Key Insights

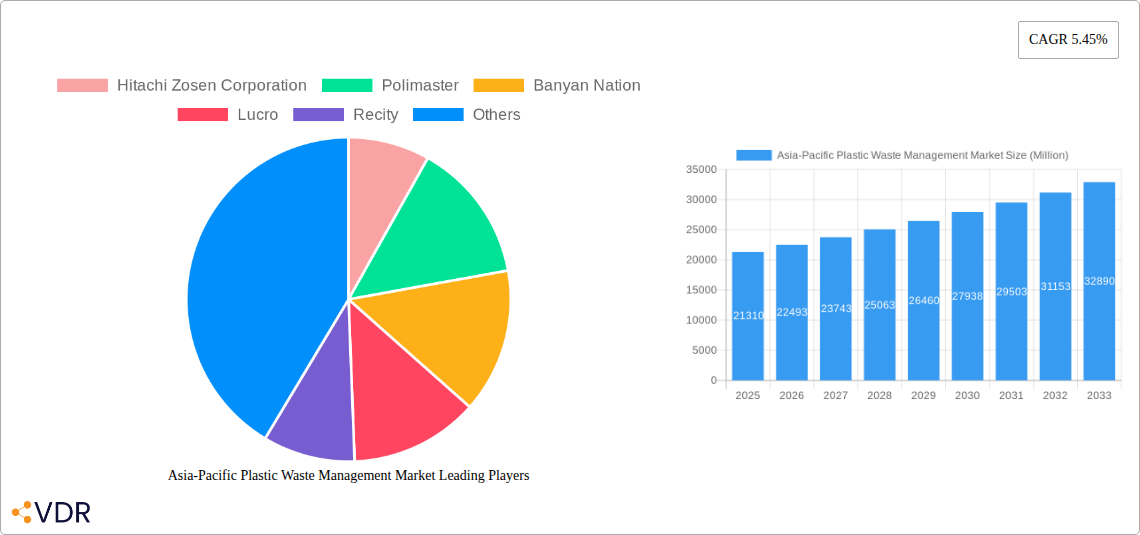

The Asia-Pacific plastic waste management market, valued at $21.31 billion in 2025, is projected to experience robust growth, driven by increasing environmental concerns, stringent government regulations, and a burgeoning awareness of sustainable practices. A compound annual growth rate (CAGR) of 5.45% from 2025 to 2033 indicates a significant market expansion, reaching an estimated value exceeding $33 billion by 2033. Key drivers include rising plastic waste generation due to rapid urbanization and industrialization, coupled with escalating public pressure for effective waste management solutions. Government initiatives promoting recycling, waste-to-energy projects, and the development of advanced waste processing technologies further fuel market growth. While challenges such as inconsistent waste collection infrastructure and high initial investment costs for advanced technologies persist, innovative solutions like chemical recycling and the emergence of the circular economy are mitigating these restraints. The market is segmented by waste type (plastics, etc.), treatment method (recycling, incineration, landfill), and end-use industry (construction, energy, etc.), offering diverse opportunities for market players. Leading companies such as Hitachi Zosen Corporation, Suez, and Waste Management Inc. are actively investing in research and development, strategic partnerships, and acquisitions to maintain a competitive edge in this rapidly evolving market.

Asia-Pacific Plastic Waste Management Market Market Size (In Billion)

The competitive landscape is characterized by both established players and emerging innovative startups. Large multinational corporations leverage their expertise in waste management and technology to dominate larger-scale projects, while smaller, specialized firms focus on niche technologies like plastic-to-fuel conversion and advanced recycling methods. Regional variations in waste management infrastructure and regulations will significantly impact market dynamics. Countries with better established infrastructure and stricter environmental laws are poised for faster growth compared to regions lacking the required supportive infrastructure. The continuing rise in environmentally conscious consumer behavior and increasing corporate social responsibility initiatives will bolster demand for sustainable waste management solutions, leading to further market expansion in the coming years. Technological advancements in plastic recycling, particularly chemical recycling, present promising avenues for growth and innovation within the Asia-Pacific region.

Asia-Pacific Plastic Waste Management Market Company Market Share

Asia-Pacific Plastic Waste Management Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Asia-Pacific plastic waste management market, offering invaluable insights for industry professionals, investors, and policymakers. The market is segmented by waste type (e.g., plastic bottles, films, packaging), technology (mechanical recycling, chemical recycling, incineration), and end-user (municipalities, industries). The report covers the historical period (2019-2024), base year (2025), and forecast period (2025-2033), with market values presented in million units. Key players like Hitachi Zosen Corporation, Polimaster, Banyan Nation, Lucro, Recity, SUEZ, Waste Management Inc, Cleanaway Waste Management Limited, Plastic Bank, Agilyx, and GreenTech Environmental Co Ltd are profiled, although this list is not exhaustive.

Asia-Pacific Plastic Waste Management Market Dynamics & Structure

The Asia-Pacific plastic waste management market is characterized by a moderately fragmented structure, with both large multinational corporations and smaller, specialized companies competing. Technological innovation, driven by the need for sustainable solutions and stringent environmental regulations, is a key driver. Market concentration is expected to increase through mergers and acquisitions (M&A) activities as larger players seek to expand their market share and geographical reach. Government regulations and policies play a significant role in shaping market dynamics, promoting investment in infrastructure and technological advancements. The presence of substitute technologies and materials (e.g., biodegradable plastics) influences market growth. End-user demographics, particularly the rising urban population and increasing awareness of environmental issues, are also significant factors.

- Market Concentration: xx% in 2025, projected to reach xx% by 2033.

- M&A Activity: xx deals recorded in 2019-2024, with a projected increase to xx deals by 2033.

- Innovation Barriers: High initial investment costs, lack of standardized technologies, and limited access to funding for smaller companies.

- Regulatory Landscape: Varying regulatory frameworks across different countries, creating both opportunities and challenges for businesses.

Asia-Pacific Plastic Waste Management Market Growth Trends & Insights

The Asia-Pacific plastic waste management market is experiencing significant growth, driven by factors such as increasing plastic waste generation, stricter environmental regulations, and rising consumer awareness. The market size is projected to expand at a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a value of xx million by 2033. Technological disruptions, including advancements in recycling technologies and the emergence of chemical recycling, are accelerating market adoption. Shifts in consumer behavior, with a growing preference for sustainable and eco-friendly products, are further supporting market growth. Market penetration of advanced waste management technologies is gradually increasing, though significant regional disparities exist. Government initiatives and funding programs are crucial in facilitating adoption.

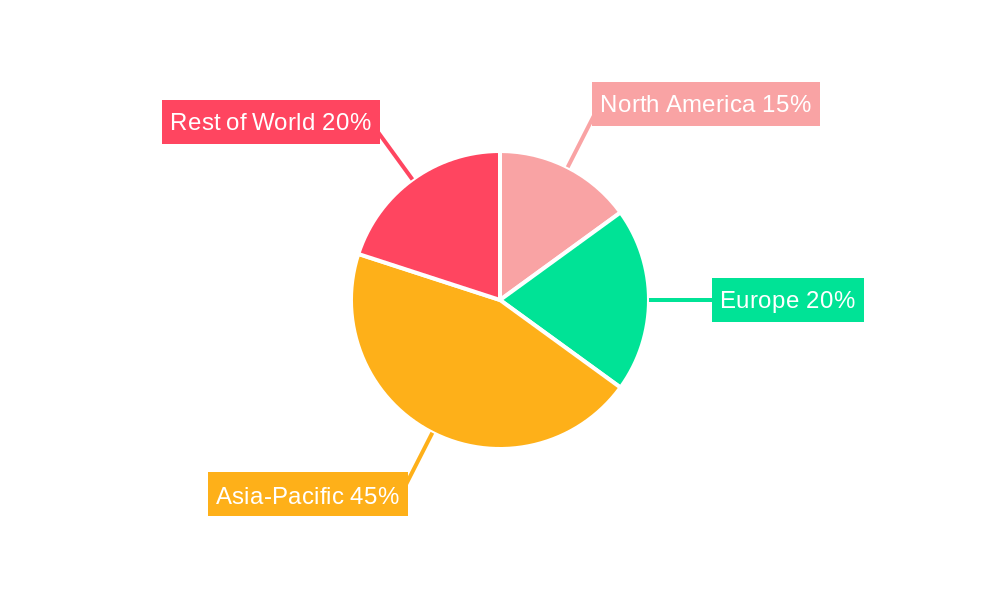

Dominant Regions, Countries, or Segments in Asia-Pacific Plastic Waste Management Market

China and India are currently the dominant markets, owing to their large populations, high levels of plastic waste generation, and significant government investment in waste management infrastructure. However, other countries in Southeast Asia, such as Indonesia, Thailand, and Vietnam, are experiencing rapid growth driven by rising economic development and increasing environmental concerns. The municipal waste segment is currently the largest, but the industrial waste segment is projected to witness faster growth due to stricter regulations and corporate sustainability initiatives.

- Key Drivers in China: Government policies promoting waste reduction and recycling, significant investments in waste management infrastructure, and the growing awareness among consumers.

- Key Drivers in India: Rapid urbanization, increased plastic consumption, and government initiatives focused on waste management improvements.

- Southeast Asia Growth Drivers: Increasing environmental awareness, supportive government policies, and growing foreign investment.

Asia-Pacific Plastic Waste Management Market Product Landscape

The product landscape encompasses a wide range of technologies and solutions, including mechanical recycling, chemical recycling, energy recovery (incineration with energy recovery), and anaerobic digestion. Recent innovations focus on enhancing the efficiency and scalability of recycling processes, reducing costs, and improving the quality of recycled materials. Technological advancements are leading to the development of more sophisticated waste sorting and processing technologies, enabling the effective recycling of various types of plastics. The unique selling propositions often revolve around cost-effectiveness, environmental impact, and the quality of recycled output.

Key Drivers, Barriers & Challenges in Asia-Pacific Plastic Waste Management Market

Key Drivers: Stringent government regulations, increasing environmental awareness among consumers, advancements in recycling technologies, and the growing demand for recycled plastics. The increasing focus on circular economy models is also a significant driver.

Challenges: Lack of efficient waste collection and sorting infrastructure, particularly in rural areas, limited availability of advanced recycling technologies, and high implementation costs. Supply chain complexities and inconsistent regulatory frameworks across different countries also pose significant challenges. Competition among various waste management technologies and the availability of cheap virgin plastics add to the pressure.

Emerging Opportunities in Asia-Pacific Plastic Waste Management Market

Untapped opportunities exist in rural areas with limited access to waste management services. Innovative applications for recycled plastics, such as in construction materials and textiles, hold significant potential. The growing demand for sustainable packaging solutions presents opportunities for companies that can offer eco-friendly and recyclable alternatives. The expansion of chemical recycling technologies can address the limitations of mechanical recycling for certain types of plastics.

Growth Accelerators in the Asia-Pacific Plastic Waste Management Market Industry

Technological advancements in waste sorting, processing, and recycling are key growth accelerators. Strategic partnerships between technology providers, waste management companies, and municipalities are facilitating the deployment of innovative solutions. Government support through funding programs and favorable regulatory frameworks is crucial for driving market growth. The growing awareness among consumers and businesses about the environmental impact of plastic waste is also a significant growth accelerator.

Key Players Shaping the Asia-Pacific Plastic Waste Management Market Market

- Hitachi Zosen Corporation

- Polimaster

- Banyan Nation

- Lucro

- Recity

- SUEZ

- Waste Management Inc

- Cleanaway Waste Management Limited

- Plastic Bank

- Agilyx

- GreenTech Environmental Co Ltd

*List Not Exhaustive

Notable Milestones in Asia-Pacific Plastic Waste Management Market Sector

- April 2024: Launch of the "Mapping Plastic Litter in Mekong Countries and Proposing Innovative Waste Management Solutions" initiative focusing on Bangkok, Vientiane, Battambang, and Can Tho. This significantly impacts the focus on plastic waste management in Southeast Asia.

- March 2023: World Bank approves a USD 250 million loan for plastic pollution reduction in Shaanxi Province, China, setting a precedent for national-level initiatives.

In-Depth Asia-Pacific Plastic Waste Management Market Outlook

The Asia-Pacific plastic waste management market is poised for substantial growth over the next decade. Continued technological innovation, supportive government policies, and increasing environmental awareness will drive market expansion. Strategic partnerships and investments in infrastructure will be crucial for unlocking the market's full potential. Companies that can offer cost-effective, environmentally friendly, and scalable solutions will be well-positioned to capture significant market share. The focus on circular economy models will be a major catalyst for this growth.

Asia-Pacific Plastic Waste Management Market Segmentation

-

1. Polymer

- 1.1. Polypropylene (PP)

- 1.2. Polyethylene (PE)

- 1.3. Polyvinyl Chloride (PVC)

- 1.4. Terephthalate (PET)

- 1.5. Other Polymers

-

2. Source

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

- 2.4. Other Sources (Construction, Healthcare, etc.)

-

3. Treatment

- 3.1. Recycling

- 3.2. Chemical Treatment

- 3.3. Landfill

- 3.4. Other Treatments

Asia-Pacific Plastic Waste Management Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Plastic Waste Management Market Regional Market Share

Geographic Coverage of Asia-Pacific Plastic Waste Management Market

Asia-Pacific Plastic Waste Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 3.3. Market Restrains

- 3.3.1. Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste

- 3.4. Market Trends

- 3.4.1. Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Plastic Waste Management Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 5.1.1. Polypropylene (PP)

- 5.1.2. Polyethylene (PE)

- 5.1.3. Polyvinyl Chloride (PVC)

- 5.1.4. Terephthalate (PET)

- 5.1.5. Other Polymers

- 5.2. Market Analysis, Insights and Forecast - by Source

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.2.4. Other Sources (Construction, Healthcare, etc.)

- 5.3. Market Analysis, Insights and Forecast - by Treatment

- 5.3.1. Recycling

- 5.3.2. Chemical Treatment

- 5.3.3. Landfill

- 5.3.4. Other Treatments

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Polymer

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hitachi Zosen Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Polimaster

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Banyan Nation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lucro

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Recity

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SUEZ

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Waste Management Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cleanaway Waste Management Limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Plastic Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Agilyx

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 GreenTech Environmental Co Ltd*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Hitachi Zosen Corporation

List of Figures

- Figure 1: Asia-Pacific Plastic Waste Management Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Plastic Waste Management Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 2: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Polymer 2020 & 2033

- Table 3: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 4: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 5: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Treatment 2020 & 2033

- Table 6: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Treatment 2020 & 2033

- Table 7: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Polymer 2020 & 2033

- Table 10: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Polymer 2020 & 2033

- Table 11: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Source 2020 & 2033

- Table 12: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Source 2020 & 2033

- Table 13: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Treatment 2020 & 2033

- Table 14: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Treatment 2020 & 2033

- Table 15: Asia-Pacific Plastic Waste Management Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Plastic Waste Management Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: China Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: China Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Japan Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: South Korea Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: South Korea Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: India Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: India Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Australia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Australia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: New Zealand Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: New Zealand Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Indonesia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Indonesia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Malaysia Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Malaysia Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Singapore Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Singapore Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Thailand Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Thailand Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Vietnam Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Vietnam Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Philippines Asia-Pacific Plastic Waste Management Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Philippines Asia-Pacific Plastic Waste Management Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Plastic Waste Management Market?

The projected CAGR is approximately 5.45%.

2. Which companies are prominent players in the Asia-Pacific Plastic Waste Management Market?

Key companies in the market include Hitachi Zosen Corporation, Polimaster, Banyan Nation, Lucro, Recity, SUEZ, Waste Management Inc, Cleanaway Waste Management Limited, Plastic Bank, Agilyx, GreenTech Environmental Co Ltd*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Plastic Waste Management Market?

The market segments include Polymer, Source, Treatment.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.31 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste.

6. What are the notable trends driving market growth?

Rapid Urbanization Exacerbates Escalating Plastic Predicament in Asia-Pacific.

7. Are there any restraints impacting market growth?

Increasing Plastic Consumption; Stricter Regulations and Policies Aimed at Reducing Plastic Waste.

8. Can you provide examples of recent developments in the market?

April 2024: A new initiative, "Mapping Plastic Litter in Mekong Countries and Proposing Innovative Waste Management Solutions," was introduced to combat Southeast Asia's escalating plastic pollution crisis. The project's primary goal is to chart and diminish the volume of plastic waste entering the waterways of the Mekong countries, focusing on four pilot cities: Bangkok (Thailand), Vientiane (Lao PDR), Battambang (Cambodia), and Can Tho (Vietnam).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Plastic Waste Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Plastic Waste Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Plastic Waste Management Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Plastic Waste Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence