burden of cancer fuels research and development in diagnostic tools like CTC detection.

- Development of Less Invasive Diagnostics: CTC detection offers a non-invasive alternative to tissue biopsies, appealing to both patients and clinicians.

- Technological Innovations: Continuous improvements in microfluidics, single-cell sequencing, and molecular detection methods enhance the performance of CTC instruments.

Barriers & Challenges:

- High Cost of Instruments and Assays: The initial investment and recurring costs can be a significant barrier for widespread adoption, especially in resource-limited settings.

- Standardization and Reproducibility: Ensuring consistent results across different platforms and laboratories remains a challenge, impacting clinical validation and regulatory approval.

- Limited Clinical Utility and Reimbursement: While promising, the definitive clinical utility for many CTC applications is still being established, leading to slow reimbursement adoption.

- Low CTC Numbers: Detecting and characterizing extremely rare CTCs (often as few as 1 in millions of blood cells) requires highly sensitive and robust technologies.

- Complex Sample Preparation: Sample handling and processing can be labor-intensive and prone to pre-analytical variability.

Emerging Opportunities in Circulating Tumor Cell Detection Instrument

Emerging opportunities lie in the development of fully automated, high-throughput CTC detection platforms that can be integrated into routine clinical diagnostics. The expansion of CTC applications beyond prognosis to real-time monitoring of treatment efficacy and resistance mechanisms presents a significant growth avenue. Untapped markets in emerging economies, driven by increasing healthcare investments and a growing cancer burden, offer substantial potential. Furthermore, the integration of AI and machine learning for analyzing CTC data and correlating it with clinical outcomes is poised to revolutionize the field. Opportunities also exist in developing companion diagnostics that leverage CTC information to guide targeted therapy selection.

Growth Accelerators in the Circulating Tumor Cell Detection Instrument Industry

Growth acceleration in the Circulating Tumor Cell Detection Instrument industry is primarily driven by ongoing technological breakthroughs that enhance sensitivity and specificity. Strategic partnerships between instrument manufacturers, academic institutions, and pharmaceutical companies are crucial for accelerating clinical validation and market adoption. Market expansion strategies, including the development of more cost-effective solutions and broader regulatory approvals, will further fuel growth. The increasing focus on liquid biopsy as a key component of precision oncology, coupled with a growing body of evidence supporting the clinical utility of CTC analysis, acts as a significant growth catalyst.

Key Players Shaping the Circulating Tumor Cell Detection Instrument Market

- Menarini-Silicon Biosystems

- ApoStream

- Epic Sciences

- CapitalBio Technology

- Surexam Bio-Tech

- Fluxion Biosciences

- Ikonisys

- Hangzhou Watson Biotech

- Biocept

- ANGLE

- MicroDiag Biomedicine

- Cellomics

- ZHIHUI MEDICAL

- ZIGZAG Biotechnology

- PDT

Notable Milestones in Circulating Tumor Cell Detection Instrument Sector

- 2019: FDA clearance for Menarini-Silicon Biosystems' CELLSTREAM® system for enumeration of epithelial cells.

- 2020: Epic Sciences receives FDA pre-submission feedback for its liquid biopsy platform for prostate cancer.

- 2021: ANGLE plc announces positive results from a clinical study on its Parsortix™ system for breast cancer.

- 2022: Biocept announces new partnerships to expand the use of its CTC technology in oncology.

- 2023: Fluxion Biosciences launches a new microfluidic platform for enhanced single-cell analysis.

- 2024 (Early): Increased investment and partnerships focusing on the integration of CTC detection with next-generation sequencing for comprehensive tumor profiling.

In-Depth Circulating Tumor Cell Detection Instrument Market Outlook

The Circulating Tumor Cell Detection Instrument market is poised for substantial growth, driven by an insatiable demand for non-invasive, precise cancer diagnostics and the relentless pursuit of personalized medicine. Future market potential is anchored in the continued refinement of detection technologies, leading to improved sensitivity, specificity, and reduced costs. Strategic opportunities abound in expanding the clinical utility of CTC analysis into earlier stages of cancer and for a wider array of cancer types. Collaborations that bridge the gap between technological innovation and clinical application will be pivotal. The integration of CTC data with other multi-omic profiling will unlock unprecedented insights into disease progression and therapeutic response, solidifying the market's trajectory towards becoming an indispensable tool in modern oncology.

Circulating Tumor Cell Detection Instrument Segmentation

-

1. Application

- 1.1. Drug R&D Institutions and Laboratories

- 1.2. Hospital

- 1.3. Other

-

2. Types

- 2.1. RNA-based Techniques

- 2.2. Microfluidic Chips-based Techniques

- 2.3. Immunostaining and Immunofluorescence Labeling-based Techniques

- 2.4. Other

Circulating Tumor Cell Detection Instrument Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Circulating Tumor Cell Detection Instrument REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Circulating Tumor Cell Detection Instrument Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Drug R&D Institutions and Laboratories

- 5.1.2. Hospital

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. RNA-based Techniques

- 5.2.2. Microfluidic Chips-based Techniques

- 5.2.3. Immunostaining and Immunofluorescence Labeling-based Techniques

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Circulating Tumor Cell Detection Instrument Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Drug R&D Institutions and Laboratories

- 6.1.2. Hospital

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. RNA-based Techniques

- 6.2.2. Microfluidic Chips-based Techniques

- 6.2.3. Immunostaining and Immunofluorescence Labeling-based Techniques

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Circulating Tumor Cell Detection Instrument Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Drug R&D Institutions and Laboratories

- 7.1.2. Hospital

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. RNA-based Techniques

- 7.2.2. Microfluidic Chips-based Techniques

- 7.2.3. Immunostaining and Immunofluorescence Labeling-based Techniques

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Circulating Tumor Cell Detection Instrument Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Drug R&D Institutions and Laboratories

- 8.1.2. Hospital

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. RNA-based Techniques

- 8.2.2. Microfluidic Chips-based Techniques

- 8.2.3. Immunostaining and Immunofluorescence Labeling-based Techniques

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Circulating Tumor Cell Detection Instrument Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Drug R&D Institutions and Laboratories

- 9.1.2. Hospital

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. RNA-based Techniques

- 9.2.2. Microfluidic Chips-based Techniques

- 9.2.3. Immunostaining and Immunofluorescence Labeling-based Techniques

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Circulating Tumor Cell Detection Instrument Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Drug R&D Institutions and Laboratories

- 10.1.2. Hospital

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. RNA-based Techniques

- 10.2.2. Microfluidic Chips-based Techniques

- 10.2.3. Immunostaining and Immunofluorescence Labeling-based Techniques

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Menarini-Silicon Biosystemsc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ApoStream

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Epic Sciences

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CapitalBio Technology

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Surexam Bio-Tech

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Fluxion Biosciences

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Ikonisys

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Hangzhou Watson Biotech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Biocept

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ANGLE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 MicroDiag Biomedicine

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Cellomics

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 ZHIHUI MEDICAL

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 ZIGZAG Biotechnology

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 PDT

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Menarini-Silicon Biosystemsc

List of Figures

- Figure 1: Global Circulating Tumor Cell Detection Instrument Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Circulating Tumor Cell Detection Instrument Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Circulating Tumor Cell Detection Instrument Revenue (million), by Application 2024 & 2032

- Figure 4: North America Circulating Tumor Cell Detection Instrument Volume (K), by Application 2024 & 2032

- Figure 5: North America Circulating Tumor Cell Detection Instrument Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Circulating Tumor Cell Detection Instrument Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Circulating Tumor Cell Detection Instrument Revenue (million), by Types 2024 & 2032

- Figure 8: North America Circulating Tumor Cell Detection Instrument Volume (K), by Types 2024 & 2032

- Figure 9: North America Circulating Tumor Cell Detection Instrument Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Circulating Tumor Cell Detection Instrument Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Circulating Tumor Cell Detection Instrument Revenue (million), by Country 2024 & 2032

- Figure 12: North America Circulating Tumor Cell Detection Instrument Volume (K), by Country 2024 & 2032

- Figure 13: North America Circulating Tumor Cell Detection Instrument Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Circulating Tumor Cell Detection Instrument Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Circulating Tumor Cell Detection Instrument Revenue (million), by Application 2024 & 2032

- Figure 16: South America Circulating Tumor Cell Detection Instrument Volume (K), by Application 2024 & 2032

- Figure 17: South America Circulating Tumor Cell Detection Instrument Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Circulating Tumor Cell Detection Instrument Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Circulating Tumor Cell Detection Instrument Revenue (million), by Types 2024 & 2032

- Figure 20: South America Circulating Tumor Cell Detection Instrument Volume (K), by Types 2024 & 2032

- Figure 21: South America Circulating Tumor Cell Detection Instrument Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Circulating Tumor Cell Detection Instrument Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Circulating Tumor Cell Detection Instrument Revenue (million), by Country 2024 & 2032

- Figure 24: South America Circulating Tumor Cell Detection Instrument Volume (K), by Country 2024 & 2032

- Figure 25: South America Circulating Tumor Cell Detection Instrument Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Circulating Tumor Cell Detection Instrument Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Circulating Tumor Cell Detection Instrument Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Circulating Tumor Cell Detection Instrument Volume (K), by Application 2024 & 2032

- Figure 29: Europe Circulating Tumor Cell Detection Instrument Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Circulating Tumor Cell Detection Instrument Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Circulating Tumor Cell Detection Instrument Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Circulating Tumor Cell Detection Instrument Volume (K), by Types 2024 & 2032

- Figure 33: Europe Circulating Tumor Cell Detection Instrument Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Circulating Tumor Cell Detection Instrument Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Circulating Tumor Cell Detection Instrument Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Circulating Tumor Cell Detection Instrument Volume (K), by Country 2024 & 2032

- Figure 37: Europe Circulating Tumor Cell Detection Instrument Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Circulating Tumor Cell Detection Instrument Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Circulating Tumor Cell Detection Instrument Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Circulating Tumor Cell Detection Instrument Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Circulating Tumor Cell Detection Instrument Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Circulating Tumor Cell Detection Instrument Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Circulating Tumor Cell Detection Instrument Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Circulating Tumor Cell Detection Instrument Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Circulating Tumor Cell Detection Instrument Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Circulating Tumor Cell Detection Instrument Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Circulating Tumor Cell Detection Instrument Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Circulating Tumor Cell Detection Instrument Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Circulating Tumor Cell Detection Instrument Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Circulating Tumor Cell Detection Instrument Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Circulating Tumor Cell Detection Instrument Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Circulating Tumor Cell Detection Instrument Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Circulating Tumor Cell Detection Instrument Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Circulating Tumor Cell Detection Instrument Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Circulating Tumor Cell Detection Instrument Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Circulating Tumor Cell Detection Instrument Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Circulating Tumor Cell Detection Instrument Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Circulating Tumor Cell Detection Instrument Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Circulating Tumor Cell Detection Instrument Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Circulating Tumor Cell Detection Instrument Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Circulating Tumor Cell Detection Instrument Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Circulating Tumor Cell Detection Instrument Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Circulating Tumor Cell Detection Instrument Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Circulating Tumor Cell Detection Instrument Volume K Forecast, by Country 2019 & 2032

- Table 81: China Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Circulating Tumor Cell Detection Instrument Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Circulating Tumor Cell Detection Instrument Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Circulating Tumor Cell Detection Instrument?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Circulating Tumor Cell Detection Instrument?

Key companies in the market include Menarini-Silicon Biosystemsc, ApoStream, Epic Sciences, CapitalBio Technology, Surexam Bio-Tech, Fluxion Biosciences, Ikonisys, Hangzhou Watson Biotech, Biocept, ANGLE, MicroDiag Biomedicine, Cellomics, ZHIHUI MEDICAL, ZIGZAG Biotechnology, PDT.

3. What are the main segments of the Circulating Tumor Cell Detection Instrument?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Circulating Tumor Cell Detection Instrument," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Circulating Tumor Cell Detection Instrument report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Circulating Tumor Cell Detection Instrument?

To stay informed about further developments, trends, and reports in the Circulating Tumor Cell Detection Instrument, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence