Key Insights

The Brazil cold chain logistics market, valued at $2.67 billion in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 10.02% from 2025 to 2033. This expansion is driven by several key factors. Firstly, the rising demand for perishable goods, particularly fresh produce, meats, and pharmaceuticals, fuels the need for efficient temperature-controlled transportation and storage solutions. Secondly, Brazil's burgeoning middle class and increasing urbanization contribute to heightened consumer demand for high-quality, readily available food products, necessitating a robust cold chain infrastructure. Furthermore, the growth of e-commerce and the rise of organized retail are significantly impacting the cold chain sector, necessitating faster, more reliable delivery networks to satisfy consumer expectations. Finally, government initiatives promoting food safety and quality standards are creating a positive regulatory environment that supports investment in modern cold chain infrastructure.

Brazil Cold Chain Logistics Market Market Size (In Billion)

However, challenges remain. Infrastructure limitations, particularly in remote areas, pose significant obstacles to efficient cold chain operations. High energy costs associated with maintaining temperature-controlled environments also represent a considerable operational expense. Moreover, the lack of skilled labor and technological adoption within certain segments of the cold chain industry can impede further growth. Nevertheless, the market's positive outlook, driven by favorable demographics, expanding retail sectors, and a growing focus on food security, positions Brazil as a compelling investment opportunity within the global cold chain logistics landscape. Key players are strategically investing in technology and infrastructure to address these challenges and capture market share. The segments of chilled and frozen storage for horticultural products, meats, and pharmaceuticals are expected to demonstrate the most significant growth in the coming years.

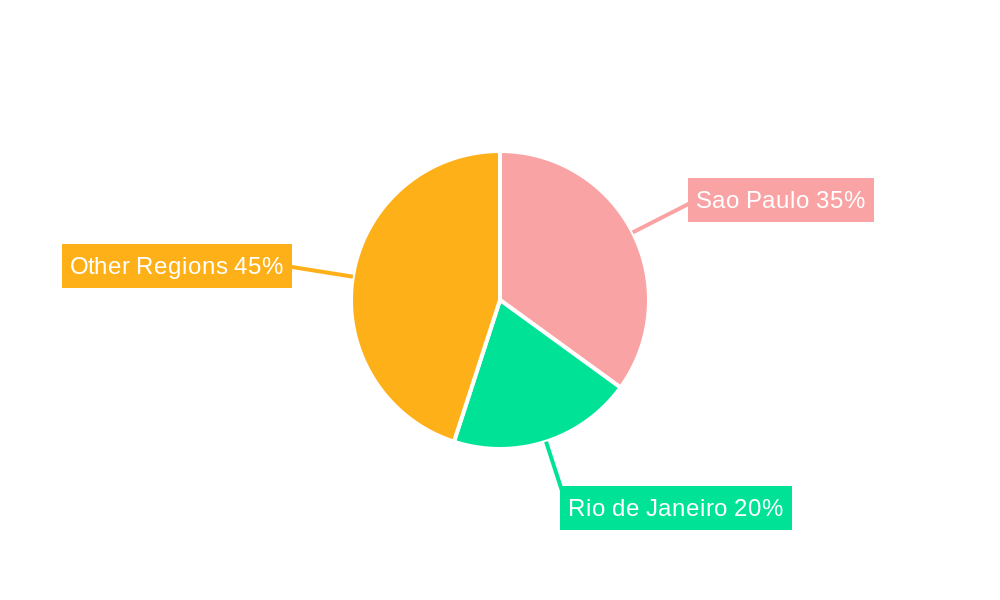

Brazil Cold Chain Logistics Market Company Market Share

Brazil Cold Chain Logistics Market: A Comprehensive Report (2019-2033)

This comprehensive report offers an in-depth analysis of the Brazil cold chain logistics market, providing critical insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by key cities (São Paulo, Rio de Janeiro, Salvador), services (storage, transportation, value-added services), temperature type (chilled, frozen), and application (horticulture, meats, fish & poultry, processed food, pharmaceuticals, life sciences & chemicals, other). Key players like Superfrio Armazens Gerais Ltda, Maersk, Logfrio SA, Nippon Express, Localfrio SA, Comfrio, Martini Meat SA, Arfrio Armazens Gerais Frigorificos, Friozem Armazens Frigorificos Ltda, Brado Logistica SA, CAP Logistica Frigorificada Ltda, and Brasfrigo SA are profiled, though this list is not exhaustive. The report reveals a market valued at XX million in 2025, projected to reach XX million by 2033, exhibiting a CAGR of xx%.

Brazil Cold Chain Logistics Market Market Dynamics & Structure

The Brazilian cold chain logistics market is characterized by a moderately concentrated structure with a few large players dominating alongside numerous smaller regional operators. Technological innovation, driven by the need for improved efficiency and reduced spoilage, is a key driver. Stringent regulatory frameworks concerning food safety and pharmaceutical handling significantly influence market operations. Competitive pressures stem from both established players and emerging tech-enabled logistics providers. The market also faces pressure from substitute products, especially in the food sector where alternative preservation methods exist. The demographic shift towards urbanization fuels growth in the cold chain sector, creating an increasing demand for efficient and reliable logistics for perishable goods. M&A activity, while not exceptionally high, is expected to increase with large players aiming to consolidate their market share and expand geographic reach. Between 2019 and 2024, approximately xx M&A deals were recorded in the Brazilian cold chain logistics sector.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Technological Innovation: Strong driver, focusing on IoT, automation, and temperature monitoring.

- Regulatory Framework: Stringent food safety and pharmaceutical regulations.

- Competitive Substitutes: Alternative preservation methods pose some level of competition.

- End-User Demographics: Urbanization drives significant market growth.

- M&A Trends: Moderate activity with potential for increased consolidation.

Brazil Cold Chain Logistics Market Growth Trends & Insights

The Brazilian cold chain logistics market has witnessed consistent growth over the past five years (2019-2024), driven by rising consumer demand for fresh and processed food, growth in the pharmaceutical industry, and increased focus on supply chain efficiency. Adoption of advanced technologies, such as real-time tracking and temperature monitoring systems, is gradually increasing, although penetration rates remain relatively low compared to developed markets. The increasing use of specialized refrigerated transportation and the expansion of warehousing facilities are key factors contributing to market growth. Consumer behavior shifts towards greater convenience and preference for fresh food also positively influence market expansion. The market is further benefiting from government initiatives focused on improving infrastructure and streamlining logistics processes. The estimated CAGR during the forecast period is expected to be xx%.

Dominant Regions, Countries, or Segments in Brazil Cold Chain Logistics Market

São Paulo, due to its large population and established industrial base, emerges as the dominant region in the Brazilian cold chain logistics market, commanding xx% market share in 2025. Rio de Janeiro holds a substantial position (xx%), followed by Salvador (xx%). The storage segment accounts for the largest share of the market (xx%) reflecting the necessity for robust cold storage solutions. Within applications, the meats, fish, and poultry sector presents the highest demand, reflecting Brazil's significant agricultural output. The chilled temperature type sector commands xx% market share, while the frozen segment accounts for xx%. Key drivers include increasing urbanization, expansion of retail networks, growing consumption of chilled & frozen products, and robust economic growth in key regions.

- São Paulo: Largest market share due to high population density and industrial activity.

- Rio de Janeiro: Significant market presence due to its size and economic activity.

- Storage Services: Largest market segment due to the demand for cold storage solutions.

- Meats, Fish & Poultry: Largest application segment driven by agricultural output.

- Chilled Products: Higher market share than frozen products in 2025.

Brazil Cold Chain Logistics Market Product Landscape

The product landscape is characterized by a diverse range of services including refrigerated transportation, warehousing, and value-added services such as blast freezing, labeling, and inventory management. Technological advancements such as IoT-enabled temperature monitoring, automated guided vehicles (AGVs), and advanced warehouse management systems (WMS) are enhancing efficiency and reducing losses. Innovative solutions like smart containers with real-time tracking and temperature control are gaining traction. The focus is on reducing operational costs, improving the safety and quality of goods and enhancing supply chain visibility.

Key Drivers, Barriers & Challenges in Brazil Cold Chain Logistics Market

Key Drivers: The expansion of the retail sector, rapid urbanization, rising disposable incomes, and a growing middle class are major drivers for the Brazilian cold chain logistics market. Government initiatives aimed at improving infrastructure, technological advancements such as improved tracking and monitoring systems are also contributing to market growth.

Key Challenges: Inadequate infrastructure particularly in the remote regions presents a major hurdle. High energy costs associated with maintaining the cold chain increase operational expenses. Fluctuations in the Brazilian real can impact the overall profitability. A lack of skilled labor also poses a challenge. Approximately xx% of logistics companies reported difficulties in hiring qualified personnel.

Emerging Opportunities in Brazil Cold Chain Logistics Market

The growth of e-commerce, particularly in grocery delivery, presents significant opportunities. Expansion into new regions, particularly in the north and northeast of Brazil, offers untapped potential. The increasing demand for specialized cold chain solutions for pharmaceuticals and life sciences represents a key area of growth. Adoption of sustainable practices, reducing environmental impact through optimization and the use of renewable energy, presents both an opportunity and a necessity.

Growth Accelerators in the Brazil Cold Chain Logistics Market Industry

Technological breakthroughs in refrigeration, transportation, and monitoring systems are key catalysts. Strategic partnerships between logistics providers and retailers/manufacturers are enhancing efficiency. Investments in infrastructure development and improved cold chain connectivity nationwide is essential for long term growth. The implementation of blockchain technology for enhancing transparency and traceability is another area of focus.

Key Players Shaping the Brazil Cold Chain Logistics Market Market

- Superfrio Armazens Gerais Ltda

- Maersk

- Logfrio SA

- Nippon Express

- Localfrio SA

- Comfrio

- Martini Meat SA

- Arfrio Armazens Gerais Frigorificos

- Friozem Armazens Frigorificos Ltda

- Brado Logistica SA

- CAP Logistica Frigorificada Ltda

- Brasfrigo SA

Notable Milestones in Brazil Cold Chain Logistics Market Sector

- 2021: Introduction of new temperature-controlled trucking routes linking key agricultural regions to major cities.

- 2022: Successful implementation of blockchain technology by a major player to improve traceability in the food supply chain.

- 2023: Launch of a major national government initiative aimed at improving cold chain infrastructure in remote areas.

In-Depth Brazil Cold Chain Logistics Market Market Outlook

The Brazilian cold chain logistics market is poised for continued growth in the coming decade. Increased investment in infrastructure, technological advancements, and expanding consumer demand, particularly in emerging markets, will drive this expansion. Strategic partnerships and the adoption of sustainable practices are essential to maximizing growth potential. This market offers compelling investment opportunities for players who can adapt to the changing landscape and leverage emerging technological advancements.

Brazil Cold Chain Logistics Market Segmentation

-

1. Service

- 1.1. Storage

- 1.2. Transportation

- 1.3. Value-ad

-

2. Temperature Type

- 2.1. Chilled

- 2.2. Frozen

-

3. Application

- 3.1. Horticulture (Fresh Fruits and Vegetables)

- 3.2. Meats, Fish, and Poultry

- 3.3. Processed Food Products

- 3.4. Pharmaceuticals, Life Sciences, and Chemicals

- 3.5. Other Applications

-

4. Key Cities

- 4.1. Sao Paulo

- 4.2. Rio de Janeiro

- 4.3. Salvador

Brazil Cold Chain Logistics Market Segmentation By Geography

- 1. Brazil

Brazil Cold Chain Logistics Market Regional Market Share

Geographic Coverage of Brazil Cold Chain Logistics Market

Brazil Cold Chain Logistics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.02% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used

- 3.3. Market Restrains

- 3.3.1. Increasing Usage of Payments from Mobile

- 3.4. Market Trends

- 3.4.1. Increasing Meat Exports to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Brazil Cold Chain Logistics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service

- 5.1.1. Storage

- 5.1.2. Transportation

- 5.1.3. Value-ad

- 5.2. Market Analysis, Insights and Forecast - by Temperature Type

- 5.2.1. Chilled

- 5.2.2. Frozen

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Horticulture (Fresh Fruits and Vegetables)

- 5.3.2. Meats, Fish, and Poultry

- 5.3.3. Processed Food Products

- 5.3.4. Pharmaceuticals, Life Sciences, and Chemicals

- 5.3.5. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Key Cities

- 5.4.1. Sao Paulo

- 5.4.2. Rio de Janeiro

- 5.4.3. Salvador

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Brazil

- 5.1. Market Analysis, Insights and Forecast - by Service

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Superfrio Armazens Gerais Ltda

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maersk

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Logfrio SA**List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nippon Express

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Localfrio SA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Comfrio

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Martini Meat SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Arfrio Armazens Gerais Frigorificos

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Friozem Armazens Frigorificos Ltda

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Brado Logistica SA

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 CAP Logistica Frigorificada Ltda

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Brasfrigo SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Superfrio Armazens Gerais Ltda

List of Figures

- Figure 1: Brazil Cold Chain Logistics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Brazil Cold Chain Logistics Market Share (%) by Company 2025

List of Tables

- Table 1: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 2: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 3: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 5: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Service 2020 & 2033

- Table 7: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Temperature Type 2020 & 2033

- Table 8: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Key Cities 2020 & 2033

- Table 10: Brazil Cold Chain Logistics Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Brazil Cold Chain Logistics Market?

The projected CAGR is approximately 10.02%.

2. Which companies are prominent players in the Brazil Cold Chain Logistics Market?

Key companies in the market include Superfrio Armazens Gerais Ltda, Maersk, Logfrio SA**List Not Exhaustive, Nippon Express, Localfrio SA, Comfrio, Martini Meat SA, Arfrio Armazens Gerais Frigorificos, Friozem Armazens Frigorificos Ltda, Brado Logistica SA, CAP Logistica Frigorificada Ltda, Brasfrigo SA.

3. What are the main segments of the Brazil Cold Chain Logistics Market?

The market segments include Service, Temperature Type, Application, Key Cities.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.67 Million as of 2022.

5. What are some drivers contributing to market growth?

The Growth of Banking and Financial Institutions in Emerging Economies; Mobile Payments are Being Increasingly Used.

6. What are the notable trends driving market growth?

Increasing Meat Exports to Drive the Market.

7. Are there any restraints impacting market growth?

Increasing Usage of Payments from Mobile.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Brazil Cold Chain Logistics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Brazil Cold Chain Logistics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Brazil Cold Chain Logistics Market?

To stay informed about further developments, trends, and reports in the Brazil Cold Chain Logistics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence