Key Insights

The Asia-Pacific package testing market is projected to reach $21.58 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 5.25% from 2025 to 2033. This robust growth is propelled by the escalating e-commerce sector, demanding comprehensive testing to safeguard product integrity during transit. Heightened consumer awareness regarding product safety and quality, alongside stringent regulatory mandates across key sectors such as food & beverage, healthcare, and consumer goods, are driving significant investments in advanced package testing solutions. Leading growth is observed in dynamic economies like China, India, and South Korea, fueled by their rapid industrialization and economic expansion. The market benefits from diverse testing methodologies, including physical performance, chemical, and environmental assessments, fostering diversification. While fluctuating raw material costs and the requirement for specialized expertise may present challenges, the outlook for the Asia-Pacific package testing market remains highly promising, offering substantial opportunities for market participants.

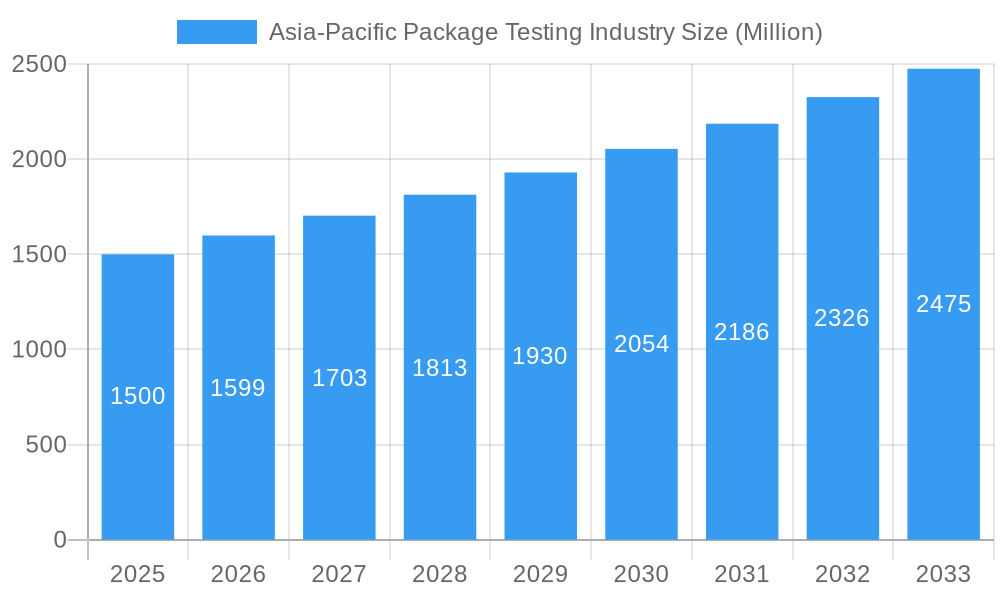

Asia-Pacific Package Testing Industry Market Size (In Billion)

Analysis of market segments indicates strong growth prospects across all major material types (glass, paper, plastic, metal) and testing categories. The food & beverage industry, driven by rigorous safety and hygiene standards, and the healthcare sector, prioritizing the protection of sensitive medical supplies, represent key growth avenues for package testing services. The competitive environment is characterized by a blend of established global entities and agile regional players addressing specific market demands. Continued e-commerce proliferation, intensified regulatory oversight, and a growing consumer emphasis on product quality will ensure sustained expansion of the Asia-Pacific package testing market. Companies offering innovative testing solutions and end-to-end services are poised for competitive advantage.

Asia-Pacific Package Testing Industry Company Market Share

Asia-Pacific Package Testing Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Asia-Pacific package testing industry, covering market dynamics, growth trends, dominant segments, key players, and future outlook. With a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report segments the market by primary material (glass, paper, plastic, metal), type of testing (physical performance, chemical, environmental), and end-user industry (food & beverage, healthcare, industrial, personal & household products, others). Market values are presented in million units.

Asia-Pacific Package Testing Industry Market Dynamics & Structure

The Asia-Pacific package testing market is characterized by a moderately consolidated landscape, featuring a dynamic interplay between established multinational corporations and agile regional contenders. A significant catalyst for growth is the relentless pace of technological innovation, with a pronounced emphasis on the integration of automation, artificial intelligence-driven data analytics, and the development of sophisticated material testing methodologies. This evolution is intrinsically linked to the tightening grip of stringent regulatory frameworks, which prioritize product safety, environmental sustainability, and consumer protection, thereby dictating rigorous testing protocols. Furthermore, the burgeoning global imperative for sustainable packaging solutions is profoundly influencing the development and adoption of novel testing approaches for eco-friendly materials. While the emergence of competitive product substitutes, particularly alternative packaging materials, presents a nuanced challenge, the market is also buoyed by a rapidly expanding middle-class demographic across the region. This demographic, armed with increasing disposable income, is fueling robust demand for packaged goods across a diverse spectrum of industries. Mergers and acquisitions (M&A) continue to be a strategic lever, with larger entities judiciously acquiring smaller firms to fortify their service offerings, expand their technological capabilities, and broaden their geographical footprints.

- Market Concentration: The market exhibits a moderate degree of consolidation. In 2025, the top 5 players are estimated to command approximately [Insert Percentage]% of the total market share, indicating a competitive yet somewhat concentrated environment.

- Technological Innovation: The industry is witnessing a paradigm shift towards embracing automation, leveraging AI for advanced data analysis, and pioneering cutting-edge material testing techniques to meet evolving industry demands.

- Regulatory Frameworks: A robust and ever-evolving landscape of regulations, particularly concerning food safety standards, environmental protection mandates, and comprehensive product labeling requirements, is a primary driver for the escalating demand for specialized package testing services.

- Competitive Substitutes: The increasing consumer and industry preference for biodegradable and environmentally conscious packaging materials is prompting a reassessment of traditional testing paradigms and creating opportunities for specialized testing solutions for these new materials.

- M&A Trends: Moderate M&A activity is anticipated, with strategic acquisitions being a key tactic for expanding geographic reach and diversifying service portfolios. Between 2019 and 2024, approximately [Insert Number] M&A deals were recorded, highlighting consolidation and strategic growth.

Asia-Pacific Package Testing Industry Growth Trends & Insights

The Asia-Pacific package testing market is experiencing robust growth, driven by factors such as increasing consumer demand for packaged goods, stringent regulatory compliance requirements, and rising awareness of product safety and quality. The market size is projected to grow at a CAGR of xx% from 2025 to 2033, reaching a value of xx million units by 2033. This growth is fueled by technological advancements leading to more efficient and accurate testing methods. The adoption rate of advanced testing technologies is also on the rise, further contributing to market expansion. Consumer behavior shifts towards demanding higher-quality and safer products are influencing the industry. The adoption of e-commerce and the resulting increase in the need for secure packaging are also significant contributors to the market growth.

Dominant Regions, Countries, or Segments in Asia-Pacific Package Testing Industry

China, India, and Japan are leading the Asia-Pacific package testing market. Within segments, the demand for physical performance testing is the highest due to the increased focus on ensuring product durability and integrity during transportation and storage. The food and beverage industry and the healthcare sector are the primary end-users, demanding rigorous quality control and safety testing.

- Key Drivers:

- China: Rapid economic growth, burgeoning manufacturing sector, and stringent regulatory requirements drive the market.

- India: Expanding consumer base, rising disposable incomes, and growing food processing industry fuel the demand for testing services.

- Japan: Focus on high-quality products, stringent quality control standards, and technological advancements.

- Food & Beverage: Stringent food safety regulations and the growing demand for processed food.

- Healthcare: Strict quality and safety standards for pharmaceutical and medical device packaging.

- Dominance Factors: Large manufacturing bases, rising consumerism, stringent regulatory environments, and robust infrastructure.

- Growth Potential: Untapped markets in Southeast Asia and increasing demand for sustainable packaging present significant opportunities.

Asia-Pacific Package Testing Industry Product Landscape

The Asia-Pacific package testing industry offers a diverse range of services, including physical, chemical, and environmental testing. Recent innovations include automated testing systems that improve efficiency and accuracy, and advanced analytical techniques that enhance data analysis. These advancements enable companies to offer faster turnaround times and more comprehensive testing solutions. Unique selling propositions include specialized expertise in specific packaging materials, industry-specific testing protocols, and integrated solutions that streamline the entire testing process.

Key Drivers, Barriers & Challenges in Asia-Pacific Package Testing Industry

Key Drivers: Growing consumer awareness of product safety, stringent regulatory requirements for packaging materials, the expansion of e-commerce, and the increasing adoption of advanced testing technologies are key drivers. Government initiatives promoting sustainable packaging are further accelerating market growth.

Key Challenges: The high cost of advanced testing equipment, the shortage of skilled professionals, and intense competition among testing laboratories are major challenges. Supply chain disruptions caused by geopolitical factors or pandemics have also impacted the industry. Further, adapting to evolving regulatory standards can be a significant hurdle.

Emerging Opportunities in Asia-Pacific Package Testing Industry

The Asia-Pacific package testing industry is ripe with emerging opportunities, largely propelled by the escalating global emphasis on sustainable packaging solutions. The exponential growth of e-commerce platforms across the region presents a significant avenue for expansion, requiring specialized testing for the unique demands of online retail packaging. Furthermore, the unwavering focus on enhancing food safety standards continues to drive demand for rigorous testing protocols to ensure consumer well-being. The development and validation of advanced testing methodologies for novel and innovative packaging materials, including smart packaging and advanced barrier films, represent a critical growth frontier. Additionally, the vast and relatively untapped markets in the less developed regions of Asia-Pacific hold considerable untapped potential for service providers looking to establish an early foothold.

Growth Accelerators in the Asia-Pacific Package Testing Industry Industry

Technological advancements in testing methodologies, strategic partnerships between testing labs and packaging manufacturers, and the expansion into new geographic markets are key growth accelerators. Focus on providing integrated solutions encompassing design, testing, and certification services will further drive market expansion.

Key Players Shaping the Asia-Pacific Package Testing Industry Market

- ALS Limited

- Intertek Group PLC (Intertek) - A global leader providing quality assurance, inspection, and testing services across numerous sectors.

- Cryopak - Specializing in temperature-controlled packaging and cold chain solutions, crucial for pharmaceutical and food industries.

- Nefab Group - Offering comprehensive packaging solutions with a strong focus on sustainability and supply chain optimization.

- Turner Packaging Limited - A prominent provider of packaging solutions with a commitment to innovation and customer service.

- National Technical Systems (NTS) - A comprehensive testing, inspection, and certification company serving a wide range of industries.

- SGS SA (SGS) - A world-leading inspection, verification, testing, and certification company, playing a pivotal role in ensuring quality and compliance.

- DDL Inc. - Focusing on medical device packaging testing and validation.

- Advance Packaging - Providing a range of packaging solutions and services tailored to diverse industry needs.

- CSZ Testing Services Laboratories - Offering a broad spectrum of environmental and product testing services.

Notable Milestones in Asia-Pacific Package Testing Industry Sector

- January 2023: SGS significantly broadened its global reach for fiber fragmentation testing services by extending its capabilities to include Bangladesh, India, Turkey, USA, and Vietnam, following crucial TMC approval. This expansion underscores their commitment to supporting the burgeoning textile and packaging industries in these regions.

- May 2022: Intertek reinforced its long-standing commitment to facilitating international trade by extending its contract with the Philippines' Committee for Accreditation of Cargo Surveying Companies. This ongoing partnership is instrumental in enhancing the efficiency and integrity of export cargo clearance processes in the Philippines.

In-Depth Asia-Pacific Package Testing Industry Market Outlook

The Asia-Pacific package testing market is on a trajectory of sustained and robust growth, propelled by a confluence of powerful drivers. The escalating consumer demand for products that are not only safe and high-quality but also sustainably packaged is a paramount influence. Coupled with this is the unwavering imperative for businesses to adhere to increasingly stringent global and regional regulatory compliance standards. Technological advancements, particularly in areas like smart packaging testing and automation, are further enhancing the efficiency and scope of testing services. Strategic collaborations and well-executed expansions into emerging and high-growth markets within the Asia-Pacific region are poised to be significant accelerators of market expansion. Companies that proactively embrace and deliver innovative, cost-effective, and demonstrably sustainable testing solutions will undoubtedly carve out a significant competitive advantage. The long-term prosperity and evolution of this market will be critically dependent on its agility in adapting to dynamic consumer preferences, the ever-shifting regulatory landscape, and the rapid pace of technological innovation.

Asia-Pacific Package Testing Industry Segmentation

-

1. Primary Material

- 1.1. Glass

- 1.2. Paper

- 1.3. Plastic

- 1.4. Metal

-

2. Type of Testing

- 2.1. Physical Performance Testing

- 2.2. Chemical Testing

- 2.3. Environmental Testing

-

3. End-user Industry

- 3.1. Food and Beverage

- 3.2. Healthcare

- 3.3. Industrial

- 3.4. Personal and Household Products

- 3.5. Other End-user Industries

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. Rest of Asia-Pacific

Asia-Pacific Package Testing Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. Rest of Asia Pacific

Asia-Pacific Package Testing Industry Regional Market Share

Geographic Coverage of Asia-Pacific Package Testing Industry

Asia-Pacific Package Testing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions

- 3.3. Market Restrains

- 3.3.1. High Costs of Equipment

- 3.4. Market Trends

- 3.4.1. Plastic Packaging is Expected to Witness Significant Adoption

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 5.1.1. Glass

- 5.1.2. Paper

- 5.1.3. Plastic

- 5.1.4. Metal

- 5.2. Market Analysis, Insights and Forecast - by Type of Testing

- 5.2.1. Physical Performance Testing

- 5.2.2. Chemical Testing

- 5.2.3. Environmental Testing

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food and Beverage

- 5.3.2. Healthcare

- 5.3.3. Industrial

- 5.3.4. Personal and Household Products

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. Rest of Asia-Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Primary Material

- 6. China Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 6.1.1. Glass

- 6.1.2. Paper

- 6.1.3. Plastic

- 6.1.4. Metal

- 6.2. Market Analysis, Insights and Forecast - by Type of Testing

- 6.2.1. Physical Performance Testing

- 6.2.2. Chemical Testing

- 6.2.3. Environmental Testing

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Food and Beverage

- 6.3.2. Healthcare

- 6.3.3. Industrial

- 6.3.4. Personal and Household Products

- 6.3.5. Other End-user Industries

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Primary Material

- 7. India Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 7.1.1. Glass

- 7.1.2. Paper

- 7.1.3. Plastic

- 7.1.4. Metal

- 7.2. Market Analysis, Insights and Forecast - by Type of Testing

- 7.2.1. Physical Performance Testing

- 7.2.2. Chemical Testing

- 7.2.3. Environmental Testing

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Food and Beverage

- 7.3.2. Healthcare

- 7.3.3. Industrial

- 7.3.4. Personal and Household Products

- 7.3.5. Other End-user Industries

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Primary Material

- 8. Japan Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 8.1.1. Glass

- 8.1.2. Paper

- 8.1.3. Plastic

- 8.1.4. Metal

- 8.2. Market Analysis, Insights and Forecast - by Type of Testing

- 8.2.1. Physical Performance Testing

- 8.2.2. Chemical Testing

- 8.2.3. Environmental Testing

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Food and Beverage

- 8.3.2. Healthcare

- 8.3.3. Industrial

- 8.3.4. Personal and Household Products

- 8.3.5. Other End-user Industries

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Primary Material

- 9. Rest of Asia Pacific Asia-Pacific Package Testing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 9.1.1. Glass

- 9.1.2. Paper

- 9.1.3. Plastic

- 9.1.4. Metal

- 9.2. Market Analysis, Insights and Forecast - by Type of Testing

- 9.2.1. Physical Performance Testing

- 9.2.2. Chemical Testing

- 9.2.3. Environmental Testing

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Food and Beverage

- 9.3.2. Healthcare

- 9.3.3. Industrial

- 9.3.4. Personal and Household Products

- 9.3.5. Other End-user Industries

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Primary Material

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ALS limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Intertek Group PLC

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Cryopak

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Nefab Group

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Turner Packaging Limited

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 National Technical Systems

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 SGS SA

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 DDL Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Advance Packaging

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 CSZ Testing Services Laboratories

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 ALS limited

List of Figures

- Figure 1: Asia-Pacific Package Testing Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Package Testing Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 2: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 3: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 7: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 8: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 9: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 12: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 13: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 14: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 17: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 18: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 19: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Primary Material 2020 & 2033

- Table 22: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Type of Testing 2020 & 2033

- Table 23: Asia-Pacific Package Testing Industry Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 24: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asia-Pacific Package Testing Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Package Testing Industry?

The projected CAGR is approximately 5.25%.

2. Which companies are prominent players in the Asia-Pacific Package Testing Industry?

Key companies in the market include ALS limited, Intertek Group PLC, Cryopak, Nefab Group, Turner Packaging Limited, National Technical Systems, SGS SA, DDL Inc, Advance Packaging, CSZ Testing Services Laboratories.

3. What are the main segments of the Asia-Pacific Package Testing Industry?

The market segments include Primary Material, Type of Testing, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Rigorous Control Regulations and Administration and Qualification Demands; Demand for Longer Shelf Life of the Products Under Varying Conditions.

6. What are the notable trends driving market growth?

Plastic Packaging is Expected to Witness Significant Adoption.

7. Are there any restraints impacting market growth?

High Costs of Equipment.

8. Can you provide examples of recent developments in the market?

January 2023 - A further five laboratories, located in Bangladesh, India, Turkey, the United States, and Vietnam, have been approved by The Microfibre Consortium (TMC), extending the scope of SGS's fiber fragmentation testing services to new geographies and industries. When TMC initially approved SGS's labs in Hong Kong, Shanghai, and Taipei City in 2021, SGS became the organization's first third-party laboratory. SGS offers practical solutions for the textile industry to reduce fiber fragmentation and its release into the environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Package Testing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Package Testing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Package Testing Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific Package Testing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence