Key Insights

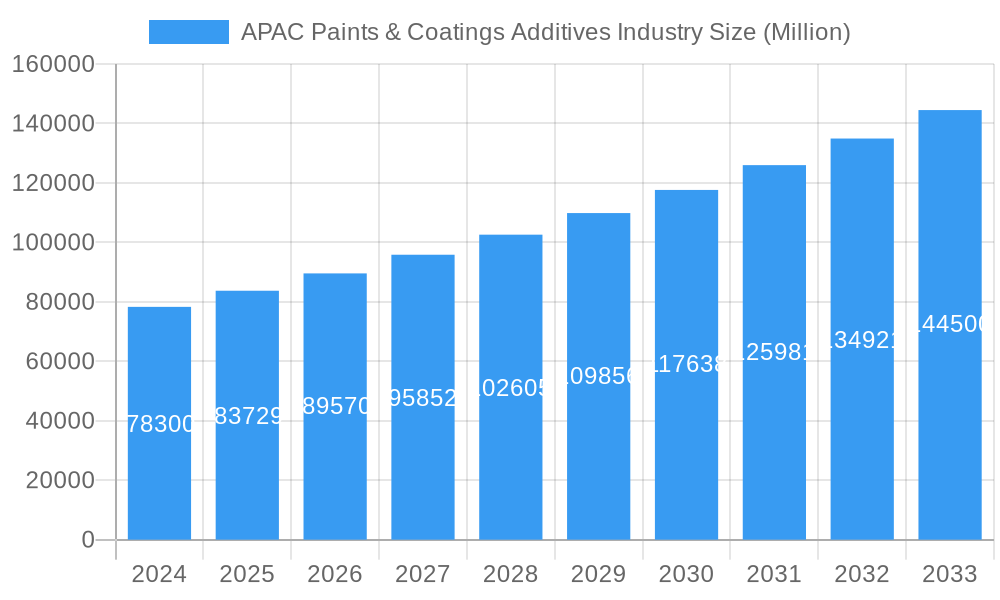

The APAC Paints & Coatings Additives market is poised for significant expansion, driven by robust demand across diverse applications and regions. In 2024, the market is estimated at $78.3 billion, projected to grow at a Compound Annual Growth Rate (CAGR) of 6.9% through 2033. This growth is fueled by increasing construction activities, urbanization, and a rising middle class across Asia-Pacific nations, leading to higher consumption of paints and coatings in architectural, protective, and transportation sectors. Furthermore, advancements in coating technologies, emphasizing performance, durability, and environmental sustainability, are propelling the demand for specialized additives such as biocides for preservation, rheology modifiers for improved application properties, and dispersants for enhanced pigment dispersion and color consistency. The burgeoning automotive and infrastructure development projects in countries like China and India are particularly strong contributors to this upward trajectory.

APAC Paints & Coatings Additives Industry Market Size (In Billion)

While the market exhibits strong growth potential, it also faces certain challenges. Fluctuations in raw material prices, stringent environmental regulations concerning volatile organic compounds (VOCs) in certain regions, and intense competition among key players present hurdles. However, innovative product development, a focus on eco-friendly and low-VOC additive solutions, and strategic expansions into emerging markets are expected to mitigate these restraints. The market is segmented by additive type, with biocides, rheology modifiers, and dispersants anticipated to witness substantial demand. Applications in architectural and protective coatings are expected to dominate, followed by significant contributions from the transportation sector. Geographically, China is set to remain the largest market, with India and ASEAN nations showcasing considerable growth opportunities. Key industry players are actively involved in research and development to introduce high-performance, sustainable additives that cater to evolving market needs and regulatory landscapes.

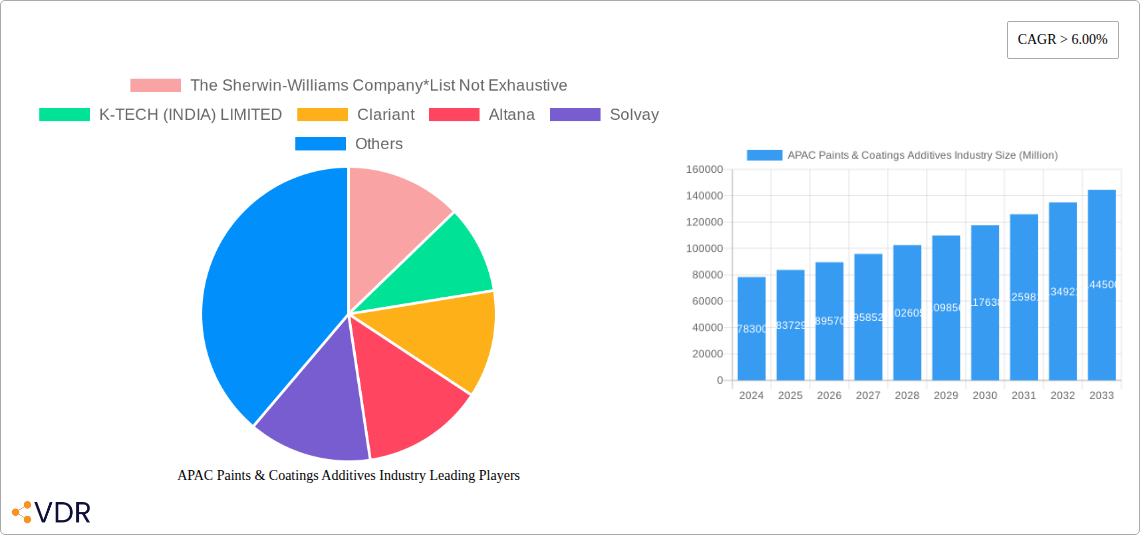

APAC Paints & Coatings Additives Industry Company Market Share

APAC Paints & Coatings Additives Industry Market Dynamics & Structure

The APAC paints and coatings additives market is characterized by a moderately consolidated to fragmented structure, with a mix of large multinational corporations and emerging regional players. Technological innovation serves as a primary driver, with significant investments in R&D focused on developing high-performance, sustainable, and multifunctional additives. These innovations address evolving industry needs such as enhanced durability, improved application properties, and reduced environmental impact. Regulatory frameworks, particularly concerning VOC emissions and hazardous substances, are increasingly influencing product development and market entry. Competitive product substitutes, while present, often require a balance of performance, cost, and regulatory compliance, limiting rapid displacement. End-user demographics are shifting, with growing demand for aesthetically pleasing, durable, and eco-friendly coatings across various sectors. Mergers and acquisitions (M&A) are a notable trend, with larger companies acquiring smaller innovators to expand their product portfolios and geographical reach. The market concentration is influenced by the production capacity and technological expertise of key players. The global market share of APAC in this sector is projected to exceed 35% by 2033. The volume of M&A deals in the APAC region has seen a 15% year-on-year increase over the past three years.

- Market Concentration: Moderate to fragmented with presence of global leaders and local specialists.

- Technological Innovation: Focus on eco-friendly, high-performance, and multifunctional additives.

- Regulatory Impact: Growing influence of environmental and safety regulations on product formulations.

- End-User Demand: Increasing preference for durable, aesthetic, and sustainable coatings.

- M&A Activity: Strategic acquisitions to enhance product offerings and market presence.

APAC Paints & Coatings Additives Industry Growth Trends & Insights

The APAC Paints & Coatings Additives industry is poised for robust growth, driven by a confluence of economic expansion, urbanization, and evolving consumer preferences. The market size is projected to reach $XX billion in 2025 and is estimated to grow at a CAGR of approximately 6.2% from 2025 to 2033, reaching an estimated $XX billion by the end of the forecast period. This upward trajectory is underpinned by the burgeoning construction sector, automotive production, and the increasing demand for protective and decorative coatings across the region. Adoption rates of advanced additives, such as low-VOC rheology modifiers and advanced biocides, are accelerating as manufacturers strive to meet stricter environmental standards and enhance product performance. Technological disruptions, including the development of smart coatings and additives with self-healing properties, are beginning to influence the market, though widespread adoption is still in its nascent stages. Consumer behavior shifts are evident, with a greater emphasis on aesthetics, durability, and sustainability in both architectural and industrial applications. The increasing disposable income in emerging economies within APAC further fuels the demand for premium paints and coatings, consequently boosting the consumption of specialized additives. The penetration of specialized additives in segments like industrial coatings is estimated to be around 70% in 2025, with significant growth potential in emerging applications. The shift towards water-borne coatings, which require specific additive formulations for optimal performance, is another key trend influencing market dynamics. Furthermore, the growing emphasis on smart manufacturing and Industry 4.0 principles is driving the adoption of additives that enable faster curing times and improved application efficiency. The report leverages proprietary market intelligence and predictive analytics to forecast these trends with high accuracy, providing a detailed roadmap for stakeholders.

- Market Size Evolution: Projected to reach $XX billion by 2033, with a CAGR of 6.2% (2025-2033).

- Adoption Rates: Increasing adoption of eco-friendly and high-performance additives.

- Technological Disruptions: Emergence of smart coatings and self-healing additive technologies.

- Consumer Behavior Shifts: Growing demand for aesthetic, durable, and sustainable coating solutions.

- Economic Drivers: Urbanization and infrastructure development fueling construction and industrial demand.

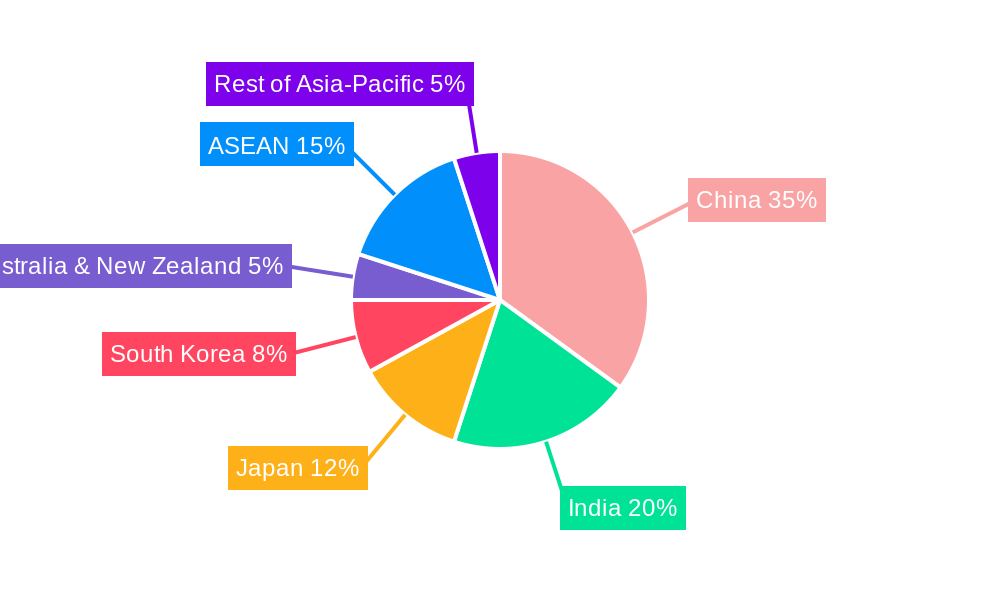

Dominant Regions, Countries, or Segments in APAC Paints & Coatings Additives Industry

China stands as the undeniable leader and growth engine within the APAC Paints & Coatings Additives Industry. Its dominant position is a result of a multifaceted interplay of economic policies, colossal infrastructure development, a massive manufacturing base, and a rapidly expanding middle class. The Chinese market alone accounts for over 40% of the total APAC paints and coatings additives market share in 2025, and this dominance is projected to continue throughout the forecast period. This leadership is further bolstered by significant government initiatives promoting domestic manufacturing and technological self-sufficiency, fostering innovation in the additives sector.

Within the Type segment, Dispersants and Wetting Agents are experiencing substantial demand, driven by the widespread use of both solvent-borne and water-borne coatings across various applications. The Architectural application segment, in particular, is a major contributor to this demand due to its sheer volume and continuous renovation and new construction activities across the region. The Protective Coatings segment, fueled by industrial expansion and infrastructure projects in countries like China and India, also represents a significant growth area.

- Dominant Geography: China

- Massive manufacturing hub for paints and coatings.

- Extensive infrastructure development driving demand for protective and architectural coatings.

- Government support for domestic chemical industries.

- Rapid urbanization and rising disposable incomes fueling consumer demand for decorative paints.

- Dominant Type Segment: Dispersants and Wetting Agents

- Essential for pigment dispersion and stability in all types of coatings.

- Crucial for the performance of both traditional and modern water-borne formulations.

- High consumption in architectural, industrial, and automotive coatings.

- Dominant Application Segment: Architectural

- Largest application by volume due to ongoing construction and renovation activities.

- Increasing demand for aesthetic appeal, durability, and low-VOC formulations.

- Growth driven by residential and commercial building projects.

- Key Drivers of Dominance:

- Economic Policies: Favorable industrial policies and trade agreements.

- Infrastructure Development: Continuous investment in roads, bridges, and buildings.

- Urbanization: Growing city populations and demand for housing and commercial spaces.

- Consumer Spending: Rising disposable incomes and demand for premium products.

- Technological Advancements: Localized R&D and adoption of new additive technologies.

APAC Paints & Coatings Additives Industry Product Landscape

The APAC paints and coatings additives product landscape is characterized by a relentless pursuit of enhanced performance and sustainability. Innovations are geared towards optimizing pigment dispersion, rheological control, surface properties, and UV stability. Dispersants and wetting agents are evolving to offer superior compatibility with a wider range of pigment types and resin chemistries, particularly for high-solids and water-borne systems. Rheology modifiers are being developed for improved sag resistance, better leveling, and enhanced application properties in both brush and spray applications. Biocides are focusing on more environmentally friendly formulations to combat microbial growth without compromising efficacy. Defoamers and deaerators are crucial for achieving smooth, defect-free coatings. Surface modifiers are increasingly incorporating functionalities like self-cleaning or anti-graffiti properties, catering to specialized applications. The growing demand for UV-curable coatings is driving innovation in photointiators and UV stabilizers. The overall trend is towards multi-functional additives that can deliver several benefits in a single formulation, reducing complexity and cost for paint manufacturers.

Key Drivers, Barriers & Challenges in APAC Paints & Coatings Additives Industry

Key Drivers:

The APAC paints and coatings additives market is propelled by several key drivers. Sustained economic growth and rapid urbanization across the region fuel demand for construction and infrastructure development, directly impacting the need for architectural and protective coatings. The expanding automotive industry, coupled with increasing vehicle ownership, drives demand for automotive coatings and their associated additives. Furthermore, a growing awareness of environmental sustainability and stringent government regulations are pushing manufacturers to adopt eco-friendly and low-VOC additives, creating opportunities for innovative solutions. Technological advancements, leading to the development of high-performance, multi-functional additives, are also a significant growth catalyst.

Barriers & Challenges:

Despite the positive outlook, the market faces several barriers and challenges. Intense price competition, particularly from local players in emerging economies, can impact profit margins for global manufacturers. Fluctuations in raw material prices, driven by geopolitical factors and supply chain disruptions, pose a significant challenge to cost management. Navigating complex and diverse regulatory landscapes across different APAC countries can be a hurdle for market entry and product compliance. The availability of skilled labor for specialized R&D and manufacturing can also be a constraint in certain regions. Moreover, the slow adoption of highly advanced or niche additives in some traditional markets can hinder the widespread implementation of cutting-edge solutions. Supply chain disruptions, as witnessed in recent years, have also highlighted the vulnerability of the sector.

Emerging Opportunities in APAC Paints & Coatings Additives Industry

Emerging opportunities in the APAC Paints & Coatings Additives Industry are diverse and promising. The burgeoning demand for sustainable and bio-based additives presents a significant avenue for growth, aligning with global environmental trends. The increasing adoption of smart coatings with self-healing or anti-microbial properties, particularly in healthcare and food processing industries, opens up niche but high-value market segments. The expansion of the electric vehicle (EV) market necessitates specialized coatings for battery components and lightweight materials, creating demand for unique additive functionalities. Furthermore, the growing e-commerce sector and increasing consumer focus on home aesthetics are driving demand for decorative paints with enhanced visual appeal and functional properties, such as UV protection and easy-to-clean surfaces. Untapped markets within Southeast Asia and Oceania offer substantial potential for growth with tailored product offerings.

Growth Accelerators in the APAC Paints & Coatings Additives Industry Industry

Several catalysts are accelerating long-term growth in the APAC Paints & Coatings Additives Industry. Technological breakthroughs in material science are enabling the development of novel additives with superior performance characteristics, such as enhanced durability, improved scratch resistance, and faster curing times. Strategic partnerships and collaborations between additive manufacturers and paint producers are fostering co-innovation and faster market penetration of new products. The increasing emphasis on circular economy principles is driving the development of recyclable and biodegradable additives. Government initiatives promoting green building standards and sustainable manufacturing practices are creating a favorable environment for eco-friendly additive solutions. Furthermore, the growing trend of customization and personalization in the coatings industry is spurring demand for specialized additives that can impart unique properties to paints.

Key Players Shaping the APAC Paints & Coatings Additives Industry Market

- The Sherwin-Williams Company

- K-TECH (INDIA) LIMITED

- Clariant

- Altana

- Solvay

- Evonik Industries AG

- 3M

- Ashland

- BASF SE

- Arkema Group

- Axalta Coating Systems

- ELEMENTIS PLC

- ALLNEX NETHERLANDS B V

- Akzo Nobel N V

- Dow

- Eastman Chemical Company

- The Chemours Company

- The Lubrizol Corporation

Notable Milestones in APAC Paints & Coatings Additives Industry Sector

- 2022 Q3: Major multinational additive supplier announces a significant expansion of its R&D facility in Singapore, focusing on sustainable coating solutions.

- 2023 Q1: Launch of a new generation of low-VOC rheology modifiers by a leading European chemical company, specifically targeting the growing Chinese architectural coatings market.

- 2023 Q2: Acquisition of a prominent South Korean specialty chemicals manufacturer by a global player, aimed at bolstering its presence in the high-growth APAC automotive coatings sector.

- 2023 Q4: Introduction of a novel biocidal additive with enhanced efficacy and reduced environmental impact by an Indian chemical firm, addressing stringent regulations in the region.

- 2024 Q1: Announcement of a strategic alliance between a Japanese chemical giant and an Australian paint manufacturer to develop advanced protective coatings for extreme weather conditions.

- 2024 Q3: A new state-of-the-art manufacturing plant for specialty additives commences operations in Vietnam, signaling increasing investment in emerging APAC markets.

In-Depth APAC Paints & Coatings Additives Industry Market Outlook

The APAC Paints & Coatings Additives Industry is set for continued strong growth, fueled by an optimistic economic outlook and sustained industrial expansion. Key growth accelerators include the escalating demand for sustainable and eco-friendly solutions, driven by both regulatory pressures and consumer preferences for greener products. The ongoing digital transformation within the coatings sector is creating opportunities for smart additives that offer enhanced functionalities and improved application efficiencies. Strategic partnerships and the increasing adoption of advanced manufacturing techniques will further bolster innovation and market penetration. Emerging economies within ASEAN and Oceania present significant untapped potential, requiring tailored product development and market entry strategies. The industry's ability to adapt to evolving consumer needs and technological advancements will be crucial for capitalizing on the vast opportunities ahead.

APAC Paints & Coatings Additives Industry Segmentation

-

1. Type

- 1.1. Biocides

- 1.2. Dispersants and Wetting Agents

- 1.3. Defoamers and Deaerators

- 1.4. Rheology Modifiers

- 1.5. Surface Modifiers

- 1.6. Stabilizers

- 1.7. Flow and Leveling Additives

- 1.8. Other Types

-

2. Application

- 2.1. Architectural

- 2.2. Wood

- 2.3. Transportation

- 2.4. Protective

- 2.5. Other Applications

-

3. Geography

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Australia & New Zealand

- 3.6. ASEAN

- 3.7. Rest of Asia-Pacific

APAC Paints & Coatings Additives Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Australia

- 6. ASEAN

- 7. Rest of Asia Pacific

APAC Paints & Coatings Additives Industry Regional Market Share

Geographic Coverage of APAC Paints & Coatings Additives Industry

APAC Paints & Coatings Additives Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rising Demand from Furniture Coatings in China; Increasing Construction Activities

- 3.3. Market Restrains

- 3.3.1. ; Rising Environmental Regulations

- 3.4. Market Trends

- 3.4.1. Architectural Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Paints & Coatings Additives Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Biocides

- 5.1.2. Dispersants and Wetting Agents

- 5.1.3. Defoamers and Deaerators

- 5.1.4. Rheology Modifiers

- 5.1.5. Surface Modifiers

- 5.1.6. Stabilizers

- 5.1.7. Flow and Leveling Additives

- 5.1.8. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Architectural

- 5.2.2. Wood

- 5.2.3. Transportation

- 5.2.4. Protective

- 5.2.5. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. China

- 5.3.2. India

- 5.3.3. Japan

- 5.3.4. South Korea

- 5.3.5. Australia & New Zealand

- 5.3.6. ASEAN

- 5.3.7. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Australia

- 5.4.6. ASEAN

- 5.4.7. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. China APAC Paints & Coatings Additives Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Biocides

- 6.1.2. Dispersants and Wetting Agents

- 6.1.3. Defoamers and Deaerators

- 6.1.4. Rheology Modifiers

- 6.1.5. Surface Modifiers

- 6.1.6. Stabilizers

- 6.1.7. Flow and Leveling Additives

- 6.1.8. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Architectural

- 6.2.2. Wood

- 6.2.3. Transportation

- 6.2.4. Protective

- 6.2.5. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. China

- 6.3.2. India

- 6.3.3. Japan

- 6.3.4. South Korea

- 6.3.5. Australia & New Zealand

- 6.3.6. ASEAN

- 6.3.7. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. India APAC Paints & Coatings Additives Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Biocides

- 7.1.2. Dispersants and Wetting Agents

- 7.1.3. Defoamers and Deaerators

- 7.1.4. Rheology Modifiers

- 7.1.5. Surface Modifiers

- 7.1.6. Stabilizers

- 7.1.7. Flow and Leveling Additives

- 7.1.8. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Architectural

- 7.2.2. Wood

- 7.2.3. Transportation

- 7.2.4. Protective

- 7.2.5. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. China

- 7.3.2. India

- 7.3.3. Japan

- 7.3.4. South Korea

- 7.3.5. Australia & New Zealand

- 7.3.6. ASEAN

- 7.3.7. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Japan APAC Paints & Coatings Additives Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Biocides

- 8.1.2. Dispersants and Wetting Agents

- 8.1.3. Defoamers and Deaerators

- 8.1.4. Rheology Modifiers

- 8.1.5. Surface Modifiers

- 8.1.6. Stabilizers

- 8.1.7. Flow and Leveling Additives

- 8.1.8. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Architectural

- 8.2.2. Wood

- 8.2.3. Transportation

- 8.2.4. Protective

- 8.2.5. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. China

- 8.3.2. India

- 8.3.3. Japan

- 8.3.4. South Korea

- 8.3.5. Australia & New Zealand

- 8.3.6. ASEAN

- 8.3.7. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South Korea APAC Paints & Coatings Additives Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Biocides

- 9.1.2. Dispersants and Wetting Agents

- 9.1.3. Defoamers and Deaerators

- 9.1.4. Rheology Modifiers

- 9.1.5. Surface Modifiers

- 9.1.6. Stabilizers

- 9.1.7. Flow and Leveling Additives

- 9.1.8. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Architectural

- 9.2.2. Wood

- 9.2.3. Transportation

- 9.2.4. Protective

- 9.2.5. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. China

- 9.3.2. India

- 9.3.3. Japan

- 9.3.4. South Korea

- 9.3.5. Australia & New Zealand

- 9.3.6. ASEAN

- 9.3.7. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Australia APAC Paints & Coatings Additives Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Biocides

- 10.1.2. Dispersants and Wetting Agents

- 10.1.3. Defoamers and Deaerators

- 10.1.4. Rheology Modifiers

- 10.1.5. Surface Modifiers

- 10.1.6. Stabilizers

- 10.1.7. Flow and Leveling Additives

- 10.1.8. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Architectural

- 10.2.2. Wood

- 10.2.3. Transportation

- 10.2.4. Protective

- 10.2.5. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by Geography

- 10.3.1. China

- 10.3.2. India

- 10.3.3. Japan

- 10.3.4. South Korea

- 10.3.5. Australia & New Zealand

- 10.3.6. ASEAN

- 10.3.7. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. ASEAN APAC Paints & Coatings Additives Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Biocides

- 11.1.2. Dispersants and Wetting Agents

- 11.1.3. Defoamers and Deaerators

- 11.1.4. Rheology Modifiers

- 11.1.5. Surface Modifiers

- 11.1.6. Stabilizers

- 11.1.7. Flow and Leveling Additives

- 11.1.8. Other Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Architectural

- 11.2.2. Wood

- 11.2.3. Transportation

- 11.2.4. Protective

- 11.2.5. Other Applications

- 11.3. Market Analysis, Insights and Forecast - by Geography

- 11.3.1. China

- 11.3.2. India

- 11.3.3. Japan

- 11.3.4. South Korea

- 11.3.5. Australia & New Zealand

- 11.3.6. ASEAN

- 11.3.7. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Rest of Asia Pacific APAC Paints & Coatings Additives Industry Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Type

- 12.1.1. Biocides

- 12.1.2. Dispersants and Wetting Agents

- 12.1.3. Defoamers and Deaerators

- 12.1.4. Rheology Modifiers

- 12.1.5. Surface Modifiers

- 12.1.6. Stabilizers

- 12.1.7. Flow and Leveling Additives

- 12.1.8. Other Types

- 12.2. Market Analysis, Insights and Forecast - by Application

- 12.2.1. Architectural

- 12.2.2. Wood

- 12.2.3. Transportation

- 12.2.4. Protective

- 12.2.5. Other Applications

- 12.3. Market Analysis, Insights and Forecast - by Geography

- 12.3.1. China

- 12.3.2. India

- 12.3.3. Japan

- 12.3.4. South Korea

- 12.3.5. Australia & New Zealand

- 12.3.6. ASEAN

- 12.3.7. Rest of Asia-Pacific

- 12.1. Market Analysis, Insights and Forecast - by Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 The Sherwin-Williams Company*List Not Exhaustive

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 K-TECH (INDIA) LIMITED

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Clariant

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Altana

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Solvay

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Evonik Industries AG

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 3M

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Ashland

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 BASF SE

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Arkema Group

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Axalta Coating Systems

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 ELEMENTIS PLC

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 ALLNEX NETHERLANDS B V

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 Akzo Nobel N V

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.15 Dow

- 13.2.15.1. Overview

- 13.2.15.2. Products

- 13.2.15.3. SWOT Analysis

- 13.2.15.4. Recent Developments

- 13.2.15.5. Financials (Based on Availability)

- 13.2.16 Eastman Chemical Company

- 13.2.16.1. Overview

- 13.2.16.2. Products

- 13.2.16.3. SWOT Analysis

- 13.2.16.4. Recent Developments

- 13.2.16.5. Financials (Based on Availability)

- 13.2.17 The Chemours Company

- 13.2.17.1. Overview

- 13.2.17.2. Products

- 13.2.17.3. SWOT Analysis

- 13.2.17.4. Recent Developments

- 13.2.17.5. Financials (Based on Availability)

- 13.2.18 The Lubrizol Corporation

- 13.2.18.1. Overview

- 13.2.18.2. Products

- 13.2.18.3. SWOT Analysis

- 13.2.18.4. Recent Developments

- 13.2.18.5. Financials (Based on Availability)

- 13.2.1 The Sherwin-Williams Company*List Not Exhaustive

List of Figures

- Figure 1: Global APAC Paints & Coatings Additives Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: China APAC Paints & Coatings Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 3: China APAC Paints & Coatings Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: China APAC Paints & Coatings Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 5: China APAC Paints & Coatings Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: China APAC Paints & Coatings Additives Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 7: China APAC Paints & Coatings Additives Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: China APAC Paints & Coatings Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 9: China APAC Paints & Coatings Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: India APAC Paints & Coatings Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 11: India APAC Paints & Coatings Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 12: India APAC Paints & Coatings Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 13: India APAC Paints & Coatings Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 14: India APAC Paints & Coatings Additives Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 15: India APAC Paints & Coatings Additives Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: India APAC Paints & Coatings Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 17: India APAC Paints & Coatings Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Japan APAC Paints & Coatings Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 19: Japan APAC Paints & Coatings Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 20: Japan APAC Paints & Coatings Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 21: Japan APAC Paints & Coatings Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 22: Japan APAC Paints & Coatings Additives Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 23: Japan APAC Paints & Coatings Additives Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Japan APAC Paints & Coatings Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: Japan APAC Paints & Coatings Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: South Korea APAC Paints & Coatings Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 27: South Korea APAC Paints & Coatings Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: South Korea APAC Paints & Coatings Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 29: South Korea APAC Paints & Coatings Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: South Korea APAC Paints & Coatings Additives Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 31: South Korea APAC Paints & Coatings Additives Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: South Korea APAC Paints & Coatings Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 33: South Korea APAC Paints & Coatings Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Australia APAC Paints & Coatings Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 35: Australia APAC Paints & Coatings Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 36: Australia APAC Paints & Coatings Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 37: Australia APAC Paints & Coatings Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 38: Australia APAC Paints & Coatings Additives Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 39: Australia APAC Paints & Coatings Additives Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 40: Australia APAC Paints & Coatings Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 41: Australia APAC Paints & Coatings Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 42: ASEAN APAC Paints & Coatings Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 43: ASEAN APAC Paints & Coatings Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 44: ASEAN APAC Paints & Coatings Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 45: ASEAN APAC Paints & Coatings Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 46: ASEAN APAC Paints & Coatings Additives Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 47: ASEAN APAC Paints & Coatings Additives Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: ASEAN APAC Paints & Coatings Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: ASEAN APAC Paints & Coatings Additives Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Rest of Asia Pacific APAC Paints & Coatings Additives Industry Revenue (undefined), by Type 2025 & 2033

- Figure 51: Rest of Asia Pacific APAC Paints & Coatings Additives Industry Revenue Share (%), by Type 2025 & 2033

- Figure 52: Rest of Asia Pacific APAC Paints & Coatings Additives Industry Revenue (undefined), by Application 2025 & 2033

- Figure 53: Rest of Asia Pacific APAC Paints & Coatings Additives Industry Revenue Share (%), by Application 2025 & 2033

- Figure 54: Rest of Asia Pacific APAC Paints & Coatings Additives Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 55: Rest of Asia Pacific APAC Paints & Coatings Additives Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 56: Rest of Asia Pacific APAC Paints & Coatings Additives Industry Revenue (undefined), by Country 2025 & 2033

- Figure 57: Rest of Asia Pacific APAC Paints & Coatings Additives Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 10: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 18: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 21: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 22: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 23: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 26: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 27: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 29: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 30: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 31: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 32: Global APAC Paints & Coatings Additives Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Paints & Coatings Additives Industry?

The projected CAGR is approximately 6.9%.

2. Which companies are prominent players in the APAC Paints & Coatings Additives Industry?

Key companies in the market include The Sherwin-Williams Company*List Not Exhaustive, K-TECH (INDIA) LIMITED, Clariant, Altana, Solvay, Evonik Industries AG, 3M, Ashland, BASF SE, Arkema Group, Axalta Coating Systems, ELEMENTIS PLC, ALLNEX NETHERLANDS B V, Akzo Nobel N V, Dow, Eastman Chemical Company, The Chemours Company, The Lubrizol Corporation.

3. What are the main segments of the APAC Paints & Coatings Additives Industry?

The market segments include Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Rising Demand from Furniture Coatings in China; Increasing Construction Activities.

6. What are the notable trends driving market growth?

Architectural Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

; Rising Environmental Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Paints & Coatings Additives Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Paints & Coatings Additives Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Paints & Coatings Additives Industry?

To stay informed about further developments, trends, and reports in the APAC Paints & Coatings Additives Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence