Key Insights

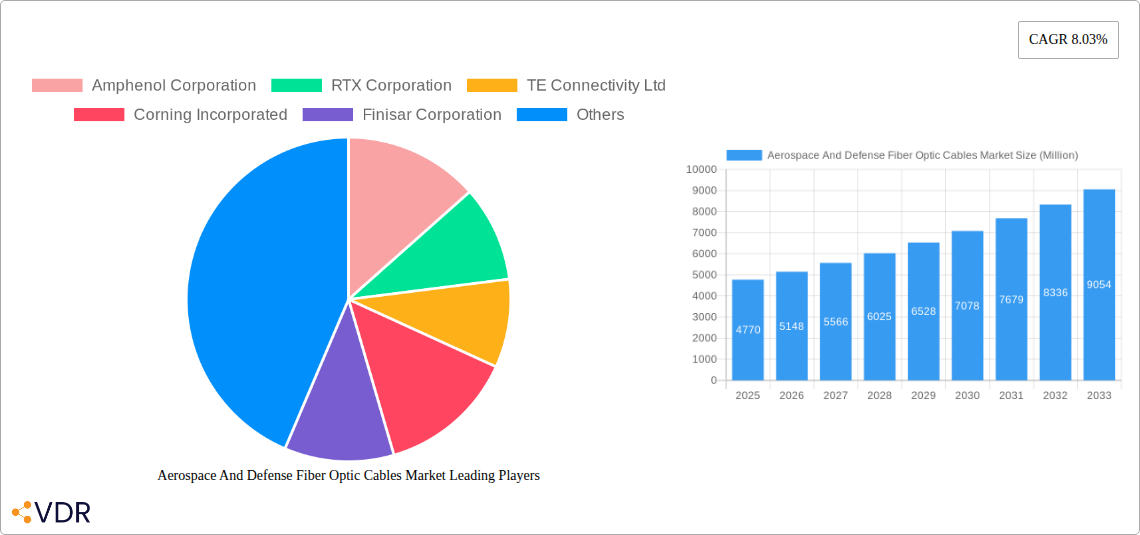

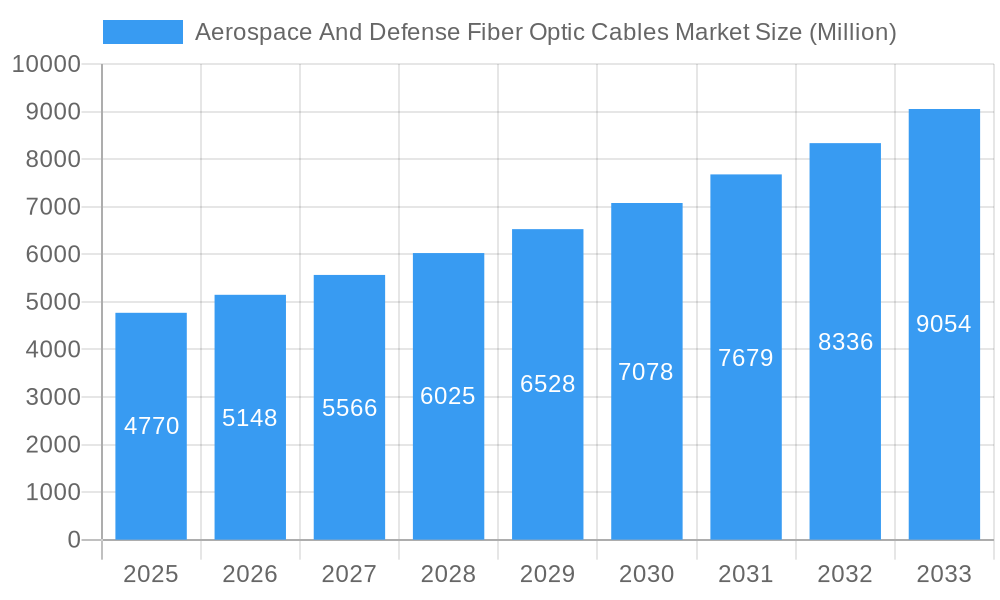

The Aerospace and Defense Fiber Optic Cables market is experiencing robust growth, projected to reach a market size of $4.77 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 8.03% from 2019 to 2033. This expansion is driven by several key factors. Increasing demand for high-bandwidth, lightweight, and reliable communication systems within aircraft and defense platforms is a primary driver. The miniaturization of fiber optic technology, coupled with advancements in materials science leading to improved durability and resistance to harsh environmental conditions, further fuels market growth. Furthermore, the rising adoption of sophisticated sensor networks in modern military applications and the growing trend towards autonomous systems significantly contributes to the market's expansion. Government investments in defense modernization programs across various nations also play a crucial role in boosting market demand. Competition among major players like Amphenol Corporation, RTX Corporation, TE Connectivity Ltd, and Corning Incorporated, is intense, leading to innovation in product development and competitive pricing strategies.

Aerospace And Defense Fiber Optic Cables Market Market Size (In Billion)

The market segmentation, while not explicitly provided, likely includes various cable types (e.g., single-mode, multi-mode), application segments (e.g., avionics, ground systems, satellites), and connection types. Future growth will hinge on continued technological advancements focusing on improved data transmission rates, enhanced security protocols, and reduced cable weight. Addressing challenges related to cost optimization and the integration of fiber optic cables into legacy systems will be crucial for sustained market expansion. The forecast period of 2025-2033 suggests a significant increase in market value driven by the aforementioned factors, with potential for even faster growth given accelerated adoption of emerging technologies in the aerospace and defense sectors.

Aerospace And Defense Fiber Optic Cables Market Company Market Share

Aerospace & Defense Fiber Optic Cables Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Aerospace & Defense Fiber Optic Cables Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is crucial for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic market. The parent market is the broader Fiber Optic Cable market, while the child market focuses specifically on aerospace and defense applications. Market values are presented in million units.

Note: Where specific quantitative data is unavailable, estimated values are provided.

Aerospace And Defense Fiber Optic Cables Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market forces shaping the Aerospace & Defense Fiber Optic Cables Market. The market is characterized by a moderately concentrated structure, with key players holding significant market share. However, the emergence of innovative technologies and new entrants presents both opportunities and challenges.

- Market Concentration: The top five players (Amphenol Corporation, RTX Corporation, TE Connectivity Ltd, Corning Incorporated, Prysmian Group) account for approximately xx% of the market share in 2025. This indicates a moderately consolidated market.

- Technological Innovation: Ongoing advancements in fiber optic technology, including the development of higher bandwidth, smaller diameter, and more radiation-resistant cables, are driving market growth. However, high R&D costs present a barrier to entry for smaller players.

- Regulatory Frameworks: Stringent regulatory compliance requirements for aerospace and defense applications influence material selection, manufacturing processes, and testing procedures. This necessitates significant investment and expertise.

- Competitive Product Substitutes: While fiber optic cables offer superior performance compared to traditional copper cables, competition arises from alternative transmission technologies, although these are limited in certain high-performance aerospace and defense applications.

- End-User Demographics: The primary end-users are military and aerospace companies, defense contractors, and government agencies involved in manufacturing and operating aircraft, satellites, and other defense systems.

- M&A Trends: Over the past five years, the aerospace and defense fiber optic cables market has witnessed xx M&A deals, primarily driven by companies seeking to expand their product portfolios and geographical reach. This consolidation trend is expected to continue. The average deal value was approximately xx million units.

Aerospace And Defense Fiber Optic Cables Market Growth Trends & Insights

The Aerospace & Defense Fiber Optic Cables Market has demonstrated robust expansion over the historical period (2019-2024), marked by a Compound Annual Growth Rate (CAGR) of [Insert Historical CAGR Here]%. This upward trend is primarily fueled by the escalating demand for high-bandwidth communication and high-speed data transmission capabilities essential for modern military and aerospace operations. Significant government investments in defense modernization programs, including the upgrade of existing infrastructure and the development of new platforms, coupled with the increasing adoption of cutting-edge technologies like artificial intelligence, advanced sensor systems, and next-generation communication networks, have been pivotal in driving market growth. The market is projected to maintain this positive trajectory throughout the forecast period (2025-2033), with an anticipated CAGR of [Insert Forecast CAGR Here]%. Market penetration within the defense sector is estimated to be [Insert 2025 Penetration % Here]% in 2025, with expectations of reaching [Insert 2033 Penetration % Here]% by 2033. Emerging technological disruptions, such as the sophisticated integration of photonics for enhanced data processing and the continuous advancements in fiber optic sensor technology for superior environmental monitoring and tactical intelligence, are further augmenting market growth and significantly influencing adoption rates. Concurrently, shifts in consumer behavior and operational paradigms towards a greater reliance on data-intensive applications across both defense and commercial aerospace sectors are creating a sustained demand for high-performance, resilient, and secure fiber optic cable infrastructure.

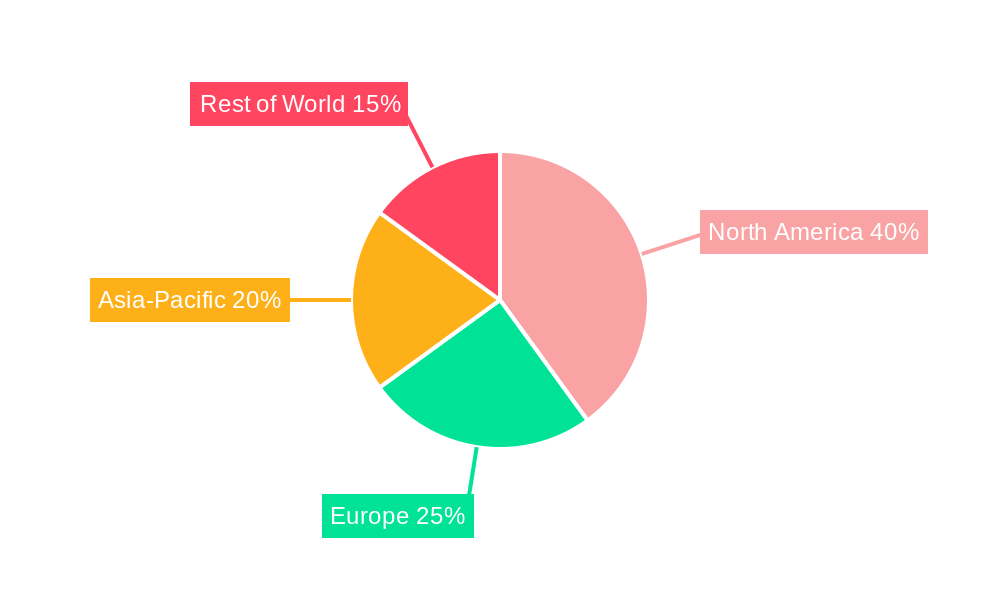

Dominant Regions, Countries, or Segments in Aerospace And Defense Fiber Optic Cables Market

North America currently holds the largest market share, driven by significant government spending on defense modernization and a robust aerospace industry. Europe follows closely, with substantial growth potential in the Eastern European region. The Asia-Pacific region is projected to witness the fastest growth rate due to increasing investment in defense infrastructure and emerging aerospace sectors.

- North America: High defense budgets, advanced technological capabilities, and a concentration of major aerospace and defense companies contribute to market dominance.

- Europe: Strong aerospace and defense industries, coupled with government initiatives to modernize military infrastructure, support market growth.

- Asia-Pacific: Rapid economic development, increasing defense spending, and government focus on developing indigenous aerospace capabilities drive market expansion. China and India are key growth drivers.

Aerospace And Defense Fiber Optic Cables Market Product Landscape

The market offers a diverse range of fiber optic cables tailored to specific aerospace and defense needs, including ruggedized cables, high-bandwidth cables, and radiation-hardened cables. These cables are designed to withstand extreme environmental conditions and meet rigorous performance requirements. Key innovations include the development of smaller diameter cables for weight reduction and increased flexibility, as well as the integration of advanced sensing capabilities. Unique selling propositions center around enhanced performance, reliability, and durability in demanding environments.

Key Drivers, Barriers & Challenges in Aerospace And Defense Fiber Optic Cables Market

Key Drivers:

- The ever-increasing requirement for high-bandwidth and low-latency data transmission capabilities within sophisticated military platforms, advanced radar systems, secure communication networks, and airborne intelligence, surveillance, and reconnaissance (ISR) applications.

- Sustained and often increasing global government investments in defense modernization initiatives, including the procurement of new fighter jets, naval vessels, ground vehicles, and the implementation of advanced command and control systems.

- Continuous technological advancements in fiber optic cable design and manufacturing, leading to enhanced performance metrics such as increased data capacity, improved signal integrity, greater durability in harsh environments, and miniaturization of components.

- The growing adoption of advanced technologies like AI-powered systems, autonomous vehicles (UAVs/UAS), and sophisticated sensor networks, all of which necessitate robust and high-speed data connectivity provided by fiber optics.

- The critical need for enhanced cybersecurity and signal integrity in defense communications, where fiber optics offer superior resistance to electromagnetic interference (EMI) and eavesdropping compared to traditional copper cabling.

Challenges and Restraints:

- The substantial initial capital expenditure required for the deployment of comprehensive fiber optic cable systems, including the specialized installation equipment, skilled labor, and infrastructure upgrades, can pose a significant barrier, particularly for smaller defense contractors or budget-constrained programs.

- Vulnerabilities in the global supply chain, including geopolitical influences, material sourcing complexities, and potential shortages of specialized raw materials, can disrupt production schedules and impact the availability and cost of fiber optic cables and their components.

- Navigating and adhering to the stringent regulatory frameworks, rigorous testing protocols, and complex certification processes mandated by defense organizations and aviation authorities across different regions can add considerable time, cost, and complexity to product development and deployment.

- The need for specialized training and expertise for the installation, maintenance, and repair of fiber optic systems in demanding aerospace and defense environments, where downtime can have critical consequences.

- The inherent fragility of some fiber optic components in extreme vibration and shock conditions, requiring careful design and robust protective measures, which can add to cost and complexity.

Emerging Opportunities in Aerospace And Defense Fiber Optic Cables Market

- The rapid and continuous growth in the development and deployment of Unmanned Aerial Vehicles (UAVs), Unmanned Combat Aerial Vehicles (UCAVs), and other autonomous systems for reconnaissance, surveillance, logistics, and combat missions, which significantly rely on high-speed, reliable fiber optic data links for control and data transmission.

- The burgeoning development and implementation of advanced fiber optic sensor technologies for applications such as structural health monitoring in aircraft and spacecraft, improved situational awareness through battlefield sensor networks, advanced navigation systems, and enhanced environmental sensing for increased control and safety.

- Strategic expansion into rapidly growing emerging markets with increasing defense budgets and modernization efforts, as well as the exploration of new and evolving applications within both the defense and commercial aerospace sectors, such as advanced air mobility (AAM) and satellite communication constellations.

- The increasing demand for lightweight, compact, and high-performance fiber optic solutions for next-generation aircraft and space missions, driving innovation in materials and cable construction.

- Opportunities in upgrading legacy defense systems with fiber optic connectivity to improve performance, data capacity, and security.

Growth Accelerators in the Aerospace And Defense Fiber Optic Cables Market Industry

Technological breakthroughs in fiber optic materials and manufacturing processes, along with strategic partnerships between cable manufacturers and aerospace companies, are driving long-term growth. Increased focus on lightweighting initiatives and the development of more robust and reliable cables further accelerate market expansion.

Key Players Shaping the Aerospace And Defense Fiber Optic Cables Market Market

- Amphenol Corporation - A leading provider of interconnect products, including robust fiber optic solutions for aerospace and defense applications.

- RTX Corporation (formerly Raytheon Technologies) - Engaged in developing advanced communication and sensor systems that incorporate fiber optic technologies.

- TE Connectivity Ltd - Offers a comprehensive range of fiber optic connectors, cable assemblies, and related products designed for harsh aerospace and defense environments.

- Corning Incorporated - A pioneer in optical fiber technology, providing high-performance fiber optic cables critical for demanding applications.

- Finisar Corporation (now part of II-VI Incorporated) - Specializes in optical components and subsystems, contributing to high-speed data transmission solutions.

- Prysmian Group - A global leader in energy and telecommunications cables, with offerings for the aerospace and defense sectors.

- Optical Cable Corporation - Manufactures a wide array of fiber optic cables for various industries, including aerospace and defense.

- Radiall - Designs and manufactures high-performance connectors and interconnect systems for aerospace and defense.

- Timbercon - Specializes in high-performance fiber optic interconnect solutions for harsh environments.

- L GORE & Associates Inc - Known for its high-performance wire and cable solutions, including fiber optics, designed for extreme conditions.

- Sumitomo Electric Industries, Ltd.

- Belden Inc.

Notable Milestones in Aerospace And Defense Fiber Optic Cables Market Sector

- November 2023: Prysmian Group completed a significant subsea interconnector project between Italy and Greece. This showcases the company's capabilities in managing large-scale cable infrastructure projects relevant to the military and aerospace sectors.

- January 2024: Amphenol Corporation launched a new line of high-performance fiber optic connectors designed for demanding military and aerospace environments, highlighting its focus on innovation in this field.

In-Depth Aerospace And Defense Fiber Optic Cables Market Market Outlook

The Aerospace & Defense Fiber Optic Cables Market is poised for significant and sustained growth in the coming years. This outlook is underpinned by a confluence of factors including relentless technological advancements in areas such as high-speed data processing, photonics, and advanced sensor integration, coupled with a global increase in defense spending and strategic modernization programs. The expanding applications of fiber optics across diverse military and commercial aerospace platforms, from fighter jets and satellites to UAVs and space exploration vehicles, will continue to be a primary growth catalyst. Strategic collaborations, mergers, and acquisitions among key market players, alongside substantial investments in research and development, will play a critical role in shaping the future market landscape, fostering innovation, and driving the development of next-generation fiber optic solutions. The market presents substantial opportunities for both established industry leaders and agile new entrants who can demonstrate a capacity to adapt to the evolving and stringent technological requirements, offer superior product performance and reliability, and deliver cost-effective, innovative solutions tailored to the unique demands of the aerospace and defense sectors. The transition towards more data-centric defense systems and the continuous evolution of airborne and space-based platforms will ensure a robust and dynamic market for fiber optic cables for the foreseeable future.

Aerospace And Defense Fiber Optic Cables Market Segmentation

-

1. Application

- 1.1. Communication Systems

- 1.2. Avionics

- 1.3. Weapon Systems

- 1.4. Surveillance and Reconnaissance

- 1.5. Electronic Warfare

-

2. Type

- 2.1. Single-mode

- 2.2. Multi-mode

Aerospace And Defense Fiber Optic Cables Market Segmentation By Geography

-

1. North America

- 1.1. US

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Germany

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. Saudi Arabia

- 5.2. United Arab Emirates

- 5.3. Rest of Middle East and Africa

Aerospace And Defense Fiber Optic Cables Market Regional Market Share

Geographic Coverage of Aerospace And Defense Fiber Optic Cables Market

Aerospace And Defense Fiber Optic Cables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Multi-mode Segment is Expected to Record the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Communication Systems

- 5.1.2. Avionics

- 5.1.3. Weapon Systems

- 5.1.4. Surveillance and Reconnaissance

- 5.1.5. Electronic Warfare

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single-mode

- 5.2.2. Multi-mode

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Communication Systems

- 6.1.2. Avionics

- 6.1.3. Weapon Systems

- 6.1.4. Surveillance and Reconnaissance

- 6.1.5. Electronic Warfare

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single-mode

- 6.2.2. Multi-mode

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Communication Systems

- 7.1.2. Avionics

- 7.1.3. Weapon Systems

- 7.1.4. Surveillance and Reconnaissance

- 7.1.5. Electronic Warfare

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single-mode

- 7.2.2. Multi-mode

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Communication Systems

- 8.1.2. Avionics

- 8.1.3. Weapon Systems

- 8.1.4. Surveillance and Reconnaissance

- 8.1.5. Electronic Warfare

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single-mode

- 8.2.2. Multi-mode

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Communication Systems

- 9.1.2. Avionics

- 9.1.3. Weapon Systems

- 9.1.4. Surveillance and Reconnaissance

- 9.1.5. Electronic Warfare

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single-mode

- 9.2.2. Multi-mode

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Communication Systems

- 10.1.2. Avionics

- 10.1.3. Weapon Systems

- 10.1.4. Surveillance and Reconnaissance

- 10.1.5. Electronic Warfare

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single-mode

- 10.2.2. Multi-mode

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Amphenol Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 RTX Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 TE Connectivity Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Corning Incorporated

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Finisar Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Prysmian Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Optical Cable Corporation

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Radiall

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Timbercon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 L Gore & Associates Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Amphenol Corporation

List of Figures

- Figure 1: Global Aerospace And Defense Fiber Optic Cables Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Aerospace And Defense Fiber Optic Cables Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Application 2025 & 2033

- Figure 4: North America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Application 2025 & 2033

- Figure 5: North America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Application 2025 & 2033

- Figure 7: North America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Type 2025 & 2033

- Figure 8: North America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Type 2025 & 2033

- Figure 9: North America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: North America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Type 2025 & 2033

- Figure 11: North America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Application 2025 & 2033

- Figure 16: Europe Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Application 2025 & 2033

- Figure 17: Europe Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Application 2025 & 2033

- Figure 18: Europe Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Application 2025 & 2033

- Figure 19: Europe Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Type 2025 & 2033

- Figure 20: Europe Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Type 2025 & 2033

- Figure 21: Europe Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Europe Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Type 2025 & 2033

- Figure 23: Europe Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Application 2025 & 2033

- Figure 28: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Application 2025 & 2033

- Figure 29: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Application 2025 & 2033

- Figure 31: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Type 2025 & 2033

- Figure 32: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Type 2025 & 2033

- Figure 33: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Type 2025 & 2033

- Figure 35: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Application 2025 & 2033

- Figure 40: Latin America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Application 2025 & 2033

- Figure 41: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Application 2025 & 2033

- Figure 42: Latin America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Application 2025 & 2033

- Figure 43: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Type 2025 & 2033

- Figure 44: Latin America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Type 2025 & 2033

- Figure 45: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Type 2025 & 2033

- Figure 46: Latin America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Type 2025 & 2033

- Figure 47: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Country 2025 & 2033

- Figure 48: Latin America Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Country 2025 & 2033

- Figure 49: Latin America Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Latin America Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Application 2025 & 2033

- Figure 52: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Application 2025 & 2033

- Figure 53: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Application 2025 & 2033

- Figure 54: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Application 2025 & 2033

- Figure 55: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Type 2025 & 2033

- Figure 56: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Type 2025 & 2033

- Figure 57: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Type 2025 & 2033

- Figure 58: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Type 2025 & 2033

- Figure 59: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 3: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 4: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 5: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 9: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: US Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: US Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 19: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 21: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: United Kingdom Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: France Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Germany Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Russia Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Russia Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Rest of Europe Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 35: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 36: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 37: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 38: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Country 2020 & 2033

- Table 39: China Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: China Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: India Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: India Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Japan Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Japan Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: South Korea Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: South Korea Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Rest of Asia Pacific Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Rest of Asia Pacific Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 50: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 51: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 52: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 53: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 54: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Country 2020 & 2033

- Table 55: Brazil Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Brazil Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Rest of Latin America Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 58: Rest of Latin America Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 59: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Application 2020 & 2033

- Table 60: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Application 2020 & 2033

- Table 61: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Type 2020 & 2033

- Table 62: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Type 2020 & 2033

- Table 63: Global Aerospace And Defense Fiber Optic Cables Market Revenue Million Forecast, by Country 2020 & 2033

- Table 64: Global Aerospace And Defense Fiber Optic Cables Market Volume Billion Forecast, by Country 2020 & 2033

- Table 65: Saudi Arabia Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Saudi Arabia Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: United Arab Emirates Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: United Arab Emirates Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Rest of Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: Rest of Middle East and Africa Aerospace And Defense Fiber Optic Cables Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aerospace And Defense Fiber Optic Cables Market?

The projected CAGR is approximately 8.03%.

2. Which companies are prominent players in the Aerospace And Defense Fiber Optic Cables Market?

Key companies in the market include Amphenol Corporation, RTX Corporation, TE Connectivity Ltd, Corning Incorporated, Finisar Corporation, Prysmian Group, Optical Cable Corporation, Radiall, Timbercon, L Gore & Associates Inc.

3. What are the main segments of the Aerospace And Defense Fiber Optic Cables Market?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.77 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Multi-mode Segment is Expected to Record the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2024: Amphenol Corporation unveiled a new line of high-performance fiber optic connectors tailored for demanding military and aerospace settings, underscoring their commitment to innovation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aerospace And Defense Fiber Optic Cables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aerospace And Defense Fiber Optic Cables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aerospace And Defense Fiber Optic Cables Market?

To stay informed about further developments, trends, and reports in the Aerospace And Defense Fiber Optic Cables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence