Key Insights

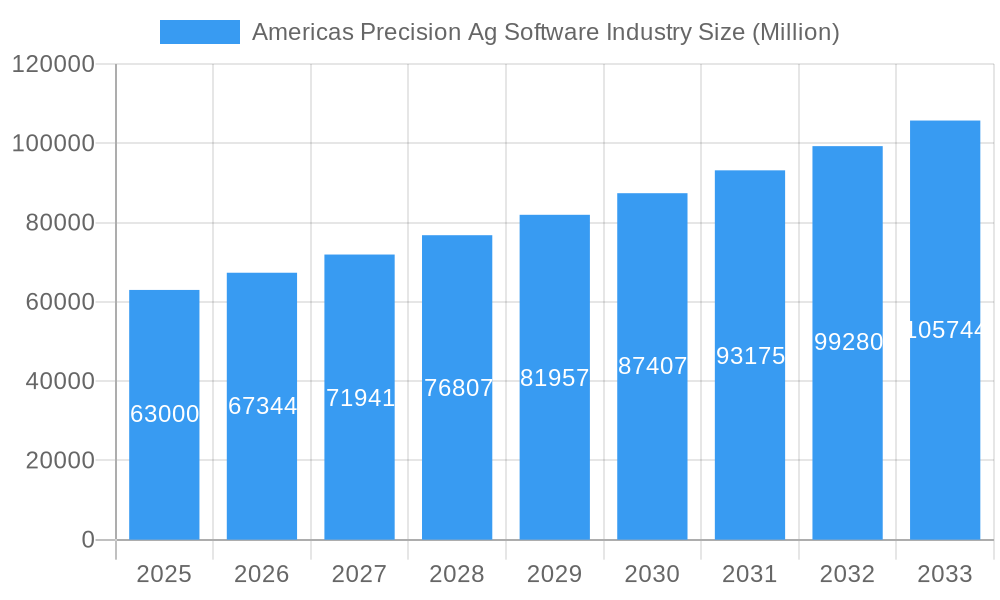

The Americas Precision Agriculture Software Market is poised for significant expansion, projected to reach a USD 63 billion valuation in 2025. This robust growth is fueled by an estimated Compound Annual Growth Rate (CAGR) of 6.8% over the forecast period of 2025-2033. The adoption of cloud-based solutions is a dominant trend, offering scalability, accessibility, and advanced analytics for farmers. Local/web-based platforms also hold a substantial share, catering to specific needs and integration capabilities. Key drivers include the increasing need for enhanced crop yields, efficient resource management (water, fertilizers, pesticides), and the growing adoption of IoT and AI technologies in agriculture. The market is characterized by a strong emphasis on data-driven decision-making, enabling farmers to optimize their operations, reduce costs, and improve sustainability. Regulatory support for precision farming initiatives and the rising awareness among farmers about the economic and environmental benefits of these technologies further propel market growth.

Americas Precision Ag Software Industry Market Size (In Billion)

Several factors are shaping the competitive landscape and future trajectory of the Americas Precision Ag Software Market. While the market presents immense opportunities, certain restraints exist, such as the high initial investment costs associated with implementing precision agriculture technologies and the need for specialized skills to operate these sophisticated software solutions. However, these challenges are being mitigated by the continuous innovation from leading companies like Deere & Company, IBM Corporation, and Bayer CropScience AG, who are developing user-friendly and cost-effective solutions. Strategic collaborations and mergers are also becoming prevalent as companies seek to expand their product portfolios and geographical reach. The study period, spanning from 2019 to 2033, with a base year of 2025, highlights a sustained upward trend, indicating a mature yet dynamic market. The region's diverse agricultural landscape, encompassing major economies like the United States, Canada, and Brazil, further contributes to the market's substantial size and growth potential.

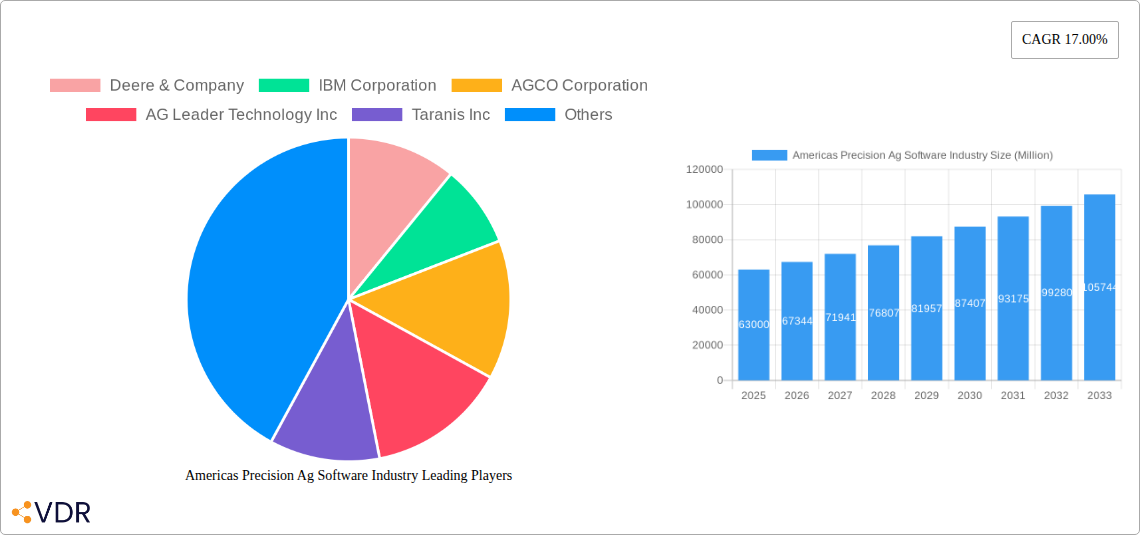

Americas Precision Ag Software Industry Company Market Share

Here is a compelling, SEO-optimized report description for the Americas Precision Ag Software Industry, designed for maximum visibility and engagement.

Report Title: Americas Precision Ag Software Industry: Market Size, Growth, Trends, and Forecast 2019-2033 | Key Players & Opportunities

Report Description:

Dive deep into the dynamic Americas Precision Ag Software Industry with this comprehensive report. Spanning the study period from 2019 to 2033, with a base year of 2025 and a detailed forecast from 2025 to 2033, this analysis delivers critical insights into market size, growth trajectories, and strategic opportunities. Explore the intricate landscape of precision agriculture software across North and South America, identifying key drivers, emerging trends, and dominant segments. This report is essential for agtech companies, software providers, investors, and policymakers seeking to understand and capitalize on the rapidly evolving precision agriculture market. Understand the parent and child market dynamics to gain a strategic advantage.

Americas Precision Ag Software Industry Market Dynamics & Structure

The Americas Precision Ag Software Industry is characterized by a moderately concentrated market, with key players like Deere & Company, IBM Corporation, and Trimble Inc. investing heavily in research and development to drive technological innovation. The adoption of advanced analytics, AI-powered insights, and IoT integration are pivotal innovation drivers, enabling farmers to optimize resource management, enhance crop yields, and reduce environmental impact. Regulatory frameworks, particularly concerning data privacy and sustainability initiatives, are increasingly influencing market development. Competitive product substitutes, such as traditional farm management software and manual data collection methods, are gradually being displaced by more sophisticated precision ag solutions. End-user demographics are shifting towards tech-savvy farmers and agricultural cooperatives embracing data-driven decision-making. Mergers and acquisitions (M&A) are a significant trend, with strategic consolidations aimed at expanding product portfolios and market reach. For instance, the acquisition of smaller specialized software providers by larger agricultural machinery or technology firms is prevalent.

- Market Concentration: Moderately concentrated with a few dominant players.

- Technological Innovation Drivers: AI, IoT, advanced analytics, satellite imagery integration.

- Regulatory Frameworks: Data privacy, sustainability mandates, government incentives for agtech adoption.

- Competitive Product Substitutes: Traditional farm management software, manual data logging, basic GPS guidance systems.

- End-User Demographics: Increasingly tech-literate farmers, large-scale agricultural enterprises, and cooperatives.

- M&A Trends: Strategic acquisitions for portfolio expansion and market consolidation.

Americas Precision Ag Software Industry Growth Trends & Insights

The Americas Precision Ag Software Industry is poised for substantial growth, driven by an escalating need for enhanced farm efficiency, sustainable practices, and increased food production to meet global demand. The market size is projected to experience a robust Compound Annual Growth Rate (CAGR) of approximately 15-18% during the forecast period of 2025–2033. This expansion is underpinned by a significant rise in the adoption rates of precision agriculture technologies, particularly among large-scale commercial farms and progressively smaller operations seeking to optimize their operations. Technological disruptions, including the proliferation of autonomous farming equipment, advanced sensor technologies for real-time data collection, and sophisticated predictive analytics, are fundamentally reshaping agricultural practices. Consumer behavior shifts towards greater demand for sustainably produced food and traceability are also compelling farmers to invest in precision ag solutions. Market penetration is expected to deepen significantly as the cost-effectiveness and tangible benefits of these software solutions become more evident to a wider range of agricultural stakeholders. The integration of machine learning algorithms for crop health monitoring, yield prediction, and pest/disease outbreak forecasting is a key trend accelerating adoption. Furthermore, the growing emphasis on precision irrigation and nutrient management, enabled by real-time data analytics, is contributing to resource optimization and reduced environmental footprint.

Dominant Regions, Countries, or Segments in Americas Precision Ag Software Industry

The United States is the dominant country within the Americas Precision Ag Software Industry, exhibiting the highest market share and growth potential. This dominance is fueled by a combination of factors, including a highly developed agricultural sector, significant investment in agricultural research and development, and strong government support for technological innovation in farming. The country's large agricultural output and the pressing need for efficiency gains in crop production make precision agriculture software an indispensable tool for farmers. Economic policies encouraging the adoption of advanced farming technologies, coupled with robust infrastructure for internet connectivity and data management, further solidify the US's leading position. The country's advanced technological ecosystem fosters the development and deployment of cutting-edge precision ag solutions, from sophisticated farm management platforms to specialized analytics software.

Within the Type segmentation, Cloud-based precision ag software is emerging as the most dominant segment, projected to outpace local/web-based solutions significantly. Cloud-based platforms offer superior scalability, accessibility from anywhere, and simplified data management and integration, which are crucial for modern farming operations. The ability to process vast amounts of data from various sources – including sensors, drones, and machinery – in real-time on cloud servers provides unparalleled analytical capabilities. This model also allows for seamless updates and continuous improvement of software features, ensuring users always have access to the latest innovations. The reduced upfront IT infrastructure costs and the subscription-based revenue model make cloud solutions more accessible to a broader range of agricultural businesses.

- Dominant Country: United States

- Key Drivers: Advanced agricultural sector, R&D investment, government support, extensive agricultural infrastructure, high internet penetration.

- Market Share & Growth Potential: Highest market share and robust growth projections due to early adoption and continuous innovation.

- Dominant Segment (Type): Cloud-based Precision Ag Software

- Key Drivers: Scalability, remote accessibility, simplified data management, real-time processing, reduced IT costs, continuous updates.

- Market Share & Growth Potential: Significant market share and projected to grow faster than local/web-based solutions due to its inherent advantages for data-intensive farming.

Americas Precision Ag Software Industry Product Landscape

The Americas Precision Ag Software Industry is witnessing a surge in product innovations focused on intelligent automation, predictive analytics, and enhanced user experience. Software solutions are increasingly integrating AI and machine learning to provide actionable insights for crop monitoring, yield prediction, pest and disease management, and optimized resource allocation (water, fertilizers). Applications span the entire agricultural value chain, from farm planning and soil mapping to in-season management and post-harvest analysis. Notable advancements include sophisticated drone-based imagery analysis for early detection of crop stress and variable rate application technologies that precisely deliver inputs only where and when needed. Performance metrics for these software are evaluated based on their ability to improve yield by 10-25%, reduce input costs by 15-30%, and enhance operational efficiency, ultimately contributing to increased profitability and sustainability for farmers.

Key Drivers, Barriers & Challenges in Americas Precision Ag Software Industry

Key Drivers:

The primary forces propelling the Americas Precision Ag Software Industry include the escalating global demand for food, the imperative for sustainable agricultural practices to mitigate environmental impact, and the need for increased farm profitability through optimized resource utilization. Technological advancements in data analytics, IoT, and AI are creating more sophisticated and accessible software solutions. Government initiatives and subsidies promoting agtech adoption also play a crucial role.

Barriers & Challenges:

Significant challenges include the high initial cost of some precision ag technologies and software subscriptions, which can be a barrier for smallholder farmers. Issues related to data connectivity in rural areas, data security and privacy concerns, and the need for farmer education and training on complex software systems also present hurdles. The interoperability of different hardware and software systems, as well as regulatory complexities surrounding data ownership and usage, are ongoing challenges. Supply chain disruptions for hardware components can indirectly impact software implementation timelines.

Emerging Opportunities in Americas Precision Ag Software Industry

Emerging opportunities in the Americas Precision Ag Software Industry lie in the development of hyper-localized weather prediction models integrated with crop management, AI-driven pest and disease outbreak forecasting for proactive intervention, and the expansion of farm-to-fork traceability solutions leveraging blockchain technology. Untapped markets include smaller farms in Latin America with increasing internet penetration and a growing awareness of precision agriculture benefits. Innovative applications in areas like carbon farming and precision livestock management are also presenting significant potential. Evolving consumer preferences for transparent and sustainable food production are creating demand for software that can provide robust proof of sustainable practices.

Growth Accelerators in the Americas Precision Ag Software Industry Industry

Catalysts driving long-term growth in the Americas Precision Ag Software Industry include significant ongoing investments in AI and machine learning research, leading to more intelligent and predictive capabilities within software platforms. Strategic partnerships between software developers, hardware manufacturers, and agricultural input providers are creating integrated solutions that enhance value for farmers. Market expansion strategies targeting emerging agricultural economies in Latin America, coupled with the increasing affordability of cloud-based solutions, are further accelerating growth. The continuous development of user-friendly interfaces and accessible training programs will also be crucial for wider adoption.

Key Players Shaping the Americas Precision Ag Software Industry Market

- Deere & Company

- IBM Corporation

- AGCO Corporation

- AG Leader Technology Inc

- Taranis Inc

- AGJunction Inc

- Harris Geospatial Solutions Inc

- Trimble Inc

- AgDNA Technologies Inc

- Granular Inc

- Bayer CropScience AG

Notable Milestones in Americas Precision Ag Software Industry Sector

- 2019: Increased adoption of AI for yield prediction and resource optimization.

- 2020: Launch of advanced drone analytics platforms for detailed crop health monitoring.

- 2021: Significant mergers and acquisitions aimed at consolidating market offerings and expanding technological capabilities.

- 2022: Growing emphasis on cloud-based solutions and data integration platforms for enhanced farm management.

- 2023: Increased focus on sustainability reporting and carbon farming solutions within precision ag software.

- 2024: Development of more integrated IoT ecosystems for real-time data flow from field to farm office.

In-Depth Americas Precision Ag Software Industry Market Outlook

The future outlook for the Americas Precision Ag Software Industry is exceptionally bright, driven by the ongoing digital transformation of agriculture. Growth accelerators such as advanced AI-driven predictive analytics, seamless integration of IoT devices, and expansion into underserved markets will continue to fuel market expansion. Strategic partnerships and the increasing demand for sustainable and traceable food production will further solidify the industry's upward trajectory. Continued innovation in user-friendly interfaces and accessible training programs will ensure broader adoption across all farm sizes. The market is well-positioned for sustained high growth, offering significant opportunities for technology providers and investors alike.

Americas Precision Ag Software Industry Segmentation

-

1. Type

- 1.1. Cloud

- 1.2. Local/Web-based

Americas Precision Ag Software Industry Segmentation By Geography

-

1. Americas

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Brazil

- 1.5. Argentina

- 1.6. Chile

- 1.7. Colombia

- 1.8. Peru

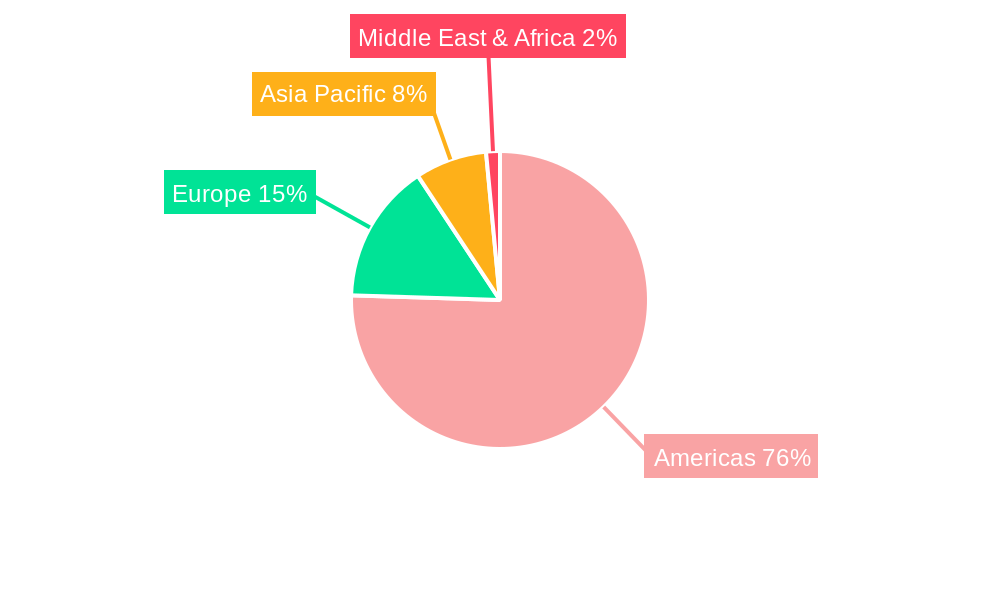

Americas Precision Ag Software Industry Regional Market Share

Geographic Coverage of Americas Precision Ag Software Industry

Americas Precision Ag Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 ; Adoption of Precision Technology in the Sustainable and Efficient Agriculture Sector in Americas; Shortage of Farm labor

- 3.2.2 Along with Increasing Farm Size Across North America

- 3.3. Market Restrains

- 3.3.1. ; High Capital Cost and Complexity Regarding System Upgrades

- 3.4. Market Trends

- 3.4.1. Cloud-based Precision Farming Software is Expected to Grow Significantly

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Americas Precision Ag Software Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Cloud

- 5.1.2. Local/Web-based

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Americas

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Deere & Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AGCO Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 AG Leader Technology Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Taranis Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 AGJunction Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Harris Geospatial Solutions Inc *List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Trimble Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 AgDNA Technologies Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Granular Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Bayer CropScience AG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Deere & Company

List of Figures

- Figure 1: Americas Precision Ag Software Industry Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Americas Precision Ag Software Industry Share (%) by Company 2025

List of Tables

- Table 1: Americas Precision Ag Software Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Americas Precision Ag Software Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Americas Precision Ag Software Industry Revenue undefined Forecast, by Type 2020 & 2033

- Table 4: Americas Precision Ag Software Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: United States Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Canada Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 7: Mexico Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Brazil Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Argentina Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Chile Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Colombia Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Peru Americas Precision Ag Software Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Americas Precision Ag Software Industry?

The projected CAGR is approximately 6.8%.

2. Which companies are prominent players in the Americas Precision Ag Software Industry?

Key companies in the market include Deere & Company, IBM Corporation, AGCO Corporation, AG Leader Technology Inc, Taranis Inc, AGJunction Inc, Harris Geospatial Solutions Inc *List Not Exhaustive, Trimble Inc, AgDNA Technologies Inc, Granular Inc, Bayer CropScience AG.

3. What are the main segments of the Americas Precision Ag Software Industry?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Adoption of Precision Technology in the Sustainable and Efficient Agriculture Sector in Americas; Shortage of Farm labor. Along with Increasing Farm Size Across North America.

6. What are the notable trends driving market growth?

Cloud-based Precision Farming Software is Expected to Grow Significantly.

7. Are there any restraints impacting market growth?

; High Capital Cost and Complexity Regarding System Upgrades.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Americas Precision Ag Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Americas Precision Ag Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Americas Precision Ag Software Industry?

To stay informed about further developments, trends, and reports in the Americas Precision Ag Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence