Key Insights

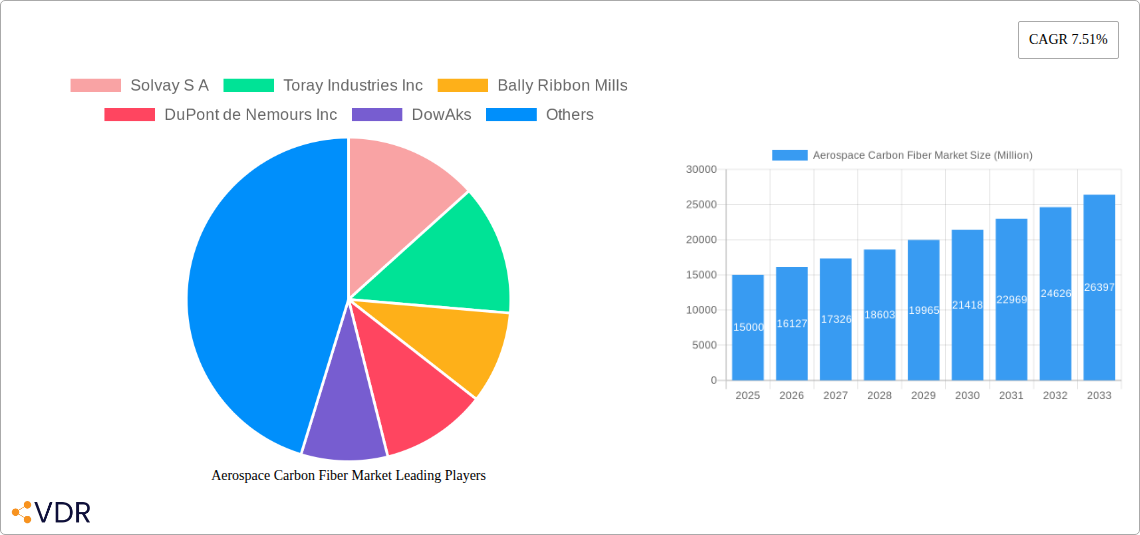

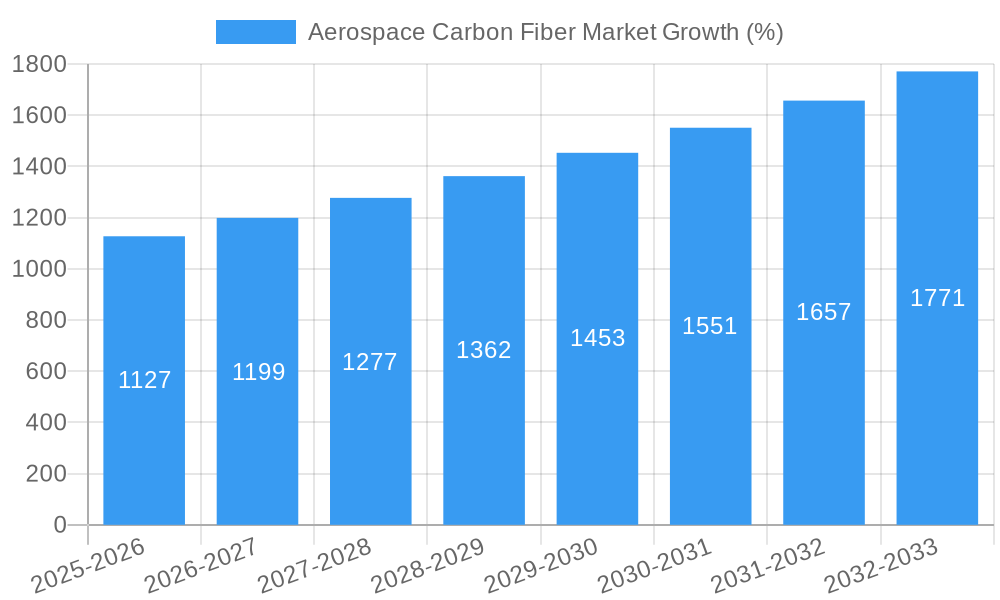

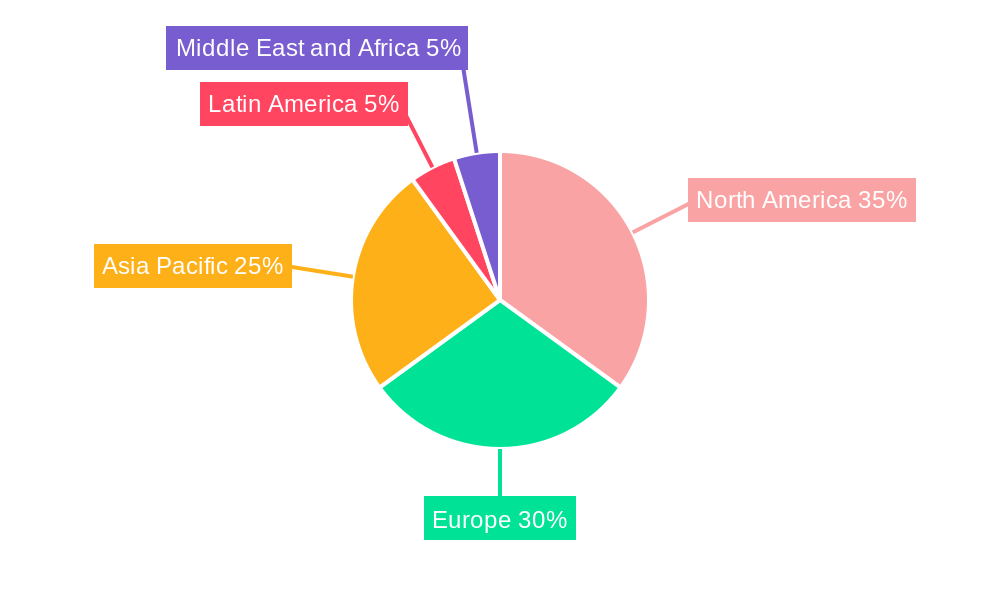

The global aerospace carbon fiber market is experiencing robust growth, driven by the increasing demand for lightweight and high-strength materials in the aerospace industry. The market's 7.51% CAGR from 2019-2024 indicates a significant upward trajectory, projected to continue into the forecast period (2025-2033). Key drivers include the rising adoption of fuel-efficient aircraft designs, stringent regulatory requirements for emissions reduction, and the ongoing expansion of the commercial and military aviation sectors. The increasing preference for composite materials over traditional metals, offering superior strength-to-weight ratios and enhanced fuel efficiency, further fuels market expansion. Segmentation analysis reveals that commercial fixed-wing aircraft currently dominate the application segment, reflecting the significant number of new aircraft deliveries anticipated in the coming years. However, the military fixed-wing and rotorcraft segments are poised for notable growth, fueled by increasing military spending and technological advancements in defense applications. Leading players like Solvay SA, Toray Industries Inc., and Hexcel Corporation are investing heavily in R&D to develop innovative carbon fiber solutions, fostering competition and driving innovation within the market. Geographic analysis shows a strong presence in North America and Europe, driven by established aerospace manufacturing hubs and technological expertise. However, the Asia-Pacific region is expected to witness considerable growth, fueled by rising domestic aircraft production and increasing investments in aerospace infrastructure.

The market's growth, however, faces certain restraints. High production costs associated with carbon fiber manufacturing, along with the complexities involved in processing and integrating these materials into aircraft structures, pose significant challenges. Furthermore, the fluctuating prices of raw materials and the potential for supply chain disruptions can impact the market's stability. Despite these constraints, the long-term outlook for the aerospace carbon fiber market remains positive, driven by technological advancements, evolving regulatory landscapes, and the ongoing focus on fuel efficiency and performance enhancement within the aerospace industry. The market is likely to witness further consolidation among key players, with a focus on strategic partnerships and collaborations to overcome the challenges and capitalize on the growth opportunities. A detailed market sizing analysis, factoring in CAGR and considering the growth of individual segments and regions, suggests a total market value exceeding $X Billion by 2033 (Note: A precise figure requires specific missing market size data for 2025 to allow accurate calculation from the CAGR and other provided information).

Aerospace Carbon Fiber Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Aerospace Carbon Fiber Market, encompassing market dynamics, growth trends, regional dominance, product landscape, and key players. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an indispensable resource for industry professionals, investors, and strategic decision-makers. The report covers the parent market of advanced materials and the child market of aerospace components. The market size is expected to reach xx Million units by 2033.

Aerospace Carbon Fiber Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory influences, and market consolidation trends. The report delves into the factors shaping the market's structure, including:

Market Concentration: The aerospace carbon fiber market exhibits a moderately concentrated structure, with key players holding significant market share. The top five companies account for approximately xx% of the global market, showcasing both collaborative and competitive dynamics. Further analysis provides detailed market share breakdowns by company.

Technological Innovation: Ongoing R&D efforts focus on enhancing fiber strength, improving processing techniques, and developing new composite materials. The adoption of advanced manufacturing processes, such as automated fiber placement, is driving efficiency and reducing production costs.

Regulatory Frameworks: Stringent safety and quality standards governing aerospace components significantly impact the market. Compliance requirements necessitate robust quality control measures and certification processes, influencing the market's operational aspects.

Competitive Product Substitutes: While carbon fiber composites dominate, alternative materials such as aluminum alloys and titanium alloys continue to compete, particularly in applications requiring specific properties. The report analyzes the competitive advantages and limitations of each material.

End-User Demographics: The primary end-users are commercial and military aircraft manufacturers, as well as rotorcraft producers. The report examines the purchasing patterns, procurement strategies, and technological preferences of these end-users.

M&A Trends: The aerospace carbon fiber industry has witnessed several mergers and acquisitions in recent years, driven by a need for greater scale and technological capabilities. The report quantifies M&A activity, examining the volume of deals and their strategic implications. The analysis includes an assessment of the potential for further consolidation.

Aerospace Carbon Fiber Market Growth Trends & Insights

This section provides a detailed analysis of the market's growth trajectory, leveraging extensive data analysis to reveal key trends and insights. The report examines market size evolution (historical and projected), adoption rates across different aircraft segments, the impact of technological disruptions, and shifts in consumer behavior affecting the market. Key metrics such as compound annual growth rate (CAGR) and market penetration rates provide quantitative insights into market expansion. Specific factors influencing growth, including government regulations, environmental concerns, and advancements in lightweighting technologies, are highlighted. The anticipated growth trajectory is analyzed based on various macroeconomic and industry-specific trends.

Dominant Regions, Countries, or Segments in Aerospace Carbon Fiber Market

This section identifies the leading regions, countries, and application segments driving market growth. The report provides a granular analysis of each segment, emphasizing the factors responsible for its dominance.

Commercial Fixed-wing Aircraft: This segment represents the largest share of the market, driven by the increasing demand for fuel-efficient aircraft and the focus on lightweighting to improve aircraft performance. The report delves into the regional breakdown of this segment, highlighting key drivers such as economic growth, airline expansion, and government policies.

Military Fixed-wing Aircraft: This segment exhibits strong growth potential, primarily due to ongoing defense modernization programs and advancements in military aircraft technology. The report analyzes regional variations, discussing the role of defense budgets and geopolitical factors.

Rotorcraft: This segment shows steady growth, driven by increasing demand for helicopters in various sectors, including emergency medical services, search and rescue, and transportation. The analysis explores factors impacting this sector, such as regulatory changes and technological advancements in rotorcraft design.

Key drivers of regional dominance are explored, including economic conditions, technological infrastructure, and government support for the aerospace industry. The growth potential of each region is assessed based on specific market factors.

Aerospace Carbon Fiber Market Product Landscape

The aerospace carbon fiber market features a diverse range of products, each tailored to meet specific application requirements. Innovations in fiber architecture, resin systems, and manufacturing processes have led to significant improvements in the mechanical properties and performance of carbon fiber composites. These advancements allow for lighter and stronger components, contributing to enhanced aircraft efficiency and safety. Unique selling propositions include high strength-to-weight ratios, fatigue resistance, and design flexibility.

Key Drivers, Barriers & Challenges in Aerospace Carbon Fiber Market

Key Drivers: The market is primarily driven by the increasing demand for lightweight and fuel-efficient aircraft, stringent environmental regulations promoting carbon emission reduction, and ongoing advancements in carbon fiber composite technology.

Challenges and Restraints: Supply chain complexities, including raw material sourcing and manufacturing capacity constraints, pose significant challenges. High production costs and the need for skilled labor also restrict market growth. Furthermore, stringent quality control requirements and regulatory hurdles add to the complexities. The competitive landscape is intense, with established players and new entrants vying for market share, influencing pricing and innovation strategies.

Emerging Opportunities in Aerospace Carbon Fiber Market

Emerging opportunities lie in the development of advanced carbon fiber composites with enhanced properties, including improved damage tolerance and recyclability. The exploration of new applications for carbon fiber in aerospace, such as interior components and engine parts, presents further growth potential. The expansion of the market into developing economies offers significant untapped opportunities.

Growth Accelerators in the Aerospace Carbon Fiber Market Industry

Long-term growth will be fueled by sustained investment in R&D, leading to breakthroughs in material science and manufacturing processes. Strategic partnerships between material suppliers and aircraft manufacturers will play a crucial role in streamlining the supply chain and fostering innovation. Furthermore, market expansion into emerging aerospace sectors, such as urban air mobility, will create significant growth opportunities.

Key Players Shaping the Aerospace Carbon Fiber Market Market

- Solvay S A

- Toray Industries Inc

- Bally Ribbon Mills

- DuPont de Nemours Inc

- DowAks

- Hexcel Corporation

- TEIJIN LIMITED

- SGL Carbon SE

- Mitsubishi Chemical Group

- BGF Industries Inc

Notable Milestones in Aerospace Carbon Fiber Market Sector

- March 2022: Solvay and Wichita State University's NIAR partnered on research and materials development for aviation.

- March 2023: SGL Carbon launched the new SIGRAFIL T50-4.9/235 carbon fiber for high-strength pressure vessels.

In-Depth Aerospace Carbon Fiber Market Market Outlook

The future of the aerospace carbon fiber market is promising, driven by sustained demand for lightweight and high-performance materials in the aerospace industry. Technological advancements and strategic collaborations will continue to drive innovation and efficiency, while expansion into new markets and applications will unlock substantial growth potential. The market is poised for significant expansion over the forecast period, presenting attractive opportunities for existing players and new entrants.

Aerospace Carbon Fiber Market Segmentation

-

1. Application

- 1.1. Commercial Fixed-wing Aircraft

- 1.2. Military Fixed-wing Aircraft

- 1.3. Rotorcraft

Aerospace Carbon Fiber Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Italy

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Mexico

- 4.2. Brazil

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. South Africa

- 5.4. Rest of Middle East and Africa

Aerospace Carbon Fiber Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.51% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Fixed-wing Aircraft Segment is Expected to Dominate the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Fixed-wing Aircraft

- 5.1.2. Military Fixed-wing Aircraft

- 5.1.3. Rotorcraft

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial Fixed-wing Aircraft

- 6.1.2. Military Fixed-wing Aircraft

- 6.1.3. Rotorcraft

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial Fixed-wing Aircraft

- 7.1.2. Military Fixed-wing Aircraft

- 7.1.3. Rotorcraft

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial Fixed-wing Aircraft

- 8.1.2. Military Fixed-wing Aircraft

- 8.1.3. Rotorcraft

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial Fixed-wing Aircraft

- 9.1.2. Military Fixed-wing Aircraft

- 9.1.3. Rotorcraft

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Commercial Fixed-wing Aircraft

- 10.1.2. Military Fixed-wing Aircraft

- 10.1.3. Rotorcraft

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. North America Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 United Kingdom

- 12.1.2 France

- 12.1.3 Germany

- 12.1.4 Italy

- 12.1.5 Rest of Europe

- 13. Asia Pacific Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 India

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Mexico

- 14.1.2 Brazil

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Aerospace Carbon Fiber Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Saudi Arabia

- 15.1.2 United Arab Emirates

- 15.1.3 South Africa

- 15.1.4 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Solvay S A

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Toray Industries Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Bally Ribbon Mills

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 DuPont de Nemours Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 DowAks

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Hexcel Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 TEIJIN LIMITED

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 SGL Carbon SE

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Mitsubishi Chemical Group

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 BGF Industries Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Solvay S A

List of Figures

- Figure 1: Global Aerospace Carbon Fiber Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Aerospace Carbon Fiber Market Revenue (Million), by Application 2024 & 2032

- Figure 13: North America Aerospace Carbon Fiber Market Revenue Share (%), by Application 2024 & 2032

- Figure 14: North America Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Aerospace Carbon Fiber Market Revenue (Million), by Application 2024 & 2032

- Figure 17: Europe Aerospace Carbon Fiber Market Revenue Share (%), by Application 2024 & 2032

- Figure 18: Europe Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Aerospace Carbon Fiber Market Revenue (Million), by Application 2024 & 2032

- Figure 21: Asia Pacific Aerospace Carbon Fiber Market Revenue Share (%), by Application 2024 & 2032

- Figure 22: Asia Pacific Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Latin America Aerospace Carbon Fiber Market Revenue (Million), by Application 2024 & 2032

- Figure 25: Latin America Aerospace Carbon Fiber Market Revenue Share (%), by Application 2024 & 2032

- Figure 26: Latin America Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Latin America Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East and Africa Aerospace Carbon Fiber Market Revenue (Million), by Application 2024 & 2032

- Figure 29: Middle East and Africa Aerospace Carbon Fiber Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: Middle East and Africa Aerospace Carbon Fiber Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Middle East and Africa Aerospace Carbon Fiber Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 3: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United Kingdom Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: France Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Germany Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Italy Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: China Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: India Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Japan Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Rest of Asia Pacific Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 19: Mexico Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Brazil Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Latin America Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: Saudi Arabia Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Arab Emirates Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: South Africa Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 28: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 29: United States Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Canada Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 32: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: United Kingdom Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Germany Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Italy Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Europe Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: China Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: India Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Japan Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Asia Pacific Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 45: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: Mexico Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Brazil Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Latin America Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Application 2019 & 2032

- Table 50: Global Aerospace Carbon Fiber Market Revenue Million Forecast, by Country 2019 & 2032

- Table 51: Saudi Arabia Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: United Arab Emirates Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: South Africa Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Middle East and Africa Aerospace Carbon Fiber Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace Carbon Fiber Market?

The projected CAGR is approximately 7.51%.

2. Which companies are prominent players in the Aerospace Carbon Fiber Market?

Key companies in the market include Solvay S A, Toray Industries Inc, Bally Ribbon Mills, DuPont de Nemours Inc, DowAks, Hexcel Corporation, TEIJIN LIMITED, SGL Carbon SE, Mitsubishi Chemical Group, BGF Industries Inc.

3. What are the main segments of the Aerospace Carbon Fiber Market?

The market segments include Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Fixed-wing Aircraft Segment is Expected to Dominate the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In March 2022, Solvay and Wichita State University's National Institute for Aviation Research (NIAR) announced a partnership on research and materials development at NIAR's facilities in Wichita, Kansas. The partnership is aimed at developing future solutions to bolster the aviation industry and create opportunities for companies of all sizes to revolutionize the future of flight.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace Carbon Fiber Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace Carbon Fiber Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace Carbon Fiber Market?

To stay informed about further developments, trends, and reports in the Aerospace Carbon Fiber Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence