Key Insights

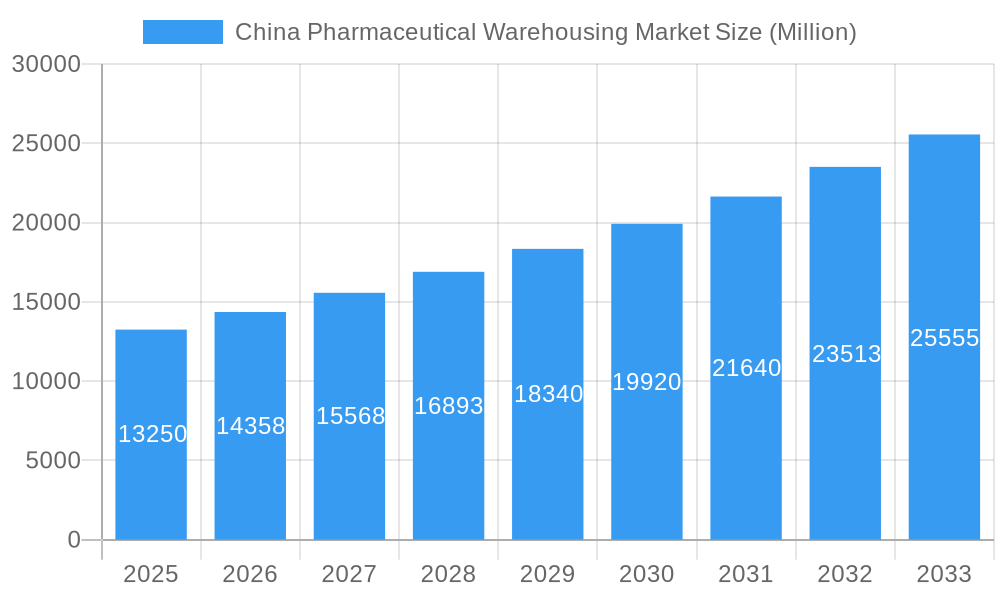

The China pharmaceutical warehousing market, valued at $13.25 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.16% from 2025 to 2033. This expansion is fueled by several key factors. The burgeoning pharmaceutical industry in China, driven by an aging population and rising healthcare expenditure, necessitates efficient and reliable warehousing solutions. Government initiatives promoting pharmaceutical supply chain modernization and stringent regulatory requirements regarding storage and handling of pharmaceuticals are further stimulating market growth. The increasing adoption of advanced technologies like temperature-controlled storage and automated warehouse management systems is enhancing operational efficiency and reducing costs, attracting further investment. The market is segmented by application (pharmaceutical factories, pharmacies, hospitals, and others) and warehouse type (cold chain and non-cold chain). Cold chain warehousing is expected to dominate due to the temperature-sensitive nature of many pharmaceutical products. Key players like DB Schenker, JD Logistics, and DHL Supply Chain are leveraging their extensive networks and technological capabilities to capture significant market share. The competitive landscape is characterized by both domestic and international players vying for dominance, leading to innovation and service improvements.

China Pharmaceutical Warehousing Market Market Size (In Billion)

Looking forward, the market's continued expansion will be influenced by several factors. Growth in e-commerce and online pharmacies will increase demand for efficient last-mile delivery solutions. Furthermore, increasing focus on pharmaceutical cold chain infrastructure development in less-developed regions of China presents significant growth opportunities. However, challenges remain, such as the need for greater standardization of warehousing practices and the high initial investment costs associated with adopting advanced technologies. Nevertheless, the long-term outlook for the China pharmaceutical warehousing market remains positive, driven by strong underlying fundamentals and favorable government policies. The market's strategic importance in supporting China's healthcare system will ensure its continued growth trajectory.

China Pharmaceutical Warehousing Market Company Market Share

This in-depth report provides a comprehensive analysis of the China pharmaceutical warehousing market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period and a base year of 2025. The report segments the market by application (Pharmaceutical Factory, Pharmacy, Hospital, Others) and by type (Cold Chain Warehouse, Non-Cold Chain Warehouse), providing granular data and analysis for informed strategic planning. The market size is presented in Million units.

China Pharmaceutical Warehousing Market Market Dynamics & Structure

The China pharmaceutical warehousing market is characterized by a dynamic interplay of factors influencing its structure and growth trajectory. Market concentration is moderate, with several key players holding significant shares, but also room for smaller specialized companies to flourish. Technological innovation, particularly in cold chain logistics and warehouse automation, is a major driver, improving efficiency and reducing spoilage. Stringent regulatory frameworks governing pharmaceutical storage and handling present both challenges and opportunities, shaping industry practices and necessitating compliance. The market experiences competitive pressure from substitute products and services, primarily in the form of alternative logistics providers, forcing companies to innovate and differentiate. End-user demographics, with an aging population and increasing demand for healthcare services, strongly fuel market growth. Finally, mergers and acquisitions (M&A) activity has played a role in market consolidation, with an estimated xx M&A deals in the historical period (2019-2024), resulting in a xx% increase in market concentration.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on automation, IoT, and AI-driven solutions for improved efficiency and temperature control.

- Regulatory Framework: Stringent regulations governing storage, handling, and traceability of pharmaceuticals.

- Competitive Substitutes: Pressure from alternative logistics providers and transportation methods.

- End-User Demographics: Aging population and rising healthcare spending driving demand.

- M&A Trends: xx M&A deals between 2019-2024, leading to xx% increase in market concentration. Innovation barriers include high initial investment costs for advanced technologies and a lack of skilled workforce.

China Pharmaceutical Warehousing Market Growth Trends & Insights

The China pharmaceutical warehousing market has exhibited robust growth in recent years, fueled by a combination of factors. Market size increased from xx Million units in 2019 to xx Million units in 2024, reflecting a CAGR of xx%. This growth is expected to continue, with a projected CAGR of xx% from 2025 to 2033, reaching xx Million units by 2033. Adoption rates of advanced technologies are increasing steadily, driven by the need for improved efficiency and reduced costs. Technological disruptions, such as the implementation of AI-powered inventory management systems and blockchain for enhanced traceability, are transforming industry practices. Consumer behavior is shifting toward greater demand for transparency and accountability in the pharmaceutical supply chain, putting pressure on warehousing providers to enhance their services. The market penetration of cold chain warehousing is expected to reach xx% by 2033, driven by the increasing demand for temperature-sensitive pharmaceuticals.

Dominant Regions, Countries, or Segments in China Pharmaceutical Warehousing Market

The coastal regions of China, particularly those near major pharmaceutical manufacturing hubs and population centers, dominate the pharmaceutical warehousing market. Among application segments, Pharmaceutical Factories and Hospitals are the leading contributors, driven by high volume storage and stringent quality control requirements. Cold chain warehousing is experiencing faster growth compared to non-cold chain warehousing due to the increasing demand for temperature-sensitive pharmaceuticals.

- Leading Region: Coastal regions (e.g., Guangdong, Jiangsu, Zhejiang) due to high concentration of pharmaceutical manufacturers and consumers.

- Leading Application Segment: Pharmaceutical Factories and Hospitals, accounting for xx% and xx% of market share respectively in 2025.

- Leading Type Segment: Cold chain warehousing, witnessing faster growth due to increasing demand for temperature-sensitive drugs.

- Key Drivers: Government support for healthcare infrastructure development, rising disposable incomes, and expanding pharmaceutical industry.

China Pharmaceutical Warehousing Market Product Landscape

The pharmaceutical warehousing product landscape encompasses a range of services and technologies, including temperature-controlled storage solutions, automated material handling systems, warehouse management systems (WMS), and specialized inventory tracking software. These solutions offer diverse functionalities catering to different needs, from basic storage to advanced supply chain management. Key selling points include enhanced efficiency, improved security, and precise temperature control, ultimately aiming to reduce waste and enhance the quality of pharmaceutical products. Technological advancements focus on automation, data analytics, and integration with broader supply chain networks.

Key Drivers, Barriers & Challenges in China Pharmaceutical Warehousing Market

Key Drivers:

- Growing pharmaceutical industry in China.

- Increasing demand for temperature-sensitive drugs.

- Government investment in healthcare infrastructure.

- Technological advancements in warehousing and logistics.

Challenges and Restraints:

- Stringent regulatory compliance requirements.

- High infrastructure costs, especially for cold chain warehousing.

- Potential supply chain disruptions due to geopolitical factors.

- Intense competition from established and emerging players. These challenges are estimated to slow market growth by approximately xx% annually.

Emerging Opportunities in China Pharmaceutical Warehousing Market

Emerging opportunities include expanding into underserved rural markets, developing specialized solutions for niche pharmaceutical products (e.g., biologics), and leveraging advanced technologies like AI and machine learning for improved efficiency and predictive analytics. The growing demand for personalized medicine and advanced therapies also presents unique warehousing challenges and opportunities.

Growth Accelerators in the China Pharmaceutical Warehousing Market Industry

Technological advancements, strategic partnerships between warehousing providers and pharmaceutical companies, and expansion into new geographical markets are key growth accelerators. Government policies promoting healthcare infrastructure development and investment in logistics technologies further stimulate market growth.

Key Players Shaping the China Pharmaceutical Warehousing Market Market

- DB Schenker

- JD Logistics

- SF Express

- Nippon Express

- Yunda Holding

- Kerry Logistics

- Yamato Holdings

- DHL Supply Chain

- Sinopharm Logistics

- CJ Rokin Logistics

Notable Milestones in China Pharmaceutical Warehousing Market Sector

- July 2023: JD Logistics launched a 10,000 sq m pharmaceutical warehouse in Shenyang, offering 3PL services and temperature-controlled storage. This expansion significantly increases capacity to meet growing demand.

- October 2022: China donated a USD 1 million high-tech pharmaceutical warehouse to Zimbabwe, boosting the country's drug storage capacity and healthcare system. This underscores China's influence in global pharmaceutical infrastructure.

In-Depth China Pharmaceutical Warehousing Market Market Outlook

The future of the China pharmaceutical warehousing market looks bright, driven by continued growth in the pharmaceutical industry, technological advancements, and supportive government policies. Strategic partnerships, investments in cold chain infrastructure, and adoption of innovative technologies will shape the market landscape. Opportunities abound for companies that can adapt to changing regulatory environments and meet the evolving demands of a sophisticated and growing market. The market is poised for continued expansion, with significant potential for both established players and new entrants.

China Pharmaceutical Warehousing Market Segmentation

-

1. BY Type

- 1.1. Cold Chain Warehouse

- 1.2. Non-Cold Chain Warehouse

-

2. Application

- 2.1. Pharmaceutical Factory

- 2.2. Pharmacy

- 2.3. Hospital

- 2.4. Others

China Pharmaceutical Warehousing Market Segmentation By Geography

- 1. China

China Pharmaceutical Warehousing Market Regional Market Share

Geographic Coverage of China Pharmaceutical Warehousing Market

China Pharmaceutical Warehousing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. 4.; Rapidly Expanding Pharmaceutical Industry4.; Population Growth is one of the main drivers for the warehousing market

- 3.3. Market Restrains

- 3.3.1. 4.; Supply Chain Disruptions4.; Temperature Controlled and Cold Chain Management

- 3.4. Market Trends

- 3.4.1. Increase In Population is driving the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Pharmaceutical Warehousing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 5.1.1. Cold Chain Warehouse

- 5.1.2. Non-Cold Chain Warehouse

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Pharmaceutical Factory

- 5.2.2. Pharmacy

- 5.2.3. Hospital

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by BY Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 DB Schenker

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JD Logistics

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SF Express

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Yunda Holding

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Kerry Logistics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yamato Holdings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 DHL Supply Chain

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sinopharm Logistics

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CJ Rokin Logistics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 DB Schenker

List of Figures

- Figure 1: China Pharmaceutical Warehousing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: China Pharmaceutical Warehousing Market Share (%) by Company 2025

List of Tables

- Table 1: China Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 2: China Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: China Pharmaceutical Warehousing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: China Pharmaceutical Warehousing Market Revenue Million Forecast, by BY Type 2020 & 2033

- Table 5: China Pharmaceutical Warehousing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: China Pharmaceutical Warehousing Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Pharmaceutical Warehousing Market?

The projected CAGR is approximately 8.16%.

2. Which companies are prominent players in the China Pharmaceutical Warehousing Market?

Key companies in the market include DB Schenker, JD Logistics, SF Express, Nippon Express, Yunda Holding, Kerry Logistics, Yamato Holdings, DHL Supply Chain, Sinopharm Logistics, CJ Rokin Logistics.

3. What are the main segments of the China Pharmaceutical Warehousing Market?

The market segments include BY Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.25 Million as of 2022.

5. What are some drivers contributing to market growth?

4.; Rapidly Expanding Pharmaceutical Industry4.; Population Growth is one of the main drivers for the warehousing market.

6. What are the notable trends driving market growth?

Increase In Population is driving the market.

7. Are there any restraints impacting market growth?

4.; Supply Chain Disruptions4.; Temperature Controlled and Cold Chain Management.

8. Can you provide examples of recent developments in the market?

July 2023: JD set up a warehouse in the Shenyang area of Liaoning to handle the growing demand for pharmaceutical products. It's 10,000 sq m and offers 3PL (3rd party logistics) services for medicine, medical equipment, and medical supplies. It's got different temperature levels for different drugs, like cool, room, fridge, and frozen.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Pharmaceutical Warehousing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Pharmaceutical Warehousing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Pharmaceutical Warehousing Market?

To stay informed about further developments, trends, and reports in the China Pharmaceutical Warehousing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence