Key Insights

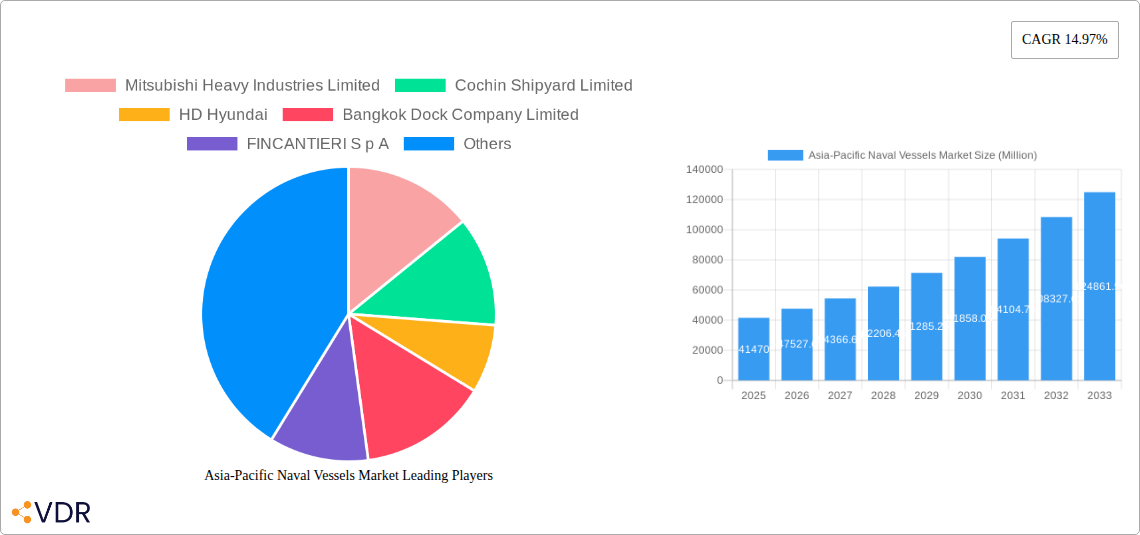

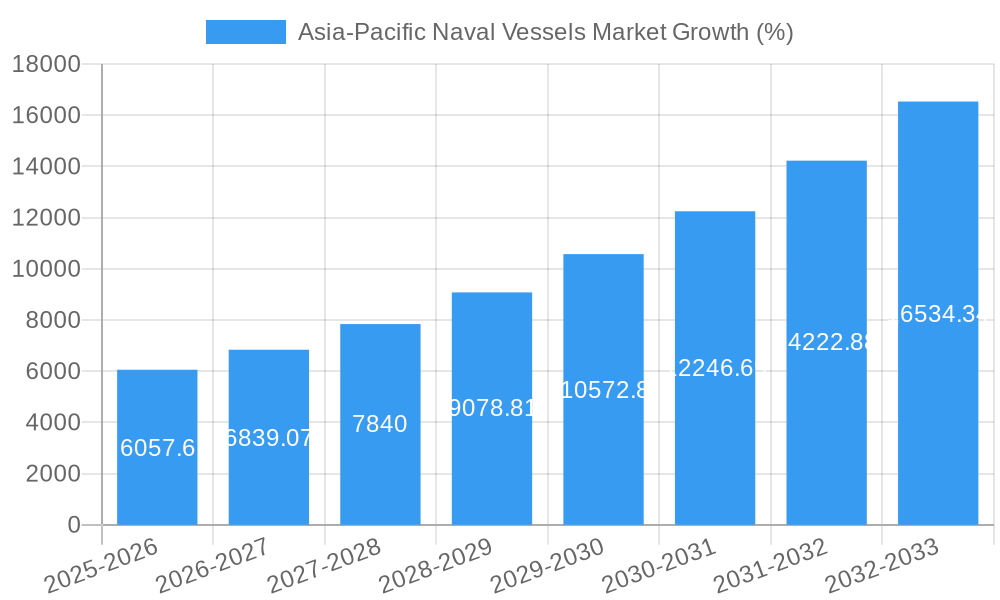

The Asia-Pacific naval vessels market is experiencing robust growth, projected to reach a value of $41.47 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 14.97% from 2025 to 2033. This expansion is fueled by several key factors. Increased geopolitical tensions and territorial disputes across the region are driving significant investment in naval modernization and expansion by numerous nations. This includes substantial procurement of submarines, frigates, corvettes, aircraft carriers, and destroyers to enhance maritime security and projection of power. Furthermore, technological advancements in naval vessel construction, such as the integration of advanced sensors, weapon systems, and autonomous capabilities, are stimulating market demand. The rising focus on anti-submarine warfare (ASW) capabilities, given the increasing submarine deployments by regional powers, contributes significantly to this growth. Finally, the burgeoning economies of several Asia-Pacific nations are providing the financial resources necessary to support these ambitious naval expansion programs.

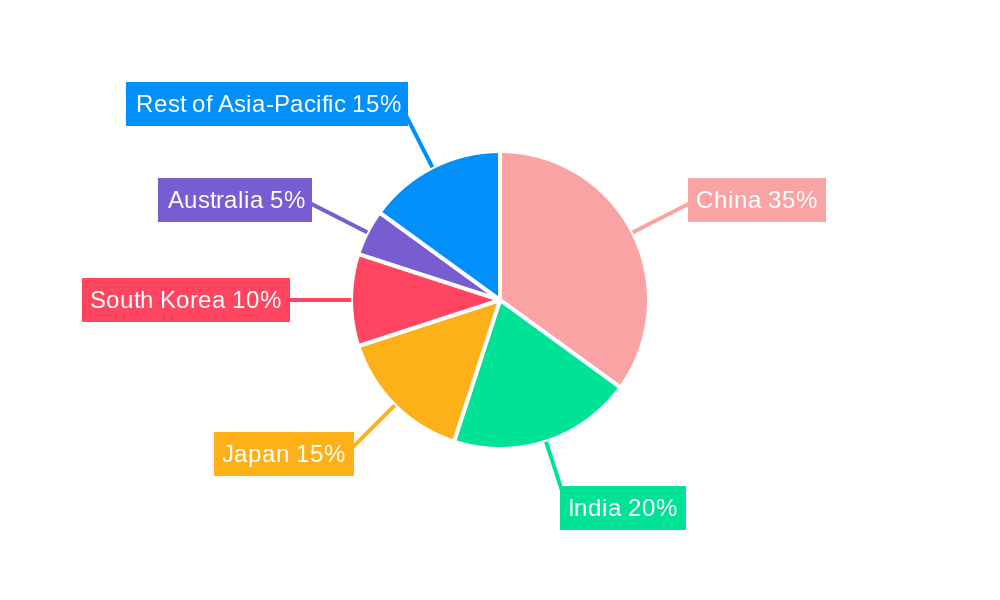

The market segmentation reveals a strong demand across various vessel types. Submarines and destroyers, crucial for offensive and defensive operations, represent substantial segments. Similarly, the growth of aircraft carriers reflects a desire for enhanced power projection and naval dominance. Growth in this sector is not uniform; countries like China, India, Japan, and South Korea are expected to lead the market due to their extensive naval modernization plans and substantial defense budgets. However, other nations in the region are also actively upgrading their naval capabilities, contributing to the overall market expansion. While challenges such as fluctuating global commodity prices and potential budget constraints could hinder growth, the overall trajectory indicates a sustained period of substantial expansion in the Asia-Pacific naval vessels market for the foreseeable future.

Asia-Pacific Naval Vessels Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific Naval Vessels Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The market is segmented by vessel type (Submarines, Frigates, Corvettes, Aircraft Carriers, Destroyers, Other Vessel Types) and key players including Mitsubishi Heavy Industries Limited, Cochin Shipyard Limited, and others. The market size is valued at XX Million units in 2025, with a projected CAGR of XX% during the forecast period. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand this dynamic market.

Asia-Pacific Naval Vessels Market Dynamics & Structure

The Asia-Pacific naval vessels market is characterized by a moderately concentrated structure, with a few major players holding significant market share. The market is driven by technological advancements in naval warfare, stringent regional security concerns, and increasing defense budgets across the Asia-Pacific region. Regulatory frameworks, including export controls and technology transfer agreements, significantly impact market dynamics. Competition is intense, with companies focusing on innovation to differentiate their offerings. The market also witnesses frequent mergers and acquisitions (M&A) activities, aiming to expand capabilities and market reach.

- Market Concentration: The top 5 players hold approximately XX% of the market share in 2025.

- Technological Innovation: Focus on autonomous systems, advanced sensors, and improved propulsion systems is driving growth.

- Regulatory Landscape: Export restrictions and licensing requirements influence market access and product development.

- Competitive Substitutes: Limited viable substitutes exist due to the specialized nature of naval vessels.

- End-User Demographics: Primarily driven by government defense ministries and navies across the region.

- M&A Activity: An average of XX M&A deals per year were observed during the historical period (2019-2024). This trend is expected to continue.

Asia-Pacific Naval Vessels Market Growth Trends & Insights

The Asia-Pacific naval vessels market has experienced substantial growth during the historical period (2019-2024), driven by escalating geopolitical tensions, modernization efforts of existing fleets, and increasing defense spending. The market size has grown from XX Million units in 2019 to XX Million units in 2024. This robust growth is projected to continue throughout the forecast period, primarily driven by technological advancements in shipbuilding, increasing demand for sophisticated naval vessels, and the rising need to maintain naval dominance in the region. The adoption rate of advanced technologies like AI and automation in naval vessels is steadily increasing, leading to improved capabilities and efficiency. Consumer behavior, represented by government procurement strategies, reflects a shift toward indigenously built vessels and strategic partnerships for technology transfer.

- Market Size Evolution: From XX Million units in 2019 to XX Million units in 2024, reflecting a CAGR of XX%.

- Adoption Rates: Adoption of advanced technologies such as AI and autonomous systems is increasing at a CAGR of XX%.

- Technological Disruptions: The introduction of unmanned surface vessels and hypersonic weapons is reshaping market dynamics.

- Consumer Behavior Shifts: Emphasis on indigenously built vessels and strategic partnerships for technology transfer.

Dominant Regions, Countries, or Segments in Asia-Pacific Naval Vessels Market

The Asia-Pacific naval vessels market exhibits significant regional variations. While several countries contribute to market growth, the India and China markets stand out due to their substantial defense budgets and ongoing naval modernization programs. Within vessel types, frigates and corvettes currently dominate the market, driven by their versatility and cost-effectiveness. However, increasing demand for submarines and the development of indigenous aircraft carriers are expected to drive future growth in these segments.

- Key Drivers for India & China:

- Massive investments in naval modernization and infrastructure development.

- Geopolitical considerations and the need to safeguard territorial waters.

- Government initiatives to promote domestic shipbuilding capabilities.

- Market Share and Growth Potential: India and China hold approximately XX% and XX% of the market share respectively, with significant growth potential in the coming years.

Asia-Pacific Naval Vessels Market Product Landscape

The Asia-Pacific naval vessels market showcases a diverse product landscape, encompassing submarines with advanced stealth capabilities, frigates with enhanced anti-submarine warfare systems, corvettes designed for coastal defense, and aircraft carriers equipped to host diverse aircraft. Continuous advancements in propulsion systems, sensor technologies, and onboard weaponry are shaping the product landscape. Unique selling propositions often revolve around advanced combat systems, superior maneuverability, and enhanced survivability. Technological advancements prioritize the integration of AI, improved communication systems, and automation to enhance operational efficiency and effectiveness.

Key Drivers, Barriers & Challenges in Asia-Pacific Naval Vessels Market

Key Drivers:

- Increasing defense budgets across the region.

- Geopolitical instability and territorial disputes.

- Modernization of existing naval fleets.

- Technological advancements in naval warfare.

Key Challenges:

- High initial investment costs and long procurement cycles.

- Supply chain disruptions impacting production schedules and costs.

- Stringent regulatory compliance requirements.

- Intense competition from established and emerging players. The combined impact of these challenges is estimated to constrain market growth by approximately XX% in 2025.

Emerging Opportunities in Asia-Pacific Naval Vessels Market

Emerging opportunities exist in developing unmanned surface vessels (USVs), expanding into the export market, and focusing on the development of cost-effective, smaller vessels for coastal defense. The rising adoption of advanced sensor technologies, cybersecurity solutions, and the integration of AI presents significant growth opportunities. Furthermore, innovative financing models and partnerships with private sector companies can unlock untapped potential.

Growth Accelerators in the Asia-Pacific Naval Vessels Market Industry

Long-term growth in the Asia-Pacific naval vessels market will be fueled by continued technological breakthroughs in areas such as hypersonic weapons, directed energy weapons, and AI-powered combat systems. Strategic partnerships between governments and private sector shipbuilders will facilitate innovation and accelerate production. Expanding into niche markets and offering tailored solutions to specific customer needs will further stimulate growth.

Key Players Shaping the Asia-Pacific Naval Vessels Market Market

- Mitsubishi Heavy Industries Limited

- Cochin Shipyard Limited

- HD Hyundai

- Bangkok Dock Company Limited

- FINCANTIERI S p A

- Garden Reach Shipbuilders and Engineers Limited

- thyssenkrupp AG

- Singapore Technologies Engineering Limited

- ASC Pty Ltd

- Mazagon Dock Shipbuilders Limited

- LARSEN & TOUBRO LIMITED

- Navantia S A SM E

- China State Shipbuilding Corporation

- Boustead Heavy Industries Corporation Berhad

- Kawasaki Heavy Industries Ltd

- PT PAL Indonesia

Notable Milestones in Asia-Pacific Naval Vessels Market Sector

- September 2022: India’s first indigenously built aircraft carrier, INS Vikrant, was commissioned into service, boosting domestic shipbuilding capabilities and influencing regional naval dynamics.

- April 2023: Hyundai Heavy Industries launched the Chungnam frigate (FFX), showcasing advancements in frigate technology and highlighting South Korea's commitment to naval modernization.

In-Depth Asia-Pacific Naval Vessels Market Market Outlook

The Asia-Pacific naval vessels market is poised for sustained growth, driven by continuous technological innovation, increased defense spending, and regional geopolitical factors. Strategic partnerships and a focus on indigenously built vessels will shape market dynamics. Opportunities abound for companies that can deliver advanced, cost-effective solutions tailored to the diverse needs of naval forces across the region. The market is expected to reach XX Million units by 2033, presenting significant opportunities for investors and industry players.

Asia-Pacific Naval Vessels Market Segmentation

-

1. Vessel Type

- 1.1. Submarines

- 1.2. Frigates

- 1.3. Corvettes

- 1.4. Aircraft Carrier

- 1.5. Destroyers

- 1.6. Other Vessel Types

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. China

- 2.1.2. India

- 2.1.3. Japan

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Singapore

- 2.1.7. Rest of Asia-Pacific

-

2.1. Asia-Pacific

Asia-Pacific Naval Vessels Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Singapore

- 1.7. Rest of Asia Pacific

Asia-Pacific Naval Vessels Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 14.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Destroyers to Exhibit the Highest Growth Rate During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 5.1.1. Submarines

- 5.1.2. Frigates

- 5.1.3. Corvettes

- 5.1.4. Aircraft Carrier

- 5.1.5. Destroyers

- 5.1.6. Other Vessel Types

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. China

- 5.2.1.2. India

- 5.2.1.3. Japan

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Singapore

- 5.2.1.7. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Vessel Type

- 6. China Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 7. Japan Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 8. India Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 9. South Korea Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 10. Taiwan Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 11. Australia Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Asia-Pacific Asia-Pacific Naval Vessels Market Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Mitsubishi Heavy Industries Limited

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Cochin Shipyard Limited

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 HD Hyundai

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Bangkok Dock Company Limited

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 FINCANTIERI S p A

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Garden Reach Shipbuilders and Engineers Limited

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 thyssenkrupp AG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Singapore Technologies Engineering Limited

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 ASC Pty Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Mazagon Dock Shipbuilders Limited

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 LARSEN & TOUBRO LIMITED

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Navantia S A SM E

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 China State Shipbuilding Corporation

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Boustead Heavy Industries Corporation Berhad

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Kawasaki Heavy Industries Ltd

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 PT PAL Indonesia

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.1 Mitsubishi Heavy Industries Limited

List of Figures

- Figure 1: Asia-Pacific Naval Vessels Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Asia-Pacific Naval Vessels Market Share (%) by Company 2024

List of Tables

- Table 1: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 3: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 4: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Japan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: India Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South Korea Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Taiwan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Australia Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Asia-Pacific Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Vessel Type 2019 & 2032

- Table 14: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 15: Asia-Pacific Naval Vessels Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Japan Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: South Korea Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Australia Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Singapore Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Asia-Pacific Naval Vessels Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Naval Vessels Market?

The projected CAGR is approximately 14.97%.

2. Which companies are prominent players in the Asia-Pacific Naval Vessels Market?

Key companies in the market include Mitsubishi Heavy Industries Limited, Cochin Shipyard Limited, HD Hyundai, Bangkok Dock Company Limited, FINCANTIERI S p A, Garden Reach Shipbuilders and Engineers Limited, thyssenkrupp AG, Singapore Technologies Engineering Limited, ASC Pty Ltd, Mazagon Dock Shipbuilders Limited, LARSEN & TOUBRO LIMITED, Navantia S A SM E, China State Shipbuilding Corporation, Boustead Heavy Industries Corporation Berhad, Kawasaki Heavy Industries Ltd, PT PAL Indonesia.

3. What are the main segments of the Asia-Pacific Naval Vessels Market?

The market segments include Vessel Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 41.47 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Destroyers to Exhibit the Highest Growth Rate During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

April 2023: Hyundai Heavy Industries launched its Chungnam frigate (FFX) at its shipyard in Ulsan, South Korea. The Chungnam is the first of six vessels that comprise the Ulsan-class FFX Batch III, which will be inducted into the Republic of Korea (ROK) Navy.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Naval Vessels Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Naval Vessels Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Naval Vessels Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Naval Vessels Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence