Key Insights

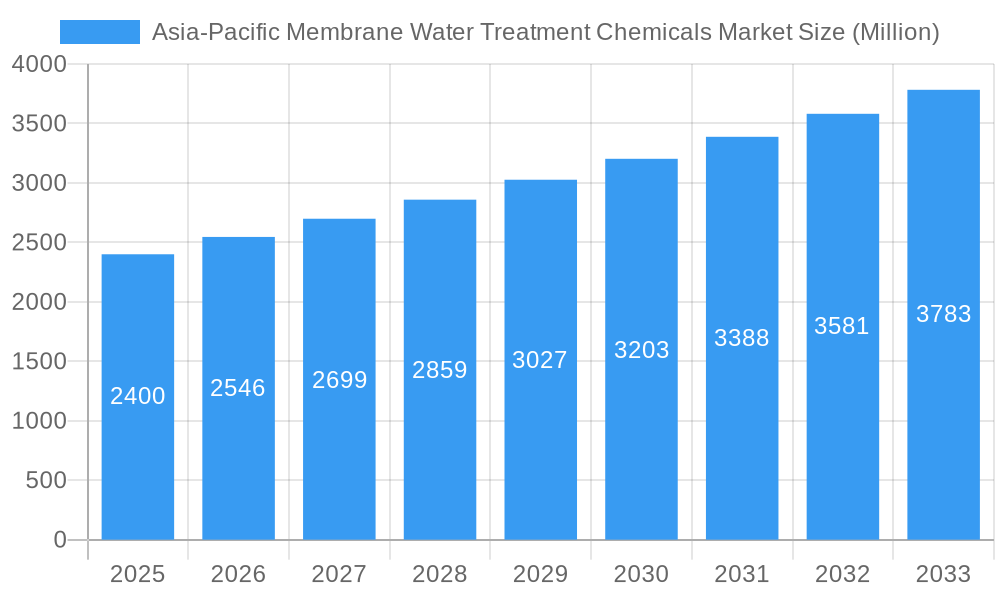

The Asia-Pacific Membrane Water Treatment Chemicals Market is poised for significant expansion, projected to reach USD 2.4 billion in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 6.1% throughout the forecast period of 2025-2033. The escalating demand for clean and safe water across diverse end-user industries, coupled with increasing environmental regulations and a growing awareness of water scarcity, are primary drivers propelling this market forward. Furthermore, rapid industrialization and urbanization in key economies like China and India are creating substantial opportunities for membrane water treatment solutions. The market's trajectory is also influenced by technological advancements in membrane fabrication and the development of more effective and sustainable water treatment chemicals.

Asia-Pacific Membrane Water Treatment Chemicals Market Market Size (In Billion)

Key trends shaping the Asia-Pacific Membrane Water Treatment Chemicals Market include a rising adoption of advanced pre-treatment chemicals to enhance membrane performance and longevity, alongside a growing preference for biological controllers as eco-friendly alternatives. The food & beverage processing and healthcare sectors are exhibiting particularly strong demand, driven by stringent quality standards and public health concerns. While the market presents immense potential, certain restraints such as the high initial investment costs for membrane systems and the operational complexities associated with certain treatment processes need to be addressed. Nevertheless, the overwhelming need for efficient water management and purification in this dynamic region ensures a sustained and upward market trend.

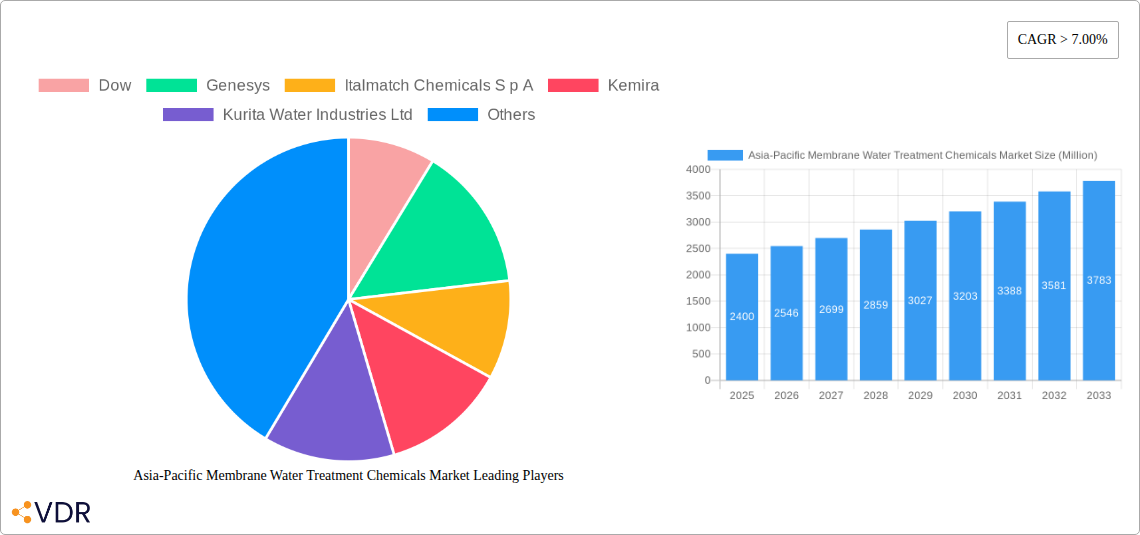

Asia-Pacific Membrane Water Treatment Chemicals Market Company Market Share

This in-depth report offers a meticulous examination of the Asia-Pacific membrane water treatment chemicals market, a critical sector for sustainable water management. Covering a study period from 2019 to 2033, with a base year of 2025, this analysis provides granular insights into market dynamics, growth trends, regional dominance, product landscapes, and future opportunities. We delve into parent and child market segments to deliver a holistic understanding of this rapidly evolving industry. The report leverages proprietary market sizing and forecasting methodologies to present precise, actionable intelligence for industry professionals, investors, and stakeholders.

Asia-Pacific Membrane Water Treatment Chemicals Market Dynamics & Structure

The Asia-Pacific membrane water treatment chemicals market is characterized by a moderately concentrated structure, with a few key players holding significant market share while a growing number of smaller, specialized companies contribute to innovation. Technological innovation is a primary driver, fueled by increasing demand for advanced membrane technologies and the need for efficient chemical solutions to enhance membrane performance, longevity, and water purity. Regulatory frameworks, driven by stringent environmental protection laws and rising water quality standards across nations like China and India, are shaping market demand. The competitive landscape features a dynamic interplay between established global chemical manufacturers and emerging regional players. Competitive product substitutes include alternative water treatment methods, although membrane technology, when supported by appropriate chemical treatments, often offers superior efficiency and a smaller footprint. End-user demographics are shifting, with growing industrialization and urbanization leading to increased demand from sectors like Food & Beverage Processing, Healthcare, and Municipal water treatment. Mergers and acquisitions (M&A) trends are observed as companies seek to expand their product portfolios, geographical reach, and technological capabilities. For instance, the last five years have seen an estimated xx significant M&A deals within the broader water treatment chemical space, indicating consolidation and strategic growth. Barriers to innovation include the high cost of R&D for novel chemical formulations and the lengthy validation processes required for new products in sensitive applications like healthcare.

- Market Concentration: Moderate to High, with key players dominating specific niches.

- Technological Innovation Drivers: Enhanced membrane efficiency, fouling prevention, energy savings, and sustainable chemical formulations.

- Regulatory Frameworks: Increasingly stringent environmental regulations and water quality standards across major economies.

- Competitive Product Substitutes: Conventional water treatment methods, but membrane technology with optimized chemicals often offers advantages.

- End-User Demographics: Growing demand from industrial (Food & Beverage, Chemicals, Power) and municipal sectors, alongside rising healthcare needs.

- M&A Trends: Strategic acquisitions aimed at portfolio expansion and market penetration.

- Innovation Barriers: High R&D investment and rigorous product approval processes.

Asia-Pacific Membrane Water Treatment Chemicals Market Growth Trends & Insights

The Asia-Pacific membrane water treatment chemicals market is poised for robust growth, driven by a confluence of escalating water scarcity, stringent environmental regulations, and rapid industrial expansion across the region. Market size is projected to reach an estimated $xx.x billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx.x% during the forecast period (2025-2033). Adoption rates for advanced membrane water treatment technologies, including ultrafiltration (UF), reverse osmosis (RO), and nanofiltration (NF), are steadily increasing, directly boosting the demand for specialized membrane treatment chemicals. Technological disruptions, such as the development of more eco-friendly and biodegradable antiscalants, biocides, and cleaning agents, are reshaping product offerings and consumer preferences. Consumer behavior shifts are evident, with end-users increasingly prioritizing sustainable and cost-effective water treatment solutions that minimize operational downtime and environmental impact. The market penetration of membrane water treatment, a critical indicator of its adoption, has grown from an estimated xx.x% in 2019 to xx.x% in 2024, and is expected to reach xx.x% by 2033. This growth is underpinned by significant investments in water infrastructure and the increasing recognition of the economic and social benefits of efficient water management. The market is also witnessing a trend towards integrated solutions, where chemical suppliers are offering a comprehensive suite of products and services, including technical support and monitoring, to optimize membrane system performance. The increasing complexity of water sources and the growing need for high-purity water in various industrial processes further propel the demand for sophisticated chemical treatments. The development of smart water management systems, incorporating real-time monitoring and predictive analytics, is also influencing the types of chemicals required, pushing for more responsive and targeted formulations.

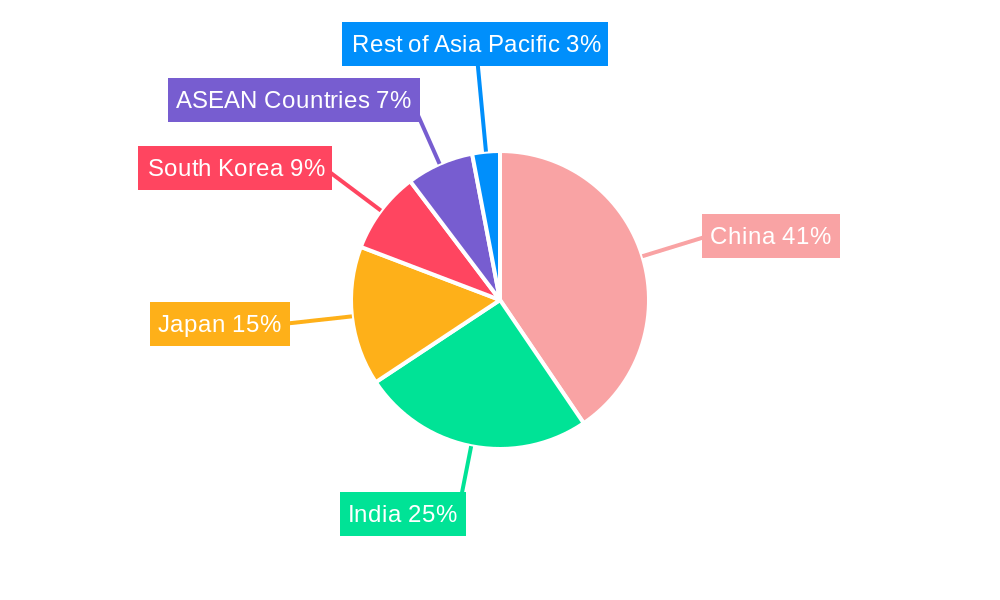

Dominant Regions, Countries, or Segments in Asia-Pacific Membrane Water Treatment Chemicals Market

The Asia-Pacific membrane water treatment chemicals market is significantly driven by the powerhouse economies of China and India, which collectively account for a substantial portion of the regional market share. China's dominance is attributed to its massive industrial base, rapid urbanization, and aggressive government initiatives focused on water pollution control and resource management. The country's extensive investments in desalination, wastewater reuse, and industrial process water treatment have created a massive demand for a wide array of membrane treatment chemicals, including pre-treatment chemicals like coagulants and flocculants, as well as cleaning chemicals. India's growth is similarly fueled by its burgeoning population, expanding manufacturing sector, and a growing awareness of water quality issues. The Municipal segment, particularly in these two nations, is a major growth engine, driven by the need to provide safe and potable water to vast populations and to treat increasing volumes of municipal wastewater.

Within the Chemical Type segment, Pre-treatment chemicals, encompassing coagulants, flocculants, and scale inhibitors, hold a leading position due to their essential role in protecting membranes from fouling and scaling, thereby extending their lifespan and optimizing performance. The End-user Industry segment is dominated by Food & Beverage Processing and Chemicals, owing to the high water purity requirements and significant wastewater generation in these sectors. The Power industry also represents a substantial market due to the extensive use of water in cooling towers and steam generation. Geographically, beyond China and India, ASEAN Countries are emerging as significant growth pockets, driven by industrial development and increasing environmental consciousness. The Rest of Asia-Pacific, including countries like Australia and New Zealand, contributes to the market with a focus on advanced membrane technologies for specialized applications.

- Dominant Countries: China and India lead due to industrialization and water management initiatives.

- Leading Segments:

- Chemical Type: Pre-treatment Chemicals (coagulants, flocculants, scale inhibitors) are crucial.

- End-user Industry: Food & Beverage Processing, Chemicals, and Municipal sectors are key.

- Geography: China and India are primary markets, with ASEAN Countries showing strong growth potential.

- Key Drivers of Dominance:

- Rapid industrialization and urbanization.

- Stringent environmental regulations and water quality standards.

- Government investments in water infrastructure and treatment technologies.

- Increasing demand for high-purity water in various applications.

Asia-Pacific Membrane Water Treatment Chemicals Market Product Landscape

The product landscape for Asia-Pacific membrane water treatment chemicals is characterized by a focus on high-performance, environmentally friendly formulations. Innovations are centered on developing advanced antiscalants that prevent mineral precipitation on membrane surfaces, biocides to control microbial growth without compromising membrane integrity, and effective cleaning chemicals to restore flux and performance. Product applications span a wide spectrum, from pre-treatment processes to membrane cleaning and disinfection. Performance metrics are increasingly emphasizing enhanced efficacy, reduced dosage requirements, extended membrane life, and improved water recovery rates. Unique selling propositions often lie in tailored chemical solutions for specific membrane types (e.g., RO, UF, MF) and diverse feedwater characteristics. Technological advancements include the development of biodegradable and low-toxicity chemicals, as well as smart chemical formulations that respond to real-time operational conditions for optimized treatment.

Key Drivers, Barriers & Challenges in Asia-Pacific Membrane Water Treatment Chemicals Market

Key Drivers:

- Rising Water Scarcity: Increasing demand for treated water for industrial, agricultural, and domestic use.

- Stringent Environmental Regulations: Government mandates for wastewater treatment and discharge quality.

- Industrial Growth: Expansion of manufacturing, F&B, and power sectors requiring advanced water treatment.

- Technological Advancements: Development of more efficient and sustainable membrane technologies and chemicals.

- Urbanization: Growing populations in urban centers necessitate improved municipal water treatment.

Barriers & Challenges:

- High Capital Investment: Initial costs for membrane systems and associated chemical treatments can be substantial.

- Technical Expertise: Requirement for skilled personnel to operate and maintain complex membrane systems and chemical dosing.

- Feedwater Variability: Inconsistent feedwater quality can pose challenges for chemical efficacy and membrane performance.

- Regulatory Compliance Costs: Meeting evolving environmental standards requires continuous investment in treatment technologies and chemicals.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges can impact the availability and cost of raw materials and finished chemicals, potentially leading to price volatility of xx% for certain key ingredients.

- Competition: Intense competition among chemical suppliers can lead to price pressures and reduced profit margins, particularly for commoditized products.

Emerging Opportunities in Asia-Pacific Membrane Water Treatment Chemicals Market

Emerging opportunities in the Asia-Pacific membrane water treatment chemicals market are abundant, driven by innovation and evolving needs. The increasing focus on water reuse and recycling presents a significant avenue for advanced chemical solutions that can handle challenging feedwater compositions. The development of smart chemicals, which can self-regulate or communicate their status, offers potential for optimized treatment and reduced operational costs. Untapped markets within developing economies of Southeast Asia and the Pacific Islands offer substantial growth potential as they invest in water infrastructure. Evolving consumer preferences for sustainable and bio-based chemical alternatives are creating a niche for eco-friendly product lines. Furthermore, the growing demand for ultrapure water in high-tech industries like semiconductor manufacturing and pharmaceuticals opens doors for highly specialized and performance-driven chemical treatments.

Growth Accelerators in the Asia-Pacific Membrane Water Treatment Chemicals Market Industry

Several key catalysts are accelerating growth within the Asia-Pacific membrane water treatment chemicals market. Technological breakthroughs in membrane materials and manufacturing processes are directly increasing the demand for compatible, high-performance chemicals. Strategic partnerships between chemical manufacturers and membrane system providers are fostering integrated solutions and expanding market reach. Government initiatives promoting water conservation, wastewater reuse, and industrial efficiency are creating a favorable regulatory and economic environment. Furthermore, market expansion strategies by major players, including acquisitions of local entities and the establishment of regional R&D and manufacturing facilities, are driving penetration into new territories and catering to localized needs. The growing adoption of digital technologies, such as IoT-enabled monitoring and predictive analytics, is also enhancing the value proposition of chemical solutions by enabling more efficient and proactive treatment.

Key Players Shaping the Asia-Pacific Membrane Water Treatment Chemicals Market Market

- Dow

- Genesys

- Italmatch Chemicals S p A

- Kemira

- Kurita Water Industries Ltd

- Solenis

- Suez

- Veolia Water Solutions and Technologies

Notable Milestones in Asia-Pacific Membrane Water Treatment Chemicals Market Sector

- 2023: Launch of a new generation of high-efficiency antiscalants by Dow, significantly improving RO membrane performance in high-salinity conditions.

- 2023: Kemira expands its research and development center in Asia, focusing on sustainable water treatment solutions for the region's growing industrial needs.

- 2022: Solenis acquires a regional player in Southeast Asia, strengthening its market presence and product portfolio in the region.

- 2021: Veolia Water Solutions and Technologies secures a major contract for a large-scale industrial wastewater treatment plant in China, emphasizing membrane technology and advanced chemical applications.

- 2020: Kurita Water Industries Ltd introduces a novel biofouling control agent designed for extended membrane life in demanding applications.

- 2019: Significant regulatory push in India for improved wastewater discharge standards, leading to increased adoption of membrane water treatment and associated chemicals.

In-Depth Asia-Pacific Membrane Water Treatment Chemicals Market Market Outlook

The outlook for the Asia-Pacific membrane water treatment chemicals market remains exceptionally bright, propelled by sustainable demand drivers and continuous innovation. Growth accelerators such as increasing investments in water infrastructure, the critical need for effective wastewater management, and the expanding industrial landscape will continue to fuel market expansion. Strategic opportunities lie in the development of advanced, eco-friendly chemical formulations that address emerging contaminants and promote circular economy principles. The market's trajectory indicates a strong emphasis on integrated solutions, digital integration for optimized performance, and geographical diversification into high-growth emerging economies. Stakeholders can anticipate sustained demand and evolving product requirements, making this a dynamic and promising sector for the foreseeable future.

Asia-Pacific Membrane Water Treatment Chemicals Market Segmentation

-

1. Chemical Type

- 1.1. Pre-treatment

- 1.2. Biological Controllers

- 1.3. Other Chemical Types

-

2. End-user Industry

- 2.1. Food & Beverage Processing

- 2.2. Healthcare

- 2.3. Municipal

- 2.4. Chemicals

- 2.5. Power

- 2.6. Other End-user Industries

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. ASEAN Countries

- 3.6. Rest of Asia-Pacific

Asia-Pacific Membrane Water Treatment Chemicals Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

Asia-Pacific Membrane Water Treatment Chemicals Market Regional Market Share

Geographic Coverage of Asia-Pacific Membrane Water Treatment Chemicals Market

Asia-Pacific Membrane Water Treatment Chemicals Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers

- 3.3. Market Restrains

- 3.3.1. ; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers

- 3.4. Market Trends

- 3.4.1. Food & Beverage Processing Industry to Account for the Fastest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 5.1.1. Pre-treatment

- 5.1.2. Biological Controllers

- 5.1.3. Other Chemical Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Food & Beverage Processing

- 5.2.2. Healthcare

- 5.2.3. Municipal

- 5.2.4. Chemicals

- 5.2.5. Power

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. ASEAN Countries

- 5.3.6. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. ASEAN Countries

- 5.4.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6. China Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 6.1.1. Pre-treatment

- 6.1.2. Biological Controllers

- 6.1.3. Other Chemical Types

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Food & Beverage Processing

- 6.2.2. Healthcare

- 6.2.3. Municipal

- 6.2.4. Chemicals

- 6.2.5. Power

- 6.2.6. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. ASEAN Countries

- 6.3.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7. India Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 7.1.1. Pre-treatment

- 7.1.2. Biological Controllers

- 7.1.3. Other Chemical Types

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Food & Beverage Processing

- 7.2.2. Healthcare

- 7.2.3. Municipal

- 7.2.4. Chemicals

- 7.2.5. Power

- 7.2.6. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. ASEAN Countries

- 7.3.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8. Japan Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 8.1.1. Pre-treatment

- 8.1.2. Biological Controllers

- 8.1.3. Other Chemical Types

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Food & Beverage Processing

- 8.2.2. Healthcare

- 8.2.3. Municipal

- 8.2.4. Chemicals

- 8.2.5. Power

- 8.2.6. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. ASEAN Countries

- 8.3.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9. South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 9.1.1. Pre-treatment

- 9.1.2. Biological Controllers

- 9.1.3. Other Chemical Types

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Food & Beverage Processing

- 9.2.2. Healthcare

- 9.2.3. Municipal

- 9.2.4. Chemicals

- 9.2.5. Power

- 9.2.6. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. ASEAN Countries

- 9.3.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10. ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 10.1.1. Pre-treatment

- 10.1.2. Biological Controllers

- 10.1.3. Other Chemical Types

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Food & Beverage Processing

- 10.2.2. Healthcare

- 10.2.3. Municipal

- 10.2.4. Chemicals

- 10.2.5. Power

- 10.2.6. Other End-user Industries

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. ASEAN Countries

- 10.3.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11. Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 11.1.1. Pre-treatment

- 11.1.2. Biological Controllers

- 11.1.3. Other Chemical Types

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Food & Beverage Processing

- 11.2.2. Healthcare

- 11.2.3. Municipal

- 11.2.4. Chemicals

- 11.2.5. Power

- 11.2.6. Other End-user Industries

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. ASEAN Countries

- 11.3.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Chemical Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Dow

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Genesys

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Italmatch Chemicals S p A

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Kemira

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Kurita Water Industries Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Solenis

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Suez

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Veolia Water Solutions and Technologies*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.1 Dow

List of Figures

- Figure 1: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 3: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 4: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 5: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 7: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: China Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 11: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 12: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 13: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 14: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 15: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: India Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 19: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 20: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 21: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Japan Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 27: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 28: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 29: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 31: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 32: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: South Korea Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 35: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 36: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 37: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 38: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 39: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 40: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: ASEAN Countries Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Chemical Type 2025 & 2033

- Figure 43: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Chemical Type 2025 & 2033

- Figure 44: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 45: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Geography 2025 & 2033

- Figure 47: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Geography 2025 & 2033

- Figure 48: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue (undefined), by Country 2025 & 2033

- Figure 49: Rest of Asia Pacific Asia-Pacific Membrane Water Treatment Chemicals Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 2: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 3: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 6: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 7: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 10: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 14: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 15: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 18: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 19: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 22: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 23: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Chemical Type 2020 & 2033

- Table 26: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 27: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Global Asia-Pacific Membrane Water Treatment Chemicals Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Membrane Water Treatment Chemicals Market?

The projected CAGR is approximately 6.1%.

2. Which companies are prominent players in the Asia-Pacific Membrane Water Treatment Chemicals Market?

Key companies in the market include Dow, Genesys, Italmatch Chemicals S p A, Kemira, Kurita Water Industries Ltd, Solenis, Suez, Veolia Water Solutions and Technologies*List Not Exhaustive.

3. What are the main segments of the Asia-Pacific Membrane Water Treatment Chemicals Market?

The market segments include Chemical Type, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers.

6. What are the notable trends driving market growth?

Food & Beverage Processing Industry to Account for the Fastest Growth Rate.

7. Are there any restraints impacting market growth?

; Growing Popularity of Zero Liquid Blowdown; Emergence of Smart Water Grid and Related Solutions; Other Drivers.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Membrane Water Treatment Chemicals Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Membrane Water Treatment Chemicals Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Membrane Water Treatment Chemicals Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Membrane Water Treatment Chemicals Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence