Key Insights

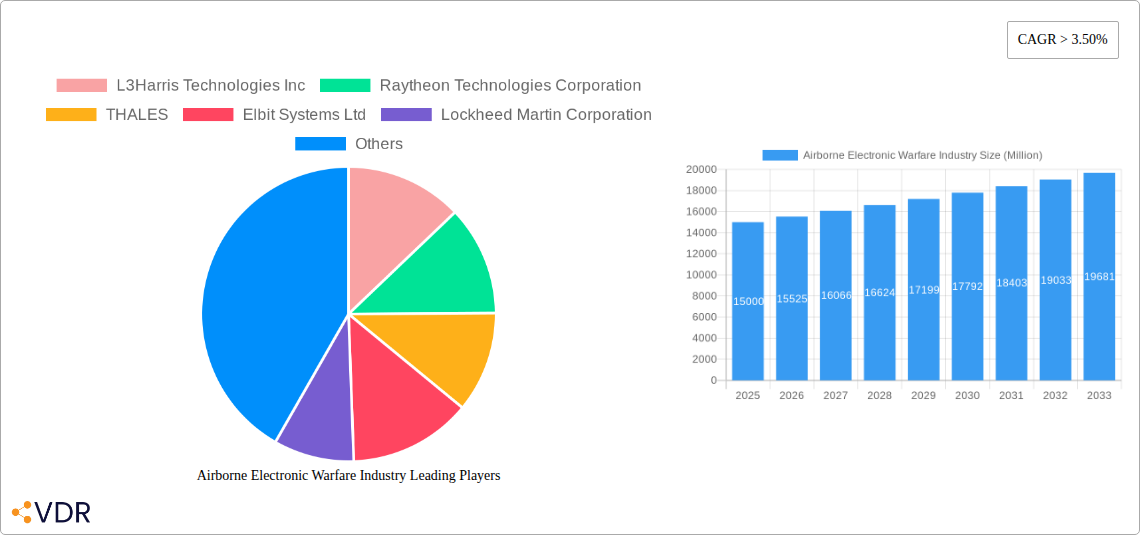

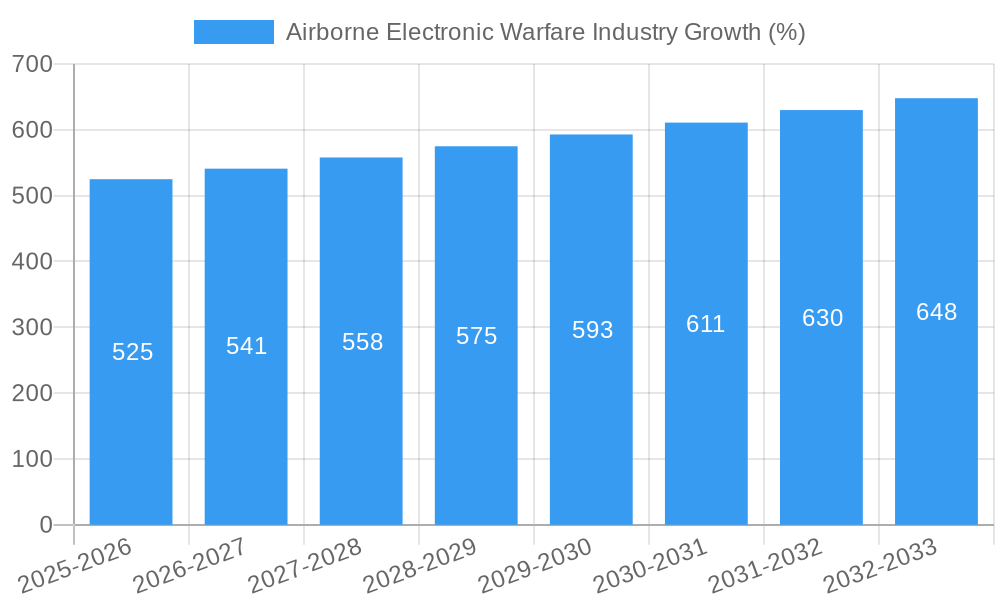

The Airborne Electronic Warfare (AEW) market is experiencing robust growth, driven by escalating geopolitical tensions, modernization of military fleets, and the increasing demand for advanced electronic warfare capabilities. The market, estimated at approximately $XX million in 2025 (assuming a reasonable market size based on industry reports and the provided CAGR of >3.50%), is projected to witness a compound annual growth rate (CAGR) exceeding 3.5% from 2025 to 2033. This growth is fueled by several key factors. The proliferation of unmanned aerial vehicles (UAVs) presents significant opportunities for integrating sophisticated electronic warfare systems, enhancing surveillance, and disrupting enemy communications. Furthermore, the development of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), is enabling more effective signal processing and threat detection, improving the overall effectiveness of AEW systems. The increasing integration of AEW systems into broader defense networks and platforms is also a critical driver.

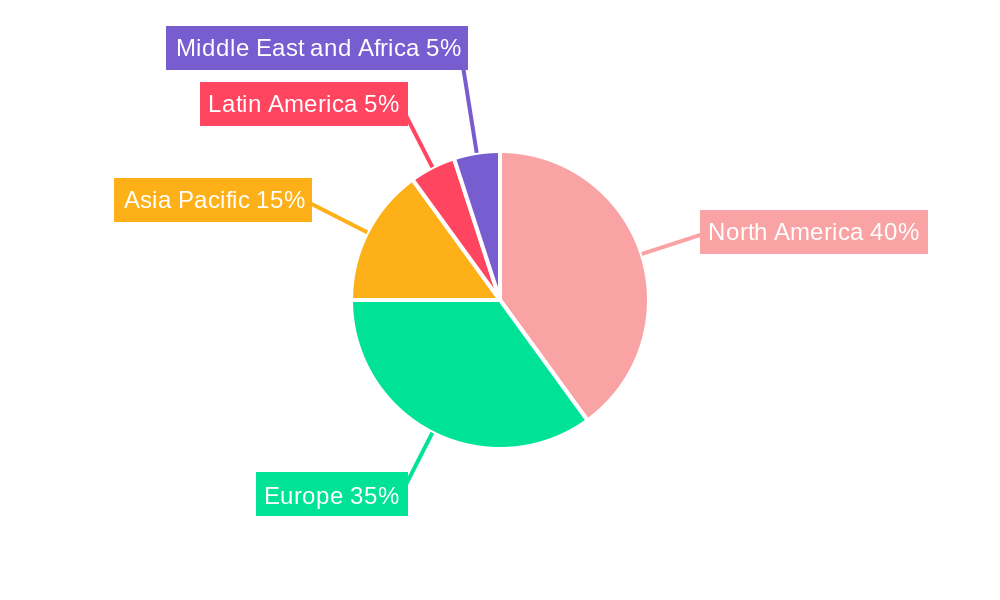

However, the market also faces certain challenges. High development and procurement costs associated with AEW systems can limit adoption, particularly in smaller nations with constrained defense budgets. Stringent regulatory approvals and lengthy development cycles also pose hurdles. Furthermore, the continuous evolution of electronic warfare technologies necessitates continuous upgrades and adaptations, creating ongoing maintenance and operational costs. The segmentation of the market, with manned and unmanned aircraft platforms and diverse capabilities (electronic attack, protection, and support), offers opportunities for specialized players, while also presenting complexities in terms of market analysis and forecasting. The regional landscape is largely dominated by North America and Europe, but the Asia-Pacific region is anticipated to witness significant growth as nations invest in modernizing their defense capabilities. The competitive landscape is characterized by established players like Lockheed Martin, Raytheon, and Thales, alongside regional players such as Elbit Systems and ASELSAN. These companies are actively engaged in research and development to maintain their market share and capture emerging opportunities.

Airborne Electronic Warfare Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Airborne Electronic Warfare (AEW) industry, encompassing market dynamics, growth trends, regional dominance, product landscapes, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the 2025-2033 forecast period. The parent market is the broader defense electronics sector, while the child market is specifically AEW systems for manned and unmanned aircraft. The total market size in 2025 is estimated at xx Million USD.

Airborne Electronic Warfare Industry Market Dynamics & Structure

The Airborne Electronic Warfare market is characterized by high market concentration among major players, with significant technological advancements driving innovation. Stringent regulatory frameworks and the evolving geopolitical landscape influence market dynamics. The market is also witnessing an increase in mergers and acquisitions (M&A) activities aimed at expanding capabilities and market share. Competitive product substitutes, such as advanced radar systems, also impact market growth. End-user demographics, predominantly defense forces and government agencies, shape the demand for sophisticated AEW solutions.

- Market Concentration: The top 5 players account for approximately xx% of the global market share in 2025.

- Technological Innovation Drivers: Advances in AI, machine learning, and software-defined radio are key drivers.

- Regulatory Frameworks: Export controls and national security regulations significantly impact market access.

- M&A Activity: The number of M&A deals in the sector has increased by xx% between 2019 and 2024.

- Innovation Barriers: High R&D costs and the complexity of integrating new technologies are significant hurdles.

Airborne Electronic Warfare Industry Growth Trends & Insights

The Airborne Electronic Warfare market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to grow at a CAGR of xx% during the forecast period (2025-2033). This growth is driven by increasing defense budgets globally, the rising adoption of unmanned aerial vehicles (UAVs) equipped with AEW systems, and the need for advanced electronic warfare capabilities to counter evolving threats. Technological advancements, such as the development of advanced electronic attack and protection systems, are also contributing factors. The market penetration of AEW systems in both manned and unmanned platforms continues to increase, further fueling market expansion. Shifts in consumer behavior, focusing on agile and adaptable systems, have led to an increased demand for software-defined solutions.

Dominant Regions, Countries, or Segments in Airborne Electronic Warfare Industry

North America currently dominates the Airborne Electronic Warfare market, followed by Europe and Asia-Pacific. Within the segments, the manned aircraft segment holds a larger market share, though unmanned aircraft systems (UAS) are witnessing exponential growth due to their cost-effectiveness and versatility. Electronic attack capabilities are currently the leading segment in terms of revenue, followed by electronic protection and electronic support.

- Key Drivers for North America: Strong defense budgets, technological leadership, and a robust domestic aerospace industry.

- Key Drivers for Europe: Significant defense spending by various European nations and a focus on collaborative defense initiatives.

- Key Drivers for Asia-Pacific: Rising defense budgets in several countries, and increased focus on modernizing their air forces.

- Manned Aircraft Segment: High demand for advanced electronic warfare systems on existing and next-generation fighter jets.

- Unmanned Aircraft Segment: Rapid technological advancement and increasing adoption of UAS across various defense applications.

Airborne Electronic Warfare Industry Product Landscape

The Airborne Electronic Warfare product landscape is marked by a wide range of systems, including sophisticated electronic attack pods, integrated electronic warfare suites for manned aircraft, and miniaturized systems for UAVs. These systems vary in capabilities, ranging from simple jamming devices to advanced self-protection systems. Recent product innovations include software-defined radios, AI-powered threat detection systems, and improved countermeasure capabilities. Key features include enhanced situational awareness, increased survivability, and greater effectiveness against evolving threats. The unique selling propositions often include customization options, modularity, and ease of integration into existing aircraft platforms.

Key Drivers, Barriers & Challenges in Airborne Electronic Warfare Industry

Key Drivers: Increased defense spending globally, the growing adoption of UAVs, technological advancements in electronic warfare, and the need for improved situational awareness in complex operational environments. The development of AI-based threat detection and response systems is driving innovation.

Challenges: High R&D costs, stringent regulatory hurdles, supply chain disruptions, and intense competition among established players are major challenges. The complexity of system integration and the need for interoperability between different systems add to the overall complexities. Supply chain issues can cause delays and increased costs, particularly for specialized components.

Emerging Opportunities in Airborne Electronic Warfare Industry

The growth of UAVs presents significant opportunities. Increasing demand for cyber warfare capabilities and the development of AI-driven EW systems present untapped markets. Miniaturization of AEW systems for small drones and other platforms represents a significant opportunity for innovative companies.

Growth Accelerators in the Airborne Electronic Warfare Industry Industry

Technological breakthroughs in areas such as AI, machine learning, and software-defined radio are accelerating market growth. Strategic partnerships between defense contractors and technology companies further enhance capabilities and market penetration. Expanding market opportunities in emerging economies provide further catalysts for growth.

Key Players Shaping the Airborne Electronic Warfare Industry Market

- L3Harris Technologies Inc

- Raytheon Technologies Corporation

- THALES

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Terma Grou

- ASELSAN AS

- Israel Aerospace Industries Ltd

- Leonardo S p A

- BAE Systems plc

- Northrop Grumman Corporation

- Saab AB

Notable Milestones in Airborne Electronic Warfare Industry Sector

- March 2022: BAE Systems plc launched its versatile Storm electronic warfare modules, enhancing offensive and defensive capabilities for combat platforms.

- November 2021: Lockheed Martin Corporation received a USD 585 million contract for F-35 ASQ-239 electronic warfare system integration.

In-Depth Airborne Electronic Warfare Industry Market Outlook

The Airborne Electronic Warfare market is poised for robust growth over the forecast period driven by continuous technological advancements, increasing defense spending, and the expanding adoption of UAVs across diverse military applications. Strategic partnerships and collaborations within the industry are expected to fuel innovation and accelerate the development of advanced AEW systems, leading to significant market expansion and lucrative opportunities for key players.

Airborne Electronic Warfare Industry Segmentation

-

1. Capability

- 1.1. Electronic Attack

- 1.2. Electronic Protection

- 1.3. Electronic Support

-

2. Type

- 2.1. Manned Aircraft

- 2.2. Unmanned Aircraft

Airborne Electronic Warfare Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Israel

- 5.4. Rest of Middle East and Africa

Airborne Electronic Warfare Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of > 3.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. Unmanned Aircraft Segment to Witness Rapid Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Capability

- 5.1.1. Electronic Attack

- 5.1.2. Electronic Protection

- 5.1.3. Electronic Support

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Manned Aircraft

- 5.2.2. Unmanned Aircraft

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Capability

- 6. North America Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Capability

- 6.1.1. Electronic Attack

- 6.1.2. Electronic Protection

- 6.1.3. Electronic Support

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Manned Aircraft

- 6.2.2. Unmanned Aircraft

- 6.1. Market Analysis, Insights and Forecast - by Capability

- 7. Europe Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Capability

- 7.1.1. Electronic Attack

- 7.1.2. Electronic Protection

- 7.1.3. Electronic Support

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Manned Aircraft

- 7.2.2. Unmanned Aircraft

- 7.1. Market Analysis, Insights and Forecast - by Capability

- 8. Asia Pacific Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Capability

- 8.1.1. Electronic Attack

- 8.1.2. Electronic Protection

- 8.1.3. Electronic Support

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Manned Aircraft

- 8.2.2. Unmanned Aircraft

- 8.1. Market Analysis, Insights and Forecast - by Capability

- 9. Latin America Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Capability

- 9.1.1. Electronic Attack

- 9.1.2. Electronic Protection

- 9.1.3. Electronic Support

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Manned Aircraft

- 9.2.2. Unmanned Aircraft

- 9.1. Market Analysis, Insights and Forecast - by Capability

- 10. Middle East and Africa Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Capability

- 10.1.1. Electronic Attack

- 10.1.2. Electronic Protection

- 10.1.3. Electronic Support

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Manned Aircraft

- 10.2.2. Unmanned Aircraft

- 10.1. Market Analysis, Insights and Forecast - by Capability

- 11. North America Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 Germany

- 12.1.3 France

- 12.1.4 Russia

- 12.1.5 Rest of Europe

- 13. Asia Pacific Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Rest of Asia Pacific

- 14. Latin America Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Airborne Electronic Warfare Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 United Arab Emirates

- 15.1.3 Israel

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 L3Harris Technologies Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Raytheon Technologies Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 THALES

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Elbit Systems Ltd

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Lockheed Martin Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Terma Grou

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 ASELSAN AS

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Israel Aerospace Industries Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Leonardo S p A

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 BAE Systems plc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Northrop Grumman Corporation

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Saab AB

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Global Airborne Electronic Warfare Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Airborne Electronic Warfare Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Airborne Electronic Warfare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Airborne Electronic Warfare Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Airborne Electronic Warfare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Airborne Electronic Warfare Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Airborne Electronic Warfare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Airborne Electronic Warfare Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Airborne Electronic Warfare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Airborne Electronic Warfare Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Airborne Electronic Warfare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Airborne Electronic Warfare Industry Revenue (Million), by Capability 2024 & 2032

- Figure 13: North America Airborne Electronic Warfare Industry Revenue Share (%), by Capability 2024 & 2032

- Figure 14: North America Airborne Electronic Warfare Industry Revenue (Million), by Type 2024 & 2032

- Figure 15: North America Airborne Electronic Warfare Industry Revenue Share (%), by Type 2024 & 2032

- Figure 16: North America Airborne Electronic Warfare Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Airborne Electronic Warfare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Airborne Electronic Warfare Industry Revenue (Million), by Capability 2024 & 2032

- Figure 19: Europe Airborne Electronic Warfare Industry Revenue Share (%), by Capability 2024 & 2032

- Figure 20: Europe Airborne Electronic Warfare Industry Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe Airborne Electronic Warfare Industry Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe Airborne Electronic Warfare Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Airborne Electronic Warfare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Airborne Electronic Warfare Industry Revenue (Million), by Capability 2024 & 2032

- Figure 25: Asia Pacific Airborne Electronic Warfare Industry Revenue Share (%), by Capability 2024 & 2032

- Figure 26: Asia Pacific Airborne Electronic Warfare Industry Revenue (Million), by Type 2024 & 2032

- Figure 27: Asia Pacific Airborne Electronic Warfare Industry Revenue Share (%), by Type 2024 & 2032

- Figure 28: Asia Pacific Airborne Electronic Warfare Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Airborne Electronic Warfare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Airborne Electronic Warfare Industry Revenue (Million), by Capability 2024 & 2032

- Figure 31: Latin America Airborne Electronic Warfare Industry Revenue Share (%), by Capability 2024 & 2032

- Figure 32: Latin America Airborne Electronic Warfare Industry Revenue (Million), by Type 2024 & 2032

- Figure 33: Latin America Airborne Electronic Warfare Industry Revenue Share (%), by Type 2024 & 2032

- Figure 34: Latin America Airborne Electronic Warfare Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Airborne Electronic Warfare Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Airborne Electronic Warfare Industry Revenue (Million), by Capability 2024 & 2032

- Figure 37: Middle East and Africa Airborne Electronic Warfare Industry Revenue Share (%), by Capability 2024 & 2032

- Figure 38: Middle East and Africa Airborne Electronic Warfare Industry Revenue (Million), by Type 2024 & 2032

- Figure 39: Middle East and Africa Airborne Electronic Warfare Industry Revenue Share (%), by Type 2024 & 2032

- Figure 40: Middle East and Africa Airborne Electronic Warfare Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Airborne Electronic Warfare Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Capability 2019 & 2032

- Table 3: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United Kingdom Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Russia Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 15: China Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: India Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: South Korea Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Asia Pacific Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Mexico Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Brazil Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Rest of Latin America Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 25: Saudi Arabia Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United Arab Emirates Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Israel Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Capability 2019 & 2032

- Table 30: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 31: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Capability 2019 & 2032

- Table 35: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United Kingdom Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Russia Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Capability 2019 & 2032

- Table 43: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 44: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Korea Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Asia Pacific Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Capability 2019 & 2032

- Table 51: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 52: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Mexico Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Brazil Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Latin America Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Capability 2019 & 2032

- Table 57: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 58: Global Airborne Electronic Warfare Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Saudi Arabia Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: United Arab Emirates Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Israel Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Rest of Middle East and Africa Airborne Electronic Warfare Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Airborne Electronic Warfare Industry?

The projected CAGR is approximately > 3.50%.

2. Which companies are prominent players in the Airborne Electronic Warfare Industry?

Key companies in the market include L3Harris Technologies Inc, Raytheon Technologies Corporation, THALES, Elbit Systems Ltd, Lockheed Martin Corporation, Terma Grou, ASELSAN AS, Israel Aerospace Industries Ltd, Leonardo S p A, BAE Systems plc, Northrop Grumman Corporation, Saab AB.

3. What are the main segments of the Airborne Electronic Warfare Industry?

The market segments include Capability, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

Unmanned Aircraft Segment to Witness Rapid Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

March 2022: BAE Systems plc launched its versatile Storm electronic warfare modules designed to provide customized, state-of-the-art offensive and defense electronic warfare mission systems for combat platforms for the broader United States and allied fleets. Storm electronic warfare modules use a proven common core architecture to accelerate the delivery of software-based electronic warfare capabilities, providing warfighters with the situational awareness, survivability, and electromagnetic capabilities needed for today's complex missions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Airborne Electronic Warfare Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Airborne Electronic Warfare Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Airborne Electronic Warfare Industry?

To stay informed about further developments, trends, and reports in the Airborne Electronic Warfare Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence