Key Insights

The Asia-Pacific small satellite market is projected for substantial expansion, driven by escalating demand for affordable Earth observation, communication, and navigation services. Key growth catalysts include the region's advancing technological landscape, favorable governmental policies, and significant investments in space initiatives. This dynamic sector is expected to reach a market size of $3.79 billion by 2025, exhibiting a compound annual growth rate (CAGR) of 31% from the base year 2025. Market segmentation covers applications (communication, Earth observation, navigation, space observation, and others), orbit classes (GEO, LEO, MEO), end-users (commercial, military & government, and others), and propulsion technologies (electric, gas-based, and liquid fuel). Major contributors such as China, Japan, India, and South Korea are leveraging their advanced infrastructure and skilled talent to lead regional manufacturing and launch capabilities. The proliferation of miniaturized satellites and the emergence of NewSpace companies are further accelerating market growth. Future expansion will be shaped by innovations in electric propulsion, continued component miniaturization, and the development of satellite constellations for IoT and environmental monitoring.

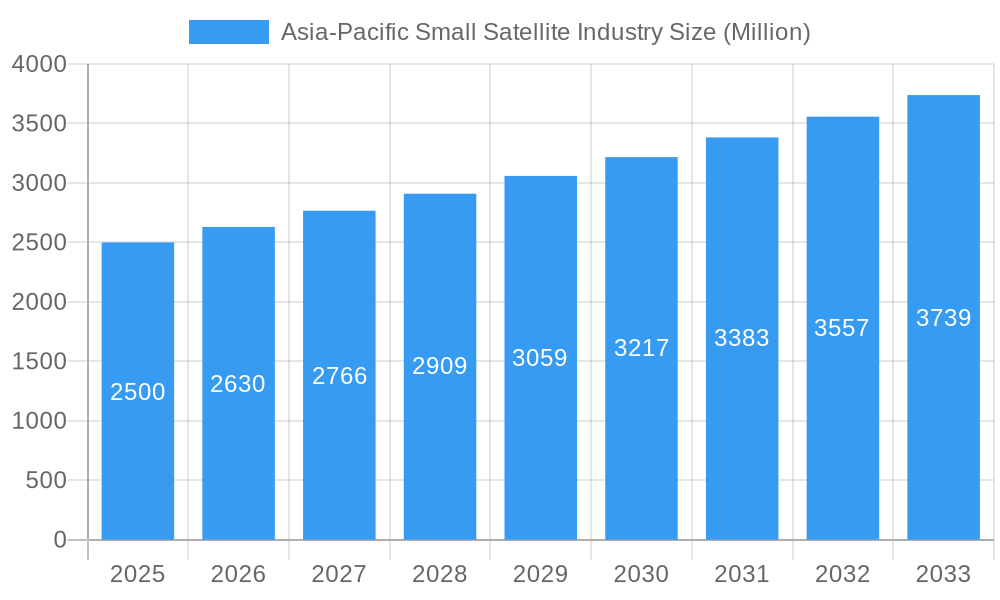

Asia-Pacific Small Satellite Industry Market Size (In Billion)

The forecast period from 2025 to 2033 anticipates sustained growth, with the market likely surpassing current estimates due to rapid technological progress and increased public and private investment in space-based solutions across the Asia-Pacific. While China is expected to maintain its market leadership, greater involvement from nations like Japan, India, and South Korea will foster a more diverse market. Heightened competition between established companies and agile startups will stimulate innovation and reduce costs, enhancing the accessibility of small satellite technology and further bolstering market expansion. The ongoing development of resilient ground infrastructure and comprehensive regulatory frameworks will be vital for supporting this sustained growth and ensuring the secure operation of these critical assets.

Asia-Pacific Small Satellite Industry Company Market Share

Asia-Pacific Small Satellite Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning Asia-Pacific small satellite industry, covering market dynamics, growth trends, key players, and future outlook. With a focus on small satellite applications, launch technologies, and regional market dominance, this report is essential for investors, industry professionals, and strategic decision-makers. The study period spans from 2019 to 2033, with 2025 as the base and estimated year.

Asia-Pacific Small Satellite Industry Market Dynamics & Structure

This section delves into the competitive landscape of the Asia-Pacific small satellite market. We analyze market concentration, highlighting the leading players and their respective market shares. Technological innovation, regulatory frameworks, and the presence of competitive substitutes are examined to understand the industry's evolution. Furthermore, we investigate end-user demographics and the impact of mergers and acquisitions (M&A) activities on market consolidation.

- Market Concentration: The Asia-Pacific small satellite market exhibits a moderately concentrated structure, with a few major players holding significant market share. The market share of the top five players is estimated to be approximately xx%.

- Technological Innovation: Continuous advancements in miniaturization, propulsion technology, and sensor capabilities are key drivers of innovation. However, barriers to entry, including high R&D costs and stringent regulatory approvals, remain.

- Regulatory Frameworks: Varying national regulations across the Asia-Pacific region impact market access and standardization. Harmonization of regulatory frameworks would facilitate greater industry growth.

- Competitive Product Substitutes: While traditional large satellites still serve specific purposes, the increasing affordability and capabilities of small satellites pose a significant competitive threat.

- End-User Demographics: The commercial sector dominates end-user demand, driven by applications in Earth observation, communication, and navigation. Government and military sectors also represent significant growth opportunities.

- M&A Trends: The past five years have witnessed xx M&A deals in the Asia-Pacific small satellite sector, indicating a trend toward consolidation and strategic partnerships.

Asia-Pacific Small Satellite Industry Growth Trends & Insights

The Asia-Pacific small satellite market is set for substantial expansion, with projections indicating a robust Compound Annual Growth Rate (CAGR) of approximately XX% from 2025 to 2033. This dynamic growth is underpinned by a confluence of factors, including rapid advancements in miniaturization technologies that enhance satellite capabilities while reducing costs, coupled with decreasing launch expenses. The escalating demand for high-resolution imagery and real-time data across an array of industries is a primary catalyst. We anticipate a significant surge in the adoption rate of small satellites, particularly within the commercial sector, projecting market penetration to reach approximately XX% by 2033. The seamless integration of emerging technologies such as Artificial Intelligence (AI) and the Internet of Things (IoT) is poised to further accelerate this adoption, unlocking new mission possibilities and expanding the utility of small satellite constellations.

Dominant Regions, Countries, or Segments in Asia-Pacific Small Satellite Industry

Within the vibrant Asia-Pacific small satellite ecosystem, several regions, countries, and segments are spearheading the market's advancement. Our analysis highlights the key drivers of growth and future potential:

- Leading Region: China continues to assert its dominance, propelled by substantial government investment in its space program and a highly developed domestic aerospace industry.

- Leading Country: Mirroring regional leadership, China remains at the forefront, with influential entities like CASC and Guodian Gaoke playing pivotal roles. Japan and India are also exhibiting remarkable growth trajectories, signifying their increasing importance.

- Leading Application Segment: Earth Observation is currently the most dominant application segment. This is driven by an insatiable demand for high-resolution imagery and geospatial data, crucial for applications in precision agriculture, sophisticated urban planning, and comprehensive environmental monitoring, including climate change studies and resource management.

- Leading Orbit Class: Low Earth Orbit (LEO) constellations are favored due to their inherent cost-effectiveness and superior data transmission speeds and lower latency compared to Medium Earth Orbit (MEO) and Geostationary Orbit (GEO). This makes LEO ideal for constellations supporting real-time data services.

- Leading End-User: The Commercial sector represents the largest and most dynamic end-user segment. Its growth is fueled by diverse and evolving application requirements across industries such as telecommunications, broadcasting, remote sensing, and enterprise solutions.

- Leading Propulsion Technology: Electric propulsion systems are increasingly gaining traction. Their advantages in fuel efficiency, precise thrust control, and the ability to achieve extended mission lifespans make them highly attractive for a variety of small satellite missions.

Asia-Pacific Small Satellite Industry Product Landscape

The Asia-Pacific small satellite market features a diverse range of products catering to varied needs. These include miniaturized satellites equipped with advanced sensors and communication systems, each boasting unique selling propositions. Recent innovations focus on enhancing data transmission speeds, improving image resolution, and developing more energy-efficient propulsion systems. This evolution addresses user needs for superior performance, longer mission lifespans, and improved data reliability. The trend is toward modular designs that allow for customization and quick deployment, shortening lead times and minimizing costs.

Key Drivers, Barriers & Challenges in Asia-Pacific Small Satellite Industry

Key Drivers:

- Increasing demand for high-resolution imagery and data across various sectors.

- Technological advancements driving miniaturization, cost reduction, and enhanced capabilities.

- Government support and investment in space exploration and related technologies.

Key Barriers & Challenges:

- High initial investment costs associated with R&D and satellite manufacturing.

- Regulatory complexities and varying national regulations across the Asia-Pacific region.

- Potential for supply chain disruptions due to geopolitical factors and global market volatility. The impact of these disruptions is estimated at xx million USD annually.

Emerging Opportunities in Asia-Pacific Small Satellite Industry

The Asia-Pacific small satellite market is ripe with emerging opportunities, offering significant potential for innovation and market penetration:

- The exponential growth of the Internet of Things (IoT) is creating a massive demand for connectivity solutions, with small satellites playing a crucial role in extending terrestrial networks to remote and underserved areas.

- Expanding use cases in critical areas such as environmental monitoring for climate change adaptation, advanced disaster management systems for early warning and response, and highly targeted precision agriculture for optimizing crop yields and resource utilization.

- The formation of strategic partnerships and collaborations between established players, innovative startups, and research institutions is essential to accelerate technological advancements, share risks, and bring novel solutions to market more efficiently. This includes joint ventures for satellite development, ground segment infrastructure, and data analytics platforms.

- The development of specialized constellations for emerging applications like in-orbit servicing, space debris removal, and on-orbit manufacturing presents exciting future growth avenues.

Growth Accelerators in the Asia-Pacific Small Satellite Industry Industry

Several factors are poised to accelerate growth in the Asia-Pacific small satellite market. These include the ongoing development of advanced propulsion technologies, enabling longer mission durations and expanded operational capabilities. Strategic partnerships between government agencies, private companies, and research institutions are fostering collaborative innovation. Furthermore, the expansion of new-space initiatives and decreasing launch costs are making small satellite technology more accessible to a wider range of users. These growth drivers are projected to significantly enhance the market's expansion potential.

Key Players Shaping the Asia-Pacific Small Satellite Industry Market

- MinoSpace Technology

- Axelspace Corporation

- Zhuhai Orbita Control Engineering

- China Aerospace Science and Technology Corporation (CASC)

- Chang Guang Satellite Technology Co Ltd

- Spacety Aerospace Co

- Guodian Gaoke

- Other prominent national space agencies and emerging private sector companies are also contributing significantly to the market landscape.

Notable Milestones in Asia-Pacific Small Satellite Industry Sector

- March 2022: The China Aerospace Science and Technology Corporation (CASC) successfully launched the Tiankun-2 satellites into a low-Earth polar orbit on the debut launch of the Long March 6A rocket, demonstrating advancements in launch capabilities.

- March 2022: Guodian Gaoke's Tianqi 19 commercial data relay satellite was launched from the Long March 8 rocket, highlighting growth in the commercial sector.

- February 2022: A total of 89 Jilin-1 optical imaging satellites manufactured by CASC, each weighing 30-45 kg, were launched into orbit, demonstrating the increasing trend toward large-scale constellations.

In-Depth Asia-Pacific Small Satellite Industry Market Outlook

The Asia-Pacific small satellite market is on an upward trajectory, poised for substantial growth in the coming years. This expansion will be propelled by continuous technological innovations, an ever-increasing global demand for comprehensive and timely data, and the implementation of supportive government policies and national space strategies across the region. Strategic alliances and focused investments are anticipated to be key enablers of innovation, fostering the development and widespread deployment of advanced small satellite technologies across a multitude of applications. The market presents significant and diverse opportunities for stakeholders involved in every facet of the value chain, from satellite manufacturing and launch services to sophisticated data processing and value-added analytics. The forward-looking outlook for the Asia-Pacific small satellite industry is exceptionally bright, characterized by numerous avenues for sustained development, market expansion, and the creation of transformative new capabilities.

Asia-Pacific Small Satellite Industry Segmentation

-

1. Application

- 1.1. Communication

- 1.2. Earth Observation

- 1.3. Navigation

- 1.4. Space Observation

- 1.5. Others

-

2. Orbit Class

- 2.1. GEO

- 2.2. LEO

- 2.3. MEO

-

3. End User

- 3.1. Commercial

- 3.2. Military & Government

- 3.3. Other

-

4. Propulsion Tech

- 4.1. Electric

- 4.2. Gas based

- 4.3. Liquid Fuel

Asia-Pacific Small Satellite Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Small Satellite Industry Regional Market Share

Geographic Coverage of Asia-Pacific Small Satellite Industry

Asia-Pacific Small Satellite Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Satellites that are being launched into LEO is driving the market demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Small Satellite Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication

- 5.1.2. Earth Observation

- 5.1.3. Navigation

- 5.1.4. Space Observation

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Orbit Class

- 5.2.1. GEO

- 5.2.2. LEO

- 5.2.3. MEO

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Commercial

- 5.3.2. Military & Government

- 5.3.3. Other

- 5.4. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.4.1. Electric

- 5.4.2. Gas based

- 5.4.3. Liquid Fuel

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 MinoSpace Technology

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Axelspace Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Zhuhai Orbita Control Engineerin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 China Aerospace Science and Technology Corporation (CASC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chang Guang Satellite Technology Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Spacety Aerospace Co

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Guodian Gaoke

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 MinoSpace Technology

List of Figures

- Figure 1: Asia-Pacific Small Satellite Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Small Satellite Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 3: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 4: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 5: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Orbit Class 2020 & 2033

- Table 8: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Propulsion Tech 2020 & 2033

- Table 10: Asia-Pacific Small Satellite Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: China Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: India Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-Pacific Small Satellite Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Small Satellite Industry?

The projected CAGR is approximately 31%.

2. Which companies are prominent players in the Asia-Pacific Small Satellite Industry?

Key companies in the market include MinoSpace Technology, Axelspace Corporation, Zhuhai Orbita Control Engineerin, China Aerospace Science and Technology Corporation (CASC), Chang Guang Satellite Technology Co Ltd, Spacety Aerospace Co, Guodian Gaoke.

3. What are the main segments of the Asia-Pacific Small Satellite Industry?

The market segments include Application, Orbit Class, End User, Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.79 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Satellites that are being launched into LEO is driving the market demand.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2022: The China Aerospace Science and Technology Corporation successfully launched the Tiankun-2 satellites into a low-Earth polar orbit on the debut launch of the Long March 6A.March 2022: Guodian Gaoke's Tianqi 19 commercial data relay satellite was launched from the Long March 8 rocket.February 2022: A total of 89 Jilin-1 optical imaging satellites manufactured by CASC each weighing 30-45 kg were launched into orbit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Small Satellite Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Small Satellite Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Small Satellite Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Small Satellite Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence