Key Insights

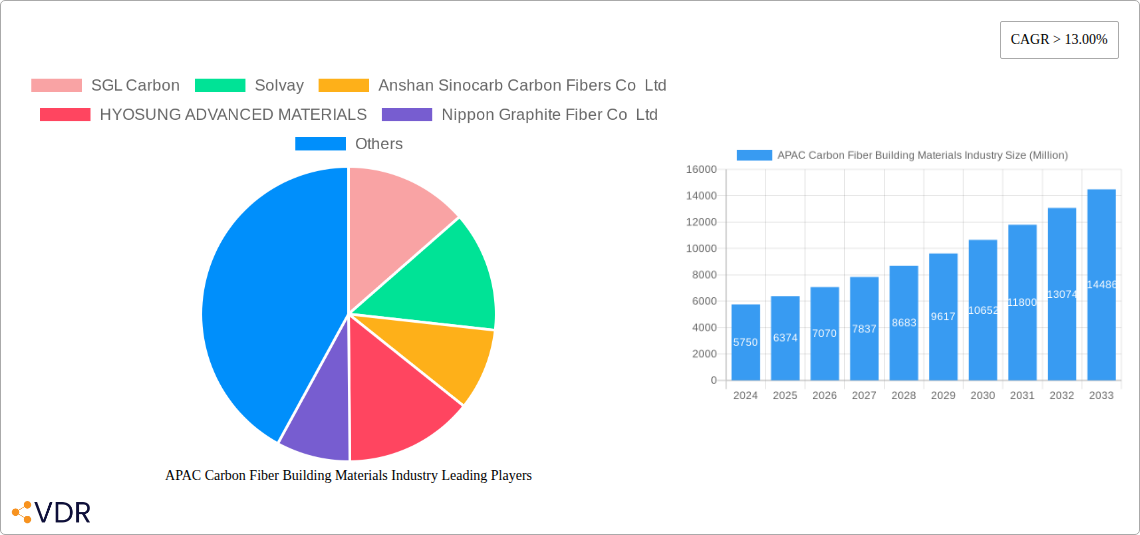

The Asia-Pacific (APAC) Carbon Fiber Building Materials market is poised for substantial expansion, driven by the increasing demand for lightweight, high-strength, and durable construction solutions. With a robust market size of approximately $5.75 billion in 2024, the industry is projected to experience a significant Compound Annual Growth Rate (CAGR) of 10.9% throughout the forecast period (2025-2033). This growth is primarily fueled by the growing adoption of carbon fiber in a variety of construction applications, including reinforcing existing structures, creating innovative architectural designs, and enhancing the durability of infrastructure projects. The inherent advantages of carbon fiber, such as its superior tensile strength, corrosion resistance, and reduced weight compared to traditional materials like steel and concrete, are making it an increasingly attractive option for developers and engineers seeking to improve building performance and longevity. Furthermore, advancements in manufacturing processes and the development of cost-effective raw materials are making carbon fiber more accessible and competitive, accelerating its integration into mainstream construction practices across the APAC region.

APAC Carbon Fiber Building Materials Industry Market Size (In Billion)

Key market drivers for this dynamic sector include the escalating need for resilient infrastructure that can withstand extreme weather events and seismic activity, a growing emphasis on sustainable building practices due to carbon fiber's lighter environmental footprint during transportation and installation, and the expanding applications in advanced composite materials. Emerging trends show a strong inclination towards the use of carbon fiber in precast concrete elements, façade systems, and even as a standalone structural material for specialized buildings. While the market presents immense opportunities, certain restraints such as the relatively high initial cost of carbon fiber materials and the need for specialized knowledge and skilled labor for installation and repair could pose challenges. However, ongoing research and development efforts are focused on mitigating these factors, with a particular emphasis on reducing production costs and developing standardized application techniques. The market's segmentation across raw materials (Polyacrylonitrile, Petroleum Pitch, Rayon), types (Virgin Fiber, Recycled Fiber), applications (Composite Materials, Textiles, Microelectrodes, Catalysis), and end-user industries (Aerospace and Defense, Alternative Energy, Automotive, Construction and Infrastructure, Sporting Goods, Others) highlights its diverse and expanding utility within the building and construction landscape of the APAC region.

APAC Carbon Fiber Building Materials Industry Company Market Share

APAC Carbon Fiber Building Materials Industry Report: Market Analysis, Trends & Forecast (2019-2033)

This comprehensive report delivers an in-depth analysis of the APAC Carbon Fiber Building Materials Industry, a rapidly evolving sector driven by innovation and increasing demand for high-performance, lightweight materials. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report provides crucial insights into market dynamics, growth trends, regional dominance, product landscape, key drivers, barriers, emerging opportunities, and the competitive landscape. Understand the future trajectory of this vital industry, essential for stakeholders in aerospace and defense, alternative energy, automotive, construction and infrastructure, sporting goods, and other end-user industries. This report quantifies market evolution with values presented in billions of USD.

APAC Carbon Fiber Building Materials Industry Market Dynamics & Structure

The APAC Carbon Fiber Building Materials Industry is characterized by a dynamic interplay of technological advancements, evolving regulatory frameworks, and robust market demand. Market concentration is influenced by the significant presence of established global players and emerging domestic manufacturers, particularly in China, driving competitive innovation. Technological innovation is primarily propelled by advancements in raw material synthesis and manufacturing processes, aiming for cost reduction and enhanced performance. Regulatory frameworks, while nascent in some areas, are increasingly focusing on sustainability and safety standards for advanced materials. Competitive product substitutes, such as high-strength steel and aluminum, are gradually being displaced by carbon fiber's superior strength-to-weight ratio. End-user demographics are shifting towards industries prioritizing lightweighting and durability, leading to increased adoption in the automotive and construction sectors. Mergers and acquisitions (M&A) are on the rise as companies seek to expand their market reach, acquire technological capabilities, and consolidate their positions. The market for carbon fiber building materials is projected to witness significant growth due to these converging factors.

- Market Concentration: Moderate, with key players holding substantial shares, but increasing fragmentation due to new entrants.

- Technological Innovation Drivers: Development of cost-effective PAN-based carbon fibers, advancements in resin systems, and novel manufacturing techniques.

- Regulatory Frameworks: Growing emphasis on fire safety, structural integrity, and environmental impact assessments for composite materials in construction.

- Competitive Product Substitutes: High-strength steel, aluminum alloys, and advanced polymers.

- End-User Demographics: Increasing demand from industries focused on weight reduction, fuel efficiency, and enhanced structural performance.

- M&A Trends: Strategic acquisitions to enhance R&D capabilities and expand production capacity.

APAC Carbon Fiber Building Materials Industry Growth Trends & Insights

The APAC Carbon Fiber Building Materials Industry is poised for substantial expansion, driven by escalating demand across diverse end-user segments. The market size is projected to grow from approximately $15.5 billion in 2025 to an estimated $35.2 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 11.5% during the forecast period. This growth is fueled by a confluence of factors, including increasing investments in infrastructure development, the automotive industry's relentless pursuit of lightweighting for fuel efficiency and electric vehicle (EV) range extension, and the aerospace sector's continuous need for high-performance materials. Adoption rates for carbon fiber in construction are accelerating, particularly in bridge reinforcement, seismic retrofitting, and prefabricated building components, owing to its corrosion resistance and superior mechanical properties. Technological disruptions, such as the development of lower-cost carbon fiber production methods and advancements in composite manufacturing technologies like Automated Fiber Placement (AFP) and 3D printing, are making carbon fiber more accessible and cost-competitive. Consumer behavior shifts are also playing a role, with a growing preference for sustainable and high-performance products influencing material selection across various applications. The integration of carbon fiber into building materials is no longer a niche application but a significant trend shaping the future of construction and manufacturing in the APAC region.

- Market Size Evolution: Expected to grow from approximately $15.5 billion in 2025 to $35.2 billion by 2033.

- CAGR: Approximately 11.5% during the forecast period (2025-2033).

- Adoption Rates: Steadily increasing across automotive, construction, and renewable energy sectors.

- Technological Disruptions: Focus on cost reduction in PAN production and development of advanced composite manufacturing techniques.

- Consumer Behavior Shifts: Growing preference for lightweight, durable, and sustainable building solutions.

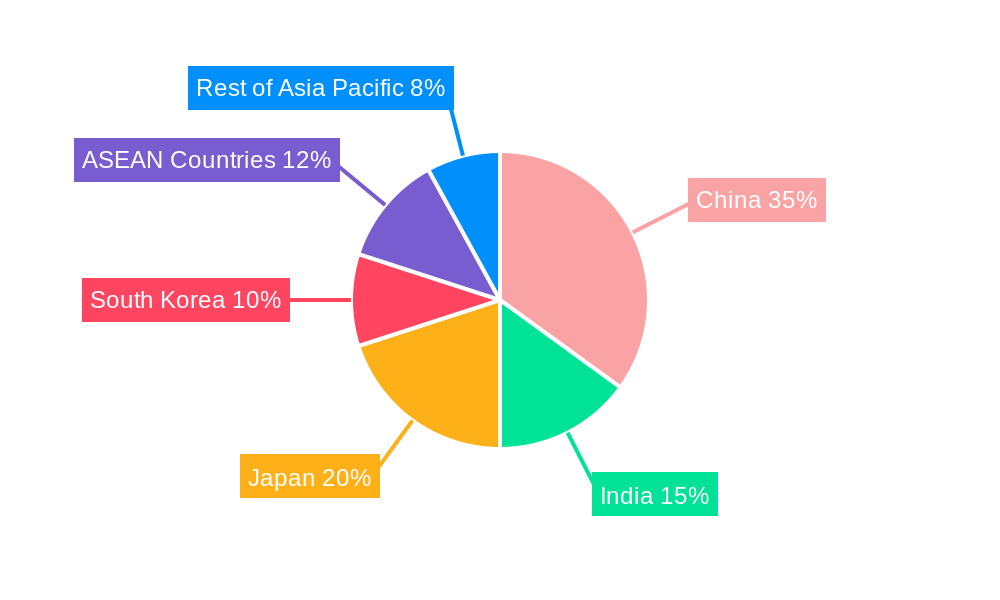

Dominant Regions, Countries, or Segments in APAC Carbon Fiber Building Materials Industry

Within the dynamic APAC Carbon Fiber Building Materials Industry, China stands out as the undisputed dominant region, driven by its massive industrial base, robust government support for advanced materials, and burgeoning construction sector. The parent market, encompassing the broader carbon fiber market, is significantly influenced by its applications in aerospace and automotive, with building materials emerging as a rapidly growing child market. China's dominance is further cemented by its extensive production capacity across the value chain, from raw materials like Polyacrylonitrile (PAN) to finished composite products.

- Dominant Country: China, due to its vast manufacturing capabilities, significant government investment in R&D for advanced materials, and large-scale infrastructure projects.

- Key Segments Driving Growth:

- Raw Material: Polyacrylonitrile (PAN) is the primary precursor, with ongoing efforts to reduce its cost and improve its quality.

- Type: Virgin Fiber (VCF) currently holds a larger market share due to its superior performance characteristics, but Recycled Fiber (RCF) is gaining traction as sustainability concerns rise.

- Application: Composite Materials are paramount, enabling lightweight and high-strength structures.

- End-user Industry: Construction and Infrastructure is the fastest-growing segment, followed closely by Automotive, driven by the demand for lightweight components and structural reinforcement.

- Geography: China leads, followed by Japan and South Korea, with ASEAN countries showing significant growth potential.

The dominance of China is also attributed to its aggressive adoption of carbon fiber in large-scale infrastructure projects, including bridges, high-speed rail components, and wind turbine blades, all of which directly or indirectly benefit the building materials sector. Furthermore, government initiatives promoting new material development and the establishment of industrial parks dedicated to advanced composites have fostered a conducive ecosystem for growth. While Japan and South Korea are significant contributors, particularly in high-end aerospace and automotive applications, China's sheer scale of demand and production capacity solidifies its leading position. The growth potential within ASEAN countries is substantial, driven by increasing industrialization and infrastructure development needs.

APAC Carbon Fiber Building Materials Industry Product Landscape

The product landscape of the APAC Carbon Fiber Building Materials Industry is characterized by continuous innovation focused on enhancing performance, reducing costs, and expanding applications. Key product developments include advanced composite panels for building facades, lightweight structural beams, reinforcing bars for concrete, and prefabricated modular components. These products leverage the exceptional strength-to-weight ratio, corrosion resistance, and fatigue life of carbon fiber, offering significant advantages over traditional materials like steel and concrete. Performance metrics such as tensile strength, flexural modulus, and durability are consistently being improved through advancements in fiber manufacturing and resin matrix development. Unique selling propositions include enhanced seismic resistance, reduced structural load, improved thermal insulation properties, and extended service life for infrastructure. Technological advancements are also paving the way for the integration of smart functionalities, such as embedded sensors for structural health monitoring.

Key Drivers, Barriers & Challenges in APAC Carbon Fiber Building Materials Industry

The APAC Carbon Fiber Building Materials Industry is propelled by several key drivers, including the escalating demand for lightweight and high-strength materials in construction and automotive sectors for improved fuel efficiency and structural integrity. Government initiatives promoting sustainable development and advanced manufacturing further fuel this growth. Technological advancements in carbon fiber production, leading to cost reductions and improved performance, are also significant drivers.

However, the industry faces notable barriers and challenges. The high initial cost of carbon fiber compared to traditional materials remains a significant restraint, limiting widespread adoption in cost-sensitive applications. Supply chain complexities and the need for specialized manufacturing infrastructure also pose challenges. Stringent regulatory approvals for new building materials can slow down market penetration. Furthermore, the availability of skilled labor for handling and installing composite materials needs to be addressed.

- Key Drivers:

- Demand for lightweighting and high-performance materials.

- Government support for advanced materials and sustainable infrastructure.

- Technological advancements in production and manufacturing.

- Barriers & Challenges:

- High initial cost of carbon fiber.

- Supply chain and infrastructure limitations.

- Regulatory hurdles and lengthy approval processes.

- Shortage of skilled labor.

Emerging Opportunities in APAC Carbon Fiber Building Materials Industry

Emerging opportunities within the APAC Carbon Fiber Building Materials Industry are abundant and diverse. The growing emphasis on green building and sustainable construction practices presents a significant opportunity for carbon fiber composites, known for their long lifespan and reduced environmental impact during use. Untapped markets in developing ASEAN countries, driven by rapid urbanization and infrastructure development, offer substantial growth potential. Innovative applications in prefabricated housing, modular construction, and disaster-resilient infrastructure are gaining traction. Evolving consumer preferences for aesthetically pleasing and high-performance building materials also present new avenues for product development and market expansion.

Growth Accelerators in the APAC Carbon Fiber Building Materials Industry Industry

Several factors are accelerating long-term growth in the APAC Carbon Fiber Building Materials Industry. Technological breakthroughs in lowering carbon fiber production costs, such as advancements in precursor synthesis and energy-efficient manufacturing processes, are critical. Strategic partnerships between raw material suppliers, composite manufacturers, and end-users are fostering innovation and accelerating product development cycles. Market expansion strategies focusing on niche applications and customized solutions for specific building needs are also contributing to sustained growth. Furthermore, increasing investments in research and development aimed at enhancing the fire resistance and recyclability of carbon fiber composites will unlock new markets and applications.

Key Players Shaping the APAC Carbon Fiber Building Materials Industry Market

- SGL Carbon

- Solvay

- Anshan Sinocarb Carbon Fibers Co Ltd

- HYOSUNG ADVANCED MATERIALS

- Nippon Graphite Fiber Co Ltd

- TORAY INDUSTRIES INC

- Mitsubishi Chemical Carbon Fiber and Composites Inc

- Hexcel Corporation

- Formosa Plastics Corporation

- TEIJIN LIMITED

- Zhongfu Shenying Carbon Fiber Co Ltd

Notable Milestones in APAC Carbon Fiber Building Materials Industry Sector

- April 2021: Hyosung Advanced Materials announced a six-year contract to supply Hanwha Solutions with high-strength carbon fiber for hydrogen vehicle fuel tanks, valued at approximately 160 billion won (USD 144 million). This signifies the growing importance of carbon fiber in the new energy vehicle sector, with direct implications for material demand and technological advancements that can be translated to building materials.

In-Depth APAC Carbon Fiber Building Materials Industry Market Outlook

The APAC Carbon Fiber Building Materials Industry is set for a robust growth trajectory, driven by a confluence of innovation, supportive policies, and increasing market demand. Key growth accelerators include the continuous reduction in carbon fiber production costs, fostering wider adoption across infrastructure and construction projects. Strategic partnerships between material manufacturers and construction firms will expedite the development and deployment of novel composite solutions. Market expansion strategies targeting emerging economies within the APAC region will unlock significant untapped potential. Furthermore, ongoing research into advanced composite functionalities, such as enhanced fire resistance and recyclability, will pave the way for new applications and solidify carbon fiber's position as a preferred building material. The future market outlook is exceptionally promising, indicating sustained growth and innovation.

APAC Carbon Fiber Building Materials Industry Segmentation

-

1. Raw Material

- 1.1. Polyacrtlonitrile (PAN)

- 1.2. Petroleum Pitch and Rayon

-

2. Type

- 2.1. Virgin Fiber (VCF)

- 2.2. Recycled Fiber (RCF)

-

3. Application

- 3.1. Composite Materials

- 3.2. Textiles

- 3.3. Microelectrodes

- 3.4. Catalysis

-

4. End-user Industry

- 4.1. Aerospace and Defense

- 4.2. Alternative Energy

- 4.3. Automotive

- 4.4. Construction and Infrastructure

- 4.5. Sporting Goods

- 4.6. Other En

-

5. Geography

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN Countries

- 5.6. Rest of Asia-Pacific

APAC Carbon Fiber Building Materials Industry Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. ASEAN Countries

- 6. Rest of Asia Pacific

APAC Carbon Fiber Building Materials Industry Regional Market Share

Geographic Coverage of APAC Carbon Fiber Building Materials Industry

APAC Carbon Fiber Building Materials Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Fuel-efficient and Lightweight Vehicles

- 3.3. Market Restrains

- 3.3.1. Concerns Related to Raw Materials

- 3.4. Market Trends

- 3.4.1. Aerospace and Defense Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Carbon Fiber Building Materials Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyacrtlonitrile (PAN)

- 5.1.2. Petroleum Pitch and Rayon

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Virgin Fiber (VCF)

- 5.2.2. Recycled Fiber (RCF)

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Composite Materials

- 5.3.2. Textiles

- 5.3.3. Microelectrodes

- 5.3.4. Catalysis

- 5.4. Market Analysis, Insights and Forecast - by End-user Industry

- 5.4.1. Aerospace and Defense

- 5.4.2. Alternative Energy

- 5.4.3. Automotive

- 5.4.4. Construction and Infrastructure

- 5.4.5. Sporting Goods

- 5.4.6. Other En

- 5.5. Market Analysis, Insights and Forecast - by Geography

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. ASEAN Countries

- 5.5.6. Rest of Asia-Pacific

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. China

- 5.6.2. India

- 5.6.3. Japan

- 5.6.4. South Korea

- 5.6.5. ASEAN Countries

- 5.6.6. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. China APAC Carbon Fiber Building Materials Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Polyacrtlonitrile (PAN)

- 6.1.2. Petroleum Pitch and Rayon

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Virgin Fiber (VCF)

- 6.2.2. Recycled Fiber (RCF)

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Composite Materials

- 6.3.2. Textiles

- 6.3.3. Microelectrodes

- 6.3.4. Catalysis

- 6.4. Market Analysis, Insights and Forecast - by End-user Industry

- 6.4.1. Aerospace and Defense

- 6.4.2. Alternative Energy

- 6.4.3. Automotive

- 6.4.4. Construction and Infrastructure

- 6.4.5. Sporting Goods

- 6.4.6. Other En

- 6.5. Market Analysis, Insights and Forecast - by Geography

- 6.5.1. China

- 6.5.2. India

- 6.5.3. Japan

- 6.5.4. South Korea

- 6.5.5. ASEAN Countries

- 6.5.6. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. India APAC Carbon Fiber Building Materials Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Polyacrtlonitrile (PAN)

- 7.1.2. Petroleum Pitch and Rayon

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Virgin Fiber (VCF)

- 7.2.2. Recycled Fiber (RCF)

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Composite Materials

- 7.3.2. Textiles

- 7.3.3. Microelectrodes

- 7.3.4. Catalysis

- 7.4. Market Analysis, Insights and Forecast - by End-user Industry

- 7.4.1. Aerospace and Defense

- 7.4.2. Alternative Energy

- 7.4.3. Automotive

- 7.4.4. Construction and Infrastructure

- 7.4.5. Sporting Goods

- 7.4.6. Other En

- 7.5. Market Analysis, Insights and Forecast - by Geography

- 7.5.1. China

- 7.5.2. India

- 7.5.3. Japan

- 7.5.4. South Korea

- 7.5.5. ASEAN Countries

- 7.5.6. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Japan APAC Carbon Fiber Building Materials Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Polyacrtlonitrile (PAN)

- 8.1.2. Petroleum Pitch and Rayon

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Virgin Fiber (VCF)

- 8.2.2. Recycled Fiber (RCF)

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Composite Materials

- 8.3.2. Textiles

- 8.3.3. Microelectrodes

- 8.3.4. Catalysis

- 8.4. Market Analysis, Insights and Forecast - by End-user Industry

- 8.4.1. Aerospace and Defense

- 8.4.2. Alternative Energy

- 8.4.3. Automotive

- 8.4.4. Construction and Infrastructure

- 8.4.5. Sporting Goods

- 8.4.6. Other En

- 8.5. Market Analysis, Insights and Forecast - by Geography

- 8.5.1. China

- 8.5.2. India

- 8.5.3. Japan

- 8.5.4. South Korea

- 8.5.5. ASEAN Countries

- 8.5.6. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. South Korea APAC Carbon Fiber Building Materials Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Polyacrtlonitrile (PAN)

- 9.1.2. Petroleum Pitch and Rayon

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Virgin Fiber (VCF)

- 9.2.2. Recycled Fiber (RCF)

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Composite Materials

- 9.3.2. Textiles

- 9.3.3. Microelectrodes

- 9.3.4. Catalysis

- 9.4. Market Analysis, Insights and Forecast - by End-user Industry

- 9.4.1. Aerospace and Defense

- 9.4.2. Alternative Energy

- 9.4.3. Automotive

- 9.4.4. Construction and Infrastructure

- 9.4.5. Sporting Goods

- 9.4.6. Other En

- 9.5. Market Analysis, Insights and Forecast - by Geography

- 9.5.1. China

- 9.5.2. India

- 9.5.3. Japan

- 9.5.4. South Korea

- 9.5.5. ASEAN Countries

- 9.5.6. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. ASEAN Countries APAC Carbon Fiber Building Materials Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Polyacrtlonitrile (PAN)

- 10.1.2. Petroleum Pitch and Rayon

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Virgin Fiber (VCF)

- 10.2.2. Recycled Fiber (RCF)

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Composite Materials

- 10.3.2. Textiles

- 10.3.3. Microelectrodes

- 10.3.4. Catalysis

- 10.4. Market Analysis, Insights and Forecast - by End-user Industry

- 10.4.1. Aerospace and Defense

- 10.4.2. Alternative Energy

- 10.4.3. Automotive

- 10.4.4. Construction and Infrastructure

- 10.4.5. Sporting Goods

- 10.4.6. Other En

- 10.5. Market Analysis, Insights and Forecast - by Geography

- 10.5.1. China

- 10.5.2. India

- 10.5.3. Japan

- 10.5.4. South Korea

- 10.5.5. ASEAN Countries

- 10.5.6. Rest of Asia-Pacific

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Raw Material

- 11.1.1. Polyacrtlonitrile (PAN)

- 11.1.2. Petroleum Pitch and Rayon

- 11.2. Market Analysis, Insights and Forecast - by Type

- 11.2.1. Virgin Fiber (VCF)

- 11.2.2. Recycled Fiber (RCF)

- 11.3. Market Analysis, Insights and Forecast - by Application

- 11.3.1. Composite Materials

- 11.3.2. Textiles

- 11.3.3. Microelectrodes

- 11.3.4. Catalysis

- 11.4. Market Analysis, Insights and Forecast - by End-user Industry

- 11.4.1. Aerospace and Defense

- 11.4.2. Alternative Energy

- 11.4.3. Automotive

- 11.4.4. Construction and Infrastructure

- 11.4.5. Sporting Goods

- 11.4.6. Other En

- 11.5. Market Analysis, Insights and Forecast - by Geography

- 11.5.1. China

- 11.5.2. India

- 11.5.3. Japan

- 11.5.4. South Korea

- 11.5.5. ASEAN Countries

- 11.5.6. Rest of Asia-Pacific

- 11.1. Market Analysis, Insights and Forecast - by Raw Material

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 SGL Carbon

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Solvay

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Anshan Sinocarb Carbon Fibers Co Ltd

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 HYOSUNG ADVANCED MATERIALS

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Nippon Graphite Fiber Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 TORAY INDUSTRIES INC

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Mitsubishi Chemical Carbon Fiber and Composites Inc

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Hexcel Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Formosa Plastics Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 TEIJIN LIMITED

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Zhongfu Shenying Carbon Fiber Co Ltd*List Not Exhaustive

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 SGL Carbon

List of Figures

- Figure 1: Global APAC Carbon Fiber Building Materials Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: China APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Raw Material 2025 & 2033

- Figure 3: China APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 4: China APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Type 2025 & 2033

- Figure 5: China APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 6: China APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Application 2025 & 2033

- Figure 7: China APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: China APAC Carbon Fiber Building Materials Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 9: China APAC Carbon Fiber Building Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 10: China APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 11: China APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 12: China APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: China APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: India APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Raw Material 2025 & 2033

- Figure 15: India APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 16: India APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Type 2025 & 2033

- Figure 17: India APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 18: India APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Application 2025 & 2033

- Figure 19: India APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 20: India APAC Carbon Fiber Building Materials Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 21: India APAC Carbon Fiber Building Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 22: India APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 23: India APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: India APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: India APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Raw Material 2025 & 2033

- Figure 27: Japan APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 28: Japan APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Type 2025 & 2033

- Figure 29: Japan APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 30: Japan APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Application 2025 & 2033

- Figure 31: Japan APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Japan APAC Carbon Fiber Building Materials Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 33: Japan APAC Carbon Fiber Building Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 34: Japan APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 35: Japan APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 36: Japan APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Japan APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: South Korea APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Raw Material 2025 & 2033

- Figure 39: South Korea APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 40: South Korea APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Type 2025 & 2033

- Figure 41: South Korea APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 42: South Korea APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Application 2025 & 2033

- Figure 43: South Korea APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 44: South Korea APAC Carbon Fiber Building Materials Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 45: South Korea APAC Carbon Fiber Building Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 46: South Korea APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 47: South Korea APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 48: South Korea APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: South Korea APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Raw Material 2025 & 2033

- Figure 51: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 52: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Type 2025 & 2033

- Figure 53: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 54: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Application 2025 & 2033

- Figure 55: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 56: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 57: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 58: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 59: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 60: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Country 2025 & 2033

- Figure 61: ASEAN Countries APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Raw Material 2025 & 2033

- Figure 63: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Raw Material 2025 & 2033

- Figure 64: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Type 2025 & 2033

- Figure 65: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Type 2025 & 2033

- Figure 66: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Application 2025 & 2033

- Figure 67: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Application 2025 & 2033

- Figure 68: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue (undefined), by End-user Industry 2025 & 2033

- Figure 69: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 70: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Geography 2025 & 2033

- Figure 71: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 72: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue (undefined), by Country 2025 & 2033

- Figure 73: Rest of Asia Pacific APAC Carbon Fiber Building Materials Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 2: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 3: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 4: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 5: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 6: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 8: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 9: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 10: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 11: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 14: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 15: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 16: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 17: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 20: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 21: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 23: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 24: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 25: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 26: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 27: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 28: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 29: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 30: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 32: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 33: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 34: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 35: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 36: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 37: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Raw Material 2020 & 2033

- Table 38: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 39: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Application 2020 & 2033

- Table 40: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by End-user Industry 2020 & 2033

- Table 41: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Geography 2020 & 2033

- Table 42: Global APAC Carbon Fiber Building Materials Industry Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Carbon Fiber Building Materials Industry?

The projected CAGR is approximately 10.9%.

2. Which companies are prominent players in the APAC Carbon Fiber Building Materials Industry?

Key companies in the market include SGL Carbon, Solvay, Anshan Sinocarb Carbon Fibers Co Ltd, HYOSUNG ADVANCED MATERIALS, Nippon Graphite Fiber Co Ltd, TORAY INDUSTRIES INC, Mitsubishi Chemical Carbon Fiber and Composites Inc, Hexcel Corporation, Formosa Plastics Corporation, TEIJIN LIMITED, Zhongfu Shenying Carbon Fiber Co Ltd*List Not Exhaustive.

3. What are the main segments of the APAC Carbon Fiber Building Materials Industry?

The market segments include Raw Material, Type, Application, End-user Industry, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Fuel-efficient and Lightweight Vehicles.

6. What are the notable trends driving market growth?

Aerospace and Defense Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Concerns Related to Raw Materials.

8. Can you provide examples of recent developments in the market?

In April 2021, Hyosung Advanced Materials announced that it had signed a long-term contract to supply Hanwha Solutions with high-strength carbon fiber to be used to reinforce fuel tanks for hydrogen vehicles for six years from 2021. The supply is worth about 160 billion won (USD 144 million).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Carbon Fiber Building Materials Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Carbon Fiber Building Materials Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Carbon Fiber Building Materials Industry?

To stay informed about further developments, trends, and reports in the APAC Carbon Fiber Building Materials Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence