Key Insights

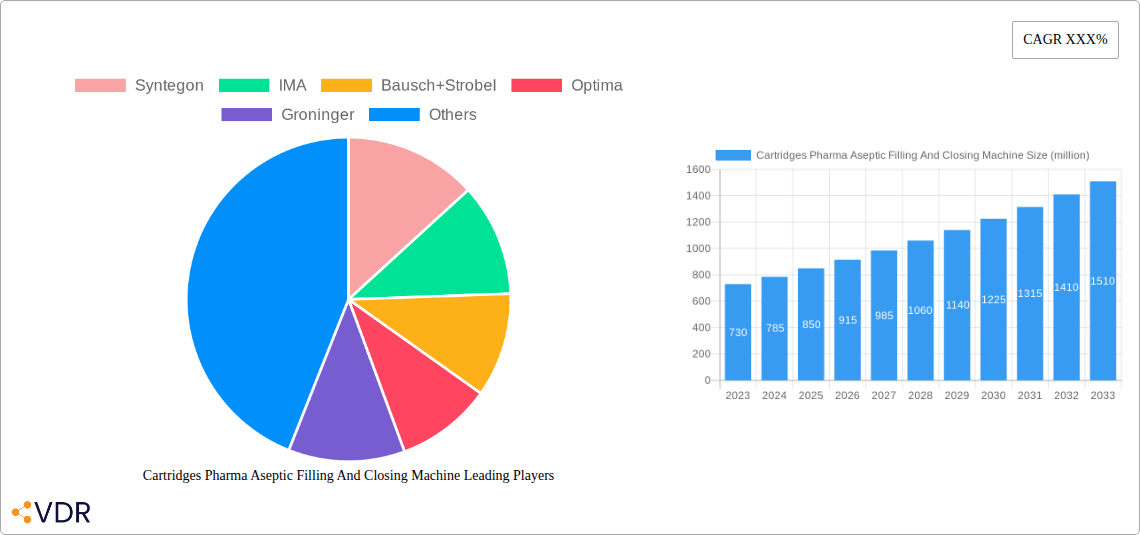

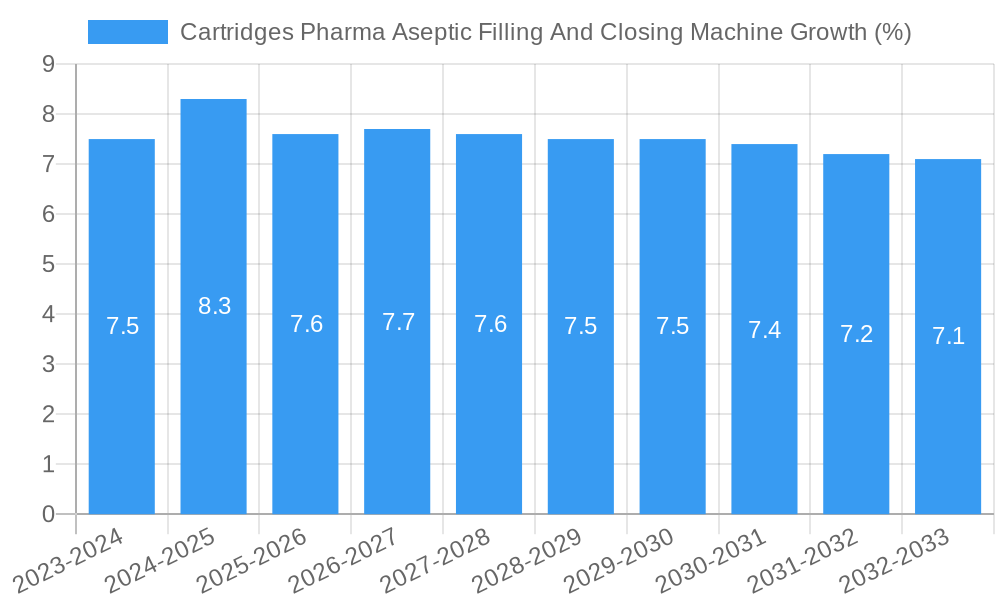

The global market for Cartridges Pharma Aseptic Filling and Closing Machines is experiencing robust growth, projected to reach an estimated market size of approximately $850 million by 2025, with a Compound Annual Growth Rate (CAGR) of around 7.5% expected to propel it further through 2033. This significant expansion is primarily fueled by the escalating demand for sterile pharmaceutical products, particularly biologics and complex injectable formulations, which necessitate advanced aseptic processing technologies. The increasing prevalence of chronic diseases and the subsequent rise in drug development pipelines, especially for sensitive therapeutic agents requiring precise sterile filling, are key drivers. Furthermore, stringent regulatory mandates for product sterility and patient safety worldwide are compelling pharmaceutical manufacturers to invest in state-of-the-art aseptic filling and closing solutions. The market is segmented by application, with the "10-100ml" volume range currently dominating due to its widespread use in vaccines, insulin, and other commonly administered biopharmaceuticals. However, the "Above 100ml" segment is anticipated to witness substantial growth, driven by the increasing development of larger volume parenteral drugs and biologics. In terms of type, fully automatic machines are taking precedence, offering enhanced efficiency, reduced contamination risk, and higher throughput, aligning with the industry's pursuit of operational excellence.

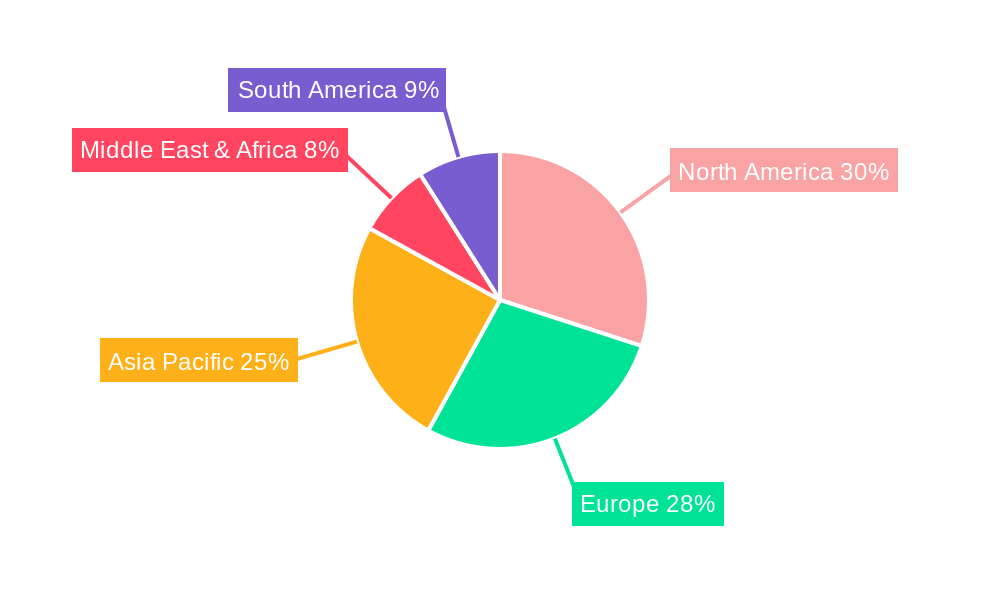

The competitive landscape features a mix of established global players and emerging innovators, including Syntegon, IMA, Bausch+Strobel, and Optima, who are continuously investing in research and development to offer advanced solutions. Key trends influencing the market include the adoption of advanced automation and robotics, integration of smart technologies for real-time monitoring and data analytics, and the development of flexible and modular systems that can adapt to diverse product formats and batch sizes. The increasing focus on single-use technologies and isolator-based systems also presents significant opportunities. However, the market faces certain restraints, such as the high initial capital investment required for sophisticated aseptic filling machinery and the complex validation processes associated with pharmaceutical manufacturing equipment. Geographically, North America and Europe currently represent the largest markets, driven by the presence of major pharmaceutical hubs and advanced healthcare infrastructure. The Asia Pacific region, particularly China and India, is emerging as a high-growth market due to a rapidly expanding pharmaceutical industry, increasing healthcare expenditure, and a growing demand for sterile injectable drugs.

This comprehensive report delves into the dynamic Cartridges Pharma Aseptic Filling and Closing Machine market, analyzing its intricate structure, growth trajectory, and future outlook. We provide in-depth insights for industry professionals, pharmaceutical manufacturers, equipment suppliers, and investors, leveraging high-traffic keywords to maximize search engine visibility and attract relevant stakeholders. The report covers a detailed market analysis from 2019–2033, with a base year of 2025 and a forecast period of 2025–2033.

Cartridges Pharma Aseptic Filling And Closing Machine Market Dynamics & Structure

The Cartridges Pharma Aseptic Filling and Closing Machine market exhibits moderate to high market concentration, with key players like Syntegon, IMA, Bausch+Strobel, Optima, and Groninger holding significant shares. Technological innovation, particularly in automation, robotics, and intelligent sensing, is a primary driver, enabling higher precision and efficiency in aseptic processing. Stringent regulatory frameworks, such as those from the FDA and EMA, mandate sterile manufacturing environments, boosting demand for advanced aseptic filling and closing solutions. Competitive product substitutes, while present in less advanced automation forms, are increasingly being phased out in favor of specialized cartridge-filling systems. End-user demographics are shifting towards biologics, vaccines, and advanced therapies, which often utilize cartridge delivery systems. Mergers and acquisitions (M&A) are notable, with companies seeking to expand their product portfolios and geographical reach. For instance, recent M&A activities indicate a trend towards consolidation and integration of advanced technologies. Barriers to entry include high capital investment, complex validation processes, and the need for specialized expertise in sterile manufacturing.

- Market Concentration: Moderate to High, with leading players investing heavily in R&D.

- Technological Innovation: Drivers include robotics, AI-powered quality control, and advanced sterilization techniques.

- Regulatory Frameworks: FDA and EMA compliance remains paramount, influencing machine design and validation.

- Competitive Substitutes: Traditional vial filling systems are being replaced for specific cartridge applications.

- End-User Demographics: Growing demand from biologics, vaccines, and cell/gene therapies.

- M&A Trends: Strategic acquisitions to broaden technological capabilities and market access.

- Innovation Barriers: High R&D costs, intricate validation protocols, and specialized workforce requirements.

Cartridges Pharma Aseptic Filling And Closing Machine Growth Trends & Insights

The Cartridges Pharma Aseptic Filling and Closing Machine market is poised for significant expansion, driven by an escalating demand for sterile injectable drugs and the increasing adoption of cartridge-based drug delivery systems. The global market size is projected to evolve from approximately $700 million in 2024 to over $1,500 million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately 8.5%. Adoption rates of advanced aseptic filling and closing machines are on an upward trajectory, spurred by pharmaceutical companies' focus on enhancing product safety, reducing contamination risks, and improving manufacturing efficiency. Technological disruptions, such as the integration of isolator technology and advanced vision inspection systems, are revolutionizing aseptic processing, allowing for higher throughput and superior product quality. Consumer behavior shifts, influenced by the growing preference for pre-filled syringes and other convenient dosage forms, are indirectly fueling the demand for cartridge filling solutions. Market penetration of fully automatic systems is expected to surge as manufacturers prioritize automation to meet stringent regulatory demands and competitive pressures. The increasing prevalence of chronic diseases and the continuous development of novel biopharmaceuticals are key factors contributing to sustained market growth. Furthermore, the expanding biologics segment, including vaccines and biosimilars, which often utilize cartridge formats, represents a substantial growth avenue. The market penetration is predicted to increase from xx% in 2024 to xx% by 2033, reflecting the industry's commitment to advanced aseptic manufacturing.

Dominant Regions, Countries, or Segments in Cartridges Pharma Aseptic Filling And Closing Machine

North America, particularly the United States, currently dominates the Cartridges Pharma Aseptic Filling and Closing Machine market, driven by its robust pharmaceutical industry, significant investment in biopharmaceutical research and development, and stringent regulatory standards that necessitate high-level aseptic processing. The region's advanced healthcare infrastructure and the presence of major pharmaceutical and biotechnology companies, including those in the vaccine development space, contribute significantly to market dominance. Europe, with countries like Germany, Switzerland, and the United Kingdom, also holds a substantial market share due to its established pharmaceutical manufacturing base and continuous innovation in drug delivery systems.

Within the Application segment, the 10-100ml category is leading market growth. This segment caters to a wide range of therapeutic areas, including widely prescribed biologics, insulins, and other injectable medications that are increasingly being formulated in cartridge formats for enhanced patient compliance and ease of administration. The Above 100ml application segment is also witnessing robust growth, driven by the development of larger-volume parenteral drugs and advanced therapies.

In terms of Type, Fully Automatic machines are the primary growth drivers. The imperative for enhanced precision, reduced human intervention in sterile environments, and increased production efficiency to meet growing global demand for pharmaceuticals pushes manufacturers towards fully automated solutions. The Semi-Automatic segment, while still relevant for smaller-scale or specialized production, is experiencing slower growth compared to its fully automatic counterpart. Key drivers in these dominant segments include government initiatives supporting domestic pharmaceutical manufacturing, favorable economic policies, and continuous investment in advanced manufacturing technologies. Market share for the 10-100ml application is estimated at xx% in 2025, while fully automatic machines account for xx% of the market in the same year.

Cartridges Pharma Aseptic Filling And Closing Machine Product Landscape

The product landscape for Cartridges Pharma Aseptic Filling and Closing Machines is characterized by continuous innovation focused on enhancing sterility assurance, operational efficiency, and flexibility. Leading manufacturers are introducing advanced isolator-based systems that provide a highly contained sterile environment, minimizing the risk of microbial contamination. These machines often incorporate sophisticated robotic handling for precise cartridge placement and closure, alongside integrated vision inspection systems for real-time quality control of fill levels, seal integrity, and cosmetic defects. Unique selling propositions include high-speed processing capabilities, adaptability to various cartridge sizes and closure types, and compliance with cGMP standards. Technological advancements such as advanced sterilization methods (e.g., VHP), single-use components, and intelligent data logging for traceability are setting new benchmarks in aseptic filling.

Key Drivers, Barriers & Challenges in Cartridges Pharma Aseptic Filling And Closing Machine

Key Drivers: The primary forces propelling the Cartridges Pharma Aseptic Filling and Closing Machine market include the escalating demand for sterile injectable drugs, the growing preference for cartridge-based drug delivery systems due to improved patient convenience and safety, and the relentless pursuit of operational efficiency and reduced contamination risks by pharmaceutical manufacturers. Technological advancements in automation, robotics, and sterile containment technologies are also significant drivers, enabling higher throughput and precision. The increasing prevalence of biologics, vaccines, and advanced therapies further bolsters demand.

Key Barriers & Challenges: Significant challenges facing the market include the substantial capital investment required for advanced aseptic filling and closing machinery. The rigorous and time-consuming validation processes mandated by regulatory bodies, such as the FDA and EMA, pose a substantial hurdle. Supply chain disruptions for critical components and the need for highly skilled personnel to operate and maintain these complex systems also present challenges. Competitive pressures from established players and the constant need to innovate to meet evolving regulatory and market demands add to the complexity. Regulatory compliance for aseptic processing is a paramount concern, requiring substantial investment in infrastructure and expertise.

Emerging Opportunities in Cartridges Pharma Aseptic Filling And Closing Machine

Emerging opportunities in the Cartridges Pharma Aseptic Filling and Closing Machine sector lie in the expanding markets for personalized medicine and advanced cell and gene therapies, which often require specialized sterile filling solutions. The increasing focus on single-use technologies presents an avenue for manufacturers to develop modular and disposable aseptic filling components, reducing cleaning validation requirements and enhancing flexibility. Untapped geographical markets, particularly in emerging economies with a growing pharmaceutical manufacturing base, offer significant potential. Furthermore, the development of integrated solutions that combine aseptic filling with downstream processing steps, such as labeling and packaging, can streamline manufacturing workflows and create new value propositions. The evolving preference for self-administration devices also drives innovation in smaller-volume, highly precise cartridge filling.

Growth Accelerators in the Cartridges Pharma Aseptic Filling And Closing Machine Industry

The long-term growth of the Cartridges Pharma Aseptic Filling and Closing Machine industry is being significantly accelerated by continuous technological breakthroughs in robotics, artificial intelligence (AI) for quality control, and advanced isolator technology, which enhance both speed and sterility assurance. Strategic partnerships between equipment manufacturers and pharmaceutical companies are crucial for co-developing tailored solutions and accelerating market adoption. Market expansion strategies, including the penetration of emerging economies and the development of specialized machines for niche therapeutic areas like mRNA vaccines, are also acting as key growth catalysts. The increasing global focus on pandemic preparedness and the need for rapid vaccine and therapeutic production infrastructure further amplify growth prospects.

Key Players Shaping the Cartridges Pharma Aseptic Filling And Closing Machine Market

- Syntegon

- IMA

- Bausch+Strobel

- Optima

- Groninger

- Truking

- Tofflon

- SP Industries

- BAUSCH Advanced Technology

- Cytiva

- Filamatic

- COLANAR

- Marchesini

- Sejong

Notable Milestones in Cartridges Pharma Aseptic Filling And Closing Machine Sector

- 2019: Launch of advanced isolator technology with enhanced robotic integration for superior aseptic filling.

- 2020: Introduction of AI-powered vision inspection systems for real-time quality control in aseptic processes.

- 2021: Significant increase in demand for high-speed aseptic filling machines for vaccine production.

- 2022: Mergers and acquisitions focused on expanding technological capabilities and market reach.

- 2023: Development of flexible, modular aseptic filling solutions for a wider range of cartridge volumes.

- 2024: Growing emphasis on digitalization and Industry 4.0 integration in aseptic manufacturing.

In-Depth Cartridges Pharma Aseptic Filling And Closing Machine Market Outlook

- 2019: Launch of advanced isolator technology with enhanced robotic integration for superior aseptic filling.

- 2020: Introduction of AI-powered vision inspection systems for real-time quality control in aseptic processes.

- 2021: Significant increase in demand for high-speed aseptic filling machines for vaccine production.

- 2022: Mergers and acquisitions focused on expanding technological capabilities and market reach.

- 2023: Development of flexible, modular aseptic filling solutions for a wider range of cartridge volumes.

- 2024: Growing emphasis on digitalization and Industry 4.0 integration in aseptic manufacturing.

In-Depth Cartridges Pharma Aseptic Filling And Closing Machine Market Outlook

The future market outlook for Cartridges Pharma Aseptic Filling and Closing Machines is exceptionally strong, driven by the persistent global demand for sterile injectables and the increasing sophistication of pharmaceutical drug delivery systems. Growth accelerators such as advancements in robotics, AI-driven quality assurance, and enhanced sterile containment technologies will continue to shape the market. Strategic partnerships and expansion into emerging markets, coupled with a heightened focus on pandemic preparedness, will further fuel this growth. The market is expected to witness continued innovation in personalized medicine and advanced therapy filling solutions, presenting significant strategic opportunities for manufacturers to lead in this critical segment of pharmaceutical production. The market is projected to exceed $1,500 million by 2033.

Cartridges Pharma Aseptic Filling And Closing Machine Segmentation

-

1. Application

- 1.1. Below 10ml

- 1.2. 10-100ml

- 1.3. Above 100ml

-

2. Type

- 2.1. Fully Automatic

- 2.2. Semi-Automatic

Cartridges Pharma Aseptic Filling And Closing Machine Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cartridges Pharma Aseptic Filling And Closing Machine REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cartridges Pharma Aseptic Filling And Closing Machine Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Below 10ml

- 5.1.2. 10-100ml

- 5.1.3. Above 100ml

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Fully Automatic

- 5.2.2. Semi-Automatic

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cartridges Pharma Aseptic Filling And Closing Machine Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Below 10ml

- 6.1.2. 10-100ml

- 6.1.3. Above 100ml

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Fully Automatic

- 6.2.2. Semi-Automatic

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cartridges Pharma Aseptic Filling And Closing Machine Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Below 10ml

- 7.1.2. 10-100ml

- 7.1.3. Above 100ml

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Fully Automatic

- 7.2.2. Semi-Automatic

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cartridges Pharma Aseptic Filling And Closing Machine Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Below 10ml

- 8.1.2. 10-100ml

- 8.1.3. Above 100ml

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Fully Automatic

- 8.2.2. Semi-Automatic

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cartridges Pharma Aseptic Filling And Closing Machine Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Below 10ml

- 9.1.2. 10-100ml

- 9.1.3. Above 100ml

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Fully Automatic

- 9.2.2. Semi-Automatic

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cartridges Pharma Aseptic Filling And Closing Machine Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Below 10ml

- 10.1.2. 10-100ml

- 10.1.3. Above 100ml

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Fully Automatic

- 10.2.2. Semi-Automatic

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Syntegon

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IMA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Bausch+Strobel

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Optima

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Groninger

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Truking

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Tofflon

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SP Industries

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 BAUSCH Advanced Technology

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Cytiva

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Filamatic

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 COLANAR

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Marchesini

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Syntegon

List of Figures

- Figure 1: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Type 2024 & 2032

- Figure 5: North America Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Type 2024 & 2032

- Figure 11: South America Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cartridges Pharma Aseptic Filling And Closing Machine Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Cartridges Pharma Aseptic Filling And Closing Machine Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cartridges Pharma Aseptic Filling And Closing Machine Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cartridges Pharma Aseptic Filling And Closing Machine?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Cartridges Pharma Aseptic Filling And Closing Machine?

Key companies in the market include Syntegon, IMA, Bausch+Strobel, Optima, Groninger, Truking, Tofflon, SP Industries, BAUSCH Advanced Technology, Cytiva, Filamatic, COLANAR, Marchesini.

3. What are the main segments of the Cartridges Pharma Aseptic Filling And Closing Machine?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cartridges Pharma Aseptic Filling And Closing Machine," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cartridges Pharma Aseptic Filling And Closing Machine report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cartridges Pharma Aseptic Filling And Closing Machine?

To stay informed about further developments, trends, and reports in the Cartridges Pharma Aseptic Filling And Closing Machine, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence